Economy (17)

This move mirrors global trends: many countries (from the U.S. to Kenya and Nigeria) are adopting policies to tax the digital economy, ensuring fairness between traditional businesses and online players.

The Ghana Revenue Authority (GRA) has unveiled comprehensive systems to monitor the earnings of bloggers, content creators, and creative professionals, emphasizing that all income earners—formal or informal—are required to meet their tax obligations.

Speaking at Joy FM’s 7th Showbiz Roundtable in Accra on September 6, Isaac Kobina Amoako, Chief Revenue Officer and Head of the GRA’s IT Training Centre, explained that the authority now applies the same tracking mechanisms used for traditional income earners to the digital and creative sectors.

“The same way we track all income earners is the same way we track the income of creatives,” Amoako told participants at the event, themed “GRA vs. Creatives – Taxation and the Future of Ghana’s Creative & Digital Economy.”

According to the GRA, its monitoring framework includes informant networks, third-party reporting, and surveillance of banking transactions. For creators who operate outside traditional banking channels, payments can be tracked through intermediaries handling financial flows on their behalf.

Alongside the compliance measures, the authority announced new incentives for young entrepreneurs in the sector. Victor Yao Akogo, Chief Revenue Officer at the Domestic Tax Division, revealed that creative businesses owned by individuals under 35 will benefit from a five-year tax holiday. In addition, modified rules introduced in September 2025 exempt some creatives from mandatory Value Added Tax (VAT) registration, easing the burden on smaller or informal operators.

The forum, which convened musicians, filmmakers, DJs, bloggers, event organizers, fashion designers, and comedians, explored how taxation is shaping Ghana’s fast-growing creative and digital economy. Speakers included Kojo Poku of the Event and Meeting Professionals Association of Ghana and Francis Doku, CEO of Maestro Africa Group.

The GRA’s broader strategy is to ensure that modern revenue streams—ranging from advertising and sponsorship deals to content platform earnings—are captured within the national tax net. Industry figures also called for closer collaboration. Playwright and Globe Productions CEO Latif Abubakar stressed the importance of partnership between tax authorities and creatives, noting the sector’s potential to significantly boost Ghana’s GDP if properly formalized.

The announcement comes as Ghana seeks to formalize its digital economy and capture revenue from online activities that are rapidly becoming mainstream sources of income. The GRA’s dual approach—tightening monitoring while offering incentives—reflects an effort to balance compliance with support for the growth of the creative sector.

The creative economy is often difficult to tax because much of the revenue comes from diverse sources like influencer sponsorships, YouTube ad revenue, DJ gigs, event organizing, or cross-border payments. The GRA’s new monitoring mechanisms show the government is moving to close revenue leakages and capture funds that might otherwise slip through the cracks.

For content creators, the message is clear: digital earnings are subject to the same obligations as traditional income. Ghana’s tax-to-GDP ratio, at 13.8% in 2022, remains well below the government’s target of 18–20% by 2027. This gap highlights why the GRA is intensifying efforts to bring informal and digital sectors into the tax net. By focusing on bloggers, influencers, and digital creators, the GRA is not just chasing compliance—it is attempting to widen the tax base in line with national fiscal goals. The combination of monitoring systems and youth-focused incentives suggests an effort to strike a balance: ensuring revenue collection while encouraging entrepreneurship and growth in the creative economy.

If successful, this approach could both boost state revenue and help formalize Ghana’s digital creative sector, making it a more stable contributor to economic growth.

Hikmatu Bilali

Cybercrime threatens Nigeria’s economic growth by tarnishing its reputation and discouraging foreign direct investment. With Nigeria positioned as one of Africa's largest economies, eradicating cybercrime is critical to maintaining investor confidence and securing its burgeoning digital economy.

The Economic and Financial Crimes Commission (EFCC) has arrested 792 suspects in a major raid targeting cryptocurrency investment fraud and romance scams. The operation, conducted on December 10, 2024, focused on a seven-story building, Big Leaf Building, at No. 7 Oyin Jolayemi Street, Victoria Island, Lagos.

EFCC Chairman Ola Olukoyede, represented by Director of Public Affairs Commander Wilson Uwujaren, revealed that the suspects included 148 Chinese nationals, 40 Filipinos, two Kazakhstani nationals, one Pakistani, and one Indonesian, alongside their Nigerian collaborators. The building served as a hub where foreign syndicates trained Nigerians to execute scams targeting global victims.

Investigators uncovered advanced computers on all floors and 500 SIM cards linked to local telecom providers. Nigerian recruits were selected for their typing and computer skills, then trained to create fake profiles, engage victims in romantic or investment scams, and promote a fraudulent platform, www.yooto.com. Activation fees on the platform started at $35.

The foreign syndicate leaders handled defrauding victims and cut off the Nigerians from the proceeds. Recruits lacked formal contracts and were paid in cash or via personal accounts.

Olukoyede highlighted collaboration with international partners to uncover links to global fraud networks. He countered the notion that Nigerians are the primary perpetrators of fraud, stating that foreign syndicates exploit Nigeria’s reputation to mask operations.

The raid follows a November 2024 operation where Nigerian police arrested 130 suspects, including 113 foreign nationals, for cybercrimes and activities threatening national security. These efforts align with the Cybercrimes Act of 2015, which criminalizes identity theft, phishing, and hacking, reflecting Nigeria’s commitment to tackling cybercrime on a global scale.

Hikmatu Bilali

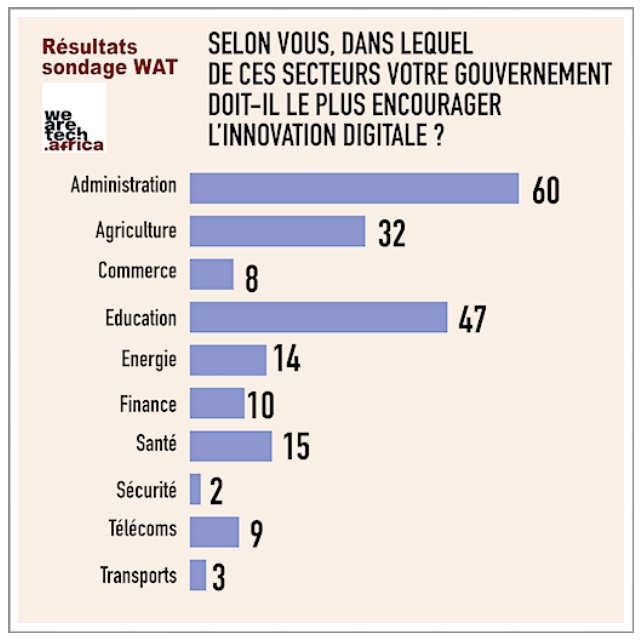

Between September 4 and 7, We Are Tech carried out an online survey into how users feel about the ongoing digitization trend in Africa, their uses, and their expectations. This survey provides interesting insights.

We want an innovative administration!

Administration is the first sector in which We Are Tech Africa’s survey respondents expect the most innovations to facilitate their daily lives and improve governance in their countries. Their second concern is education. Then agriculture. Other sectors lag far behind.

Evolving and diversified uses

When it comes to digital adoption, it's no surprise that social networks are the most widely used, followed by online media and financial services (mobile money and fintech). However, there has been a significant breakthrough in e-commerce, e-admin, e-education, and even artificial intelligence.

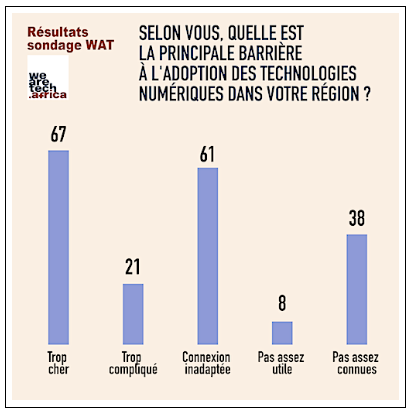

There are still obstacles to digitalization in Africa

According to respondents, the main obstacles to digitalization in Africa are high costs, poor connectivity, and a lack of promotion of new services.

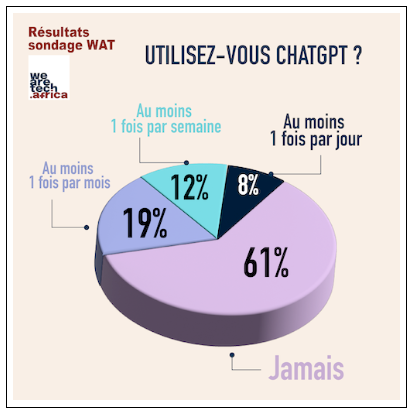

ChatGPT is getting into daily habits

Of the respondents, 39% claim to use the OpenAI service, while 8% even claim to use it daily.

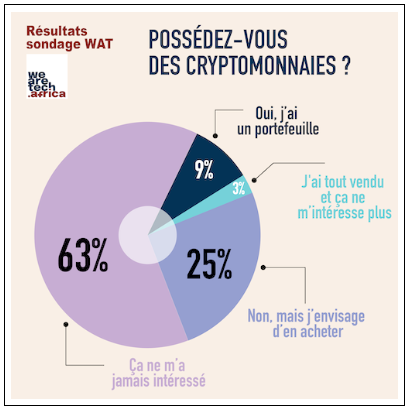

Cryptos remain attractive

While 63% of Internet users believe that cryptocurrencies are of no interest to them, 9% already own a wallet and 25% are considering opening one.

Zanzibar started its digital transformation journey a few months ago. All sectors are undergoing the process; this includes payment systems, which play a crucial role in digital inclusion.

MasterCard recently committed to supporting the digital transformation ambitions of the government of Zanzibar, an autonomous administrative region of Tanzania. Last Tuesday, the the US company inked a memorandum of understanding (MOU) with the Zanzibar e-Government Agency (eGAZ), in this framework.

Under their partnership, MasterCard will provide technical support and its expertise to Zanzibar, over three years. According to the payment giant, this includes setting up a digital transformation team, collaborating with the ZanMalipo government payment portal to enable digital payments, and launching two million government cards for better access to services and tourism.

“This collaboration confirms our commitment to leveraging innovative technologies to improve service delivery. We believe that by working with MasterCard, a trusted partner, we can significantly accelerate the realization of our digital strategy and provide invaluable benefits to our citizens,” said Said Seif Said, Director General of eGAZ.

The agreement, signed during the launch of Zanzibar’s digital government strategy (2023-2027), aligns perfectly with the island's digital transformation objectives outlined in its master plan and digital economy roadmap.

The collaboration builds on MasterCard’s global experience in promoting digital transformation and facilitating financial and digital inclusion. It will, ultimately, foster an environment conducive to a pan-African digital economy, and stimulate innovation, trade, and investment in the United Republic of Tanzania and the region as a whole.

Samira Njoya

Although financial inclusion has recently improved in West Africa, small businesses in the region still consider financing a major barrier to their growth. This new partnership intends to change this dynamic by providing loans.

The International Finance Corporation (IFC) recently partnered with Orange Bank Africa, the digital bank of the Orange Group. The World Bank’s private sector arm made the announcement last Monday, July 3. The move, according to the source, aims to effectively and sustainably support, financially, small businesses in West Africa, including those in rural areas.

"This innovative investment demonstrates our firm commitment to leverage the power of digital financial services, especially in regions where financial inclusion remains limited. It also has the potential to set a precedent in digital lending," said Olivier Buyoya, IFC's Regional Director for West Africa.

Under the partnership, the IFC will partly cover loans made by Orange Bank Africa to micro, small, and medium-sized enterprises (MSMEs), in Ivory Coast, first, then in Senegal, and other West African countries, once the digital bank has received approval to operate there.

In detail, the IFC will cover 50% of the $30 million in loans that Orange Bank Africa will provide in the form of microcredits accessible via mobile to its clientele of small businesses and individuals. The bank, which has been operating in the Ivorian market since July 2020, also plans to allocate "larger loans" to local actors in the creative industry. This will enable the 100% digital bank to distribute an additional 300,000 loans by 2025.

According to Jean-Louis Menann-Kouamé, CEO of Orange Bank Africa, the partnership will accelerate the financing of MSMEs with concrete solutions, thus bolstering their productivity, making them more competitive on local and international markets, and creating jobs.

A year ago, in July also, the IFC inked a first agreement with Orange Bank Africa, to increase access to financing for agents and traders operating in the mobile money ecosystem in West Africa.

Samira Njoya

E-commerce is often touted as the way of the future in Africa. The sector has grown exponentially in recent years and the International Finance Corporation (IFC) expects it to grow further in the coming years.

Last Tuesday, the African Development Fund (ADF) -the concessional window of the African Development Bank (AfDB)- and the Smart Africa Alliance announced a Memorandum of Understanding (MoU) to launch the Multinational - Institutional Support for Digital Payments and e-Commerce Policies for Cross-Border Trade (IDECT), which aims to streamline digital payments and e-commerce policies in ten African countries.

The MoU was signed in Zimbabwe by Lacina Koné (photo, left), the CEO of Smart Africa, and Leïla Mokaddem, Director General of the African Development Bank for Southern Africa on the sidelines of the 6th Transform Africa Summit (TAS), which runs until Friday, April 28, in Victoria Falls.

"This initiative will support the development of harmonized e-payment policies, capacity building, and gender-responsive frameworks, ultimately fostering a digital business ecosystem that generates employment opportunities across the continent," Leïla Mokaddem said.

According to the AfDB, IDECT will assess policy gaps in the digital trade and e-commerce ecosystems of Côte d'Ivoire, Benin, Ghana, Liberia, Uganda, South Sudan, Zimbabwe, Republic of Congo, São Tomé and Príncipe, and the Democratic Republic of Congo.

The 3-year project will be executed by the Smart Africa Alliance from Kigali (Rwanda) and jointly funded by the African Development Fund and Smart Africa.

Ultimately, IDECT's programs are expected to reach 600 participants, 60% of whom will be women and youth. In addition, a certified online training program will be designed for 2,500 participants, 60 percent of whom will be women. This program will be gender sensitive and address the specific challenges faced by women in the fields of e-commerce and digital business.

Samira Njoya

The e-commerce industry has grown exponentially in recent years and the number of online marketplaces has followed suit. The marketplaces that were developed in the wake of the e-commerce boom include DizzitUp, an African start-up and finalist of the Ecobank Fintech Challenge 2022. The platform has great ambitions and wants to become the African alternative to Alibaba. During the Lomé chapter of the Africa Fintech Tour, Togo First interviewed its CEO, Solofo Rafeno, to learn more about this marketplace which is getting popular by the day in Benin, Togo, and Madagascar.

Togo First: Could you tell us what DizzitUp is about?

Solofo Rafeno (SR): DizzitUp is an online marketplace that offers African SMEs access to financing solutions to develop their activities. The start-up also helps these businesses increase their revenue by providing an online store that enables them to showcase their products and services to locals and the African diaspora, which is constituted of over 40 million individuals.

DizzitUp is focused on essential goods and services sold exclusively by African companies in 6 categories: food, renewable energy and construction, health, education, tech (phones, computers & internet), and shortly, new decentralized financial services (DeFi).

As a result, DizzitUp enables the digital and financial inclusion of African VSEs/SMEs while bringing them additional revenues.

In 4 months of operation, DizzitUp Marketplace has registered 150 merchants and we plan to exceed 1,000 merchants in Togo, Benin, Madagascar, and Ivory Coast by the end of 2023.

Togo First: What are the main consumer profiles targetted by DizzitUp?

SR: DizzitUp buyers are divided into two main groups: locals that buy for their consumption and members of the African diaspora -more than 40 million individuals- that buy for their relatives based in Togo, Benin and Madagascar to date, and soon in Côte d’Ivoire.

Togo First: How does your marketplace address trust issues?

SR: 80% of the African economy is made up of informal small and medium enterprises (SMEs). To encourage trust between merchants and consumers, one solution is to carefully select merchants, verify them, and focus on essential products and services such as food, self-sufficient solar power equipment, building materials, phones, computers, and health and education services.

DizzitUp field teams verify that the stores have physical addresses and offer products that meet our criteria. We then take pictures and videos and only selected products are posted on our platform.

