With over 10 years of entrepreneurship experience, he specializes in financial technologies. He heads two start-ups that work towards financial inclusion in Africa.

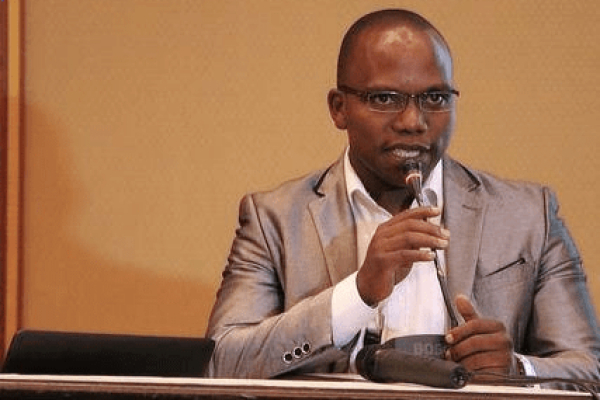

Opio Obwangamoi David (photo) is a Ugandan-trained economist, entrepreneur, and co-founder/CEO of the fintech company gnuGrid CRB.

His fintech company, founded in 2019, facilitates financial inclusion by providing credit data on “last mile financial services consumers.” Since 2021, it is licensed by the Ugandan central bank as “the first-ever indigenous Credit Reference Bureau (CRB)” in the country. Indeed, the data it generates base reports and credit scores on individual borrowers, helping credit providers make more informed lending decisions. One of its core offerings is Solar Sentra, a paygo system combining software and hardware to allow solar energy companies to manage customers’ data, sales, delivery, installation, and after-sales services.

Before gnuGrid CRB, in 2012, David founded Ensibuuko, a software company that develops fintech solutions to let Savings and Credit Cooperative Societies, lending companies, savings groups, and investment clubs automate operations.

A Westerwelle Foundation Younger Founders Program Fellow and World Frontiers Young Convergence Pioneer, in 2021, Opio Obwangamoi David attended a masterclass at the America Express Leadership Academy, where he studied Ashoka System Change.

Between 2009 and 2010, the entrepreneur was a volunteer youth mentor at Educate! a nonprofit organization that prepares African youth with the skills needed to succeed in today's economy. In 2013, he won the ICT4agric competition through Ensibuuko.

Melchior Koba