-

Amr Yassine Mouaqit founded Charikaty in 2025 as Morocco’s first fully digital company-formation platform.

-

Charikaty enables entrepreneurs in Morocco and abroad to create companies online within days, without physical travel.

-

The platform covers company formation, legal filings, and trademark registration through a single digital process.

Amr Yassine Mouaqit is a Moroccan entrepreneur with a legal background. He founded and leads Charikaty, an online platform that supports entrepreneurs in creating companies in Morocco within a few days, without travel or complex administrative procedures.

Mouaqit launched Charikaty in 2025 as the country’s first fully digital platform dedicated exclusively to company formation. The service operates entirely online and targets both Morocco-based entrepreneurs and project holders living abroad. The platform aims to make company creation fast, smooth, and accessible, including for users unfamiliar with administrative processes.

Charikaty covers all key stages of a company’s lifecycle through three main service categories. The platform first manages all company formation formalities, from collecting shareholder information to securing official registration numbers and legal documents required for incorporation. Throughout the process, a dedicated advisor supports each user.

Charikaty also enables online registration of corporate deeds and meeting minutes, which removes the need for physical travel. In addition, the platform offers trademark filing and protection services, including file preparation, submission to the relevant authority, publication tracking, and renewal reminders.

The platform structures the company-creation journey into clear and guided steps. Users enter essential project information through an online form, after which Charikaty handles procedures with the relevant public administrations. At the end of the process, clients receive all identifiers and documents required for the legal operation of their companies.

Alongside Charikaty, Mouaqit also co-founded and co-chairs the Moroccan Innovation Circle. He launched the non-profit organization in 2024 to promote innovation, entrepreneurship, and technological progress in Morocco.

Mouaqit graduated from the University of Nottingham in the United Kingdom, where he earned a bachelor’s degree in law in 2023. He currently pursues a master’s degree in international relations and affairs at King’s College London. During his academic career, he completed several legal internships at Moroccan law firms, including Hajji & Associés in 2023 and A&O Shearman in 2025.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J. A. de BERRY QUENUM

The ICT Africa Summit, a flagship event on innovation, digital transformation and connectivity, will return for its sixth edition on April 21-23, 2026, at the SAFEX Exhibition Center in Algiers. The summit will bring together policymakers, companies, startups and investors, with the aim of supporting a more inclusive and sustainable digital ecosystem across Africa. Following the 2025 edition, this year’s event will highlight innovation and cross-border collaboration to speed up the continent’s digital transformation.

Following a court order declaring its data collection illegal, the crypto project Worldcoin has purged all biometric data gathered in Kenya. Regulators confirmed that iris scans and other personal identifiers have been destroyed, ending a protracted legal dispute that underscores the clash between tech innovation and data privacy.

-

Madagascar will train 1,000 young people for free in digital professions by the first half of 2026.

-

The program relies on a partnership between the OIF and Madagascar’s vocational training ministry.

-

Authorities aim to train 40,000 people in digital skills nationwide by 2028.

In Madagascar, the government and its partners will train 1,000 young people free of charge in digital professions by the end of the first half of 2026 under the “D-CLIC, train in digital skills with the OIF” program. Authorities officially launched this new phase of the project on Monday, January 19, in Antananarivo through a partnership between the International Organisation of La Francophonie and the Ministry of Technical Education and Vocational Training.

Le projet #DCLIC franchit une étape décisive à #Madagascar. Grâce à un partenariat entre l’OIF et le ministère de l’Enseignement technique et de la Formation professionnelle (METFP), 1 000 jeunes seront formés gratuitement aux métiers du #numérique d’ici la fin de l’année 2026.… pic.twitter.com/Cn7iVvBHqr

— La Francophonie (@OIFrancophonie) January 21, 2026

This phase marks the program’s transition to larger-scale operational deployment. The initiative begins with the training of national instructors, who will form a network designed to provide long-term support to beneficiaries across the country. The OIF developed the training pathways through an online learning platform, with a focus on digital skills in demand on the labor market as well as digital entrepreneurship.

