Online education platforms are becoming popular by the day since the coronavirus pandemic. Besides attention and adoption, these platforms are also attracting a growing volume of investments.

Almentor is an e-learning platform developed by an Egyptian startup. It lets users get trained with various educational videos.

For Ihab Fikry, co-founder and CEO of Almentor, the solution hosts "an abundance of courses and talks that are capable of nurturing Arab youth, enhancing their experiences, and serving their career paths by providing them with what they deserve to advance their careers on all fronts."

To access the courses, users need to create an account, either via the solution's Android app or web platform, subscribe (the monthly subscription fee is $7.5), then choose a course or lecture. The user can choose courses in several categories including arts and design, photography and filmmaking, human resources, management, lifestyle, theater, sports, business, corporate communication, digital media, sales and marketing, and technology. All the courses and talks are in Arabic and most of the users and lecturers are Arab speakers.

In addition to the video content, the solution has a document library where users can expand their knowledge. According to PlayStore data, the mobile app has already been downloaded more than 50,000 times but, the startup behind the solution wants to reach more people. Since its launch, it has raised some $14.5 million to support its growth in the Middle East and North Africa.

Adoni Conrad Quenum

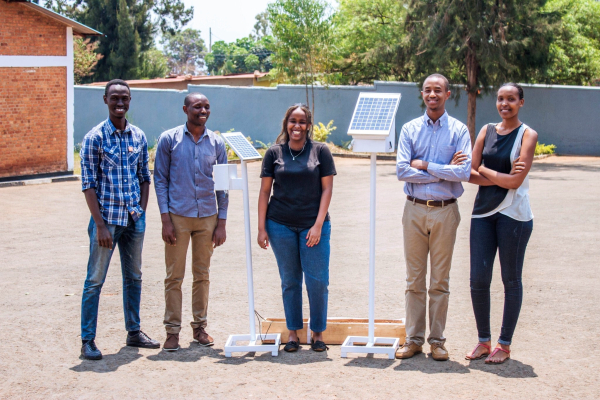

Since its launch in 2015, the App Challenge has supported the development of digital applications that address African issues. The challenges allow projects to access personalized support and even financing (for some projects).

Last Friday, the jury of the Africa App Challenge unveiled the 10 finalists of the seventh edition of the challenge.

The challenge, organized by France Médias Monde, aims to encourage the development of innovative solutions (mobile and web) that promote sustainable agriculture in Africa. The ten finalists are from Cameroon, Rwanda, Benin, DRC, Tunisia, and Morocco.

The selected projects are:

- Crop's Talk is a mobile application developed by Tunisian Rabeb Fersi to help small farmers improve their productivity and resilience to climate change.

- Bazafarm is a real-time soil quality monitoring system developed by Rwandan national Samantha Ruzibiza.

- Ki@foret, a platform created by Beninese-born Finagnon Robert Agbovoedo, connects non-timber forest product collectors and traders with the products going to the highest bidders.

- MukulimaSoko is a digital and physical trading and renovation center offering several services to agricultural actors. The project was designed by Mbumba Lapaque from the Democratic Republic of Congo.

- OGPM (Outil de Gestion de Projet Agricole), developed by Cameroonian Adamou Nchange Kouotou, is a digital platform made up of two applications. The first is a mobile app that collects information to analyze technical agricultural risks while the second is a web app that recommends the best agricultural credits and facilitates technical and commercial support for farmers.

- E-Pinea is a mobile application that connects pineapple producers to potential buyers through a dynamic map that allows buyers to locate pineapple plantations and the plants' maturity state in real time. It also offers an online trading space that allows processors and suppliers to display and sell pineapple products and related services. It was designed by Lucien Medjiko from Benin.

- Kivugreen, developed by DRC native Chris Ayale, is a digital platform that provides small-scale farmers with technical information such as weather, market price, and agricultural advice. It also gives them access to a broader market.

- Daki Farm, launched by Moroccan-born Mounir Jamaï, is an app ecosystem made of two main apps. The first app is Daki Farm e-learning which gives agricultural training in local languages. The second app is Daki Farm Smart Irrigation which helps properly irrigate crops according to plants' needs and weather conditions.

- Pallitracks is a sustainable forest management platform developed by Cameroonian-born Jean Gilbert Soh Ndeh. It was initially developed, in 2012, to ensure the traceability and management of forest products.

- Clinicagro provides an in-depth diagnosis of soil and plant diseases, as well as various soil-related technical indicators. It was developed by Cameroonian-born Pyrrus Oreste Kouoplong Koudjou.

As usual, the ten finalists will receive personalized support from an incubator in their respective origin countries. The winner will also receive €15,000 to develop his/her project.

Samira Njoya

African countries have great tourism potential, which is not optimally exploited. To boost the sector in Kenya, some entrepreneurs launched a digital solution that helps tourists plan their stays.

Tripitaca is a digital solution launched by a Kenyan eponymous startup to allow users (tourists notably) to find accommodations closer to tourist attractions.

The souliton has no mobile application. So, users can access its services only through its web platform. Via the platform, tourists can create accounts and search for accommodation by providing information like the tourist attraction they are going to visit, the number of people, and the stay duration in the search bar. They can pay in multiple installments if they want, get assistance in case of emergency, get discounted offers, and extend their stay duration if their tours take longer than expected.

Property and hotel owners can also create accounts on Tirpitaca, thus offering services tailored to guests' specific needs and charging them accordingly.

Tripitaca also provides financial assistance to homeowners who need it. This gives these homeowners access to loans to get their businesses on track. In February 2023, the startup was selected along with four others to participate in Baobab Network's accelerator program. In addition to a support program, the startups will each receive $50,000 and meet potential investors during a demo day.

Adoni Conrad Quenum

He studied in France and the United States and gained experience working for several companies and management firms before joining Jumia some eight years ago.

Francis Dufay (photo) is an Ivorian entrepreneur and a Management and marketing graduate from the Global Alliance in Management Education (CEMS) and Northwestern University's Kellogg School of Management. He was recently appointed CEO of the e-commerce group Jumia.

He formally became CEO of the unicorn in February 2023 but, he had been acting in the position since November 2022 when the e-commerce group's co-founders stepped down as co-CEOs. In that position, his role is to oversee Jumia's pan-African expansion into 11 countries, as well as the evolution of its products, which now include a marketplace, its payment arm JumiaPay, and a logistics platform, Jumia Logistics.

Jumia is a technology company built to help consumers conveniently access millions of goods and services while giving sellers a new avenue to reach more clients and grow their businesses. The company already has over 1 billion visits, 100,000 active sellers, 50 million products, and over 8 million active consumers in Africa.

Confident in the e-commerce group's potential, Francis Dufay says "we remain more than ever confident about the growth opportunity across our markets and are making fundamental improvements to our consumer value proposition which will help us drive sustainable long-term growth."

The new CEO joined Jumia as the managing director of Jumia Côte d'Ivoire. From March to November 2022, he was the executive vice president of Jumia in charge of African operations. Then, from November 2022 to February 2023, he was the Acting CEO of Jumia Group. He joined the professional world in 2009 when he was hired by McKinsey & Company as a business analyst. In 2012, he was appointed associate junior engagement manager for the same consulting firm.

In 2007, he interned as an analyst at Business France, the "national agency supporting the international development of the French economy." He completed another internship at Deloitte & Touche from September 2007 to February 2008.

Melchior Koba

A doctor by training, he wanted to address the poor access to healthcare services in his country. So, along with his friends, he launched an app that allows remote consultations.

Desire Ruhinda (photo) is a Tanzanian medical doctor who graduated from Kilimanjaro Christian Medical University with a Ph.D. in 2019. In 2021, he also graduated from the University of Cape Town's Graduate School of Business with a Master of Philosophy in Inclusive Innovation. A year earlier, he co-founded the healthtech startup Medikea, with his friends Elvis Silayo, and John Manko.

In 2016 he joined the International Federation of Medical Students Association as the national exchange officer. In 2019, he became a medical trainee at the Muhimbili University of Health and Allied Sciences.

Currently, he is the logistics manager of the non-government organization International Federation of Medical Students Associations (IFMSA).

He is also the CEO of the healthtech startup Medikea. Through the startup, he offers online consultations with doctors and supplements them with lab tests and home drug delivery, so patients can get timely care, avoid long queues and save money.

The doctors registered on the platform can manage common and chronic illnesses, mental health, and lifestyle issues. The solution is suited for anyone seeking high-quality, affordable, and convenient treatment for non-emergency medical problems, medical advice, a prescription, a letter of recommendation, a medical certificate, or a second opinion on a pre-existing condition.

Recently, in February, it was selected by Kenyan venture capital company The Baobab Network as one of the five startups that will participate in the 2023 Baobab Network's acceleration program. The selection entitles it to $50,000 support.

Melchior Koba

In its seven African markets, Bolt claims more than 47 million customers, 900,000 drivers, and more than one billion trips. Its new investments are expected to generate more than 300,000 new jobs.

Last Thursday, Estonian mobility start-up Bolt announced plans to invest €500 million to expand its activities in Africa over the next two years.

According to the company's statement, the investments will create new opportunities allowing more than 300,000 new drivers and couriers to join the platform by 2023. "Over the past seven years, we have built a strong team of 500 people in Africa and we remain committed to investing in local communities for the long term," said Markus Villig, Bolt's founder and CEO.

