Tech (1156)

- ECOWAS drafts its first regional e-government strategy to harmonize public-service digitalization.

- The plan includes shared cybersecurity mechanisms, interoperable digital infrastructure and data-governance frameworks.

- Ghana, Cape Verde, Côte d’Ivoire and Senegal show the strongest national progress, according to the UN DESA 2024 Index.

ECOWAS is developing its first regional e-government strategy as West African states accelerate national digital-administration reforms. Government officials, ICT experts and technical partners met last week in Abuja to review and validate the strategic directions of the forthcoming framework.

The strategy aims to build an interoperable public digital infrastructure for the region, strengthen data-governance systems, and support member states in modernizing administrative services. It also seeks to introduce shared cybersecurity mechanisms and align national policies that remain fragmented across the bloc.

The initiative complements ongoing ECOWAS digital-transformation programs such as WARDIP, which targets faster regional digital integration. It also reflects the ambitions of ECOWAS Vision 2050, which calls for a connected, resilient community built on modern institutions.

Member states have already undertaken major e-government reforms. Ghana has launched reference digital-ID platforms; Cape Verde continues to consolidate one of the region’s most advanced electronic administrations; Côte d’Ivoire is betting on centralized online public services; and Senegal is expanding its e-services ecosystem, supported by a unique identifier and interoperability systems. A regional strategy is now seen as a natural step to scale and coordinate these efforts.

If adopted, the strategy could significantly improve administrative efficiency, enable secure data circulation, strengthen transparency and accelerate regional integration by allowing citizens and businesses to access public services across borders.

According to the 2024 UN DESA E-Government Development Index, several ECOWAS states rank among West Africa’s top performers. Ghana stands at 108th globally, followed by Cape Verde (109th), Côte d’Ivoire (124th) and Senegal (135th). These rankings highlight a strong regional momentum and show that, despite uneven progress, the foundations for a shared strategy are already in place.

Samira Njoya

-

Algeria launched a national digital platform on December 1 to report corruption in the social sector.

-

Transparency International ranks Algeria 107th globally in the 2024 Corruption Perceptions Index.

-

Nearly 9,500 civil servants have already been trained to use the new reporting tool.

Algeria launched a digital platform to help citizens and public officials report corruption in the social sector, strengthen transparency, and improve trust in public institutions.

The country continues to face systemic corruption that undermines public services and weakens citizen confidence. Consequently, authorities aim to modernize governance tools and reinforce accountability across the administration.

The Ministry of National Solidarity, Family and Women’s Affairs launched the national platform on December 1. The tool, available on both mobile and desktop, enables users to report suspicious practices, upload digital evidence, and track the status of their submissions.

Minister Soraya Mouloudji said the platform “forms part of the implementation of the national strategy to combat corruption and strengthen integrity, which is based on public ethics, the promotion of a culture of integrity within institutions, and improved transparency in the management of public funds.”

The platform centralizes all tools required for effective processing of corruption alerts: a structured reporting form, a secure space to upload supporting documents, an option for anonymous submissions, and a dashboard that informs users of the progress of their cases.

The ministry intends to improve administrative responsiveness, shorten processing times, and ensure strict traceability of all reports.

The launch comes as Algeria continues to struggle with governance issues. Transparency International’s Corruption Perceptions Index 2024 ranks Algeria 107th out of 180 countries, with a score of 34 out of 100, reflecting persistent public-sector corruption concerns.

According to the ministry, nearly 9,500 public agents have already received awareness and training sessions to ensure proper use of the platform and promote a culture of transparency in public services. The government considers these skills essential to guarantee the system’s reliability and the credibility of follow-up actions.

Although the platform could democratize reporting, improve the quality of evidence, and increase public pressure for stronger anti-corruption measures, its success depends on several key factors: serious investigations, effective whistleblower protection, and public visibility of enforcement outcomes.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

- Côte d’Ivoire launched Tradepost to digitalize postal logistics and ease cross-border trade in ECOWAS.

- Authorities expect the system to accelerate customs procedures, reduce logistics costs and provide full shipment traceability.

- The initiative targets improved access to African and international markets for Ivorian SMEs.

Côte d’Ivoire launched the Tradepost project on December 1 in Abidjan to modernize postal logistics and facilitate cross-border commerce within ECOWAS. The Universal Postal Union (UPU), La Poste de Côte d’Ivoire and the West African Postal Conference (CPEAO) jointly support the initiative. The project signals a new phase in regional economic integration and in the digitalization of postal services.

Assoua Raymond, chief of staff at the Ministry of Digital Transition and Digitalization, said Tradepost will “accelerate customs procedures through digitalization, reduce logistics costs and delivery times, while offering full shipment traceability.” He added that the platform represents “a strategic instrument to connect Ivorian SMEs to African and international markets.”

Tradepost aims to digitalize and harmonize procedures linked to trade flows, including parcel declaration, processing, tracking and customs formalities. It also seeks to connect users to regional and global e-commerce platforms. Authorities designed the system to remove long-standing barriers to cross-border trade in West Africa, such as fragmented regulations, high logistics costs, slow procedures and weak integration of digital ecosystems.

The launch aligns with the rapid rise of digital trade in West Africa. Improved connectivity, broader digital public services and the growth of online-commerce platforms drive this momentum. Côte d’Ivoire stands out in this trend. The country’s e-commerce market reached more than CFA280 billion ($495.5 million) in 2023 and is expected to grow at a compound annual rate of 11.3% through 2027, according to Ivorian e-commerce industry stakeholders.

Authorities expect Tradepost to strengthen parcel traceability and harmonize procedures across borders. They said the system should reduce obstacles to regional commerce, improve market access for artisans, farmers and young entrepreneurs, and support a more transparent and efficient e-commerce ecosystem in ECOWAS. The data-driven approach will allow policymakers to identify bottlenecks, guide investment and sustain long-term digital and economic integration.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

Togo integrates three new procedures online: renunciation of nationality, reinstatement of nationality, and modification of patronym or matronym.

-

The national portal now centralises 101 digital public services, including passports, residency cards and nationality certificates.

-

The UN’s 2024 EGDI report ranked Togo 161st out of 193, highlighting a major digitalisation gap the government actively seeks to close.

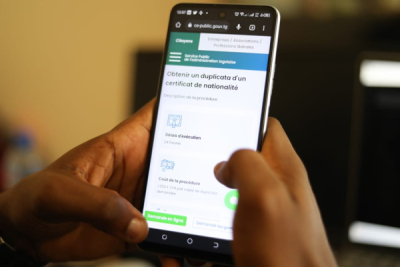

Togo aims to digitise all public services in the coming years to simplify administrative processes and improve access for all citizens. The addition of new online procedures confirms the progress of this nationwide transformation.

Togo continues to modernise its administration by adding three new services to the national portal service-public.gouv.tg. Citizens can now complete online the renunciation or reinstatement of Togolese nationality and the modification of their patronym or matronym.

The Ministry of Justice and Human Rights leads these digital procedures as part of a methodical modernisation effort. The platform now enables users to complete entire processes remotely: application submission, real-time tracking and receipt of decisions. Officials strengthened the national digital one-stop shop to centralise administrative services and improve accessibility.

This deployment comes as Togo accelerates the digitalisation of administrative services. In recent months, the national portal added major services, including applications for nationality certificates, passport renewals, residence permits, criminal records, construction permits and other formalities. With these additions, the platform now offers 101 online services.

The integration of the three new procedures addresses key priorities: reducing citizens’ travel, increasing procedural transparency, shortening processing times and improving administrative efficiency. The expansion also strengthens administrative inclusion by enabling citizens—especially those far from urban centres—to access essential services without geographic constraints.

This acceleration of digital transformation occurs as Togo works to close a significant gap in public-service digitalisation. The 2024 UN E-Government Development Index (EGDI) assigned Togo a score of 0.3920, ranking the country 161st out of 193, a result that underscores the scale of the challenges ahead. The progress achieved in recent months demonstrates the government’s determination to modernise public administration, improve accessibility and integrate Togo’s public sector into the digital era.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

Enovation Factory and UNDP Cameroon launched Scale 32, a 14-month national programme to support 32 tech startups.

-

The programme provides intensive training, mentorship, workspace access and investor matchmaking, followed by 12 months of alumni support.

-

Cameroon seeks to strengthen its technology ecosystem amid low startup survival rates, weak governance and limited access to capital.

Cameroonian startups continue to struggle to attract investment as limited managerial expertise and weak ecosystem structuring hinder their growth. Observers argue that targeted support remains essential to improve competitiveness and unlock financing opportunities.

Enovation Factory, a Cameroon-based incubator and accelerator, launched in partnership with UNDP Cameroon a national 14-month initiative named Scale 32. The programme aims to support 32 technology startups by addressing their main barriers to growth, including access to capital, management skills and investor networks.

The programme unfolds in two phases. The first cohort will receive six months of intensive support from January to June 2026. The second cohort will benefit from a similar cycle from June to December 2026.

Enovation Factory will integrate selected startups into one of its two streams: Newbie, which targets early-stage or ideation-level projects, and Cracker, which targets operational startups seeking accelerated growth. The support package includes specialised training, mentorship, workspace access and connections with institutional partners and investors.

Enovation Factory will transition each startup into its Alumni programme after the six-month support phase. The incubator will provide an additional 12 months of follow-up, which includes access to its network, financing opportunities and major ecosystem events. The structure aims to ensure that each company consolidates the skills and gains achieved during the programme.

The initiative comes as Cameroon seeks to fortify its technology ecosystem and stimulate job creation. Policymakers attempt to complement existing sector-building efforts by addressing low startup survival rates and the weak governance that affects many early-stage companies.

However, challenges persist. The small volume of capital raised by local startups, the limited number of firms able to attract investors and the region’s low share of venture-capital flows underscore the need for deeper structural reforms. Analysts stress the need to strengthen corporate governance, improve investor appeal, reinforce institutional support and enhance the visibility of Cameroonian startups on the global stage.

Startups operating in technology, agritech, healthtech, fintech, edtech, green economy and other innovative sectors may apply before 18 December via the link provided by Enovation Factory: https://www.enovation-factory.com/postuler.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

Youth unemployment in Lesotho reaches nearly 50% among 15–35-year-olds.

-

The government launched the YOMA digital platform with UNICEF to improve employability and access to skills.

-

Only 48% of the population uses the Internet, which threatens the programme’s adoption.

Lesotho faces one of the highest youth unemployment rates in Southern Africa, with nearly half of young people unable to find work. The government uses digital solutions to expand access to skills, boost employability and create new economic opportunities.

The Ministry of Gender, Youth and Social Development launched the Youth Agency Marketplace (YOMA) on 26 November in Maseru in partnership with UNICEF. The ministry says the platform aims to remove barriers that limit youth integration, including restricted access to training, digital skills and market opportunities.

YOMA operates as a pan-African digital platform that allows young people to acquire skills, receive mentorship and access economic opportunities. It offers pathways ranging from basic training to matchmaking with companies, NGOs and institutions. Users complete social or environmental “impact missions,” which reward them with digital tokens they can exchange for goods or services such as mobile credit or additional training.

The platform records all user activities in a verifiable digital CV, which increases the visibility and credibility of young jobseekers. YOMA aligns with international skills-development standards and uses a personalised approach. It adapts opportunities to each user’s profile, goals and potential while staying linked to labour-market demand.

Authorities say YOMA supports the government’s strategy to empower young people through accessible digital solutions. The stakes are high in a country where youth represent a large share of the unemployed. Official data estimate unemployment among 15–35-year-olds at nearly 50%, one of the highest ratios in the region.

Officials expect YOMA to improve employability, stimulate self-employment, facilitate access to certified training and generate income through paid missions. The platform also seeks to expand digital literacy in a country where young people still lack the tools to participate in a rapidly digitalising economy.

However, weak connectivity threatens uptake. DataReportal estimates that only 48% of Lesotho’s population used the Internet at the start of 2025, while mobile data costs remain high relative to average income. Rural areas face unstable mobile coverage, which limits access to a fully digital platform. YOMA’s success depends on stronger connectivity, lower access costs and broader awareness campaigns.

By launching in Lesotho, YOMA adds to deployments already underway since 2020 in Benin, Burundi, Côte d’Ivoire, Kenya, Nigeria and South Africa. The partnership with UNICEF allows Lesotho to rely on a tested model to broaden access to training, economic opportunities and entrepreneurship.

Samira Njoya

- Strategy targets curriculum reform, teacher skills, infrastructure and online learning tools

- Strategy aligns with SDG 4 and aims to boost youth employment and digital readiness

Guinea has approved its National Strategy for the Digital Transformation of Technical and Vocational Education and Training. The 300 billion Guinean franc (34.5 million dollar) plan was adopted at a workshop in Conakry hosted by the Ministry of Technical Education and Vocational Training. It aims to modernize the country’s technical and vocational training system.

The strategy is aligned with the Sustainable Development Goals, particularly SDG 4 on quality education. It seeks to make technical education a key driver of employment and entrepreneurship. Its priorities include updating training programs, adapting curricula to labor market needs, improving digital infrastructure and connectivity, and closing the skills gap among teachers.

According to the ministry, the funding will be used to strengthen digital infrastructure, equip training institutions, train teachers and deploy online learning platforms. The plan forms part of Guinea’s 2035 development vision, which aims to build a strong digital ecosystem that can support technical education over the long term. Regionally, Guinea is contributing to a pan-African initiative to digitize technical education in order to align approaches and share funding and expertise across countries.

The approval comes as Africa’s labor market is rapidly changing with rising demand for digital skills. The Brookings Institution’s report “Foresight Africa 2025-2030” estimates that 230 million jobs in sub-Saharan Africa will require digital competencies by 2030. It also anticipates up to 650 million training opportunities, which represent a potential market of 130 billion dollars.

The successful implementation of Guinea’s strategy will depend on several factors. These include securing the necessary funding, strengthening governance, improving teacher training in digital tools and ensuring the availability of essential infrastructure such as reliable electricity and high-speed internet in rural areas.

If fully implemented, the strategy could expand access to professional training, modernize technical programs, increase youth employability and strengthen the country’s competitiveness in a rapidly digitalizing economy. Youth unemployment remains particularly high in Guinea and is estimated at nearly 60 percent according to national statistics.

Samira Njoya

- Government launches a 2025–2029 national child online protection strategy with a $1.8 million budget.

- UNICEF and GSMA created the Africa Taskforce on Child Online Protection in October 2025 to harmonize continental standards.

- Zambia joins Nigeria and Ghana, which already adopted national policies on child cybersecurity.

Zambia has introduced a national strategy to protect children online as digital adoption accelerates amo

ng the country’s youth. The government aims to ensure safer and more responsible Internet access for minors.

The government launched the National Child Online Protection Strategy (2025–2029) on Monday, November 24. The document sets a roadmap to strengthen digital safety for children nationwide and to build a safer online environment for young users.

The government allocated $1.8 million to this plan. The strategy focuses on several pillars, including strengthened national policy coordination, development of digital skills, awareness programs for children and parents, and a structured collaboration framework connecting public, private and civil society stakeholders.

This initiative comes as Internet penetration grows quickly across Africa, especially among younger populations. UNICEF reports that African children rank among the fastest-growing digital user groups worldwide, which increases their exposure to cyberbullying, misinformation, online exploitation and harmful content.

These risks prompted UNICEF and GSMA in October 2025 to launch the Africa Taskforce on Child Online Protection (COP). The platform aims to harmonize protection efforts, deepen cooperation among states and promote shared digital safety standards across the continent.

In Zambia, recent national data on children’s Internet use remains limited. Authorities, however, recognize a steady rise in youth connectivity, which makes preventive, educational and regulatory measures urgent.

With this strategy, Zambia joins other African countries that have already implemented structured national child online safety policies. Nigeria and Ghana in recent years adopted legal frameworks and government programs dedicated to child cybersecurity.

If fully implemented, Zambia’s strategy could reduce minors’ exposure to digital risks and strengthen trust among families and schools in the use of online tools. Its success, however, will also depend on the development of an adapted legislative framework to ensure a safe, inclusive and protective digital environment for children.

Samira Njoya

-

Google.org will provide $1.5 million to fund a digital literacy and online-safety programme across four African countries.