The D-CLIC program forms part of a broader strategy to strengthen digital skills across the Francophone space. The program operates in several African countries and aims to improve youth employability, facilitate professional integration, and address rising demand for digital talent amid the gradual digitalization of African economies.

In Madagascar, the initiative comes as demand for digital training continues to intensify. The country faces strong demographic pressure, with a predominantly young population, while the formal labor market remains limited. Authorities now position digital skills as a core pillar of vocational training policy. The Minister of Technical Education and Vocational Training, Marie Marcelline Rasoloarisoa, recently said Madagascar aims to train 40,000 people in digital skills by 2028 in order to adapt the workforce to new economic and technological uses.

Against this backdrop, the D-CLIC program functions as an operational component of the national strategy. By expanding access to certified training and promoting the acquisition of immediately applicable skills, the new cohort could improve youth employability, support self-employment, and contribute to the emergence of a more structured digital ecosystem in Madagascar.

This article was initially published in French by Samira Njoya

Adapted in English by Ange J. A. de BERRY QUENUM

-

Zimbabwe will deploy 8,000 Starlink internet kits to primary and secondary schools nationwide.

-

The government aims to close the digital divide, especially in remote and underserved areas.

-

Authorities already connected 3,500 of the country’s 7,000 schools through international programs.

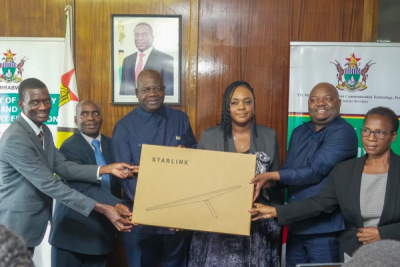

The Zimbabwean government decided to equip primary and secondary schools with 8,000 Starlink internet kits. Authorities said the initiative seeks to guarantee nationwide connectivity for schools, with a particular focus on remote and poorly served areas.

The Minister of ICT, Postal and Courier Services, Hon. Tatenda Mavetera, today donated 8,000 Starlink internet kits to the Ministry of Primary and Secondary Education under the Presidential Internet Scheme.

— Ministry of ICT, Postal & Courier Services - Zim (@MICTPCS_ZW) January 21, 2026

The consignment was officially received by the Minister of Primary and… pic.twitter.com/GK3CGoJoek

The Ministry of Information and Communication Technologies formally handed over the equipment to the Ministry of Primary and Secondary Education on Wednesday, January 21, 2026. During the ceremony, ICT Minister Tatenda Mavetera said the program aims to reduce the digital divide and provide learners across Zimbabwe with access to affordable and reliable internet services.

In a statement published on X, the Ministry of ICT said that “this initiative should strengthen digital learning, improve access to global educational resources, and prepare students to participate competitively in the digital economy.” The ministry added that the project forms part of government efforts to modernize the education sector and promote inclusive access to information and communication technologies.

Zimbabwe already benefits from the GIGA project, a joint initiative of the International Telecommunication Union and UNICEF, which aims to connect all schools worldwide to the internet. According to official data cited by GIGA in March 2025, 3,500 Zimbabwean schools out of a total of 7,000 already have internet connectivity. The ITU committed to working with national authorities to identify the most efficient and cost-effective connectivity solutions for the remaining schools.

While international institutions, including UNESCO, widely recognize the potential of ICT to improve education systems, the use of Starlink’s satellite technology raises several questions. These concerns include the availability of connection devices in schools such as computers, tablets, or smartphones, the digital skills of teachers, access to electricity, the relevance of digital educational content, and the sustainability of the model, given that Starlink operates on a monthly subscription basis.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange Jason A. de BERRY QUENUM

-

Burundi launched the e-KORI system to digitalize tax declaration and payment.

-

The Burundi Revenue Authority leads the project with World Bank support.

-

Authorities aim to expand the tax base, improve transparency, and strengthen budget planning.

