A medical doctor by training, he has developed a passion for technology. He creates technological solutions to improve patient care in hospitals.

Gracien Kibala Katanga (photo) is a trained medical doctor and a passionate tech entrepreneur from the Democratic Republic of Congo. He is the founder and CEO of the healthtech startup Mavimpy Care.

Established in 2020, Mavimpy Care develops web and mobile applications to digitalize medical practices. It enhances emergency medical services, geolocates nearby hospitals, facilitates appointment scheduling, and offers online consultations throughout the DRC.

At the forefront of technology, the startup integrates artificial intelligence into its solutions. "With the connected bracelet that digitizes medical records, we personalize our health forms. Our connected bracelets provide information about your health; just scan a QR code to access your medical history," reveals Kibala Katanga in February 2024.

In addition to Mavimpy Care, Gracien Kibala Katanga serves as an administrator at Cortex Corporate, a tech solutions company. Their main application, Yangela App, assists merchants in managing stock, monitoring transactions, controlling inventory movements, and identifying sources of losses. The app also enables the management of multiple sales points and inventory control.

Before founding Mavimpy Care, he established Kibal’s and Mak Business in 2018, a telecommunication and mobile money transfer company, where he served as CEO until 2022. He is also a co-founder of Lubumbashi Trading, an academy for forex trading training.

Gracien Kibala Katanga graduated from the University of Lubumbashi with a degree in medicine. His career began in 2016 at the same university, where he was a mobile security coordinator. From 2018 to 2019, he worked as a marketing and sales agent at Kwakoo Group, an organization developing tech solutions for e-commerce businesses.

Melchior Koba

Digital transformation is enabling multinational companies to operate without a physical presence in the countries where they do business. This poses a significant fiscal challenge for African economies. As a result, it is urgent to regulate the activities of these digitally-enabled multinational firms.

The Senegalese Directorate General of Taxes and Domains (DGID) recently announced the introduction of a digital services tax, effective from July 1st. This measure aims to tax the revenues of foreign digital companies and platforms operating in the country, in accordance with Article 355 bis of the General Tax Code (CGI).

The tax will apply specifically to online marketplaces facilitating transactions between suppliers and customers, platforms for downloading and streaming music, movies, and online games, as well as data storage and processing services via cloud and database management services. It will also cover online learning and teaching platforms, and content hosting services such as websites, images, and text. Digital giants like Google, Apple, Meta, Amazon, and Microsoft are particularly targeted by this tax.

The taxable base will be determined based on the actual revenue of non-resident suppliers or foreign digital platform operators, evaluated according to the consideration received or to be received. The VAT rate in Senegal is 18%, with a specific reduction to 10% for the hospitality and restaurant sectors, which have struggled since the Covid-19 pandemic.

This regulation, introduced by the new government, is expected to have a positive impact on the Senegalese economy by generating additional tax revenue for the state and contributing to a fairer business environment. It will also allow the country to better regulate the activities of foreign digital companies on its territory and ensure they contribute fairly to the Senegalese economy

Samira Njoya

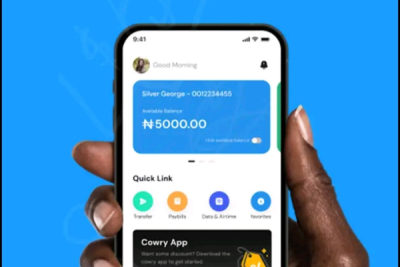

African populations are increasingly relying on fintech solutions to access financial services. From mobile money transfers and digital savings accounts to online loans, this Nigerian startup has taken steps to provide these services to underserved communities across the continent.

AwaCash is a fintech solution developed by a Nigerian startup. It allows users to make payments, transfer money, and manage their finances via a mobile application. The startup, based in Lagos, was founded in 2021 by Dayo Okunfolami, Bonaventure Igboanugo, and Oladele Dada.

AwaCash aims to simplify the lives of Nigerians by providing customized on-demand banking experiences and expanding its range of services in the dynamic fintech sector. "We understand the obstacles encountered by the average Nigerian in obtaining credit and efficiently managing their finances. Our primary objective is to streamline their lives by offering an on-demand banking experience that is tailor-made to meet their ever-evolving needs," said Dayo Okunfolami.

The solution features a mobile iOS and Android application, which has been downloaded over a thousand times from the PlayStore. Users can create an account in just a few clicks to access various services. Among other things, they can pay electricity bills and various subscriptions, buy airtime and mobile data, save money, access loans, and obtain virtual bank cards for online purchases.

In June 2024, the fintech was selected by the Nigeria Sovereign Investment Authority (NSIA) for its eponymous award. AwaCash will benefit from an acceleration program that includes a five-week training course at Draper University in Silicon Valley, USA.

Adoni Conrad Quenum

African nations are actively driving digital development to unlock its full potential. Close collaboration is key to maximizing these efforts.

Egypt and Burkina Faso are committed to bolstering their cooperation in the digital sector. The commitment was the focus of discussions between the Egyptian Ambassador to Burkina Faso, Shérif Abdel Kader Abdel Latif Nada, and the Burkinabe Minister of Digital Transition, Posts, and Electronic Communications, Aminata Zerbo/Sabane, on Friday, June 21.

"I came to discuss with the minister the opportunities for bilateral cooperation in the field of digitalization between our two countries. We want to further strengthen this cooperation. Egypt intends to share its expertise in digitalization with Burkina Faso," stated the Egyptian diplomat following the meeting.

This initiative is part of the Egyptian government's efforts to implement its digital transformation strategy, known as "Digital Egypt 2030." Cairo aims to develop its ICT sector and modernize its national telecom infrastructure, making digitalization the driving force behind the country's socio-economic development.

In this context, Egypt is seeking partnerships with countries like Burkina Faso, which is also actively working to develop its digital sector. Burkina Faso is striving to modernize its public services through various projects aimed at improving administrative efficiency and providing better services to its citizens.

The cooperation between the two countries could enable Burkina Faso to benefit from Egyptian expertise in implementing large-scale digital projects. It could also pave the way for technological partnerships, knowledge exchanges, and joint investments in digital infrastructure, creating new economic opportunities for both nations.

Samira Njoya

Through his pre-incubation, incubation, and acceleration programs for small and medium-sized enterprises (SMEs), he supports young entrepreneurs in creating and developing their projects.

Fabrice Ntchango (photo) is a Gabonese serial entrepreneur and the founder and general coordinator of Akewa Accélérateur, an innovation hub supporting businesses, entrepreneurs, organizations, and project leaders in developing innovative initiatives.

Founded in 2013, Akewa Accélérateur is an incubator for small and medium-sized enterprises (SMEs) that promotes innovative entrepreneurship in Gabon. As a member of the Afric’innov network, it offers a wide range of support programs. "Akewa Accélérateur provides services ranging from ideation and incubation to the growth acceleration of startups and other organizations. Additionally, our hub offers tailored advice, open innovation, seed funding services, and training for young entrepreneurs and startups," Ntchango stated in May 2024.

Akewa Accélérateur's services primarily focus on sectors such as cultural industries, renewable energy, agri-food, information and communication technologies (ICT), and the environment. Since its inception, Akewa Accélérateur has supported around 100 projects. In 2022, it won the "Tech Company" award from the Alpha Blue Foundation and the African Digital Conference & Awards, recognizing it as Africa's best tech company of the year.

Fabrice Ntchango is also the co-founder and general manager of Iboundji Technologie, a company providing IT and technological engineering services. He serves as the permanent secretary of the One Forest Youth Initiative (OFYI), an international NGO for youth, and the national coordinator for Gabon programs within the Pan African Climate Justice Alliance.

Ntchango holds a bachelor's degree in accounting and finance, obtained in 2009 from Groupe SupDeco Dakar, a business school in Senegal. He also graduated from Alioune Diop University of Bambey (UADB) in 2012 with a master's degree in legal engineering and project management, with a focus on economics.

Before founding Akewa Accélérateur, Ntchango worked as an accounting assistant at Tradecorp International, a Spanish company specializing in crop biostimulation and sustainable nutrition, in Senegal from 2008 to 2009. Concurrently, he interned as a technical sales representative at Africaine de l’Automobile du Sénégal. In 2010, he was appointed executive director of Gabon Ecologie, where he worked until 2013.

Melchior Koba

In 2019, two tech entrepreneurs, a Moroccan and a Senegalese, embarked on a mission to track informal buses in Dakar, Senegal, to estimate their arrival times and develop a solution for this pervasive issue. Later, they relocated the project to Morocco.

Weego is an e-mobility solution developed by a Moroccan startup, enabling users to navigate cities by choosing the optimal mode of transportation. Founded in 2020 by Saâd Jittou and Mor Niane and based in Casablanca, Weego aims to enhance the use of public transport and reduce travel time to less than thirty minutes.

"The solution ensures that at least one virtual station is within two minutes of users' homes, assigns them a bus and a driver, and designates a station where the minibus will pick them up. No human intervention is required," explains Saâd Jittou.

The mobile application is available on both iOS and Android, with over 10,000 downloads on PlayStore. After downloading the app, users create an account and access various services. "WeegoMaas" is the basic service that offers users ride-hailing options, carpooling, buses, or trams depending on their city.

To provide this service, Weego has integrated several e-mobility applications available in different regions. Apps like Heetch, Pip Pip Yalah, Train, and Tramway contribute to Weego's offerings. The startup also offers "WeegoLines," a service that helps companies reduce their employees' commute times and lateness. Employees can use the mobile app to track company shuttles in real-time, knowing arrival times and any delays.

Since its launch, Weego claims over 100,000 corporate shuttle trips, significantly reducing lateness and absenteeism and lowering transport costs by 30% for employees. Weego also offers "WeegoPro" for users with a fleet of vehicles, and "WeegoSchool" is slated for future release. The app includes a digital wallet that can be recharged via bank cards.

Adoni Conrad Quenum

On Monday, June 24, Chadian Minister of Communications, Digital Economy, and Administrative Digitalization, Boukar Michel, met with Wang Xining, the Chinese Ambassador to Chad. The discussions covered various topics, focusing primarily on strengthening Sino-Chadian cooperation.

During the talks, Boukar Michel assured the ambassador of his Ministry’s commitment to working synergistically to meet the expectations of the Chadian population in the areas of digital economy and communications.

At the forefront of the financial sector's digital transformation, the Bank of Mauritius has launched initiatives for years to make financial services more accessible and improve citizens' everyday lives.

The Bank of Mauritius, the central bank of the Republic of Mauritius, plans to open a fintech innovation center on September 4. The plan was unveiled by Harvesh Seegolam, Governor of the Bank of Mauritius, during the "Digital Finance in Africa" workshop organized on Thursday, June 20 by the Regional Centre of Excellence and the Organization for Economic Cooperation and Development (OECD). The goal is to facilitate brainstorming sessions, hackathons, and regional collaborations to address digital issues in Mauritius.

This decision comes at a time when fintech is increasingly dominating the financial sector in Africa. Traditional financial institutions, led by central banks, want to be included in this technological revolution affecting all sectors on the continent. The establishment of such a center by the Bank of Mauritius will promote innovation and the implementation of cutting-edge technologies in the country's banking sector.

According to the "Africa Tech Venture Capital" report published in January 2024 by Partech Africa, African fintech fundraising dropped by 56% to $852 million in 2023. Despite this significant decline, fintech remains the most capital-attractive segment on the continent due to its appeal. This attractiveness is partly due to the low banking penetration rate and the exclusion of the informal sector, which fosters the development of crypto assets on the continent.

The Bank of Mauritius confirmed through Harvesh Seegolam the commencement of the pilot phase of its digital currency implementation in January, following its launch in December 2023 with a commercial bank.

Adoni Conrad Quenum

In an effort to help her mother, who had become blind, continue enjoying African books and novels, she came up with a brilliant idea. She developed a digital platform that provides all reading enthusiasts with access to a vast collection of African audiobooks.

Ama Dadson (photo) is a Ghanaian computer scientist and tech innovator. She is the founder and CEO of AkooBooks Audio, a digital streaming platform dedicated to African audiobooks.

Established in 2018, AkooBooks Audio uses machine learning to connect African authors and voice talents with new readers and listeners. The platform offers audiobooks in several African languages, making literature accessible to both literate and non-literate Africans, as well as the global African diaspora.

The idea for AkooBooks Audio was born from Ama Dadson's desire to entertain her mother, a children's book author who had become blind. While searching for audiobooks for her mother, she quickly realized that most of them were foreign and not suited to her mother's tastes.

"All the book titles I found for my mother had nothing to do with Africa. Yet, she wanted to immerse herself back in the atmosphere and imagination of our continent. So, I realized that there was a lack of essential content, adapted to our needs. This is how AkooBooks was born in 2018. Our continent is immense, we have so many talented authors and publishers. The field is vast and I took the plunge," explains Ama Dadson in 2023.

Ama Dadson graduated from the Kwame Nkrumah University of Science and Technology with a bachelor's degree in computer science in 1986. She was also certified as an IT business manager in 2014 by the IT Manager Institute, created by the IT management training company, MDE Enterprises.

Following her studies, she worked as a regional computer trainer for the United States Agency for International Development (USAID) from 1991 to 1996. Between 2005 and 2022, she held various positions at the University of Ghana, including Deputy Director of IT Services and Head of IT Service Delivery.

In 2018, Ama Dadson received the African Entrepreneurship Award in the "High Potential" category from BMCE Bank of Africa. In 2021, her startup won the Startup of the Year award at the Women in Tech Africa Awards. In 2023, she won the AFD Digital Challenge Africa, organized by the French Development Agency.

Melchior Koba

On Friday, June 21, Rose Pola Pricemou, Guinea's Minister of Posts, Telecommunications, and the Digital Economy, met with His Excellency Huang Wei, the Ambassador of the People's Republic of China to Guinea. The meeting provided an opportunity for both parties to discuss potential collaborations and partnerships in the digital sector aimed at advancing Guinea's development.

More...

Gabon's transitional government is injecting fresh momentum into the country's development by prioritizing digital transformation. This modernization drive seeks the backing of key financial institutions, including the World Bank.

Gabon aims to make significant progress in digital projects this year. On Thursday, June 20, the Council of Ministers adopted a draft law authorizing the Gabonese state to borrow €56.2 million from the International Bank for Reconstruction and Development (IBRD), a World Bank entity. This initiative is intended to fund the project titled "Gabon Digital."

According to the final communiqué from the Council of Ministers, this funding will catalyze the adoption of digitized public services and increase the number of citizens with a unique identifier. This identifier is crucial for facilitating inclusive access to various public services, thereby contributing to administrative efficiency and improving the quality of life for Gabonese citizens.

"Gabon Digital" will receive a total of $68.5 million in funding from the World Bank. It comprises several major components, including creating an environment conducive to rapid digital transformation, modernizing legal identity systems, and digitizing public administration and essential services.

This initiative is part of the transitional government's strategy to make the digital economy a strategic lever for economic and social growth. To this end, several priority projects have been reactivated, including the construction of a national data center, the development of a Cybercity on Mandji Island, and the digitization of key sectors of the country.

The support from the World Bank is expected to help the country realize these ambitious projects. The planned investments are likely to foster innovation, stimulate the creation of skilled jobs, and enhance the country's competitiveness on the international stage. According to a recently published report by the International Telecommunication Union (ITU), titled "Measuring Digital Development: The ICT Development Index 2023," Gabon ranks as the most developed country in ICT in the Central Africa sub-region and holds the 10th place in Africa with a score of 72.9 out of 100 points.

Samira Njoya

During her visit to Madagascar, Jennifer Bachus, Principal Deputy Assistant Secretary of the U.S. Bureau of Cyberspace and Digital Policy, met with a Malagasy delegation led by Tahina Razafindramalo, Minister of Digital Development, Posts, and Telecommunications, on Thursday, June 20. The primary objective of this meeting was to promote a safe and secure cyberspace, enhance Madagascar's digital resilience, and support local initiatives for digital transformation.

A seasoned tech entrepreneur, he specializes in creating innovative solutions to help businesses smoothly complet their digital transformation. He has already worked on hundreds of projects, consistently delivering satisfaction to numerous clients.

Mohamed Sounkere (photo) is an Ivorian tech entrepreneur and an expert in cybersecurity, cloud, and open source technologies, and an Ivorian tech entrepreneur. He is the co-founder and CEO of Veone, a startup that aims to make open source technologies and solutions accessible to businesses.

Founded in 2010, Veone is committed to providing innovative and high-quality IT solutions, leveraging its expertise in software development, integration of open source technologies, and cloud services. The company's stated mission is "to become the trusted partner for businesses, helping them navigate an ever-evolving digital landscape while optimizing their performance and efficiency.”

Veone's expertise spans various technological domains, including application development, big data, enterprise management, artificial intelligence, and automation. Its areas of operation include healthcare, telecommunications, transport and logistics, education, infrastructure, the public sector, and banking and insurance.

To date, the startup has completed over 1,500 projects and mastered more than 500 technologies. Among its flagship innovations are AssurLink and CentralBill. AssurLink is an all-in-one solution designed to optimize all business processes for insurance firms. CentralBill, on the other hand, is designed to modernize and simplify payment and collection processes for large companies and public institutions. This solution received the award for Best Digital Innovation at the 2024 Digital Transformation Awards.

Mohamed Sounkere graduated from Groupe Loko in 2002 with a Higher Technical Certificate (BTS) in Mathematics and Computer Science. In 2005, he earned a degree in Computer Science from Agitel Formation.

His professional career began in 2005 at CIMARKET, an electronic payment startup, where he was an IT security specialist and IT manager. In 2008, he joined Talentys SA, a company specializing in IT security and networks, as a senior technical project manager, working there until 2011.

Melchior Koba

He aims to bring businesses closer to their customers and improve their performance. To achieve this, he is developing a series of technological tools designed to optimize these interactions between the two parties.

Achraf Gabsi (photo) is the founder and CEO of Go Mybiz, a technology startup specializing in providing IT solutions. Originally from Tunisia, Gabsi created this company to strengthen the relationships between businesses and their clients.

Founded in 2020, Go Mybiz offers a suite of customer relationship management (CRM) software, enabling businesses to fully digitize their customer journey. The startup has already developed three key software solutions: Go Voice, Go Contact, and Go Sales.

Go Voice is an advanced business telephony solution offering a wide range of essential features, including an interactive voice response (IVR) system, personalized messages for business hours and queues, detailed statistics, and computer-telephony integration (CTI).

Go Contact is designed for commercial and marketing departments. It helps manage customer service, conduct prospecting campaigns and appointment setting, perform satisfaction surveys, and handle debt collection.

Go Sales is a sales force management tool that provides detailed tracking of opportunities, quotes, and tasks through a configurable sales cycle tailored to the company's internal processes.

In addition to leading Go Mybiz, Achraf Gabsi is a member and secretary-general of TunisianStartups. He also serves as vice-president of the Confederation of Tunisian Citizen Enterprises (CONECT), an innovative organization representing businesses of all sizes across the country.

Achraf Gabsi graduated from the Institute of Higher Commercial Studies of Carthage with a specialized graduate diploma (DESS) in Information Technology and E-commerce in 2002. His career began the same year at Tunisie Voyages, where he was responsible for new information and communication technologies (ICT).

In 2007, he joined Satec, a digital solutions integrator, as a senior account manager for government projects. From 2012 to 2020, he worked at Smarthost, a technology company providing cloud services for SMEs, large enterprises, and government organizations, where he held positions as sales director and CEO.

Melchior Koba