-

Morocco’s UM6P has launched a Global Hub in New York and Cambridge to link Africa with global innovation networks.

-

The hub will support joint research, student exchanges, start-up funding, and cross-border entrepreneurship.

-

The move is part of UM6P’s international expansion, with campuses already in Canada and France.

Morocco’s Mohammed VI Polytechnic University (UM6P) announced on Monday, September 8, the official launch of its Global Hub in the United States, with offices in New York and Cambridge. The hub is designed to connect African talent with leading international ecosystems in research, innovation, and entrepreneurship.

“The goal of this new hub is to directly address Morocco’s and Africa’s urgent challenges by combining rigorous scientific research with practical, scalable solutions, helping the Kingdom build pathways toward technological sovereignty,” said UM6P president Said Hicham El Habti.

The U.S. Global Hub is structured as a two-way platform. It will promote joint research projects, student exchanges, and cross-border entrepreneurial collaborations. The center also provides African start-ups with privileged access to venture capital and North American tech networks, while helping adapt U.S.-developed innovations to African realities. In addition, immersion programs will expose African leaders to international innovation practices.

This move is part of UM6P’s broader global expansion strategy, which already includes new campuses in Canada and France. It also reflects Morocco’s ambition to position itself as Africa’s anchor point for research and scientific investment.

Since its creation in 2017, UM6P has enrolled nearly 7,300 students from 40 nationalities, including 1,000 doctoral candidates. Its entrepreneurial ecosystem has supported more than 1,000 project holders and forged over 200 international partnerships with institutions such as MIT, Stanford, Columbia Business School, and Arizona State University. The U.S. hub strengthens this mission by engaging the African diaspora as a strategic resource to co-develop innovative projects across both continents.

Beyond academic cooperation, UM6P’s American hub aims to tackle three key weaknesses in Africa’s innovation ecosystem: limited global visibility in research, underutilization of the diaspora as a strategic lever, and difficulties in translating international technological advances into solutions tailored to local realities. The challenge now lies in turning this ambition into tangible, inclusive results that bring real value to African societies.

Samira Njoya

-

South Africa’s IT agency SITA is testing a government super-app to ease access to public services.

-

The “Citizen Super-App” will allow service requests, digital payments, identity verification, and real-time updates.

-

The project is still in pilot phase and faces hurdles, with 24% of the population offline in 2023.

South Africa’s State Information Technology Agency (SITA) has begun testing a government super-application designed to make public services easier to access. The platform, called the “Citizen Super-App,” was introduced by acting SITA chief executive Gopal Reddy during the 16th GovTech conference, held from September 8 to 10, according to local media.

Reddy explained that the app will let citizens access government services, track their requests, receive real-time updates and notifications, and interact with departments through self-service tools. It will also simplify identity verification, digitize administrative forms, integrate digital payment options, and enable smoother data sharing.

The project is part of South Africa’s broader digital transformation drive. In its 2025–2030 strategy, SITA highlights the modernization of government through technology as a central pillar, aiming for greater efficiency and transparency.

The strategy notes that this includes large-scale digital innovation, the use of artificial intelligence, and the rollout of new digital products such as the Citizen Super-App. Other priorities include modernizing government systems, expanding national connectivity, growing cloud and data center capacity, and improving cybersecurity through a centralized Cybersecurity Center (CSC).

The Citizen Super-App is still in its pilot phase, and officials have not disclosed when it will be fully launched. Its success will also depend on internet access and device availability, particularly in rural areas. According to the International Telecommunication Union, about 24% of South Africans were still offline in 2023.

Isaac K. Kassouwi

- Nigeria launches 1Gov Cloud to enable paperless governance by 2025

- Platform integrates secure tools for workflows, communication, and assets

- ICT sector seen reaching 21% of GDP by 2027

The Nigerian government has launched its 1Government Cloud (1Gov Cloud) platform to create a paperless administration across ministries, departments, and agencies (MDAs). This initiative is part of the country’s digital transformation goals, which aim for a fully digital government by the end of December 2025.

