Brief_simple (454)

Nigerian fintech Paycrest announced a $404,000 funding round on Tuesday to build out its decentralized settlement layer. By linking stablecoins with fiat in emerging markets, Paycrest is making cross-border payments faster and more compliant. Having already undergone real-world testing, the platform offers a resilient payment infrastructure designed specifically to navigate local constraints.

Egypt’s MoneyHash has teamed up with Spare to bring Pay-by-Bank options to UAE merchants. By reducing costs and accelerating settlements, the collaboration promises a more seamless checkout experience. The move is a key step in MoneyHash’s mission to scale open banking and modernize the Middle East’s payment landscape.

Egyptian startup Oasys Health has raised $4.6 million to enhance its AI-powered mental healthcare platform. The company plans to use the funds to automate clinical tasks, integrate data from wearable devices, and offer personalized patient monitoring. This investment will also support its expansion across partner clinics and universities.

The 2026 Africa Tech Summit Nairobi will feature 12 promising startups: Bekia, Bosso Africa Inc, Chefaa, Hizo, Innobid, Niteon, Pretium, Timart, TIBU Health, Vepay, Winich Farms, and Zerobionic. Spanning sectors from healthcare and finance to sustainability and robotics, these ventures represent the next generation of African innovation, offering high potential for both investment and impact.

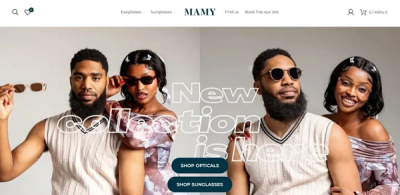

Mamy Eyewear, a Kenyan AI-driven vision testing startup, has received backing from Japan’s Ikemori Venture Support. The investment will help the company expand in East Africa and improve access to optical services.

NALA, a pan-African startup, has partnered with UK payment infrastructure provider Noah to launch a cross-border settlement network linking Africa and Asia. Through its Rafiki platform, NALA allows businesses to receive payments in stablecoins and convert them into local currency immediately, cutting fees and delays in emerging-market payments.

Last week, Moroccan startup Woliz raised $2.2 million in a pre-seed round led by insurer Sanlam Maroc to modernize the country’s vast network of local retail shops. Its platform leverages automation, data, and AI to connect shopkeepers, suppliers, and financial partners, optimizing inventory management and streamlining access to financial services. Looking ahead, the company plans to expand into other African markets.

Tanzanian fintech NALA announced last week that it has secured Payment Service Provider and Payment System Operator licenses from the Bank of Uganda, adding to its existing money transfer license. This new status allows NALA to operate on the country's primary regulated payment rails and supports a $2 million investment plan to bolster local infrastructure and serve the diaspora.

Rwandan fintech Kayko recently raised $1.2 million in seed funding to scale its management platform for small businesses. Founded in 2021, the startup already supports over 8,500 SMEs in tracking sales, inventory, expenses, and taxes through its POS system. Kayko plans to leverage this data to develop credit scoring models and streamline access to financing.

Egyptian scientific services platform Nawah Scientific has closed a $23 million Series A round in mixed financing—comprising equity, debt, and grants—to accelerate its regional expansion. The group plans to use the funds to launch a research center in Rwanda and expand laboratory capacity in Egypt and Saudi Arabia while modernizing its equipment. The goal is to position the region as a major hub for research and testing, serving both Africa and the Middle East.

More...

Twelve startups were recognized at the third annual South African Startup Awards, which selected 44 finalists from 221 entries across 12 categories. The winners span various sectors—including AI, fintech, healthcare, mobility, and climate—illustrating the dynamism of South Africa's tech ecosystem and the emergence of high-impact solutions for both consumers and businesses.

Stealth Money has launched a self-custody Bitcoin service in Nigeria, which the platform describes as a first for the continent. Users can purchase a hardware wallet using nairas for delivery anywhere in the country. The service also provides personalized support to help users secure their holdings away from exchanges deemed vulnerable, thereby strengthening their financial sovereignty over their digital assets.

Nigerian platform Bildup AI, which specializes in AI-powered personalized training, has closed a $400,000 funding round backed by angel investors. The capital will be used to grow the team, expand online offerings, and launch physical AI learning centers in Abuja and Lagos starting in 2026. The initiative aims to make digital skills more accessible to young Africans.

Delivery platform Chowdeck has partnered with startup GoLemon to stock its grocery warehouses and offer near-instant delivery through its app. While Chowdeck maintains control of its warehouse management and rapid logistics, GoLemon focuses on procurement, quality control, and scheduled grocery orders.