- Fintech founded in 2024 offers access to real-asset projects across Africa

- Platform targets youth, diaspora, and global investors seeking impact

- Blockchain ensures transparency, traceability, and simplified governance

Based in Lomé and founded in 2024 by brothers Julien and Hervé Gakpé (photo), Togolese fintech Minah.io aims to transform how young Africans finance impact-driven projects. Its platform allows users to invest in real-world assets (RWA) on the continent, such as real estate, energy, and agriculture, using blockchain to ensure transparency and security.

“Convinced of the continent’s potential, we lower the barriers to entering the African market by connecting investors from around the world with high-potential local development projects. […] We facilitate investment in rigorously selected projects, ensuring clear follow-up and simplified management,” the start-up says.

The solution offers several “investment strategies,” each built around concrete projects driven by committed local actors. Through this approach, it gives young Togolese, as well as the diaspora and international investors, the opportunity to participate in the continent’s economic development while generating financial returns.

By channeling regular financial flows toward concrete projects, the platform provides a sustainable alternative to simple money transfers. For young entrepreneurs or project leaders in Togo, this means broader access to structured financing. Minah does not limit itself to one-off support but focuses on long-term, high-potential initiatives. Thanks to blockchain technology, it ensures investment traceability and transparent governance.

Overall, the fintech represents a new generation of financial solutions in Africa, combining blockchain, impact investing, and inclusion to pave the way for fairer and more sustainable financing for African youth.

- Alya offers interest-free installment payments over 2 to 4 months

- Platform is approved by Bank Al-Maghrib and integrated with the CIM

- Founder Brahim Zaid has a background in finance, consulting, and venture capital

Brahim Zaid (pictured) is a Moroccan entrepreneur specializing in financial innovation. He is the founder and CEO of Alya, a Moroccan installment payment solution that allows users to buy immediately and pay later in two, three, or four monthly installments.

Founded in 2022, Alya positions itself as a tool that spreads payments over several months. The goal is to enable users to access a product or service without paying the full amount upfront, while distributing the cost to better manage their expenses.

Alya relies on an interest-free, fee-free installment model. Users know the total amount and the exact payment schedule from the start. This approach limits risks linked to borrowing costs and addresses common concerns about credit-based services.

Alya is licensed by Bank Al-Maghrib and complies with the standards of the National Commission for the Control of Personal Data Protection. The solution is also integrated into the Interbank Electronic Payment Center (CIM), strengthening its operational framework.

Brahim Zaid holds a bachelor’s degree in economics and finance earned in 2014 from the University of Melbourne in Australia. He also graduated from the University of Sydney, where he obtained a master’s degree in management in 2016.

He began his professional career in 2012 as president of the Melbourne Microfinance Initiative. In 2015, he became finance and operations associate at CliniCloud, a company specializing in health technology. The following year, he worked as a student consultant at Deloitte in Sydney before joining Artesian as a venture capital analyst.

After returning to Morocco, he joined Boston Consulting Group in 2019 as an associate. In 2020, he joined Southbridge A&I, a Moroccan strategy consulting firm, as a senior consultant. Between 2021 and 2023, he worked independently as a strategy consultant.

-

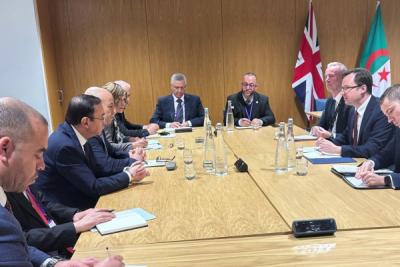

Algeria and the United Kingdom have signed a memorandum of understanding to enhance operational partnership and develop the Algerian police's capabilities in advanced electronic fingerprint analysis.

-

The agreement provides for training Algerian personnel in cutting-edge biometric technologies and expertise exchange, addressing rising organized crime and transnational digital threats.

-

The partnership aims to close gaps in Algeria's biometric capacities, leveraging the UK's advanced forensic information databases and digital fingerprint capabilities.

Facing rising organized crime and transnational digital threats, strengthening electronic fingerprint analysis skills has become urgent. This discipline leverages digital traces to identify and link perpetrators of offenses.

Ali Badaoui, Director General of National Security, and Alex Norris, British Minister of State for Border Security and Asylum, signed a memorandum of understanding on Wednesday, November 12. The agreement aims to strengthen operational partnership between the two countries and develop the Algerian police's expertise in advanced electronic fingerprint analysis.

