- FastClaim digitizes roadside assistance, claims tracking, and vehicle inspections through a mobile app.

- The startup launched operations in Zambia last week after expanding beyond Nigeria.

- The platform uses remote photo and video inspections to reduce processing times and fraud.

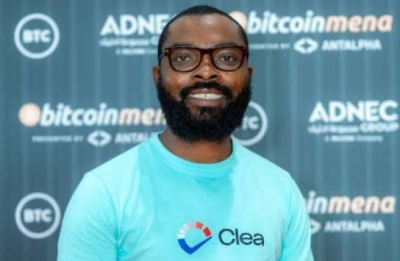

Okugo Uche Ayodele is a Nigerian entrepreneur and a seasoned insurance professional. He serves as founder and chief executive officer of FastClaim, a technology startup specializing in motor insurance management.

Founded in 2022, FastClaim operates as a mobile application that allows users to request roadside assistance, manage administrative documents, and track insurance claims directly from their phones. The application removes long waiting times and unnecessary travel. The solution serves both policyholders and insurance companies and aims to shorten processing timelines while limiting abusive claims.

FastClaim centralizes multiple automotive and insurance-related services within a single platform. In a few steps, users can request towing services from any location to receive rapid assistance during breakdowns. The application also simplifies vehicle ownership transfers by reducing paperwork and administrative bottlenecks.

The platform also enables users to renew driving licenses online without visiting physical offices. In addition, the system accelerates vehicle compliance by enabling rapid renewal of mandatory documents.

A core feature of FastClaim relies on remote vehicle inspection. Using a smartphone, users capture photos or videos that the application analyzes to identify damage. This process eliminates on-site inspection delays and accelerates the transition from claim submission to processing. The system also reduces exaggerated or fraudulent claims by verifying damage through visual evidence submitted via the application.

Last week, the startup announced the launch of its operations in Zambia. Industry bodies previously named the platform the most promising insurance application in 2023 and the best Nigerian insurance application in 2025.

Alongside his entrepreneurial activities, Okugo Uche Ayodele serves as a board member of Teens TV Africa in Nigeria. He holds a master’s degree in marketing obtained in 2003 from the University of Calabar. He began his professional career in 1998 at International Merchant Bank, where he worked as credit and marketing manager.

In 2000, he became marketing manager at Sovereign Trust Insurance. In 2004, he assumed the role of branch manager at Consolidated Hallmark Insurance in Port Harcourt before joining Cornerstone Insurance in 2005 as marketing manager. Between 2006 and 2020, he worked at International Energy Insurance, where he successively held regional director and managing director roles. Between 2023 and 2024, he also served as advisory director at JAVAT 365, a US-based content-sharing technology company.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum