Across Africa, microfinance has the potential to be a game-changer for financial inclusion. These institutions offer services that can empower vulnerable individuals by providing them with a safety net against life's unexpected challenges.

On Friday, May 3rd, telecommunications operator Orange Guinea officially launched Orange MicroFinances Guinée (OMIG), its microfinance program. This initiative leverages Orange Money to deliver accessible and inclusive financial services to local communities.

"Credit and insurance remain underutilized within mobile financial services, despite their vast potential for African populations," explained Ousmane Boly Traore, CEO of Orange Guinea. "Through OMIG, we aim to empower micro-entrepreneurs, particularly women, by offering them credit and savings solutions tailored for success, wherever Orange Money operates."

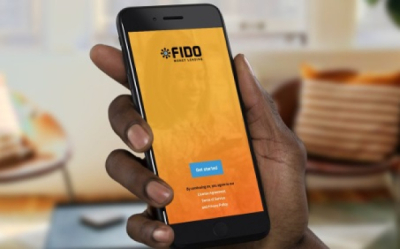

OMIG will provide a range of services accessible through the Orange Money app or USSD menu, targeting micro-entrepreneurs and those without access to traditional banking. This includes loans, money transfers, and savings options. These services aim to simplify and streamline business development and financial goals. Customers will benefit from a fully digital experience, competitive loan and savings rates, and the ability to manage repayments, accounts, and track loans directly within the app.

By introducing OMIG, Orange aims to drive financial inclusion and economic growth in Guinean communities. The diverse services offered by OMIG are expected to further encourage and stimulate entrepreneurship within the country.

Samira Njoya