According to the Algerian official, this partnership will enhance national capabilities in identity recognition and verification, a strategic issue given the rise of organized crime and transnational threats.

Specifically, the agreement provides for training Algerian executives and technicians in advanced biometric technologies used in the United Kingdom. It also includes an exchange of expertise in advanced electronic fingerprint analysis. This process involves exploiting individuals' digital footprints (connection history, traces on electronic devices, metadata, technical identifiers) to establish identity, reconstruct online activities, or link multiple offenses.

This cooperation occurs as Algeria accelerates the modernization of its forensic police tools. This modernization responds to an increase in cases related to cross-border trafficking, structured criminal networks, and cybercrime. The phenomenon is not isolated. According to INTERPOL's "Africa Cyberthreat Assessment 2025" report, 90% of African countries believe they must significantly strengthen their investigation and prosecution capabilities in digital crime.

Implementation of this partnership should enable Algeria to address certain shortcomings in its biometric capabilities. The United Kingdom possesses highly advanced expertise. According to the official "Forensic Information Databases 2023-2024" report, its IDENT1 fingerprint database contains over 28.3 million fingerprint forms from police investigations.

Furthermore, the British Police Digital Service has developed a "Digital Fingerprint Capability," a cloud platform enabling the transmission of fingerprint images from crime scenes to laboratories, real-time fingerprint analysis, and accelerated matching through the IDENT1 database.

Through this agreement, Algeria could access advanced digital methods and protocols (capture, comparison, identification) already used in the United Kingdom. This would allow for faster identification of suspects while improving the quality of evidence available for criminal investigations.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

- Ericsson opens new Zambia office to support national digital transformation goals

- Govt unveils “Digital Pact” with focus on innovation, local solutions, and inclusion

- ICT sector grew 17.4% in 2023; digital shift could add $1.26B by 2028

Swedish technology firm Ericsson opened its new office in Zambia last week, a move that authorities say reflects a strengthening partnership aimed at advancing the country’s digital transformation. The government also encouraged other technology companies to invest in the country.

“The opening of the Ericsson Zambia office marks a pivotal moment in the country’s technological advancement. It reflects a collective vision shared by government, industry, and international partners to build a secure, inclusive, and innovative digital future,” Zambia’s Ministry of Technology and Science said in a Facebook post on Friday, November 14. “With strong policy reforms, trusted partnerships, and continued investment in infrastructure and skills, Zambia is well-positioned to become a leading digital hub in the region.”

During the event, Minister of Technology and Science Felix Mutati introduced a “Digital Pact,” a cooperation framework involving Ericsson, the government and the Zambian public. The pact is built around four principles: agility and innovation, solutions tailored to Zambia’s needs, faster processing and smoother operations, and shared responsibility and opportunity.

Mutati also highlighted government efforts to create a supportive policy environment, including tax exemptions on digital infrastructure imports and regulatory reforms that have helped make information and communication technology the country’s fastest-growing sector, expanding by 17.4 percent in 2023.

Zambia’s national digital strategy aims to make the country an integrated, inclusive and digitally autonomous nation by 2030. Authorities say digital adoption can raise productivity, improve efficiency and deliver better services, which in turn can support growth and reduce poverty. Mutati noted that technology can also cut costs and improve efficiency in priority sectors such as mining.

The GSM Association (GSMA) estimates that continued digital transformation could generate additional value of 28.64 billion Zambian Kwacha, or about 1.26 billion dollars, across the agriculture, trade, manufacturing, transport and public service sectors by 2028. The first four sectors alone could add 5.16 billion Kwacha in tax revenue and create 378,422 jobs.

Isaac K. Kassouwi

Casablanca will host EMECEXPO from Nov. 19-21, a major gathering for digital innovation in Africa. The event will bring together decision-makers, entrepreneurs, and experts for panels, workshops, and competitions on digital commerce, artificial intelligence, and SME capacity-building. It aims to promote collaboration, strengthen professional skills, and help African startups expand into new markets.

Ouagadougou will host the 20th edition of Digital Week from Nov. 18-21, with this year’s event centered on how artificial intelligence can support Burkina Faso’s digital transition. The program features sessions on future technology trends, robot demonstrations, youth-led initiatives, training workshops, regional dialogue, and a competition aimed at promoting talent and shaping a shared vision for digital innovation.

- Karsa enables Nigerians to open fully digital USD accounts with virtual Visa cards.

- The fintech offers 4–5% dollar yields tied to U.S. Treasury instruments.

