By streamlining cross-border payments and reducing reliance on third-party currencies, initiatives like these promote financial inclusion and stability. Moreover, they pave the way for greater investment, innovation, and collaboration in key sectors, ultimately driving sustainable development across the continent.

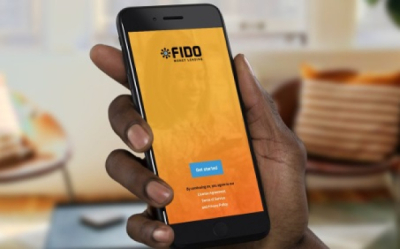

India and Ghana have decided to fast-track the linkage of India’s Unified Payment Interface (UPI) with Ghana’s Interbank Payment and Settlement Systems (GHIPSS). This will facilitate real-time fund transfers between users in both nations within a six-month timeframe. The decision was made during a Joint Trade Committee (JTC) meeting held in Accra from May 2-3.

This step is a part of India’s broader strategy to globalize its UPI system, which has already made its mark in countries such as France, the UAE, Sri Lanka, and Mauritius.

The JTC meeting also brought to the table potential agreements on digital transformation solutions and the adoption of the Local Currency Settlement System (LCCS) under the African Continental Free Trade Agreement. The LCCS is designed to enable cross-border transactions in local currencies, thereby reducing dependence on third-party currencies.

The meeting identified several sectors for increased bilateral trade, including pharmaceuticals, healthcare, ICT, agriculture, renewable energy, and digital infrastructure.

According to the World Bank, in a press release dated April 28, 2022, Ghana stands out as a digital frontrunner in Sub-Saharan Africa, with its digital sector demonstrating robust growth, averaging 19 percent annually from 2014 to 2020.

The 2020 Payment Systems Oversight Annual Report by the Bank of Ghana reveals that the Ghana GhIPSS experienced a 103% surge in processed transactions by the end of 2020. The platforms handled a total of 77 million transactions, double the 2019 figure of 38 million. This surge suggests a shift towards digital transactions, highlighting the increasing adoption of digital financial services and the expanding digital economy in Ghana.

Hikmatu Bilali