Also, since logistics is crucial to guaranteeing service quality, our platform offers an extra service: delivery, which is carried out by independent deliverymen.

Togo First: How are the deliveries made?

SR: Our main aim is to always boost the activities of our [registered] merchants. So, we prefer buyers picking their products directly from stores so that the flow of customers can be increased. Package pickup is the default choice but, each merchant can suggest delivery services, which are offered by local DizzitUp partners.

Let’s say for instance that a relative living in Kara buys on the platform and pays using TMoney or Flooz, the beneficiary, a family member in Lome, can come and pick up the goods at the store in Lome or the goods can be delivered by DizzitUp's partner.

Another case is the recurrent purchase of food baskets, "FoodBox", by a Togolese living in New York for his relatives living in Lome. Once the order is paid via Visa or Mastercard, the relatives living in Lome can pick up the goods at the selling store or have them delivered. The merchant is immediately paid by DizzitUp -via TMoney or Flooz or by bank transfer- after the goods are delivered. It should be noted that for any order exceeding CFA30 000, there is free delivery anywhere within the Greater Lome region.

Togo First: You have a Blockchain-based strategy. Do you think that payment methods such as crypto-currencies can be game-changers for marketplaces like yours in Africa?

SR: It is important to note that blockchain is not a payment method in itself, but rather an infrastructure similar to Swift.

Currently, our marketplace accepts Visa and Mastercard international bank cards and mobile money from seven French-speaking countries in West Africa.

We will soon launch our DizzitApp application, based on the Blockchain infrastructure, allowing the diaspora and young urban Africans to pay in Bitcoin and other crypto-currencies knowing that merchants will still be paid in local currency, FCFA, and Ariary for Madagascar. This third means of payment on DizzitApp will allow those with digital assets to use part of their assets to support their families back home with their needs (buying them food, paying school fees and medical procedures, etc.).

Cryptocurrencies are becoming a global medium of exchange with 200-400 million users, including over 40 million in Africa. These people will soon be able to use their cryptocurrency assets to buy essential goods such as food for their consumption or their families in other African countries

Togo First: What do you think of regulations, notably those related to crypto-currency use?

SR: Togo is the second African country with the largest number of crypto-currency users after Nigeria, which represents huge opportunities for the African economy.

Decentralized blockchain networks and associated crypto-currencies are an opportunity for emerging countries. They can allow African countries to accelerate intra-continental trade and facilitate the financial inclusion of VSEs/SMEs and citizens as mobile money services have done for a decade.

But all these new technologies can only be beneficial to businesses and citizens if there is a clearly defined regulatory framework that is regularly amended over time.

Regulators have realized that there is a need for this regulatory framework. We are eagerly expecting them to comply with them to sustain our investments and boost our merchants’ activities.

Togo First: Why did you choose Togo as your base? Do you think that Togo can accelerate the deployment of your startup in the sub-region?

SR: We created our first subsidiary in Togo, which is a real financial hub in the sub-region. We chose to set up here in Togo because the country has a legal infrastructure and a favorable business environment that attracts many financial institutions. The presence of Ecobank's global headquarters in Lomé was also a decisive factor.

Despite our start-up status, they welcomed us into their multinational division. This partnership allowed us to integrate their payment gateway to manage bank cards worldwide and mobile money in 7 countries in the sub-region.

As a result, we were able to create our subsidiary in less than a month, which is an important comparative advantage.

Togo First: You were one of the finalists of the annual competition organized by your partner Ecobank. Was the initial partnership a decisive factor in that selection?

SR: Our partnership with Ecobank was not the decisive factor in our selection in the competition, as other start-ups also had significant partnerships. However, our ambition to expand in 21 countries, of which Ecobank is absent in only two, and our vision and ambition to be an economic player impacting the VSE/SMEs in Africa gave us a definite advantage.

We were one of the six finalists, selected among 700 startups from 59 countries, in the Ecobank Fintech Challenge 2022.

Togo First: You have already raised venture capital funds once. Do you intend to raise additional funds?

SR: Indeed, DizzitUp has already managed to raise $340,000 in funding from 44 individual investors, called "business angels". About a third of these investors are Africans living in Africa or Europe. The funds raised helped develop the start-up and its technology platform over 3 years.

The company is currently planning a second round of $3 million in equity to finance its expansion in Côte d'Ivoire and Nigeria and to develop the new decentralized finance services for VSEs/SMEs merchants of DizzitUp Marketplace.

For this new round, DizzitUp aims to attract private African investors for about 20% of the total amount sought and international investment funds (VCs, international institutions, and corporate funds) for the remaining.

Togo First: What are your future expansion plans?

SR: Regarding our plans, we have decided to strengthen our presence in Madagascar, Togo, and Benin in 2023 and launch a subsidiary in Côte d’Ivoire. We also plan to expand in Nigeria, in 2024, to consolidate our position in West Africa.

I am convinced that Nigeria is not only Africa’s economic driver but also the key to success for a pan-African expansion. No one can claim to be a pan-African company without being present and operational in Nigeria.

Togo First: What are your strategies to achieve those plans?

SR: Our marketplace model is quite simple: purchases are proportional to the number of merchants and products listed. The more offers we have, the more accounts are created, because people can buy what they want. We invest in advertising for merchants and have already made sales in 2022. One of our competitive advantages beyond our decentralized payment infrastructure is our ability to attract merchants by combining digital and on-ground approaches.

We always start with a physical presence approach, deploying teams on the ground to recruit merchants. We also have student recruiters and an incentive system to encourage recruiters, who are also marketing managers for merchants. We provide full free support to merchants, including creating visuals, photos, and videos that we post on Facebook. Recruiters become marketers for our merchants.

Interview by Fiacre E. Kakpo

The Ugandan government has decided to digitize key economic sectors to combat widespread poverty. In that bid, it is supported by various partners.

The Uganda Development Bank (UDB), fintech company Ensibuuko, the European Union, the United Nations Capital Development Fund (UNCDF), and the Food and Agriculture Organization of the United Nations (FAO) recently launched "AgriConnect," a fintech solution aimed at facilitating access to digital finance for smallholder farmers in Uganda.

“The world is fast evolving, a result of the advancements in technology, and it is key that as a development finance partner, we recognize such changes and make a deliberate effort to back inventions that influence the growth of key sectors of the economy like Agriculture, which employs 68% of the country’s population,” said Patricia Ojangole, managing director of the Uganda Development Bank.

According to the UN Food and Agriculture Organization, Uganda's fertile agricultural land has the potential to feed 200 million people. Eighty percent of Uganda's land is arable, but only 35 percent is under cultivation. This is due to several reasons, including a lack of funding for farmers.

AgriConnect is set up to address the funding issue. It will provide both savings and loan options for Ugandan smallholder farmers. The platform will allow Village Savings and Loan Associations (VSLAs) to digitally access short-term seasonal loans and savings products at affordable prices.

For Evelyn Anite, Minister of State for Investment and Privatization, AgriConnect will reinvigorate and reshape Uganda. "With services like this, Uganda is indeed on a good trajectory to achieve its goals as stipulated in the National Development Plan and Vision 2040," she said.

Samira Njoya

To successfully implement its digital transformation projects, Cabo Verde is multiplying partnerships with other countries. After its joint subsea fiber interconnection project with Senegal, it recently partnered with the Portuguese archipelago to promote technological innovation.

Last Wednesday, the Cabo Verdean institute for business support and promotion "Cabo Verde Digital" and Startup Madeira, a business incubator based in Madeira, Portugal, signed a memorandum of understanding aimed at stimulating entrepreneurship and boosting the two archipelagos' digital cooperation.

According to Cabo Verdean State Secretary for Innovation Pedro Lopes, the memorandum will help empower young tech entrepreneurs and encourage collaboration and the development of joint projects.

The agreement comes at a time when Cabo Verde is preparing a major digital project. In fact, the country is preparing its EUR40 million technology park, which the government believes will boost the ICT sector by positioning Cabo Verde as an international service center and as a gateway to Africa for major international technology companies.

Madeira Island is also committed to research and innovation. In 1997, the government launched Startup Madeira to offer real support to project promoters and to work for the creation and modernization of companies in every economic sector.

Thanks to the memorandum, Cabo Verde and Madeira plan to pool their experience to identify future cooperation actions to strengthen their respective entrepreneurship ecosystem and facilitate the development of innovative and digital companies.

Samira Njoya

In Africa, there is still a shortage of qualified workforce for the continent’s digital ambitions. Hence the importance of actions like training and youth support which Orange is offering across the continent.

Last Wednesday, telecom operator Orange officially inaugurated its Digital Center in Conakry, Guinea. The tech infrastructure is the result of a collaboration between the operator and the German development cooperation agency GIZ. It will allow young graduates and non-graduates to be trained in digital technology, to be incubated, free of charge, and to become self-employed. They can also take part in accelerator programs.

According to Ousmane Boly Traoré, general manager of Orange Guinea, this new digital center will allow young people to be not only competitive in the job market but also to find the resources necessary to train in new technologies, embark on entrepreneurship and create jobs.

The center spans over 600 square meters. It hosts four of Orange group’s strategic programs, namely a Coding School, the digital manufacturing workshop FabLab Solidaire, the accelerator Orange Fab, and the investment fund Orange Ventures Middle East and Africa.

The programs are free for everyone. Young people will receive training (90% hands-on training) while project leaders will receive support, including acceleration and investment.

Over the past few years, Guinea has taken action to develop its population’s digital skills. Last September, the Minister of Technical Education and Vocational Training, Alpha Bacar Barry, unveiled the government's plan to transform the national telecom academy into a National Digital School. Orange’s initiative enriches such actions and offers the youth more opportunities to get digital training and get the skills needed to let the country benefit from the digital economy.

Orange Digital Guinea is the thirteen similar infrastructures launched by Orange in the Middle East and Africa. It is in line with Orange's approach to digital inclusion. According to Frank Lütje, chargé d'affaires of the Embassy of the Federal Republic of Germany in the Republic of Guinea, it aims to strengthen access to the labor market as well as entrepreneurship to help the youth fully contribute to a better future for their generation and Guinea as a whole.

Samira Njoya

More...

The Egyptian start-up ecosystem has greatly flourished in recent years. To help its actors achieve better results, the government has committed to supporting it. This pledge has renewed investors’ interest in the ecosystem.

The Egyptian Information Technology Industry Development Agency (ITIDA) announced, Friday (Nov 25), a memorandum of understanding with 500 Global, one of the world's most active venture capital firms. The three-year agreement will allow the company to open an office in Egypt- its first ever in Africa, build the capacity of 200 start-ups and create an investment fund to support Egyptian startups.

"We are thrilled to partner with ITIDA to bring 500 Global’s world-class programs, which have produced eight of our 49 unicorns, and a venture education program tailored for accelerator managers. [...] As long-time investors in the country, we have the utmost confidence in the potential of the Egyptian market and look to be a key enabler of its fast-growing ecosystem," said Courtney Powell (photo, left), COO and Managing Partner of 500 Global.

Indeed, in a very short time, Egypt's startup ecosystem has emerged as one of the four largest in Africa. In 2021, its startups attracted nearly US$500 million in venture capital funding, more than double the amount raised in 2020. They also enabled the development of key sectors such as public transport, alternative, and renewable energy, agribusiness, and e-commerce.

The agreement signed aims to provide the country’s promising startups with the tools they need to succeed, and to train managers of budding accelerators, creating the conditions necessary to foster a regional community of innovators.

According to Amr Talaat (photo, center), Egypt's Minister of Communications and Information Technology, the partnership is part of the ministry's commitment to establishing cooperation with key global players. This commitment aims to create an inclusive and robust network of experts and investors, to accelerate the growth of the local start-up ecosystem, and encourage innovation and entrepreneurship.

Samira Njoya

Over the past few years, the number of digital solutions developed in Africa has grown significantly. With the ongoing digital transformation, it is poised to rise further but, there is still an urgent need to train the youth to accelerate productive transformation and end unemployment.

Last Wednesday, the National Agency for the Promotion of Employment and Competencies (ANAPEC) and Orange Morocco signed a framework agreement to train young people in digital professions.

The agreement aims to ensure that 1,000 young Moroccans and legal migrants are trained and supervised at Orange Digital Centers and ANAPEC’s MoukawiLab in the framework of a technical and professional support program. The training will take into account the labor demand and entrepreneurial potentials.

According to Minister of Economic Inclusion Younes Sekkouri, it is a promising project that aims to support thousands of young people -graduates and non-graduates alike as well as young persons neither in education nor employment or training- by providing them with intensive training and tailored support to create their businesses and develop their ideas.

In March, Orange opened its 10th African Digital Center in Rabat to boost innovation in Morocco. During the inauguration, it committed to promoting youth employment and entrepreneurship by democratizing access to technologies in the country.

The newly signed agreement lines up with that commitment. It covers the implementation of dedicated programs under the "Orange fiber school" which trains qualified technicians and sales representatives and develops valuable fiber optic technician skills.

The agreement will also allow the two institutions to co-organize roadshows to raise awareness of the training and entrepreneurship opportunities offered by the program and encourage participation in each of the targeted regions.

Samira Njoya

Morocco is currently developing its human capital to become a global tech hub. To do so, it is partnering with various actors.

The Moroccan Ministry of Industry announced, Tuesday (November 2), two memorandums of understanding with international consulting agency Capgemini.

The memoranda aim to create the conditions required to train tech talents and develop the local engineering talent to make the country a leading destination for tech investments.

In a press statement, the government explained that the MoUs would help create 1,500 additional highly skilled jobs in the engineering sector by 2026. The “investment embodies the growing confidence in Moroccan skills and confirms the attractiveness of the Kingdom as a technological and engineering destination of choice for outsourcing,” added Minister of Industry Ryad Mezzour (photo, left).

According to a study financed by the European Bank for Reconstruction and Development (EBRD), Morocco is faced, for years now, with a shortage of engineers and technicians. To address the issue, the government has inked partnerships with several international companies to develop diversified skills and competencies in a range of innovative sectors. In April, the country signed four more MoUs for investment projects that are expected to create over 5, 000 jobs in the outsourcing sector.

CapGemini launched its Moroccan subsidiary in 2007. Since then, it has become the largest tech company in the country. According to Idriss Elasri (photo, right), Managing Director of Capgemini Engineering Morocco, the company hired 800 new staff in 2021 and 1,100 in 2022.

Samira Njoya

Africa is gradually establishing itself as one of the strong cryptocurrency markets. This makes complying with national and international regulations a requirement for actors looking to capitalize on the market.

Pan-African cryptocurrency exchange Yellow Card announced, Tuesday, it secured a virtual asset service provider license to operate in Botswana. The license, per Section 11 of the Virtual Assets Act 2022, was issued by the Non-Bank Financial Institutions Regulatory Authority (NBFIRA) on September 29, 2022, and will become the standard for crypto operations in the country.

The license officially authorizes Yellow Card to facilitate bitcoin sales and purchases for its users in Botswana. According to Chris Maurice, CEO, and co-founder of Yellow Card, this is an important milestone for the company, as it will open up "greater channels of expansion with regards to payment partners, banking and expanding our client base across Africa.”

“This will further show regulators in other markets that we are not just any other cryptocurrency company – we are pioneering, pushing boundaries, and setting the standard. All the more reason for them to work together with us as well,” he added.

Botswana is one of the few countries in the world to take significant steps to regulate cryptocurrencies and digital tokens. Last February, the government passed a bill to regulate cryptocurrency and digital token trades in the country, all in a bid to combat money laundering.

Despite its about two million population, Botswana has significant purchasing power thanks to its currency (the pula), which is stronger than most African currencies. The population is constantly looking for innovation, hence the adoption of digital currency. According to gobitcoin.io, an African Bitcoin news site, Botswana is one of the top Bitcoin users in Africa alongside Ghana, Kenya, Nigeria, South Africa, Zimbabwe, and most recently the Central African Republic.

The newly regulated firm, Yellow Card, says it also complies with key global regulations, including anti-money laundering and know-your-customer requirements under the Travel Rule introduced by the Financial Action Task Force.

Samira Njoya