The 1Gov Cloud platform centralizes several digital tools to modernize governance. It includes GovDrive for secure, sovereign cloud-based file management and encryption; GovECMS to automate workflows and inter-agency interactions; GovMail for secure, government-only communication; GovE-Sign for legally recognized electronic signatures; and GovConference for encrypted video and audio conferencing. Other features include GovOTP for secure one-time password authentication, GovAsset Management for a unified registry of government assets, and GovCollaboration Tools for chat, document sharing, and inter-agency coordination.

"The paperless governance initiative will eliminate bureaucratic bottlenecks by streamlining approvals and inter-agency communication," said Wumi Oghoetuoma, the 1Gov Cloud Program Director, in comments reported by Nairametrics. "It will significantly cut costs associated with printing, storage, and distribution of physical files, while enhancing transparency and accountability in public service delivery."

Digital Economy Growth

This initiative underscores the Nigerian government's commitment to making digital technology a cornerstone of socioeconomic development, with the ICT sector's contribution to GDP projected to reach 21% by 2027. In recent months, the government has stepped up efforts to strengthen cybersecurity, train citizens and civil servants in digital tools, and expand digital infrastructure.

According to a joint study by the International Finance Corporation (IFC) and Google, Africa’s digital economy is expected to reach at least $712 billion by 2050, representing 8.5% of the continent's GDP. The GSMA, a global association of mobile operators, projects that e-government could also generate an additional 814 billion naira in tax revenue for Nigeria by 2028.

Isaac K. Kassouwi

- Kenya pledges support for digital creators via Meta, Google deals

- Part of "Digital Super Highway" to expand tech infrastructure

- Africa’s creator economy valued at $5.1B, rising to $30B by 2032

The Kenyan Ministry of Information, Communications, and the Digital Economy announced a new commitment on Monday, September 8, to support digital content creators. The initiative aims to help creators monetize their work through strategic partnerships with digital platforms like Meta and Google while expanding access to training and support programs for young talent.

The Ministry of Information, Communications and The Digital Economy is committed to supporting creators to monetize their content in a concerted effort to grow the Digital Economy. pic.twitter.com/aOKK4FNA5C

— Ministry of Info, Comms & The Digital Economy KE (@MoICTKenya) September 8, 2025

According to John Tanui, Principal Secretary for Digital Economy and ICT, the government is taking concrete actions to accelerate digital transformation. These include extending the fiber optic network, establishing digital hubs, installing public Wi-Fi hotspots, and implementing supportive policies. The goal is to create a secure and reliable environment that fosters business growth for content creators.

This decision is part of the "Digital Super Highway," a key pillar of the national digital strategy. The program intends to modernize the country's technological infrastructure and stimulate related sectors, such as content creation, which is seen as a key driver of economic diversification. The content creator economy in Africa is estimated at $5.1 billion in 2025 and could reach nearly $30 billion by 2032, according to the firm Coherent Market Insights.

By investing in its digital creators, Nairobi hopes to boost its digital economy and generate new income opportunities for its youth. However, this ambition must contend with persistent challenges, including account hacking, a tax burden deemed too heavy, demonetization, and a dependence on major foreign platforms.

Samira Njoya

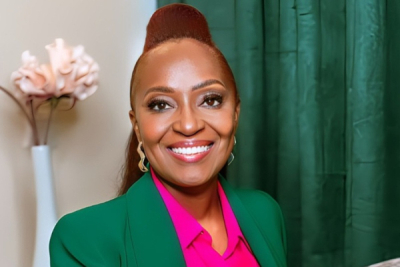

Kenyan entrepreneur Serah Mwikali Katusya is helping African businesses scale their digital presence through Belva Digital, a technology marketing agency she founded in 2013.

The firm provides end-to-end services in content marketing, SEO, UX/UI design, app development, digital advertising and organizational transformation. Its team combines data, strategy, media and tech expertise to support clients ranging from startups to large corporations.

Belva Digital has rolled out AXIS, an integrated platform that centralizes customer engagement across Facebook, WhatsApp, SMS and Instagram, and launched GrowthLab, a subsidiary focused on digital transformation and performance optimization.

Beyond Belva Digital, Katusya has founded or co-founded several ventures. In 2023 she launched WildMango, a branding and organizational development company, and ChangeKraft, a consultancy for institutions. In 2024, she co-created Muse Money Africa, a digital finance platform.

Her career began in 2004 as brand manager at Sarova Hotels in Kenya. She later worked as media director at WPP-Scangroup (2012–2013), and from 2016 to 2021 served as managing director for Sub-Saharan Africa at EssenceMediacom, a global marketing agency.

Katusya holds an advanced diploma in mass communication from the Kenya Institute of Mass Communication (2004) and a master’s degree in strategy, organizational management, leadership and social entrepreneurship from Hult International Business School (2024).

Recognized for her leadership, she was named among Kenya’s most influential women in marketing in 2022 and won the award for Best CEO in MarTech in 2024.

Her trajectory highlights how local initiatives in marketing technology are driving Africa’s digital growth and supporting businesses adapting to a rapidly changing marketplace.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Ugandan entrepreneur Marvin Peter Akankwasa is reshaping access to finance in Africa with digital platforms designed to link small businesses directly with lenders.

Akankwasa is the founder and CEO of Social Lend Africa, a fintech startup launched in 2019 that uses artificial intelligence to connect entrepreneurs with investors, bypassing traditional banking bottlenecks. The platform tailors loan rates through proprietary algorithms while providing lenders with risk assessments to secure their investments.

Borrowers must submit identity details, proof of residence, tax certificates and business documents, while lenders only need to verify the source of their funds. The company primarily targets small and medium-sized enterprises (SMEs) that often struggle to secure credit.

In 2023, Akankwasa also launched Highlend, a startup developing credit decisioning technology aimed at helping financial institutions manage risk. The company has set a target of working with 10,000 financial institutions across 10 African markets by 2033.

His entrepreneurial track record spans beyond fintech. In 2015, he founded African Food Vending Solutions, a fast-food distribution venture. Three years later, he co-founded Ugabus, an intercity bus network and online booking platform, which was acquired in 2021 by transport startup Treepz. Following the acquisition, he served as head of legal and general affairs at Treepz until 2023.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

The startup aims to transform urban and intercity mobility with its mobile app, which was designed to be specifically adapted to the local context.

Good’Trip is a carpooling app developed by Togolese startup Anaxar. Designed to provide a flexible and affordable alternative to traditional transportation, the app, available on iOS and Android and connects drivers and passengers with common travel routes.

The app allows drivers to post their trips and available seats, while passengers can view and book rides in real time. Payments are made via mobile money, ensuring a secure and seamless experience. Drivers are automatically reimbursed once the trip is completed.

Good’Trip emphasizes trust and safety. Every driver must submit their license and vehicle documents for verification before they can use the app. The platform also includes a rating and feedback system, allowing both drivers and passengers to review their experiences.

The initiative aims to tackle local challenges like rising transportation costs, urban congestion, and the growing demand for shared mobility. By facilitating carpooling, Good’Trip seeks to lower individual travel expenses, optimize vehicle use, and reduce the environmental impact of daily commutes.

With its fully digital approach, Good'Trip is poised to capitalize on Africa’s accelerating digital transformation. If adoption rates are strong, the platform could become a key player in Togo's connected mobility sector, helping to popularize a new approach to urban and intercity travel.

Adoni Conrad Quenum

-

Nigeria, Cape Verde launch African Digital Corridor initiative

-

Program trains 500 students in coding, AI, and innovation

-

Business mission set to deepen tech, trade cooperation in 2025

Nigeria and Cape Verde have launched the African Digital Corridor (ADC), an initiative designed to strengthen their digital, trade, and innovation ties. The project, unveiled last week in Abuja, is a strategic step toward defining cooperation priorities in artificial intelligence, youth empowerment, and bilateral development.

"This initiative demonstrates that innovation diplomacy can produce tangible results," said Christiana Onoja, co-founder and CEO of SheCode.ai, the organization behind the project. "When governments, innovators, and the private sector collaborate, concrete programs and partnerships become a reality."

As part of the initiative, the "Code the Future – Cabo Verde Rising" program will train over 500 high school students on three islands in coding, AI, and digital innovation. The program also plans to provide STEM tools in Portuguese, offer educational training for teachers, and will conclude with a national showcase highlighting student projects.

Beyond education, the ADC is founded on developing human capital and modernizing infrastructure. For Nigeria, the continent’s largest economy, the digital sector already accounts for about 18% of GDP and is a key driver of economic diversification. Cape Verde sees the initiative as a way to boost its competitiveness and regional integration. With an internet penetration rate estimated at 73.5% at the beginning of 2025, the archipelago plans to leverage its agile digital economy strategy and infrastructure like the TechPark CV, a special technology zone.

Bilateral cooperation will be further solidified by a Nigeria-Cape Verde Business and Innovation mission scheduled for the fourth quarter of 2025 in Praia. The mission aims to connect 20 to 25 Nigerian companies with Cape Verdean partners in key sectors, including digital technology, renewable energy, and tourism.

The corridor is expected to ultimately enhance digital inclusion, foster the growth of local startups, support innovation in strategic sectors, and build lasting bridges between education, technology, and the economy. However, its success will depend on both countries’ ability to sustain investment, ensure connectivity, and adapt their infrastructure to local needs.

Samira Njoya

• Gabon enacts digital law to modernize public services, boost transparency.

• Framework stresses inclusion, data security, local private sector role.

• Gov’t targets higher UN e-gov ranking, job creation and investment inflows.

Gabon has introduced a legal framework to accelerate the digital transformation of its public administration, part of efforts to boost competitiveness and modernize services.

The ordinance, signed by transitional President Brice Clotaire Oligui Nguema and published in the country’s official gazette on Sept. 7, sets out guiding principles for e-government reforms. The measures aim to improve efficiency and transparency, curb corruption through process traceability, and foster economic growth via digital innovation.

The framework emphasizes universal access to technology, interoperability of systems, data security and privacy, and digital inclusion to narrow the digital divide. It also calls for greater participation from local private-sector players, including a preference clause for domestic firms in public tenders related to digitalization.

Gabon currently ranks 174th out of 193 countries in the United Nations’ e-government development index (EGDI), with a score of 0.5741. Authorities say the reforms are designed to close that gap and position the country among Africa’s leaders in digital governance.

The initiative is expected to stimulate the local tech ecosystem, create jobs and attract investment in a sector considered vital to diversifying Gabon’s economy beyond oil.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

• Nigerian entrepreneur Foluso Ojo co-founded truQ to digitize and streamline logistics.

• truQ connects companies with nearby vehicles to cut delays and increase transparency.

• The start-up won Lagos AOT mobility award in 2022 and ranked among Nigeria’s top 10 innovators in 2023.

Foluso Ojo, a Nigerian tech entrepreneur, co-founded and now leads truQ, a logistics start-up that aims to digitize and optimize freight transport across Africa.

Founded in 2020, truQ operates a platform that connects businesses with available logistics vehicles nearby. The system enables faster and more efficient transport of goods.

The start-up works as digital infrastructure for third-party logistics providers, helping reduce delays, optimize routes and make operations more transparent.

truQ explained: “On the users’ side, we save them the stress of making several phone calls to different vehicle owners each time they need to move something, spending time negotiating prices, and depending on a driver’s availability, with occasional disappointments.”

Ojo graduated from Adekunle Ajasin University in Nigeria with a bachelor’s degree in communication in 2014.

She began her career in 2012 as an intern at public relations firm CMC Connect. In 2016, she joined Nigerian management company Brooks and Blake as a project manager.

In 2020, she became community manager at eTradeforWomen, an initiative that supports female digital entrepreneurs.

truQ’s progress has earned industry recognition. In 2022, the start-up was named best mobility start-up of the year at the Art of Technology (AOT) Lagos event.

In 2023, it was ranked among Nigeria’s top 10 most innovative companies by NSIA Group, a financial services firm specializing in banking and insurance.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

More...

• Togolese expert Radia Ouro-Gbele leads Paris-based OG IT Consulting with operations in Africa.

• Her firm trained 500+ young Africans in cybersecurity for global companies.

• She aims to make Africa a global cybersecurity hub within 15 years.

Radia Ouro-Gbele, a Togolese cybersecurity specialist, has built her career working with global companies in energy, nuclear and industrial sectors, designing identity and access management (IAM & PAM) systems and leading large-scale cybersecurity projects.

She is the founder and president of OG IT Consulting, a Paris-based cybersecurity advisory and integration firm launched in 2021 with operations across Africa. The firm provides audits, identity and privileged access management services, as well as executive training. It also runs awareness and skills-building programs, training more than 500 young Africans who have since joined international firms.

Ouro-Gbele told We Are Tech Africa that the venture stemmed from a desire to protect the continent’s digital assets after hearing the struggles of an African executive. Her mission, she said, is to “protect Africa, by Africans and for Africans” through local structures and workforce development.

She has set a long-term target of making Africa a global hub for cybersecurity expertise within 10 to 15 years, envisioning a “cyber Silicon Valley” capable of securing organizations in North America, Europe, Asia and the Middle East.

Ouro-Gbele holds a telecommunications diploma from the École supérieure multinationale des télécommunications (ESMT) in Dakar, and a master’s degree in information systems security from the Université de technologie de Troyes in France. Her career began at Togocom in 2013, followed by a stint at ASECNA in Senegal. She later joined Accenture France as a cybersecurity consultant and worked as a cybersecurity project manager at Thales from 2021 to 2023.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

• Chad to invest $1.5bn by 2030 in digital transformation and e-government.

• ARCEP, ITU push to train civil servants, young professionals in digital skills.

• 2,000 youths trained in AI as Chad seeks to boost startups, jobs, innovation.

Chad plans to invest $1.5 billion through 2030 to accelerate its digital transformation, focusing on digitizing public services. However, the government faces challenges in ensuring public employees can effectively use the new digital platforms.

The Chadian government wants to enhance cooperation with the International Telecommunication Union (ITU) to develop digital skills among its young cadres. This objective emerged during the 2025 Global Symposium for Regulators (GSR-25), held from August 31 to September 3 in Saudi Arabia.

At this event, Haliki Choua Mahamat, Director General of Chad’s Regulatory Authority for Electronic Communications and Posts (ARCEP), met with Doreen Bogdan-Martin, ITU Secretary-General. Both emphasized investing in training young professionals, especially in regulatory roles, to support digital transformation and manage strategic infrastructure effectively.

This initiative builds on recent efforts by Chad to strengthen local digital capacities. In late July, the Agency for Development of Information and Communication Technologies (ADETIC) signed a framework agreement with the International Institute for Water and Environmental Engineering (2iE) based in Ouagadougou. The agreement includes training Chadian cadres in artificial intelligence and emerging technologies. Additionally, the National School of ICT (ENASTIC) and 2iE signed a separate protocol to facilitate academic exchanges and joint program development.

Between August 4 and 14, Chad organized free AI training for 2,000 young people aged 15 to 35, with partners including UNESCO and the World Bank. Authorities present this program as a gateway to employment, innovation, and digital entrepreneurship through startup creation. This comes amid projections by the World Bank that approximately 230 million jobs in sub-Saharan Africa will require digital skills by 2030.

The Organisation for Economic Co-operation and Development (OECD) stresses the need to invest in public officials’ skill development, as digital technologies can transform administration by enabling more accessible and efficient service delivery.

The February 2024 OECD report Developing Skills for Digital Government: A Review of Good Practices across OECD Governments stresses that building a digital government—where technology shapes processes, policies and services tailored to citizens’ needs—requires public administrations to adopt new working methods and skills, while also fostering the abilities, attitudes and knowledge that allow civil servants to thrive in a digital environment and generate public value.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange Jason Quenum

The financing will enable iXAfrica to meet the demand for cloud services, AI workloads, and hyperscale data needs accelerating across East Africa.

IX Africa Data Centre Limited (iXAfrica) has closed a multi-tranche funding package with Rand Merchant Bank (RMB), a division of FirstRand Limited, to accelerate the next phase of its expansion in Kenya, it announced September 4. The financing amount was not disclosed.

The financing will enable iXAfrica to add 20 MW of IT power at its Nairobi campus, building on the initial 2.25 MW already operational. Guy Willner, Chairman of iXAfrica, said the agreement secures the company’s next growth stage. “Closing this financing with RMB positions us to welcome more hyperscale and AI customers. We remain committed to expanding our East African footprint and deepening our investment in Kenya.”

RMB designed a customised financing solution, underscoring its commitment to supporting Africa’s digital infrastructure. “This transaction reflects RMB’s commitment to supporting scalable, high-impact digital infrastructure across Africa,” said Corrie Cronje, Senior Transactor at RMB.

iXAfrica’s Nairobi One Campus is designed to deliver a total capacity of 22.5 MW, making it the largest data centre project in the greater East African region. Serving a population of over 300 million people, the facility is strategically located near key fibre optic arteries and resilient power sources.

The expansion highlights a growing trend across Africa, where data centre capacity is rapidly scaling to meet the continent’s digital transformation goals. According to a joint report by the Africa Data Centres Association (ADCA) and Xalam Analytics, Africa needs around 1,000 MW of additional IT power and 700 new data center facilities to meet the growing demand driven by cloud adoption, e-commerce, and AI applications.

This surge is largely due to structural shifts in the continent’s digital landscape—like the doubling of broadband users and the rapid expansion of Tier III and above data centers. For Kenya, the availability of robust data infrastructure is critical to supporting innovation, attracting investment, and positioning Nairobi as a regional tech hub.

For iXAfrica, the financing secures the resources needed to accelerate its Nairobi campus buildout and expand its total capacity to 22.5 MW. This positions the company to attract hyperscalers, cloud service providers, and AI-driven businesses that require high-density infrastructure.

The partnership with Rand Merchant Bank not only strengthens iXAfrica’s credibility in the investment community but also signals its financial stability to prospective clients. With demand for data hosting and cloud services surging across Kenya and East Africa, the deal creates significant revenue growth opportunities.

Beyond Kenya, the transaction demonstrates iXAfrica’s ability to raise large-scale capital, laying the groundwork for future regional expansion and reinforcing its status as East Africa’s largest carrier-neutral hyperscale data centre operator.

Hikmatu Bilali

- Ghana, Code Raccoon discuss €4M digital training for 350,000 youth

- Program covers coding, AI, cybersecurity; aims for global accreditation

- Builds on “One Million Coders” initiative launched in April 2025

Ghana is exploring a partnership with private firm Code Raccoon to train 350,000 young people in digital skills, according to a government statement.

Communications Minister Samuel George met with a Code Raccoon delegation on Thursday, September 4, to discuss a three-month training program valued at 4 million euros ($4.7 million). The initiative will be supplemented by an annual software development course.

The curriculum, which has been piloted in Germany, will focus on high-demand skills such as Python and JavaScript programming, along with modules on artificial intelligence and cybersecurity. The government aims for the program to be accredited by both the state and major global technology companies.

"This initiative aligns with our national vision of creating a digital workforce ready for the opportunities of the AI-driven economy. With the right partnerships, we can empower our young people with the skills to thrive locally and internationally," the minister said.

The move builds on Ghana's "One Million Coders" program, a four-year initiative launched in April to provide essential digital training to one million Ghanaians. The government had previously engaged in discussions with local tech company TECHAiDE, which offers an offline learning management system called Asanka.

Isaac K. Kassouwi