- Orange Money Group and Visa signed a strategic partnership to expand access to online payments in Africa and the Middle East.

- The partnership integrates a virtual Visa card into Orange Money’s ecosystem via the Max it app.

- Orange Money operates more than 45 million active accounts across 17 African countries.

Online payments continue to expand rapidly in Africa, driven by the rise of mobile services and e-commerce. However, limited access to secure and interoperable digital payment tools still constrains financial inclusion for a large share of the population.

Orange Money Group and Visa announced on Friday, December 12, in Casablanca that they signed a strategic partnership to facilitate online payments and strengthen financial inclusion across Africa and the Middle East. The collaboration aims to broaden the use of digital financial services as e-commerce and cashless payments accelerate across the region.

Speaking at the announcement, Orange Money Group Chief Executive Officer Thierry Millet said the partnership marks a key milestone in the group’s strategy. “From now on, individuals and entrepreneurs can create their virtual Visa card in seconds and pay online internationally across the entire Visa network. This first step in our strategic partnership brings Orange Money closer to a clear objective: becoming a payment method accepted everywhere, from major e-commerce platforms to local merchants,” he said.

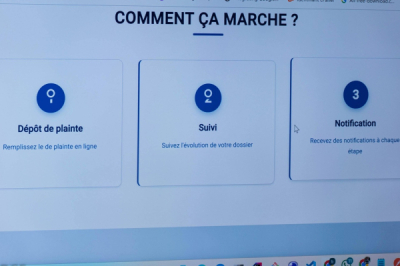

Operationally, the partnership centers on integrating a Visa virtual card directly into the Orange Money ecosystem through the Max it application. Users can generate their card in a few clicks, fund it from their mobile wallet and pay for online purchases on local and international websites. Orange Money initially rolled out the solution in pilot markets such as Botswana, Madagascar and Jordan. The company has since introduced the service in Côte d’Ivoire and plans to expand it to additional countries, including Guinea, Burkina Faso and the Democratic Republic of Congo. Orange Money also plans to launch a physical version of the card to support broader use cases.

The initiative comes as Africa consolidates its position as a global engine of mobile money growth. According to GSMA data, the continent recorded more than one billion registered mobile money accounts in 2024 and accounted for over 70% of global mobile money transactions. At the same time, e-commerce continues to grow, supported by rising internet and smartphone penetration, although limited access to international online payment methods still restrains adoption. By combining Visa’s global acceptance network with Orange Money’s strong local footprint, the partnership aims to address this structural gap.

By leveraging Orange Money’s local presence — with more than 45 million active accounts across 17 African countries — and Visa’s international acceptance network, the partnership could help narrow the digital payments divide. Over time, it aims to integrate millions of users and small businesses into the digital economy by providing payment tools aligned with the requirements of online commerce while reinforcing financial inclusion across the continent.

Samira Njoya