Brief (644)

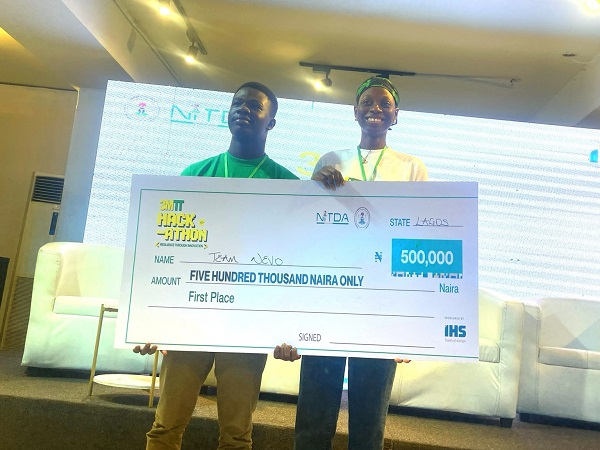

The Lagos team behind NEVO, a personalized learning platform for neurodivergent children, has won the innovation hackathon for the Southwest region in the third cohort of the 3 Million Technical Talent programme, taking a prize of N500,000 (about $345). The event highlights local digital solutions designed to improve inclusive education and expand economic opportunities for Nigerians.

South African bank Capitec is acquiring payment firm Walletdoc for $23.5 million. The transaction includes an immediate payment of 300 million rand ($17.6 million) and 100 million rand ($5.8 million) in contingent consideration. The deal is intended to bring Walletdoc’s technology into Capitec’s business-services platform and strengthen the bank’s position in e-commerce.

The Egyptian platform MoneyHash is partnering with Saudi firm Amwal Tech to boost adoption of local payment methods and offer installment plans. The partnership strengthens MoneyHash’s presence in Saudi Arabia and makes it easier for merchants to add new payment options for their customers.

Ezeebit, a pan-African company specializing in cryptocurrency and stablecoin payments, has raised $2.05 million in a seed funding round. The funds will support expansion in South Africa, Kenya and Nigeria, and help strengthen partnerships with banks and telecom operators. Ezeebit aims to reduce the cost and processing time of digital payments across the continent.

Goodwell Investments is seeking partnerships with revenue-generating companies across Africa. They specifically target enterprises led by African founders that provide essential goods or services with a strong social or environmental impact. Selected companies will receive funding, hands-on operational support, mentorship, and access to an extensive global network. Submissions are due online by Wednesday, December 31, 2025.

The Imagine H2O Accelerator has opened its application window to African water startups. Eligible companies must be under seven years old, have less than $5 million in revenue, and have secured less than $10 million in total funding. This program is non-equity-taking and provides mentorship, specialized training, and introductions to a massive worldwide network of industry leaders, investors, and founders. The application deadline is December 31st.

South African enterprise AI startup Ageiro has raised 3 million dollars to scale its autonomous agent platform, which turns business objectives into production-ready applications within days. The company plans to use the funding to strengthen its decision models, enhance compliance tooling and expand commercial operations, framing software autonomy as a core driver of enterprise digital transformation.

Investisseurs & Partenaires has completed a first close of €41 million (about $47.7 million) for its Africa Entrepreneurs 3 fund. The fund is targeting $81.5 million in total and expects a second close in 2026. It plans to invest $1.2 million to $5.9 million in 15 to 20 small and medium-sized enterprises operating in sectors including education, health, energy, agribusiness, logistics, financial services and manufacturing, with a strong emphasis on climate and gender impact.

Pan-African fund Five35 Ventures has received an anchor investment from the Mauritius-based Mennonite Economic Development Associates (MEDA), which manages the Mastercard Foundation Africa Growth Fund. The capital will strengthen Five35 Ventures’ backing for women-led technology startups across East, West and Southern Africa. The fund seeks to bridge the gap between seed funding and scaling up by combining capital, strategic guidance and access to a broad network of mentors and investors.

Send by Flutterwave, a money-transfer service, is rolling out a physical naira card for Nigerians living abroad who are visiting the country over the holidays. The card is linked to the app and can be topped up with U.S., European or U.K. bank cards. It works on POS terminals, ATMs and contactless payment systems across Nigeria. The product is designed to help visitors bypass cash-withdrawal limits, unstable exchange rates and frequent problems with foreign cards.

More...

Binance has launched Binance Junior, a new sub-account app that lets parents oversee activity while allowing children and teenagers to save in cryptocurrencies. The app offers a flexible savings feature with no trading, enabling young users to accumulate digital assets under parental supervision. Parents can fund the account, set limits and monitor all activity. The platform also includes an educational book, “ABC’s of Crypto,” designed to help families learn about digital finance together.

Nigerian startup Gigmile, founded in 2022, has closed a funding round led by Enza Capital, with participation from Seedstars International Ventures and Norrsken Africa Fund, to support its next phase of expansion. Through its Gamma Mobility rent-to-own model, Gigmile has already provided more than 10,000 vehicles to delivery agents and drivers in Nigeria and Ghana. The company aims to finance $100 million in assets by 2027.

Credit Direct, a Nigerian financial institution, has integrated “Yield” into its mobile app, adding automated savings and investment tools. The platform offers annual returns of up to 21% on fixed-term deposits and 15% on flexible plans. After a simple setup, users can access clear, fully digital products with features such as real-time account management, scheduled contributions and the option to send investment “gifts” to others.

The Judith Neilson Foundation and the Million Lives Collective have launched a new African Cities Innovation Fund. It will provide grants of up to $75,000 for projects linking startups, civic groups and public-sector partners.

The goal is to test digital and infrastructure solutions for mobility, basic services and climate resilience in fast-growing African cities.