The Burundian government officially launched the implementation phase of the e-KORI system on Monday, January 19, in Bujumbura. The Burundi Revenue Authority is leading the project with financial and technical support from the World Bank. The program focuses on online tax declaration and payment for both taxes and fees.

“The implementation of such a system represents a crucial step toward the digital transformation of our country by allowing the state to mobilize its own resources more effectively,” Finance, Budget, and Digital Economy Minister Alain Ndikumana said. “The e-KORI project is a strategic tool because it will allow Burundi to collect its own funds and finance its development projects without relying exclusively on external aid,” he added.

The e-KORI program aims to digitalize all processes related to domestic tax collection and non-tax revenue. The system allows taxpayers to submit declarations and make payments online, track transactions remotely, and reduce physical interactions with tax offices. Authorities also present the platform as a tool to improve revenue traceability, reduce errors, and strengthen tax control.

The launch comes as Burundi accelerates its transition toward a digital public administration. In recent years, authorities have implemented reforms to modernize public financial management, improve governance, and strengthen transparency. However, domestic revenue mobilization remains a challenge in a country characterized by a large informal sector and tax procedures that many economic actors consider complex.

Project officials said e-KORI will roll out in nine phases, with authorities validating each deliverable before moving to the next stage. The program also includes training and awareness sessions for tax officials and taxpayers. Authorities placed system security at the center of the project. A technical partner is responsible for infrastructure protection, data security, and cyber-risk prevention amid growing cybersecurity challenges linked to the digitalization of public finances.

Over the long term, authorities expect e-KORI to broaden the tax base, strengthen taxpayer compliance, and improve state budget planning. By facilitating access to tax services and securing digital exchanges, the system could also improve the business climate, strengthen trust between the administration and citizens, and support Burundi’s ambition to build a more efficient, transparent, and digitized state.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

- South Africa–based entrepreneur Paulo Matos leads AI startup Ageiro, founded in 2025.

- Ageiro raised $3 million in December 2025 to scale its autonomous agent platform.

- The company targets faster execution and productivity gains for organizations of all sizes.

Execution remains a major friction point for many organizations between strategy and outcomes. Paulo Matos is betting on artificial intelligence to close that gap.

Paulo Matos is a South Africa–based technology entrepreneur and the co-founder and chief executive officer of Ageiro. He leads the company’s mission to help organizations transform ideas and operational needs into tangible results using artificial intelligence.

Founded in 2025, Ageiro develops a platform designed to allow companies to execute tasks rapidly on their computers. The platform aims to help teams work faster and more efficiently in order to deliver practical results without unnecessary delays.

The startup positions itself as a productivity and time-saving tool. Ageiro removes long and repetitive steps so teams can focus on core objectives, including turning vision and ideas into actionable outputs. The company targets organizations of all sizes, from small teams to large enterprises, that want to reach objectives without traditional development or digital tool constraints.

In December 2025, Ageiro raised $3 million to accelerate the development of its autonomous agent platform. The company plans to use the funding to strengthen decision-making models, compliance frameworks, and commercial expansion.

Before launching Ageiro, Paulo Matos co-founded Manex Systems in 1995. He served as chief executive officer of the South African technology company until 2001. He graduated from Nelson Mandela University and earned a master’s degree in business management and administration in 2016.

Alongside his entrepreneurial career, Matos held senior roles in several technology companies. In 2001, he joined UK software publisher McGuffie Brunton as product manager and pre-sales director. From 2005 to 2024, he worked at UK-based SYSPRO, where he successively served as business development manager and product director.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason de BERRY QUENUM

-

South African entrepreneur André de Wet founded Flood to digitize local commerce through mobile-first platforms.

-

Flood aims to become a “Shopify for physical stores” by turning existing audiences into local marketplaces.

-

The platform targets telecoms, digital banks, and SMEs seeking monetization and proximity-based engagement.

André de Wet is a South Africa–based entrepreneur operating from Cape Town. He founded Flood, a platform designed to help neighborhood retailers remain visible and competitive in a mobile-driven economy without imposing complex technologies.

Founded in 2020, Flood positions itself as a commerce solution built for a smartphone-centric world. The company aims to create the equivalent of Shopify for physical stores that serve customers in person while extending relationships into digital channels.

The platform converts existing audiences, including telecom subscribers, digital bank customers, and radio listeners, into localized marketplaces. The audience owner becomes the central access point where consumers discover offers, select products, and complete payments.

Flood primarily targets organizations that control large user bases, including telecom operators and digital banks, but underutilize their commercial potential. The platform allows these organizations to become their customers’ main digital destination by combining offer discovery and payment within a single environment.

For small and medium-sized businesses, Flood simplifies engagement with geographically nearby customers and places merchants at the center of a local digital ecosystem. For consumers, the platform enables mobile wallet usage, contactless payments, instant rewards at purchase, and real-time interaction tracking.

Alongside Flood, André de Wet founded consulting firm 2ndBase in 2018 and serves as its chief executive officer. The firm supports corporate clients in understanding and adopting digital technologies. He launched his first entrepreneurial venture in 2005 with the creation of IT services company WebTec.

From an academic perspective, de Wet holds a bachelor’s degree in medicine earned in 1989 from the University of the Free State in South Africa. He later earned a master’s degree in international management from the University of Salford in 2020. He began his professional career in 1997 at Global Visual Media, where he served as senior marketing manager.

In 2010, de Wet joined fintech company PayU as head of business development. In 2011, he became chief executive officer of price-comparison platform PriceCheck. Between 2016 and 2017, he served as Africa head at on-demand entertainment platform iFix.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason de BERRY QUENUM

Algeria will host the African Digital Transformation Summit this March 28-30. Preparations are already in full swing following a meeting between the Secretary-General of the ATU and Algerian Minister Sid Ali Zerrouki at the 2026 Algeria Optical Summit. The summit aims to turn high-level discussions into measurable actions that drive the continent’s digital transition and attract sustainable investment.

Chipper Cash is officially operating in the black. The African payments specialist reported that it covered all operating expenses in Q4 2025, successfully halting its cash burn after two years of restructuring. By doubling down on key markets like Nigeria and Uganda and leveraging the success of its dollar-denominated cards, Chipper Cash is now signaling that its business model is built to last.

More...

eYouth, the Egyptian edtech company, has entered the Iraqi market through a partnership with Al-Majal Group. Together, they are launching Iraq’s first Arabic digital learning platform, designed to boost employability through career-focused training and international-standard certifications for young professionals and graduates.

- Congolese engineer Elie Yossa founded Findapp to centralize access to local products, services, and events.

- Launched in 2023, the mobile application targets residents and visitors by aggregating fragmented local information.

- The platform offers local businesses a low-complexity visibility tool to reach nearby consumers.

Elie Yossa is a Congolese engineer specializing in electronics and software engineering. He founded Findapp and serves as the application’s product lead. The mobile platform promotes local life by making a city’s products, services, events, and initiatives visible to residents and visitors.

Launched in 2023, Findapp positions itself as a clear and accessible showcase of local activity. The application allows users to quickly identify what they can do, buy, or experience nearby by centralizing information that often remains scattered across multiple channels or social networks.

Through the application, users access featured products, available services, ongoing events, and local initiatives in their city. The platform aims to deliver readable and useful information about nearby offerings within seconds.

For local shops and organizations, Findapp serves as a visibility tool targeting city residents. The platform enables businesses to promote products, services, or events without managing complex or multi-channel communication strategies.

As a result, local actors can increase brand awareness at the city level and reach audiences that traditional channels may not capture. The application creates a shared digital space where each contribution supports local activity while generating tangible benefits for users.

