Finance (113)

The partnership comes a month after Mastercard partnered with Egypt to digitize the local economy. It aims at giving consumers faster access to digital loans.

Egyptian software development company egabi FSI and Mastercard recently signed a partnership to expand access to digital lending solutions across Africa, Eastern Europe, and the Middle East. The information was disclosed by Mastercard on Thursday, April 27.

This agreement will lead to the digitization of the lending ecosystem and the introduction of innovative products for “growing segments such as BNPL, microfinance and SME.”

According to Ahmed Sameh, CEO of egabi FSI, the partnership with Mastercard "reflects the confidence of global financial institutions in egabi FSI as a fintech facilitator and the quality of egabi's products. This partnership will pave the way for greater market coverage and together with Mastercard, we will be able to redefine the digital lending industry in the region."

Under the partnership, “Mastercard will activate egabi’s digital-lending capabilities and assets to provide an end-to-end lending proposition to financial institutions and fintech companies.” The proposition will be “further enhanced by offering Mastercard’s Digital First products to issuers willing to enter the digital lending space.”

This strategic partnership follows partnerships initiated by Mastercard in Egypt to connect and power an inclusive digital economy that benefits everyone, everywhere with secure, simple, smart, and accessible transactions. In March 2023, Mastercard announced a new partnership with the National Bank of Egypt (NBE) to “bring next-level digitization into the Egyptian economy.” Five months earlier, in October 2022, the company partnered with some Egyptian banks to bolster the local fintech ecosystem and boost financial inclusion.

Samira Njoya

This acquisition comes months after Autochek bought the car sales platform CoinAfrique, in Q3-2022.

Nigerian car financing provider Autochek announced, Monday, the acquisition of majority shareholding in Egyptian car dealer AutoTager.

According to the company's statement, the acquisition aims to strengthen Autochek's presence in North Africa and support the company's continued growth.

Commenting on the transaction, Olajide Adamolekun, group CFO and co-founder of Autochek said: “Amr’s -ed. note: Amr Rezk founder of AutoTager- background and track record are as impressive as it gets and I am delighted to have him on board. His experience will be invaluable as we enter the Egyptian market and continue on our mission to improve the automotive finance value proposition on the continent and catalyze more growth across the automotive ecosystem.”

Autochek launched the acquisition of automotive platforms a while ago. In July 2022, the car financing company acquired CoinAfrique. In September 2021, it acquired Cheki Kenya and Cheki Uganda.

With this majority shareholding acquisition, the company now has a presence in nine countries in East Africa, West Africa, and North Africa, with more than 2,000 partner-run dealerships and workshops, according to its release.

By targeting AutoTanger, Autochek is aiming at North African markets, mainly Egypt - which is the third largest economy in Africa according to the African Development Bank (AfDB), and the third largest automotive market on the continent (according to 2021 data from the International Organization of Motor Vehicle Manufacturers-OICA).

Samira Njoya

In recent months, South Africa’s digital sector has attracted several important investment pledges. Earlier, Amazon committed to investing in tech services in the country. It is now followed by pan-African digital solutions Cassava Technologies.

Last Friday, Pan-African tech company Cassava Technologies announced its commitment to investing ZAR4.5 billion ($250 million) in its South African operations over the next two years. The initiative was unveiled at the fifth South Africa Investment Conference (SAIC) held the previous day in Johannesburg.

The investment will be made through Cassava Technologies' business units, namely Liquid Intelligent Technologies, Africa Data Centres, and Distributed Power Africa. It is aimed at supporting the expansion of Liquid Intelligent Technologies' fiber network, the expansion of Africa Data Centre’s capacity and footprint, the enhancement of cloud and cybersecurity capacity, and the deployment of clean, renewable energy by Distributed Power Africa in South Africa.

“South Africa accounts for the largest proportion of Africa’s industrial GDP with a sophisticated and growing ICT sector. The country’s unique combination of highly developed first-world economic infrastructure and a stable macro-economic environment affords businesses like ours a conducive investment environment in which we can partner with government to drive economic development and create jobs,” said Hardy Pemhiwa, President & Group CEO of Cassava Technologies.

The initiative is in line with the ambitions of South African President, Cyril Ramaphosa, to stimulate the country's economy and attract ZAR2 trillion in investments over the next five years to achieve development objectives.

Cassava Technologies has eight subsidiaries, namely Liquid Intelligent Technologies, Liquid Dataport, Liquid C2, Africa Data Centres, Distributed Power Africa, Sasai Fintech, Telrad, and Vaya Technologies.

Samira Njoya

In recent years, Senegal, like most African countries, has accelerated its digital transformation. To successfully implement that transformation, the country is relying on support from valued partners like the World Bank.

The World Bank recently approved a CFAF91 billion ($150 million) to support Senegal in the implementation of its Digital Economy Acceleration Project (PAEN). A financing agreement was signed to this effect on Thursday, April 6, between Mamadou Moustapha Bâ (photo, right), Senegal's Finance Minister, and Keiko Miwa (photo, left), Director of the World Bank Regional Office for Cape Verde, Gambia, Guinea-Bissau, Mauritania, and Senegal.

"For the population’s benefit, it is essential to leverage digital technologies in critical sectors such as health where digital solutions, including electronic medical records, telemedicine, and immunization campaign management can have a tangible impact," said Keiko Miwa after the agreement was signed.

According to the Finance Minister, the funds will help improve the legal, regulatory, and institutional frameworks governing the digital economy. It will support the digital transformation of the public sector by strengthening the technical foundation and e-government services. It will also promote digital adoption by improving digital literacy and skills -particularly among women and youth- and increasing access to health information to improve the delivery of health services.

PAEN is the first axis of the Plan for an Emerging Senegal (PSE) adopted in 2014 by the government to make Senegal an emerging country by 2035.

Samira Njoya

In 2019, the Moroccan government launched a national strategy to improve financial inclusion across the country. To achieve the objectives set in that strategy, the executives are working with public and private partners.

Last Friday, the World Bank’s board of directors approved a third Development Policy Loan (DPL) of $450 million for Morocco.

According to an IMF release dated April 3, 2023, this DPL aims to support the Moroccan government in the implementation of reforms to improve financial inclusion, digital entrepreneurship, and individuals and businesses’ access to infrastructure and digital services.

“This third financing is in line with the recommendations of the New Development Model (NDM), which emphasizes the need for a paradigm shift to promote inclusive, private sector-led growth to improve public services and reduce social and spatial disparities,” indicated Jesko Hentschel, Country Director for the Maghreb and Malta at the World Bank.

The first DPL, amounting to $500 million, was approved in 2020. In June 2021, a second one -$450 million- was approved. Combined with the new one, the total DPL secured by Morocco amounts to $1.4 billion.

It is a continuation of the $700 million financing the World Bank approved, in 2019, to support financial inclusion and the digital economy in Morocco.

The various funding enabled Morocco to significantly push back the barriers to financial and digital inclusion. Today, 44% of Moroccans have a bank account compared to 29% in 2017, and 30% of them use digital payments compared to 17% in 2017, the IMF release reported.

“The infrastructure for digital payments has expanded with 31% of rural districts now covered by mobile payment networks and 19 mobile payment providers in operation,” the IMF indicates.

Samira Njoya

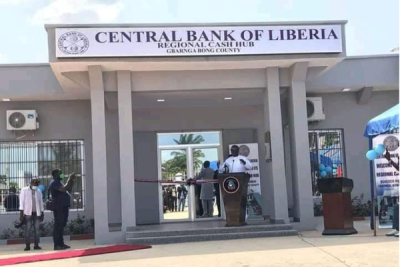

Liberia's financial sector faces several challenges, including inadequate ICT infrastructure. The existing payment infrastructure deployed in 2016 has served the country well over the past six years but requires urgent upgrading.

The African Development Bank (AfDB) will finance the Liberia Payments Infrastructure and Systems Upgrade Project. For the said project, the Board of Directors of the African Development Fund, the AfDB's concessional lending window, approved a $3.9 million grant on Friday, March 17.

“The modernization of Liberia’s payments infrastructure and systems to improve payments efficiency will not only strengthen the formal financial sector but contribute to greater financial stability and improved private sector development,” explained Benedict Kanu, African Development Bank country manager for Liberia.

According to an AfDB release, the financing will target the automated check processing and automated clearing house systems, as well as the real-time gross settlement systems that form the backbone of payment processing in the country's financial sector.

It will also finance the upgrading of the Central Bank of Liberia's main data center and “impact the institution and government ministries involved in the payment.”

The main objective is to strengthen Liberia's payments ecosystem for increased efficiency and to foster growth and innovation, as well as financial inclusion, which currently stands at 44.2 percent according to the World Bank's Global Findex 2021 database.

Samira Njoya

The Cameroonian platform launched three years ago has attracted investments from across the globe. In 2022, it was the Central African startup to attract the second-highest volume of funding.

Blockchain-backed accelerator Adaverse announced Monday a strategic investment in Ejara, the Cameroonian investment platform that improves financial inclusion through blockchain technology.

The investment, whose amount was not disclosed, will support Ejara's drive to empower itself and expand into new markets in Francophone Africa.

“Ejara meets a pressing need across the Francophone region, and we are excited about the business model, which we believe can be replicated across the African continent. They have shown that they understand the people and have built a bridge between crypto and traditional finance, leveraging continuity rather than disruption,” said Vincent Li, founding partner at Adaverse.

Since its launch in 2020, Ejara has completed several funding rounds. The last before this financing was in November 2022, when it secured $8 million from several investors.

To date, Ejara has served more than 33,000 people from Cameroon, Côte d'Ivoire, Burkina Faso, Mali, Guinea, Senegal, and the Francophone African diaspora in Europe, Asia, and the United States. The fintech startup has also launched cross-border money transfers and user-to-user payments for Africans in the diaspora.

With this new funding, it wants to conquer Francophone African countries, democratizing access to crypto-currency investments by offering the average resident the opportunity to invest as little as CFAF1,000 (~$2) and earn interest daily.

Samira Njoya

African start-ups play a vital role in economic growth and development. They create jobs, solve problems, and positively impact societies. Funding them is therefore more important than ever.

Last Tuesday, Flat6Labs, MENA’s leading venture capital, announced the launch of the Africa Seed Fund (ASF), a new $95 million seed fund aimed at supporting the growth and development of early-stage tech start-ups in Africa.

The venture capital firm informs that ASF will focus on three main investment territories, namely North Africa, West Africa, and East Africa. It will invest in more than 160 early-stage African tech startups over the next five years with check sizes ranging from $150,000 to $500,000.

It will provide beneficiaries with seed funding, regional business support, access to a regional network of experienced mentors, and regulatory and logistical support to set up and grow their businesses. Two cohorts will be run every year, each with an average of 10 to 15 start-ups. The first investments in the selected start-ups are expected before the end of 2023.

Flat6Labs “ will also be providing seed tickets to seasoned founders independently of the program,” the release announcing the ASF explains. According to the release, the large influx of ASF capital is likely to create more than 14,000 jobs, support more than 1,200 founders, 20% of whom are women, and generate more than $700 million in revenue.

“Africa is one of the most exciting regions to invest in tech and innovation, with huge untapped potential and unique business opportunities. We will leverage our experience and knowledge to guide the startup founders to create truly scalable, investment-ready, Africa-based companies,” said Ramez El-Serafy, General Partner for ASF.

The African tech ecosystem has grown significantly in recent years. According to Partech's Africa Venture Capital Report 2022, the ecosystem attracted $6.5 billion of investments in 2022, up by 8% from the $6 billion attracted in 2021.

Samira Njoya

The Democratic Republic of Congo is one of the African countries with the largest rural-urban connectivity gap. In that context, the post-Covid-19 growth in demand for broadband connectivity coupled with the country’s large population is attracting local and foreign investments in the digital sector.

In the coming months, more than 2.5 million people living in the eastern regions of the Democratic Republic of Congo (DRC) will benefit from a faster, cheaper, and more reliable internet connection. A financing agreement to this effect was signed on Saturday, March 4, between the European Investment Bank (EIB) and Bandwidth and Cloud Services Group (BCS).

Under the agreement, BCS will receive $10 million to deploy 1,200 km of fiber optic cable out of the 20,000 km that it plans to install in Southern, Central, and Eastern Africa over the next three years.

The investment will help connect areas with poor or no access to broadband internet. It will create jobs and connect 319 schools and 70 hospitals and health centers. According to Yonas Maru (photo, left), founder and CEO of BCS Group, it "will go a long way to ensure implementation of the MOU between the Government of DRC and BCS to connect over 1,900 schools, 1,640 public hospitals and government institutions along the BCS backbone and metro fiber infrastructure."

“The Digital is such a powerful driver of equity, inclusion, and growth, that the EU has made it a pillar of our Global Gateway strategy. Expansion of the fiber-optic infrastructure will enable local communities, schools, and hospitals to benefit from mobile broadband, which ultimately means new opportunities for learning, business, jobs, and healthcare,” said Thomas Östros, Vice-President of the European Investment Bank.

The funding was officially announced last November at the AfricaCom 2022 in Cape Town, South Africa. It is the EIB’s first quasi-equity investment and its second cooperation with BCS. In 2018, the institution provided an $18 million long-term loan for BCS.

Samira Njoya

The coronavirus pandemic accelerated digital transformation projects in Africa, boosting demand for digital tools. This creates a funding gap, which is partially filled by investment funds and venture capital firms.

Pan-African diversified group Axian announced Monday (Feb 13), the launch of Axian Investment, an entity that will manage its investments in tech and innovative companies in Africa.

According to the press release issued by the group, Axian Investment will aim to share the group's experience and provide support, directly and indirectly, to companies at different stages of maturity.

"It will empower AXIAN Group to deliver an even broader positive impact through diverse yet synergized investments, reaffirming its commitment to support entrepreneurs and create shared and inclusive values. Meanwhile, supporting Africa’s growing position within the global economy," the release informs.

The Pan-African group kickstarted the implementation of its long-term investment strategy in 2017 by taking indirect stakeholding in companies and startups. To date, it has invested in 20 private equity and venture capital funds "across the world, but with a strong regional focus on Africa."

Currently, its venture capital branch is a minority shareholder in 10 African start-ups. It aims to accelerate its activity and spread across the entire ecosystem (fintech, e-commerce, e-health́, e-logistics...). It will also create synergies with the group's other activities.

Samira Njoya

More...

The second fund comes four years after the close of the first. Like the first, it is also focused on African startups but the envelope raised is larger.

US VC firm Partech announced, Tuesday (Feb 7), the first closing of Partech Africa II, its second investment fund focused on Africa. The EUR245 million raised will "support entrepreneurs who use a combination of technology and excellent operations to address some of the hard-to-solve but very large opportunities the continent offers across all sectors."

“We had set an ambitious goal for Partech Africa II at €230M, with a hard cap at €280M, essentially doubling the size of our first fund. We overreached it with a closed amount already above the target fund size," said Cyril Collon (photo, left), General Partner at Partech Africa.

The second fund is backed by leading development finance institutions, as well as institutional and commercial investors. It will pursue the first fund's strategy, which is to identify and support early-stage and growth-stage start-ups on the continent. It will invest between US$1 million and 15 million to support the targeted entrepreneurs.

To date, Partech's portfolio includes 17 startups in 9 African countries now operating in 27 countries across the continent. They include TradeDepot, Yoco, Wave, Nomba (formerly Kudi), Gebeya, ChatDesk, Reliance Health, MoneyFellows, TerraPay, Tugende, and Almentor.

Samira Njoya

The fintech startup is now Egypt's second unicorn after the e-payment platform Fawry.

Last Wednesday, Egyptian fintech MNT-Halan announced a US$400 million funding round, which helped it achieve unicorn status.

The startup founded in 2018 by Mounir Nakhla and Ahmed Mohsen said it secured US$260 million in equity financing (equity) and US$140 million in debt financing, with securitized bond issuance last year.

A single investor, Abu Dhabi-based investment fund Chimera Investments, injected about US$200 million into the start-up in exchange for a 20% stake.

"The timing of the transaction is [...] a testament to our ability to significantly increase our revenues and open new revenue streams while growing our bottom line, despite the macro-economic situation," said MNT Halan CEO Mounir Nakhla.

Thanks to this new funding round, MNT-Halan becomes the second unicorn in Egypt, after the e-payment platform Fawry.

In September 2021, it raised US$120 million from several private equity funds, including Apis Growth Fund II, Development Partners International (DPI) and Lorax Capital Partners, and venture capital funds Middle East Venture Partners, Endeavor Catalyst, and DisruptTech. Among other things, the funds secured helped it acquire the online grocery shopping platform Talabeyah. Currently, it is the leading Egyptian lender to the unbanked with over US$2 billion of loans already disbursed.

The approval comes six months after the Ghanaian fintech startup raised US$10 million from Symbiotics BV and a Mauritian fund.

Ghanaian fintech startup Zeepay recently received the Central Bank of Zambia's approval to operate in Zambia offering users the possibility to directly send funds from their mobile money wallets to over 150 countries.

According to Andrew Takyi-Appiah (photo), co-founder and managing director of Zeepay, the new service, which is the first of its kind in the world, is the result of a partnership with Moneygram International. "Our partnership with MoneyGram is helping to make Africa borderless day by day, and we are excited to be at the forefront of this revolutionary change," he said.

Zeepay operates in more than 25 countries around the world. Since its launch in 2016, it has grown exponentially. In March 2020, it became the first Ghanaian company to secure an Electronic Money Issuer (EMI) license from Bank of Ghana, the Ghanaian central bank.

In August 2022, it raised US$10 million to enter more African markets and support local banks.

Samira Njoya

After securing initial funding in 2020, the company wants to continue its expansion with additional capital.

Moroccan e-logistics start-up Cathedis recently secured US$735,000 in pre-series A funding from an investor cohort consisting of Afrimobility, a venture capital fund of AKWA Group, and CDG Invest.

According to Imad El Mansour Zekri, founder and CEO of Cathedis, the renewed support from CDG Invest, its old investor and partner, as well as the entrance of Afrimobility into its Cathedis' capital will help the startup consolidate its performance, develop its innovation platform and accelerate its growth.

In 2020, the startup secured MAD3 million (US$296,000) through CDG Invest's 212 Founders, raising the resources to achieve over 300% growth between 2020 and 2022.

In its four years of operation, the start-up has built a fully digital platform that manages all deliveries, based on a system that easily handles every operation from production to delivery, payment, and complaint handling with real-time or near-instantaneous tracking.

Cathedis has also deployed an automated 4,000-parcels-per-hour sorting center, thanks to which it serves more than 160 cities and regions in Morocco. To successfully achieve its goals, the startup turned to the association R&D Morocco, which promotes and drives innovation.

According to its CEO, it is one of the leading e-logistics operators in Morocco, with proprietary industrial and tech solutions. Its goal is to reach an annual flow of 3 million packages by 2024.

Samira Njoya