- The platform targets freelancers and remote workers who struggle to access simple cross-border payment tools.

In Nigeria, fintech firm Karsa positions itself as a gateway to the U.S. banking system. The company offers a simple, secure and cost-efficient way to receive, save and spend dollars while leveraging the potential of stablecoins.

Karsa is a solution developed by the Nigerian fintech of the same name. The company provides Nigerians with a virtual U.S. dollar banking service, which includes a fully digital USD account and a virtual Visa card. Founders Shahryar Hasnani and Dale Wilson launched the start-up in 2024.

Hasnani told Disrupt Africa that Nigerians still face fragmented tools for cross-border payments. “In Nigeria, transferring money internationally still means using a dozen different tools. You get paid through one app, you convert your money through another, you store your savings in a third, and you still cannot easily spend those dollars,” he said. He added: “There is no simple and reliable solution for managing money internationally, especially for remote workers, freelancers and anyone who wants to hold U.S. dollars.”

Karsa operates through a mobile app available on iOS and Android. Play Store data shows more than one thousand downloads. The platform lets users receive dollar payments, including from marketplaces such as Upwork or Fiverr, and send funds to any bank account worldwide with reduced fees. The service aims to ease financial mobility for international workers, freelancers and individuals with foreign-currency income or obligations.

The fintech also allows users to save in dollars while earning returns. The company’s website reports a 4–5% interest rate tied to yields from “US Treasury yield” instruments. This feature helps users protect their savings from naira volatility while earning a competitive dollar return.

On the spending side, Karsa says users can pay internationally through a virtual Visa card, which offers some of the most competitive fees on the market. The company’s roadmap also includes a physical card launch.

Nigeria already shows strong adoption of stablecoins. In this context, Karsa’s offer could attract users looking for a secure and liquid refuge in a strong currency.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum

He develops initiatives that are reshaping how young people approach technology, opening new opportunities to experiment, create, and build practical solutions.

Dodji Honou is a serial entrepreneur who has spent several years building fab labs across West Africa. Based in Côte d'Ivoire, he is the co-founder and CEO of HFabLab, a digital fabrication laboratory designed to promote hands-on learning for young people, regardless of their background or language.

Founded in 2021, HFabLab offers a space where people can design, build, and refine everyday objects. The initiative helps turn ideas into prototypes, test new approaches, and develop projects that respond to real-world needs.

The lab develops training programs built around practical, experience-based learning. Participants are introduced to digital fabrication tools and learn to use them to design and carry out their own projects. HFabLab runs workshops for audiences ranging from children to adults, with sessions tailored to different skill levels. Courses cover robotics, drone piloting, laser cutting, electronics, programming, IoT devices and 3D printing.

Alongside HFabLab, Dodji Honou is also the co-founder and CEO of H-Venture, an Ivorian technology company. He serves as President of Forum 2040, a think tank focused on the future of learning ecosystems in Côte d'Ivoire, and as Vice-President of the Francophone Network of West African Fab Labs (ReFFAO). He is also a makerspace and fab lab specialist with JokkoLabs.

Before founding H-Venture and HFabLab, Honou co-founded Digitek Plus in 2016, which he managed until 2019. The company provided tech services to micro- and small businesses in the informal sector and offered IT training to young people who left school early.

Honou graduated from École libre africaine des technologies et des sciences appliquées (ELATSA) in Togo in 2009 with a Bachelor's degree in Marketing Management and Communication. From 2012 to 2015, he served as Executive Director of Woelab in Lomé. During that same period, from 2013 to 2014, he worked with the Organisation Internationale de la Francophonie (OIF) as a Fab Lab facilitator and multimedia specialist.

Melchior Koba

Noting the limitations of existing payment tools, he set out to rethink how they are used and built an interface that makes money transfers simpler and more intuitive.

Casimir Akuete Domlan is a Togolese entrepreneur specializing in fintech solutions and the Chief Executive Officer of LeGombo, a financial technology company he co-founded with Attisso Luz Koumedzro.

Founded in 2020 as eGo Transfert, LeGombo allows users to send, receive, and manage money through a mobile application or online interface. The platform is designed to make everyday transactions easier by avoiding the frequent limitations users face with traditional mobile network operators and payment systems.

The start-up operates as an aggregator, connecting users to essential financial services such as mobile money, bank cards, and other payment methods. In addition to basic money transfers, LeGombo offers online payment solutions, including the ability for users to generate a virtual card for e-commerce platforms and digital services. In October 2025, the company expanded its operations to Benin and Burkina Faso.

Domlan holds a Bachelor’s degree in Software Architecture from the École supérieure de gestion, d’informatique et de sciences (ESGIS) in Togo, which he earned in 2017. He later received a certificate in Operational Unit Management from Ascencia Business School in France in 2021.

Between 2017 and 2018, he worked both as a Community Manager and an IT Technician for Orange in Burkina Faso, while also serving as a Community Manager for ASMADE, a Burkinabe NGO focused on improving living and working conditions. In 2021, he completed an internship in innovation project management at Togo Invest Corporation S.A.

Domlan has received national recognition for his work. In 2020, he won first prize at the OpenHack competition organized by NunyaLab and the United Nations Development Programme (UNDP). In 2022, he again won first prize at the Togo Digital Awards in the “Achievement of the Year” category.

Melchior Koba

-

Plan includes national health data system, online services, and AI tools

-

Aims to ease system strain, but rural gaps and training remain key hurdles

Amid rising demographic pressure and growing strains on its healthcare system, Egypt is accelerating its digital transformation with a new national roadmap for the health sector. The country aims to leverage digital technologies to modernize management, expand access, and improve service efficiency.

Egypt officially unveiled its National Digital Health Strategy 2025-2029 on Saturday, November 15. Presented by Minister of Health and Population Khaled Abdel Ghaffar during the 3rd World Congress on Population, Health and Development (PHDC’25), the roadmap sets the foundation for a fully digitized health system by 2029.

A core element of the strategy is the creation of an integrated digital ecosystem intended to modernize health services through the systematic use of information technology. Key measures include consolidating national health data, building secure and interoperable digital platforms and expanding access to online services to improve the speed and reliability of patient monitoring.

The initiative falls under the broader “Digital Egypt 2030” transformation strategy, which places health among its priority areas. Implementation is supported by favorable conditions: the ICT sector is one of the fastest-growing in the Egyptian economy, and internet penetration exceeds 80%, according to DataReportal. Still, persistent disparities between urban and rural areas could slow the rollout of e-health solutions.

Several previous initiatives show that Egypt has already begun laying the groundwork for this transition. Millions of electronic medical records have been created under the universal health insurance program, while new platforms for telemedicine, hospital automation, and AI-assisted medical analysis continue to emerge.

For the government, the objective is twofold: to improve the efficiency of an overburdened healthcare system where bureaucratic bottlenecks and barriers to care remain widespread, and to strengthen national resilience against health crises, a priority underscored by the COVID-19 pandemic, which exposed the limits of traditional systems.

Implementing the strategy will require overcoming several challenges. Training health professionals to use new digital tools remains essential, as does strengthening cybersecurity to protect sensitive data. Expanding connectivity in underserved regions will also be critical to ensuring equitable access to digital health services.

Samira Njoya

More...

-

Morocco launches Gamification Lab to support gaming start-ups and innovation

-

Initiative targets public-sector adoption in education, health, and tourism

-

Part of broader push to grow creative economy, now with 40 gaming start-ups

Morocco’s Ministry of Youth, Culture and Communication has partnered with the state-owned Caisse de dépôt et de gestion (CDG) and its investment arm, CDG Invest, to launch the “Gamification Lab” program. The agreement, signed in Rabat on Thursday, November 13, aims to boost local development and strengthen Morocco’s position in the fast-growing video game market.

The Gamification Lab will create a national platform to promote and facilitate the adoption of gamification solutions developed by Moroccan start-ups. These tools will be made available to public- and private-sector organizations active in education, health, culture, employment, and tourism.

Minister of Youth, Culture and Communication Mohamed Mehdi Bensaid said the initiative is part of a broader effort to support small cultural businesses, particularly those involved in video gaming. He noted the sector’s rapid expansion, pointing out that Morocco now counts around 40 gaming start-ups, compared with just two or three in 2021.

This new agreement follows recent efforts to organize and develop the gaming ecosystem. Last May, two agreements were signed to strengthen professional training in gaming-related careers. One introduced dedicated university programs in video game development, while the other created three vocational pathways: e-sport caster, e-sport streamer, and video game laboratory technician.

The announcement comes at a time when Africa’s gaming market is experiencing strong momentum. According to a report released in February by the African publisher Carry1st and research firm Newzoo, the sector generated 1.8 billion dollars in 2024, up 12.4 percent from 2023. By comparison, the global market grew by only 2.1 percent.

Through this partnership, Moroccan authorities aim to support content creation, strengthen the broader start-up ecosystem, and develop skilled employment. Their goal is to position Morocco as one of Africa’s emerging hubs in the creative and digital economy.

Samira Njoya

Recognizing the need for structured learning in the AI boom, this Egyptian entrepreneur is developing a systematic method for integrating artificial intelligence tools into daily workflows.

Nabil Khalifa, an Egyptian entrepreneur based between Chicago and Cairo, is the co-founder and CEO of Meska AI, a 2024 startup that aims to make artificial intelligence accessible to individuals and organisations. The company offers training, consulting and events focused on practical uses of AI.

Meska AI positions itself as a resource for professionals who want to use AI without needing a technical background. It provides skills training, guidance on how to integrate AI into daily work and tailored support for organisations adopting these tools.

Training is a core part of its activities. Meska AI offers certifications and courses built around hands-on use of co-pilots and other AI applications, with an emphasis on real-world workflows. Alongside online and in-person classes, the company runs events and retreats that mix learning with networking.

Meska AI also advises organisations on how to build an AI strategy, choose the right tools and set internal rules for their use.

Outside Meska AI, Khalifa is Investment Director at ZeroCarb LYFE, a U.S. restaurant business. He is also co-founder and CEO of Sigma Fit, a fashion company. His entrepreneurial work began in 2015 with Menidy, an e-commerce platform for Egyptian handicrafts, and continued in 2016 with Hive Analytics, a performance-marketing agency.

Khalifa graduated in 2013 from the Institute of Aviation Engineering and Technology in Egypt with a bachelor’s degree in mechanical engineering. He worked between 2014 and 2015 as a measurement engineer for drilling operations at Schlumberger, the U.S. energy-technology company.

Melchior Koba

He created a solution that integrates the entire automotive lifecycle onto a single platform. This brings a much-needed organizational structure to a market segment traditionally hampered by scattered and complex procedures.

Younes Benboujida, a Moroccan entrepreneur with a background in finance, is the founder and co-CEO of Autocash, a 2024 startup that helps users buy, sell and finance used cars.

Autocash combines three services: the sale of certified pre-owned vehicles, support for sellers looking to resell their cars and assistance with securing financing, including for vehicles found on other platforms. The company handles the full process from vehicle choice to final handover.

Its listings feature cars vetted by professional inspectors before being posted, ranging from small city models to SUVs. Each listing includes year, mileage, transmission type, fuel type and price in dirhams.

For sellers, Autocash conducts an inspection, issues a detailed report, provides an estimate of the car’s market value and can obtain an immediate purchase offer through a partner. For buyers seeking credit, the platform helps arrange financing and manages the administrative steps of the loan application.

Benboujida has held several senior roles in the financial sector. He is a Managing Partner at B6 Capital, a Moroccan venture capital and private equity firm. He holds a postgraduate degree in accounting and financial management from Montesquieu University Bordeaux-IV. He began his career in 1998 as a director at PwC France, became Deputy General Manager of Société Générale in Morocco in 2004 and was appointed General Manager of EQDOM, a Moroccan consumer credit company, in 2018.

Melchior Koba

In Ghana, Soko Job has launched an AI-powered recruitment platform designed to assist job seekers in their search and help employers find qualified candidates.

Soko Job, a digital hiring tool built by the Ghanaian startup of the same name and led by Roberta Mensah, has launched an AI-based platform designed to speed up recruitment for employers and make it easier for candidates to find jobs. The platform was first introduced in 2024.

“We built SokoJob because we believe that finding a job or talent shouldn’t be a lengthy and painful process. Our goal is to become a catalyst for economic opportunity in Ghana by enabling fast and accurate matching of talent with opportunities,” Roberta Mensah told Disrupt Africa.

Available through its website, Soko Job lets applicants create profiles, upload their CVs or enter their information directly. An AI engine reviews the data to deliver personalized suggestions and highlight openings that match a user’s skills and goals.

The service also offers automated tools for employers. In addition to posting vacancies, companies can use AI-generated pre-screening questions to filter applicants. An Applicant Tracking System (ATS) built into the platform’s messaging interface allows recruiters to handle the hiring process end-to-end, from receiving applications to evaluating candidates.

In its pilot phase, Soko Job helped several Ghanaian firms fill technical and operational roles. The company says it prioritizes user privacy by keeping personal information confidential unless candidates choose to share it. Only verified employers can publish job ads or invite applicants to apply.

Adoni Conrad Quenum