-

JA Africa aims to train 250,000 children, 6,000 teachers and 8,000 parents and caregivers by 2027.

-

The programme will deploy Google’s “Be Internet Awesome” curriculum, including Interland, through schools and community networks.

Children in Africa gain access to digital technology at increasingly early ages as connectivity expands across the continent. This rapid exposure, however, brings major risks such as cyberbullying, harassment and exploitation, which compel governments and organisations to strengthen online-safety protections.

JA Africa, the regional arm of one of the world’s oldest youth-focused economic-education organisations, announced on 26 November the launch of a digital-literacy and online-safety programme in Ghana, Kenya, Nigeria and South Africa. The initiative uses $1.5 million in funding from Google.org, the philanthropic arm of Google, and targets the training of 250,000 children, 6,000 teachers and 8,000 parents and caregivers by 2027 to reinforce child safety in a fast-growing digital ecosystem.

“Digital connectivity now forms the backbone of modern life in Africa, and our children must be equipped not only to participate but also to stay protected,” JA Africa CEO Simi Nwogugu said. “With support from Google.org, we help young people turn access into opportunity by building a generation of smart, safe and respectful digital citizens.”

The programme relies on Google’s “Be Internet Awesome” curriculum, which teaches digital security, privacy protection, anti-cyberbullying practices and responsible online citizenship. The curriculum uses Interland, a game-based platform, to engage young learners. JA Africa will deploy the programme through school workshops, teacher-training sessions and community-based activities, including in underserved rural areas. The initiative aligns with existing national frameworks on child protection and ICT-in-education policies in Ghana, Nigeria and Kenya.

The launch comes as minors face rising digital-exposure risks across Africa. GSMA data shows that 18% of children aged 5 to 7 in sub-Saharan Africa already use mobile Internet. The International Telecommunication Union estimates that one child connects to the Internet every half-second worldwide, highlighting the accelerating pace of early digital access. Yet, in 2024, only 39 African countries had completed a national online-child-protection strategy, while 32% were still drafting one and 41% had taken no formal steps.

The project could ultimately support the creation of common continental standards for online child protection through planned collaboration with education, ICT and communications ministries. JA Africa and Google intend to amplify the programme with awareness campaigns, digital-content production and key events, including Safer Internet Day 2026, to broaden public reach.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

Benin set a 2026 digital budget of CFA27.2 billion ($48 million), down 6.32% from 2025 due to a 12.22% drop in external financing.

-

The government will still fund major initiatives, in cluding AI integration in public services, nationwide high-speed coverage, and the launch of a national digital-skills school.

-

The GSMA estimates that Benin’s digital economy could add CFA1,200 billion to GDP by 2028 and create over 300,000 jobs.

Benin reduced its 2026 digital budget despite expanding ambitions for nationwide digital transformation. The government attributes the decline mainly to a 12.22% drop in external financing, even as it seeks to widen access to digital services and strengthen inclusion across the country.

Digital and Digitalisation Minister Aurélie Adam Soulé Zoumarou presented on 25 November a planned allocation of CFA27.2 billion (US$48 million) to the National Assembly’s budget commission. The figure marks a 6.32% decrease from the CFA29.034 billion approved for 2025.

The 2026 proposal includes CFA9.7 billion in operating expenses and CFA17.4 billion in capital spending.

The budget distributes resources across three main programmes. Piloting and Support receives CFA2.1 billion to improve ministry performance and provide backing to the digital, digitisation and media sectors. The Digital Programme, allocated CFA12.3 billion, aims to promote nationwide digital transformation.The Media Programme, with CFA12.6 billion, targets audiovisual modernisation, improved access to quality information, upgrades to public media and continued deployment of digital terrestrial television (DTT).

The ministry highlights several strategic priorities, including the progressive integration of artificial intelligence into public administration and priority sectors. It also positions digital-divide reduction as a central goal through extended high-speed connectivity initiatives.

Authorities expect additional investments to improve access to digital equipment and strengthen the population’s digital skills.

The project outlines the development of an École des métiers du numérique, which will train specialised talent such as developers, network administrators, cybersecurity experts and data analysts. The facility aims to support a competitive, skilled digital workforce.

The 2026 programmes complement several projects already launched, including Phase 2 of the nationwide high- and ultra-high-speed broadband rollout, the SMART GOUV initiative to digitalise public administration, and the digital transformation of local governments.

The GSMA reports that Benin’s digital economy—supported by mobile connectivity and digital services—could generate CFA1,200 billion in additional GDP by 2028, create over 300,000 jobs and raise CFA150 billion in extra fiscal revenue.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

More...

- Officials discuss collaboration on digital government, AI, and cybersecurity.

- Azerbaijan showcases its MyGov super-app and national digital strategy.

- Senegal’s New Deal aims to invest $1.7 billion to modernize public services.

Senegal and Azerbaijan are considering stronger cooperation in the digital sector. On November 25, on the sidelines of the World Telecommunication Development Conference, Senegal’s minister of Communication, Telecommunications and Digital, Alioune Sall, met with Farid Osmanov, president of the Innovation and Digital Development Agency (IDDA), to explore potential areas of technological partnership.

Rencontre entre le MCTN et l’IAAD d’Azerbaïdjan : vers une coopération numérique renforcée

— Ministère Communication - Télécoms et Numérique (@mctngouvsn) November 25, 2025

En marge de la CMDT-25, le Ministre de la Communication, des Télécommunications et du Numérique Alioune SALL a rencontré M. Farid Osmanov, pic.twitter.com/KsUaSSX50U

During the discussions, Osmanov presented several solutions developed by the agency, including the MyGov super-app, used by more than 2 million citizens, as well as Azerbaijan’s strategy integrating AI, cybersecurity, and digital identity. He also highlighted Digital Bridge, a system that connects public platforms with private companies, including banks.

Minister Alioune Sall reaffirmed Senegal’s priorities in digital transformation, including modernizing state services, developing new digital offerings, and improving infrastructure. Both parties agreed to move toward a formal partnership framework focused on digital government, artificial intelligence, and cybersecurity.

The meeting comes as both Dakar and Baku accelerate their digital agendas. Senegal’s New Deal, launched in February 2025, plans about $1.7 billion in investments to modernize the administration and support the digital economy. In Azerbaijan, the IDDA leads the national digital development strategy and is expanding public digital solutions.

A structured partnership would offer benefits to both countries. Senegal could draw on Azerbaijan’s experience in administrative digitalization, digital identity, and other areas, given Azerbaijan’s advanced status in e-government, with a United Nations index score of 0.7607 out of 1. For its part, Azerbaijan could strengthen its presence in West Africa and promote its digital solutions in a growing market.

Samira Njoya

- Ivorian officials meet a Russian delegation to discuss digital cooperation.

- Talks focus on technopoles, AI integration, and public-service digitalization.

- A visit to VITIB aims to deepen potential collaboration on innovation projects.

As part of its digital transformation strategy, the Ivorian government aims to modernize public services and build a strong innovation ecosystem. Collaboration with experienced partners is seen as essential to accelerate these ambitions.

Raymond Assoua, chief of staff to the minister of Digital Transition and Digitalization, met on Monday, November 24, in Abidjan with a delegation from the Skolkovo Foundation led by Russia’s ambassador to Côte d’Ivoire, Alexey Saltykov. The meeting is part of a cooperation program designed to strengthen exchanges between Côte d’Ivoire and Russia in digital technology, innovation, and ecosystem development.

Discussions covered several strategic areas, including the development of technopoles, the integration of artificial intelligence in both public and private sectors, and the acceleration of administrative digitalization. The Russian delegation also presented Skolkovo’s expertise in building innovation ecosystems, a model that could support Côte d’Ivoire’s ambitions for tech-driven urban development.

During the meeting, concrete collaboration opportunities were identified between the Skolkovo Foundation and VITIB, the Ivorian technology park in Grand-Bassam. The director general of VITIB outlined existing infrastructure and ongoing projects, opening the door to future initiatives in start-up incubation, applied research, and sovereign digital solutions.

The visit comes one day after Côte d’Ivoire’s National Assembly approved a CFA83.27 billion (about $146 million) budget for 2026 to support the country’s digital transformation. The funding targets modernization of the postal sector, implementation of universal electronic communications service, and development of the digital economy.

The Skolkovo Foundation is one of Russia’s main innovation hubs, specializing in supporting tech start-ups, developing technopoles, and conducting AI-related research through its partnership with the Skoltech Institute. Its expertise could help Côte d’Ivoire with talent development and the rollout of pilot projects in innovation and digital services.

No formal agreement has been announced yet. However, the delegation will visit VITIB on November 25 to continue technical discussions and explore partnership opportunities.

Samira Njoya

- Government plans lower Internet costs and expanded rural fiber coverage.

- A new national data center, Digital Delta, will open on November 25.

- Reforms support a wider digital strategy as Botswana ranks 6th in Africa for ICT.

One year after his appointment as Botswana’s minister of Communications and Innovation, David Tshere presented on Thursday, November 20, the main priorities of his roadmap. He emphasized the government’s ambition to make digital transformation a driver of growth, inclusion, and competitiveness.

Among the key announcements, the minister revealed a significant reduction in Internet and mobile data costs to make digital access more affordable for citizens and businesses. He also introduced a plan to extend fiber-optic infrastructure to rural and underserved areas to improve national connectivity and promote digital inclusion.

Minister Tshere confirmed the imminent commissioning of the Digital Delta data center, with its official opening set for Tuesday, November 25, in Gaborone. This state-of-the-art facility aims to strengthen national digital capacity, host critical cloud services, and support government and private-sector applications in areas such as education, health, and public administration.

The roadmap forms part of a broader national strategy that includes the expanding 1Gov government platform and the adoption of modern digital legislation covering cybersecurity, data protection, and technological innovation. Botswana also plans to commercialize data from the BOTSAT-1 satellite to support agriculture, environmental management, and smart infrastructure.

Results from earlier initiatives highlight the country’s progress. According to the 2025 edition of the International Telecommunication Union’s “Measuring Digital Development – ICT Development Index,” Botswana ranks sixth in Africa with a score of 82.1 out of 100, reflecting advances in ICT use and the development of a strong digital ecosystem. DataReportal estimates that 2.09 million people were using the Internet in Botswana at the end of 2025, representing an 81.4 % penetration rate.

Samira Njoya

- Government launches a free digital platform for all Official Journal editions.

- The portal offers authenticated laws, decrees, and regulations since 1959.

- The project supports wider digital reforms under the World Bank–funded WARDIP.

The Mauritanian government inaugurated on Monday, November 24, a new digital portal dedicated to the Official Journal, now freely accessible to the public. The initiative aims to modernize access to legal texts, strengthen transparency in public information, and simplify consultation of laws in force, gathering more than 30,000 authenticated legislative and regulatory documents.

The portal centralizes all editions of the Official Journal since 1959, along with a selection of laws, decrees, international conventions, and other regulatory texts. Available in Arabic and French, it features an advanced search engine that allows legal professionals, investors, researchers, public administrations, and citizens to access authenticated and updated versions quickly.

The Official Journal is the primary legal source confirming the existence, entry into force, and authenticity of state-issued texts. Its digitization responds to the growing need to modernize procedures, reduce publication delays, and ensure easier access to legal information in a context of rapid digital transformation.

The project is part of the West Africa Regional Digital Integration Program (WARDIP – Mauritania), financed by the World Bank, which supports the country’s administrative modernization. It also includes a training program for staff at the General Secretariat of the Government, covering digital archiving, legal database management, and code updates to ensure the platform’s reliability and long-term sustainability.

Beyond the digitization of the Official Journal, WARDIP also plans the creation of a public-service interoperability framework, the development of a government cloud, improvements in broadband access, and support for innovation and start-ups. These actions aim to create an environment conducive to digital public services and economic development.

The launch of the Official Journal portal is expected to improve access to law for citizens and courts, strengthen public-sector transparency, secure the regulatory environment for investors, and consolidate the rule of law. With more than 30,000 authenticated texts covering over six decades, the platform marks a major step in modernizing Mauritania’s legal system and aligning the country with international best practices in digital governance.

Samira Njoya