With the global development of tech giants like Amazon, Facebook, and Netflix, the importation of digital services has significantly increased in Africa in recent years. To enable every country to benefit from the development, a global tax framework was elaborated. It is expected to become enforceable in January 2024.

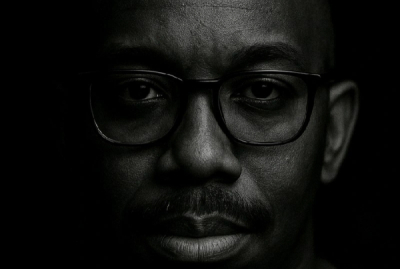

Kenya will align its digital tax with the inclusive framework spearheaded by the Organization for Economic Cooperation and Development (OECD). President William Ruto (photo, center) announced this to investors on Thursday, March 30, at the American Chamber of Commerce Regional Business Summit.

“Following discussions with players in this sector, we have committed to review this tax regime and align it with the two-pillar solution currently being developed by the OECD inclusive framework,” President Ruto said.

The OECD finalized the reform of the international tax system aimed at solving tax base erosion and multinationals’ profit-shifting problems. The framework is based on two pillars, the first of which is to align tax rates more closely with local market engagement. To date, 138 jurisdictions have approved it.

Under the former administration, Kenya suspended its support for the global minimum tax rate, which would have seen the government suspend the collection of the digital services tax from tech giants such as Google, Facebook, and Amazon.

At the time, the country expressed its uneasiness with the terms of the agreement that would have seen the end of the digital services tax, which is currently 1.5% of sales made by foreigners in the country. After several negotiations, Kenya finally decided to align itself and sign the pact before its implementation on January 1, 2024.

According to OECD estimates, if Kenya joins, the tax authorities could collect between 3.3 billion shillings ($25 million) and 5.3 billion shillings in taxes, more than 10 times the 400 to 500 million shillings they currently collect each year in digital services tax.

In addition to Kenya, three other countries, namely Nigeria, Pakistan, and Sri Lanka have not yet signed the declaration.

Samira Njoya