Alongside Findapp, Elie Yossa serves as chief technology officer at Jambo-Lab, a platform specializing in climate technologies. In 2023, he co-founded Agri Pannel Connect, an agri-tech solution designed to improve yields, strengthen climate resilience, and support sustainable agriculture. In the same year, he also founded Kivu Guard, an initiative aimed at protecting vulnerable communities in eastern Democratic Republic of Congo from armed violence and insecurity.

Elie Yossa graduated from the Higher Institute of Computer Science and Management of the Democratic Republic of Congo. He also won the 2025 Global Youth Action Fund award, which organizers launched during the International Baccalaureate Festival of Hope.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

- La Poste Burkina Faso launched Fasoranana in 2019 as part of its digital transformation strategy.

- The platform integrates e-commerce, payment, and nationwide delivery through the postal network.

- Fasoranana supports local merchants while expanding access to online retail in Burkina Faso.

La Poste Burkina Faso developed Fasoranana as an online commerce platform. The postal operator designed the solution to allow users to buy and sell goods easily. The platform, launched in 2019, forms part of the operator’s broader strategy to embed digital services into its core postal activities.

Fasoranana operates through a mobile application available on Android. The application has already recorded more than one hundred downloads, according to the Play Store.

On the platform, customers browse hundreds of products through smartphones or web browsers. Users select items, manage orders, and complete secure payments via mobile money, bank cards, or cash on delivery. Meanwhile, La Poste Burkina Faso ensures delivery through its national postal network, which leverages its logistics and distribution expertise.

Fasoranana aims to recreate the physical market experience in a digital environment. The platform reduces travel constraints and improves purchasing convenience for Burkinabe consumers. At the same time, the initiative allows local merchants to expand online operations, reach new customers, and increase visibility without facing traditional barriers linked to physical retail.

By broadening access to e-commerce, Fasoranana contributes to the modernization of Burkina Faso’s retail sector. In addition, the platform capitalizes on existing postal infrastructure to deliver an integrated solution covering sales, payments, and last-mile delivery.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum

-

Stéphane Lavri co-founded Madata in 2024 to centralize data and operations for African SMEs.

-

Madata provides web and mobile tools to manage sales, clients, invoices, projects, and payments in one platform.

-

The solution targets freelancers and SMEs and supports real-time collaboration and financial monitoring.

Amid persistent management challenges facing small and medium-sized enterprises, Stéphane Lavri chose to develop a tool adapted to on-the-ground realities. His innovation aims to turn company data into actionable insights.

Stéphane Lavri, an Ivorian entrepreneur and consultant, co-founded Madata, a digital solution dedicated to supporting small and medium-sized enterprises in managing information systems, data, and digital transformation.

Founded in 2024, Madata operates as an online application designed to help African entrepreneurs and SMEs structure and monitor daily operations from a computer or mobile phone. The platform centralizes sales, customers, invoices, projects, and payments in a single environment and provides simple and secure access to company data at any time.

Available on both web and mobile versions, Madata primarily targets freelancers and SMEs. The application groups essential management functions within one interface, including customer tracking, quotations, contracts, invoices, purchase orders, projects, payments, and daily activities. In addition, the platform allows users to manage financial flows, analyze cash inflows and outflows, and obtain a clear view of business health to support fast and informed decision-making.

The solution also improves collaborative work. Users can share professional documents directly through WhatsApp. Companies can organize teams, plan assignments, and allocate tasks, which strengthens internal coordination and supports the fulfillment of client commitments. The platform updates data in real time, allowing all collaborators to work on the same information regardless of location.

Before launching Madata, Stéphane Lavri co-founded DIGIT-A.L., a digital consulting firm, where he served as co-managing director until 2024. He holds a master’s degree in international trade obtained in 2006 from Jean Moulin University Lyon 3 in France.

Lavri began his professional career in 2007 at international IT company Umanis, where he worked as a business engineer. In 2008, he joined Belgian technology firm Adneom in the same role before securing a promotion in 2011 as head of the commercial unit. In 2014, he took charge of the commercial unit at IT consulting and services company AUSY.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum