Finance (113)

In recent years, East Africa has emerged as an economic powerhouse in Africa. To get even better results, the region has turned its attention to digital development as a key driver for further acceleration.

On Tuesday, December 5, the World Bank announced the approval of $130 million in financing for a series of regional digital integration projects in East Africa. The funding aims to bring broadband connectivity to communities in Djibouti and Ethiopia, including border areas, refugees, and host communities.

"This project is not only a significant milestone for regional integration, but also a powerful catalyst for national inclusion. By fostering a single digital market in the Horn of Africa, this initiative extends its benefits to both Tadjourah and Obock regions in Djibouti, making a substantial contribution to the country’s digital inclusion strategy," said Ilyas Moussa Dawaleh, Djibouti’s Minister for the Economy and Finance, in charge of Industry.

The financing is part of a series of initiatives supported by the World Bank to promote the expansion of a digital market in the Horn of Africa. The first operation in the series covers Somalia, South Sudan, and Kenya. This brings the total number of countries covered to five.

In choosing Ethiopia and Djibouti, the World Bank aims to address one of the main challenges facing the two countries, namely the lack of well-developed basic fiber optic networks. The World Bank's support should enable network operators, including mobile network operators, satellite operators, and internet service providers, to promote a regional digital market conducive to growth.

Ultimately, the funding will advance the integration of digital markets in the East African region by improving affordable access to regional broadband connectivity, strengthening the environment and policy convergence for cross-border digital trade and data flows, and developing digital skills.

Last week, the World Bank also approved $266.5 million in financing for a digital transformation program in West Africa.

Samira Njoya

Despite ongoing endeavors to expand international connectivity and the deployment of fiber optic backbones across West Africa, significant hurdles remain. The steadfast support of the World Bank is poised to further accelerate progress in this critical domain.

The World Bank has approved $266.5 million in financing for the Digital Transformation for Africa (DTfA)/West Africa Regional Digital Integration Program (WARDIP). This transformative initiative aims to revolutionize the digital landscape of Gambia, Guinea, Guinea-Bissau, and Mauritania, laying the foundation for a connected, innovative, and inclusive future.

"DTfA/ WARDIP is a crucial step toward an interconnected, innovative, and inclusive future for West Africa. Beyond shaping a digital landscape, it aims to foster regional integration through collaboration and strategic investments,” commented Boutheina Guermazi, World Bank Director for Regional Integration for Africa and the Middle East.

This timely intervention comes amidst West Africa's burgeoning efforts to digitize the region. While mobile broadband coverage has expanded, substantial gaps in digital connectivity, access, and usage persist. According to World Bank data, mobile broadband adoption rates remain below 40%, primarily due to prohibitively high retail prices.

The World Bank's support will empower ICT companies and service providers to capitalize on opportunities to foster a growth-conducive regional digital market. Public sector entities, universities, and regulatory bodies will also receive targeted support to enhance their contributions to digital development. The project will further bolster the efforts of the Smart Africa alliance, building the capacity of African decision-makers and policymakers in digital transformation.

Ultimately, the program will lower the digital divide by reducing the cost of Internet services in the region, stimulating competition among service providers, and upgrading underlying infrastructure. This transformation is expected to generate new employment opportunities, expand access to services for 1.3 million inhabitants, and reduce gender inequalities in digital skills, entrepreneurship, and financial services. The goal is to ensure that women have equal opportunities to benefit from the digital economy, with a target of reaching 50% of women and people with disabilities.

Samira Njoya

The South African government is stepping up initiatives to accelerate the adoption of broadband Internet as part of its digital transformation ambitions. It is supported in its efforts by a number of key international partners.

The International Finance Corporation (IFC) and South African investment bank Rand Merchant Bank (RMB) recently committed to investing a total of $49.2 million in the Eastern Cape fibre project piloted by Liquid Intelligent Technologies. Each of the two parties will invest 450 million rand ($24.6 million).

"Not only will this investment from RMB and IFC help fund the expansion of our fibre backbone network in the Eastern Cape, but it will also help us upskill more South Africans and create employment. We believe this collaboration sets a new benchmark for the financing and development of digital infrastructure in South Africa," said Hardy Pemhiwa (photo, center), Group Chief Executive Officer of Liquid Intelligent Technologies.

The funding granted to Liquid Intelligent is part of the three companies' collective commitment to advancing broadband connectivity in South Africa in general, and particularly in Eastern Cape, one of the country's least connected regions.

According to statistics quoted by Liquid, only 65% of households in the Eastern Cape have access to the Internet. What's more, only 5% of the province's households have Internet access from home, which is twice as low as the South African average, where 10% of the total population has Internet access from home.

Ultimately, the project will reduce the digital divide in the Eastern Cape and extend Internet access to underserved areas. The aim is to support the South African government's National Development Plan to achieve 100% broadband coverage in the country by 2030.

Samira Njoya

The sixth session of the India-Ethiopia Joint Trade Committee was held earlier this week in Addis Ababa, Ethiopia. During the summit, several decisions were taken.

To solve all the problems hindering bilateral trade with Ethiopia and facilitate commercial exchanges with the country, India “invited” Ethiopia’s collaboration for the creation of a payment interface between the two countries. The request was made at the India-Ethiopia Joint Trade Committee (JTC) held on Monday, November 6, and Tuesday, November 7 in Addis Ababa, Ethiopia.

"The Indian side invited the Ethiopian side to collaborate on the Unified Payment Interface (UPI) of India with Ethswitch– a share company owned by all banks in Ethiopia– of Ethiopia. Further, the Indian side also urged Ethiopia to explore the possibility of settlement of trade transactions in local currency which will help boost bilateral trade and conserve foreign exchange," reads a statement published by the Indian Ministry of Commerce.

The two countries signed a trade agreement in 1997 to strengthen their economic and commercial cooperation. Trade between the two countries in 2022-2023 is estimated to be worth more than $642.5 million. Also, to date, Indian companies have invested more than $5 billion in Ethiopia.

Last August, Addis Ababa was one of six countries to join the BRICS, a group of developing nations advocating a new economic world order. India is one of the founding members of this alliance, along with Brazil, Russia, China, and South Africa.

Let’s note that the new gateway is expected to boost Indian investment in Ethiopia.

Adoni Conrad Quenum

With the acquisition, Gozem enters another segment of the tech ecosystem while accelerating its growth on the continent.

Beninese fintech startup Moneex announced earlier today its acquisition by Togolese mobility solution Gozem. The amount of the transaction was not disclosed but the acquisition aims to launch a financial services arm, Gozem Money, in French-speaking African countries.

“Expanding our financial services through the Gozem Money solution represents the next frontier in our ongoing commitment to delivering essential digital services to our users across Africa. With the addition of the Moneex Team to our ranks, we are poised to accelerate the introduction of our innovative fintech offerings to the market,” said Martial Konvi (photo, left), Global Head of Product at Gozem.

Since its creation, Gozem has raised $11.7 million to accelerate its growth on the continent. The e-mobility startup, launched in 2018 and based in Togo and Singapore, is present in several French-speaking African markets such as Benin, Togo, and Cameroon. It has managed to add various services, such as parcel delivery, food ordering, and e-commerce, to its mobile app, becoming a super app.

Meanwhile, Moneex, the fintech created by Florent Ogoutchoro and Henry Ukoha, offers its customers multi-currency accounts, enabling them to convert funds at the best rates, receive international payments, and pay for goods and services worldwide.

The financial technology sector is the most attractive in Africa. Between July 2021 and June 2023, African fintechs raised $2.7 billion, according to the report "Finnovating for Africa: Reimagining the African financial services landscape 2023" published by Disrupt Africa.

Adoni Conrad Quenum

The African continent has a number of assets to help it become a leader in the field of artificial intelligence, including its young population. However, it needs to groom those assets to be able to capitalize on available opportunities.

The UK and partners have pledged £80 million ($100 million) to accelerate development in several African countries through the use of artificial intelligence (AI). The investment was announced, by the British government, at the AI Safety Summit held in England from November 1 to 2.

The first phase of the project, which will initially focus on sub-Saharan Africa, aims to, among other things: create or develop at least 8 responsible AI research labs in African universities; help at least 10 countries create robust regulatory frameworks for responsible, fair and safe AI; help reduce barriers to entry for African "AI-innovators" into the private sector.

"This collaborative initiative is of paramount importance as it empowers African countries to become producers, not just consumers, in the AI revolution, ensuring that we are at the forefront of shaping our own future and driving sustainable progress across the continent," said Paula Ingabire, Rwanda's Minister of Information Technology and Innovation.

According to a UK government's press release, this new collaboration is part of a wider UK commitment to harnessing the opportunities of AI and “ensure its use as a force for good.”

As part of the partnership, AI scholarships will be awarded to students at African universities. The collaboration will also support investment in the creation of data models ensuring an accurate representation of Africa. In addition, it will enable the establishment of responsible AI governance frameworks to manage the potential risks associated with its use.

Samira Njoya

The adoption of blockchain technology is swiftly gaining momentum throughout Africa. While the continent may not currently lead in resource mobilization, investments in the sector are rapidly gaining speed, benefitting numerous companies in the region.

On Monday, October 23, Uganda's Presidential Advisory Committee on Export and Industrial Development (PACEID) signed a memorandum of understanding with a TA-CargoX technology consortium comprising Technology Associates and CargoX, a blockchain-based document transfer company. The MoU aims to create TradeXchange, a national digital trade facilitation platform.

"The TA-CargoX Consortium will provide a robust, globally compliant digital trade platform as the surest means to integrate Uganda into the global trade network. This platform shall automate the import and export value chain, provide visibility in the trade supply chain, ensuring transparency, traceability, authenticity, and reliability in trade processes, as well as save cost directly for all participants," said Girisch Nair, Chairman of Technology Associates.

The new partnership is part of Uganda's ambitious goal to double its exports by 2026. PACEID aims to leverage this collaboration to support exporters, resolve trade bottlenecks, and easily comply with global trade standards, among other things.

TradeXchange will therefore be a blockchain-based collaboration platform that will streamline processes and improve the flow of information between farmers, producers, traders, and government agencies.

Once up and running, it will help the government reduce cargo release times, cut import compliance costs, and improve the efficiency of risk assessment when importing goods, tax revenue collection, and overall transparency of goods flow.

Samira Njoya

The funds announced by the Gates Foundation will complement ongoing investments in the use of artificial intelligence to develop the healthcare sector worldwide.

The Bill & Melinda Gates Foundation pledges $30 million to support the development of a new artificial intelligence platform for Africa. American billionaire Bill Gates (photo) made the announcement on Tuesday, October 10, at this year's "Grand Challenges" meeting in Dakar, Senegal.

According to the donors, the platform will provide African scientists and innovators with the technical and operational support they need to turn promising health and development ideas into real, scalable solutions.

It is a step towards ensuring that the benefits of AI are relevant, affordable, and accessible to all and that these essential tools are developed both safely, ethically, and equitably.

"The world needs to make sure that everyone—and not just people who are well-off—benefits from artificial intelligence. Governments and philanthropy will need to play a major role in ensuring that it reduces inequity and doesn’t contribute to it. This is the priority for my own work related to AI," Bill Gates said in an interview last March.

According to the Foundation, this latest investment aligns with its recent focus on funding technological innovation, particularly as it relates to AI, in the world's low- and middle-income countries. Last August, the Foundation announced that it would spend $5 million to fund nearly 50 AI projects in the said countries.

These investments aim to increase funding for healthcare R&D (research and development) worldwide to make development easier and faster and enable the next generation of scientific and technological breakthroughs that are relevant and accessible to all.

According to the Foundation, only 2% of R&D funding is devoted to diseases affecting the world's poorest populations.

Over the past decade, the Kenyan government has invested heavily to make the country a technological hub in East Africa. It wants to reach even greater heights with the support of various partners.

On Thursday, October 5 in Nairobi, the European Union (EU) Commission launched a €430 million digital package aimed at extending connectivity in Kenyan schools, creating a green digital innovation center, and supporting the government in its digital transition.

The package, unveiled during the official visit of the European Union's Commissioner for International Partnerships, Jutta Urpilainen, underlines the EU's commitment to Kenya's technological transformation.

"Expanding digital connectivity, upskilling jobs, and driving digital governance and services is at the heart of what our investment strategy is about: Creating sustainable connections and local added value while cutting unsustainable dependencies," said Jutta Urpilainen.

The launch of this digital package in Kenya is part of Europe's Global Gateway strategy, an initiative of the European Commission to advance the dual digital and green transition and provide reliable, sustainable connections to partner countries.

In Kenya, the initiative will reduce the digital divide by providing Internet access to around 1,300 schools in remote areas. A grant of 9.8 million euros will fund the development of infrastructure and digital educational skills and services in schools in 47 counties. These will benefit over 219,000 children as part of the GIGA program, a global initiative set up by the United Nations Children's Fund (UNICEF) and the International Telecommunication Union (ITU).

The package will also enable the creation of a green digital innovation cluster supported by the EU and Germany, as well as e-government initiatives in partnership with Estonia and Germany, and participation in Govstack, an innovative community project formed as part of a multilateral partnership between Germany, Estonia, ITU, and Digital Impact Alliance.

According to William Ruto, President of the Republic of Kenya, the aim of the partnership with the European Union is to create a link that will contribute to sustainable development, the empowerment of the most disadvantaged, and the promotion of good governance and the rule of law in the country.

Samira Njoya

Cryptocurrency and blockchain adoption is growing rapidly around the globe. To stay relevant in the market in such context, global fintechs are committed to expanding their services and bridging the gap between fiat and digital currencies.

On Tuesday, September 26, US financial services company MoneyGram announced plans to launch its digital wallet, which enables conversion to fiat currency, next year.

The wallet, which will officially debut in the first quarter of 2024, will enable consumers worldwide to leverage stablecoin technology to seamlessly switch between fiat and digital currencies or the other way around, all via Moneygram.

"Our vision to connect the world's communities, by empowering our customers through innovative financial solutions, takes another step forward today. [...] We're thrilled to have the vision, strategic plans, innovative technology, and expansive retail network in place to continue offering consumers access to the digital economy, but now further backed by our global reputation for speed, efficiency, and trust," said Alex Holmes, MoneyGram CEO.

The launch of Moneygram's crypto wallet is part of a partnership signed with the Stellar Development Foundation. The agreement became effective last year, with the launch of an initial service aimed at offering a bridge between cash and cryptocurrency. The service has been extended to eight digital wallets on the Stellar blockchain, offering consumers the ability to make withdrawals in over 180 countries and cash-ins in more than 30 countries worldwide.

As such, the new non-custodial wallet will use the Stellar network and MoneyGram's fiat transfer services to facilitate instant transactions. It will be a “zero-fee service” until June 2024, redefining cross-border payments and giving MoneyGram customers new ways to send and receive money.

Samira Njoya

More...

Last May, the government imposed new taxes aimed at increasing national revenues and reducing the budget deficit, in response to the current cash crunch.

The Blockchain Association of Kenya (BAK) announced on Friday, September 1, that it had officially filed a petition, in the High Court of Kenya, challenging the implementation of the Digital Asset Tax (DAT) introduced by the Finance Act 2023.

The new regulations, which came into force on September 1, impose a 3% tax on revenues generated by the transfer or exchange of digital assets in the country.

"Our petition aims to address concerns about the DAT’s impact on both our industry and the broader economy. Enforcement of this harsh DAT could potentially lead to adverse effects on the industry’s growth and innovation. The core focus of the petition is to thoroughly examine the legal and constitutional dimensions surrounding the imposition of this tax on digital assets. The matter will be mentioned before the court on September 28, 2023," states a BAK press release.

The petition introduced by the BAK comes a few months after a press release issued by the same organization, in which it set out seven reasons for opposing the digital asset tax. Among other things, BAK criticized the unclear classification of digital assets, the ambiguity surrounding transfers of digital assets, and the failure to take into account loss-making transactions.

According to Allan Kakai, BAK's legal and policy director, DAT was introduced as an income tax, but it is taxed on the gross value of the asset, not on gains and profits. This means that those in a loss-making position will still pay the tax.

The new tax regulations also require crypto exchanges, as well as those facilitating the exchange or transfer of digital assets, to retain tax deductions, and transmit them to the country's tax authority within 24 hours of the transaction.

For BAK, the government should review the texts, hence the request. Kenya is ranked 5th worldwide for peer-to-peer crypto transactions and 19th for cryptocurrency adoption, according to the Chainalysis 2022 report.

Samira Njoya

Nearly half of the African population lacks access to digital financial solutions. To address this issue–meeting the needs of financially excluded and disadvantaged people– the African Development Bank (AfDB) and its partners have taken several steps.

India will contribute $2 million to the African Digital Financial Inclusion Facility (ADFI), a fund hosted and managed by the African Development Bank (AfDB). The Bank disclosed the news on August 2.

According to the AfDB, the money will help tackle bottlenecks to the growth and adoption of digital financial solutions, as well as accelerate financial inclusion in Africa.

#India pledges $2M to @ADFI_AfDB for digital financial solutions in Africa. India's #financialinclusion success offers valuable insights to scale up initiatives to meet the needs of the financially excluded. Learn more: https://t.co/v34gM3EpY1 #IntegrateAfrica pic.twitter.com/DAF80VDaQf

— African Development Bank Group (@AfDB_Group) August 2, 2023

"India's pioneering role in digital financial services, the extension of financial inclusion to remote rural areas, and the creation of infrastructure for digitizing financial services offer India an excellent opportunity to work within the ADFI partnership to share learning and expertise on public digital infrastructure to promote digital financial inclusion across the continent," said Manisha Sinha, Deputy Secretary to the Department of Economic Affairs and Principal Board Member of the ADFI for India.

Due to Covid-19, Africa’s need for greater digital financial inclusion expanded. As a result, less expensive dematerialized financial services were deployed to support those who have no or low access to formal banking services.

In 2019, the AfDB launched the ADFI fund with an initial endowment of $40 million from the Bill & Melinda Gates Foundation, the Government of Luxembourg, and the French Development Agency: the African Digital Financial Inclusion Facility (ADFI).

By 20230 the fund hopes to devote $400 million to support the digital financial inclusion of 332 million people in Africa, 60% of whom are women.

India is recognized worldwide for having a thriving public digital payment system; a system that transformed governance, financial inclusion, and resilience for millions of people. The financial support of the Asian giant should thus advance AfDB’s goal regarding digital financial inclusion.

Samira Njoya

Over the past few years, mobile money has become an increasingly important financial tool for a growing segment of the African population. As the service becomes more diversified, it continues to gain maturity and conquer new markets across the continent

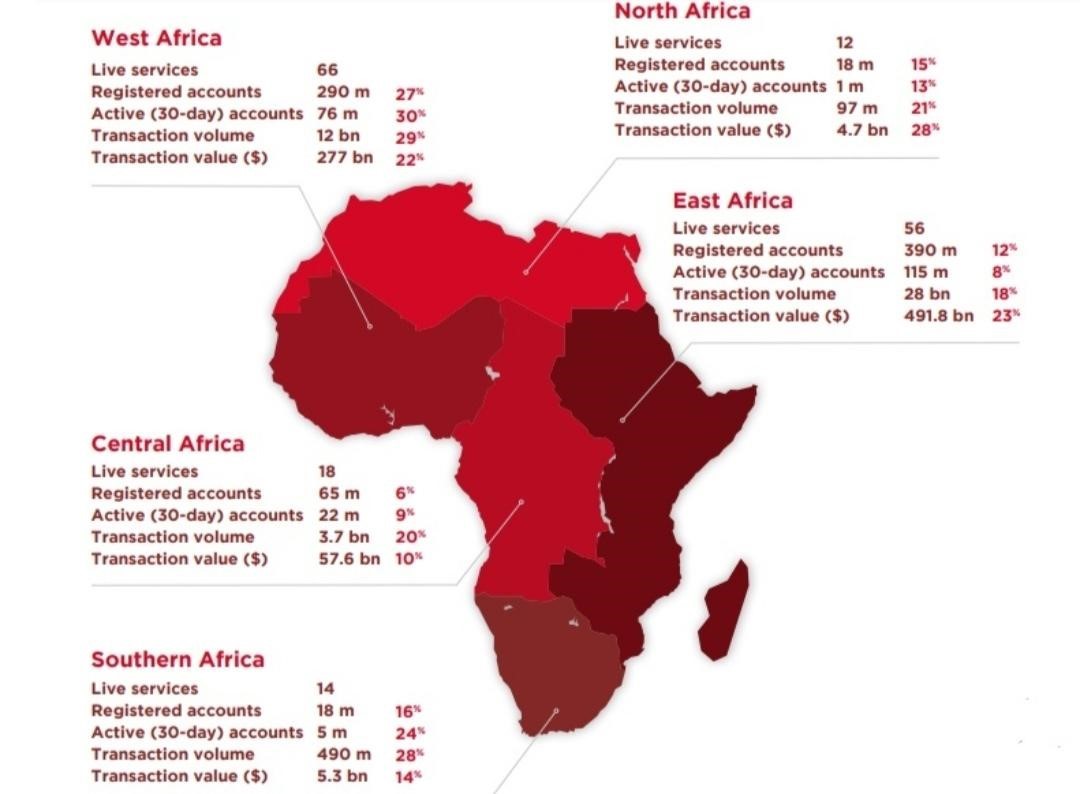

In 2022, Africa was the fastest-growing mobile money market in the world. In its "State of the Industry Report on Mobile Money 2023", the GSM Association (GSMA) reveals that the continent recorded 166 active services (out of 315 worldwide) and 781 million active accounts (48.81% of the world's 1.6 billion registered users), up by 17% compared to 2021.

The continent also accounted for 44.9 billion (+21%) financial transactions estimated at $836.5 billion (+22%). The amount represents 66.39% of the $1.26 trillion mobile money transactions recorded worldwide in 2022.

East Africa remained the most dynamic sub-region on the continent with 390 million active accounts, 28 billion transactions, and $491.8 billion in transaction value. North Africa, due to its small size, recorded the lowest performance with 18 million active accounts, 97 million transactions, and $4.7 billion in transaction value.

Infographic: Mobile Money Market in Africa (2022)

Source: GSMA

According to the GSMA, despite this positive performance, there are lingering challenges that threaten financial inclusion. “Some countries have introduced taxes on mobile money transactions and fees that do not align with their financial inclusion objectives. Fraud also remains an industrywide issue, which many regulators are aiming to overcome through improved consumer awareness and capacity building,” the report indicates.

Since 2020, the U.S.-based international organization has been providing additional capital to associations working for digital inclusion in three countries around the world. For this edition, six countries are concerned, including Ghana and Senegal.

The Internet Society Foundation, an organization that promotes the development of the Internet worldwide, announced on April 30, the opening of applications for the 2023 edition of its Strengthening Communities, Improving Lives, and Livelihoods (SCILLS) program.

The organization will award up to $250,000 in grants for projects that leverage the Internet to promote economic inclusion and boost education opportunities. In Africa, two countries are eligible, namely Ghana and Senegal.

"Internet access has increased significantly in Indonesia, however, access to Internet knowledge and skills remain out of reach for some. This new round of SCILLS program grants will support organizations that connect underserved communities with the critical digital skills needed to unlock economic growth and educational opportunities," said Sarah Armstrong, executive director of the Internet Society Foundation.

Interested parties are invited to apply with complete applications by May 31st.

Let’s note that at the of end 2022, the Internet penetration rate was 99.03%, up from 94.82% the previous year, according to a report by the Senegalese Telecommunications and Postal Regulatory Authority (ARTP).

Samira Njoya