On January 1, 2021, the African Continental Free Trade Area (AfCFTA) officially became operational. Recently, the Zone reached a new milestone by launching its payment solution.

The Pan African Payment and Settlement System (PAPSS) was officially launched in West Africa on 13 January 2022, in Accra, Ghana. The cross-border payment platform was developed by Afreximbank and successfully tested in Gambia, Ghana, Guinea, Liberia, Nigeria, and Sierra Leone. Integrating a growing network of central banks, commercial banks, payment service providers, and other financial intermediaries, PAPSS will serve as the settlement interface for the African Continental Free Trade Area (AfCFTA).

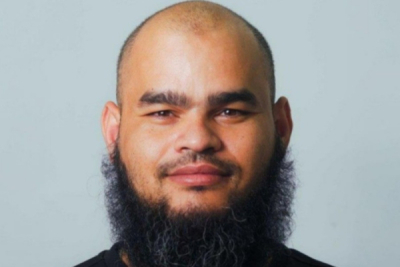

“The commercial launch marks a significant milestone in connecting African markets seamlessly. It will provide a fresh impetus for businesses to scale more easily across Africa and is likely to save the continent more than $5 billion in transaction costs every year,” said Mike Ogbalu III (pictured), the chief executive officer of the financial platform.

PAPSS will connect African markets, enabling instant cross-border payments in local African currencies. It can be used for purchases, money transfers, wage payments, stock and share trading, or major business transactions. No more transfer fees, SWIFT fees, and bank charges. No more worries about exchange rates.

For example, a user in Mali can buy goods in Ghana from an SME, pay in CFA francs and the seller will get the payment in cedis. This is how it works: After the Malian buyer issues a payment order in the local currency (CFA) to his affiliated financial institution, the latter submits the transaction to PAPSS, which then proceeds to the necessary validation checks. Next, the payment order is forwarded to the seller's financial institution that gets the payment done in the local currency.

PAPSS collaborates with African central banks to provide a payment and settlement service that commercial banks, payment service providers, and fintechs in Africa can connect to as "Participants."

With PAPSS, central banks can instantly process settlements, hence reducing their hard currency holdings. Compliance, legal, and sanction checks are performed instantly by the system which processes transactions within seconds, thereby dealing with delays that constitute a significant barrier to the growth of African e-commerce, services, and products.

To access PAPSS, banks and other financial institutions must register and meet some criteria. The platform features two types of participants: direct and indirect. “Direct Participants”, banks and other financial institutions, have a settlement account with the central bank of the country in which they operate and comply with all the financial and regulatory proficiency requirements of that central bank.

"Indirect Participants", also banks and other financial institutions, do not have a settlement account with the central bank of the country in which they operate. They may, however, enter into individual sponsorship arrangements with direct participants to facilitate the settlement of payment instructions.

Adoni Conrad Quenum