On Monday, February 20, Linda Ndungu, Bolt Kenya's country manager, announced that of the planned investment amount, €100 million will be injected into the Kenyan subsidiary to expand its services beyond the 16 cities where it currently operates.

As such, this investment is expected to intensify the growing competition in the Kenya mobility sector that recently welcomed new entrants such as Farasi Cabs and Yego Global. Nevertheless, Bolt remains the largest ride-sharing services provider by the number of cities covered in Kenya.

The multinational company plans to add more employees to its team of 200 in South Africa while establishing additional offices across the continent in the next 12 to 18 months. To date, Bolt has more than 100 million customers worldwide, nearly half of whom are based in Africa.

Samira Njoya

In the African informal sector, which is a key component of most Sub-Saharan African economies (according to the IMF), traders face numerous challenges daily. In Kenya, some tech entrepreneurs have set up a solution to address the challenges for cosmetics traders.

Vutia is a virtual marketplace developed by a Kenyan startup. It allows cosmetics stores to source beauty and skincare products by democratizing access to quality cosmetics and beauty products in Africa through its distribution platform. "Positioned between the brand and the business customer, we are focused on the distribution of multiple categories of cosmetic and beauty products to informal traders, beauty salons, SPAs, and beauty shops. We source our products directly from manufacturers at the top of the value chain and deliver to vendors at competitive prices," the platform explains.

Via its website or by sending SMS and Whatsapp messages, users can order cosmetics in bulk. Before they can order the products via the website, they need to create an account.

Products purchased on the marketplace are delivered for free (for Vutia clients) the following day. The platform also offers users the possibility to become cosmetics sellers or Vutia agents. As sellers or agents, they can earn money by promoting and delivering beauty and personal care products in their communities or neighborhoods.

In February 2023, the platform was selected along with four other startups by the Baobab Network's 2023 acceleration program. The selection entitles it to $50,000 support and the opportunity to be presented to potential investors during demo days.

Adoni Conrad Quenum

The successful entrepreneur worked for Facebook's parent company Meta before starting his own company, which has quickly become one of Africa's unicorns.

Ham Serunjogi (photo) is a Ugandan economist and entrepreneur. He is the CEO and one of the co-founders of the fintech company Chipper Cash.

Founded in 2018 and based in San Francisco, Chipper Cash develops software for instant cross-border payments in Africa and Europe. It also develops solutions to help businesses and merchants process online and in-store payments.

It is "a lifestyle payment platform that started as a cross-border product. It is now a more holistic platform for people to not just send and receive money easily, but also do things like investing," Ham said in 2021.

The startup, which is available in seven countries, has more than 5 million users and more than 300,000 Visa cards issued.

Its CEO is, since May 2022, a member of the Grinnell College Board of Trustees. He entered the job market with internships at companies such as the cleantech accelerator Cleantech Open (2013), the edtech company Fullbridge (2014), and Meta (formerly Facebook) in 2015.

In 2016, he joined Facebook (now Meta) as a Client Manager responsible for building partner relationships with some of the largest advertisers in the UK.

Thanks to Chipper Cash, he made it to the international non-profit journalism organization Rest of World's 2022 list of the 100 Global Technology Change Makers of 2022.

A former competitive swimmer, Ham Serunjogi competed for several years and represented Uganda at the 2010 Youth Olympic Games in Singapore. He was also named the 2010-2011 Athlete of the Year by the Aga Khan Academy in Mombasa.

Melchior Koba

By setting up a series of digital projects, Angolan authorities want to meet citizens' need for electronic services, namely to facilitate access to some public services.

Angola will invest $89 million to build the national cloud infrastructure, train technicians, and store and unify government services, Communications Minister Mário de Oliveira (photo) announced last Thursday during the official launch of the cloud project.

"It's a unified government cloud built on government data centers to provide more than 80 services," said Mário de Oliveira, adding that the project includes the migration of existing applications and the development of new ones.

According to André Pedro, director of the National Institute for the Promotion of the Information Society (INFOSI), the project includes the construction of two data centers that will cover 5,320 square meters and house 204 server racks, thus reducing electronic communication costs for the government.

The technology project will also complement the Angolan State's dedicated network, which connects all ministries and the National Assembly with a 50 GB fiber ring. It is scheduled to be implemented within 15 months and completed between February and March 2024.

It is the result of a Memorandum of Understanding signed in December 2021 between the Angolan government and the United Arab Emirates. It will be implemented by INFOSI with the support of the Ministry of Communications, we learn.

According to Mário de Oliveira, the project aims to promote the digital development of the national economy, bring citizens closer to government action, promote the use of IT and cloud services, and lay the foundations for the digital transformation of the industrial sector.

Samira Njoya

He is a tech entrepreneur, agriculture enthusiast, blogger, and coach. Thanks to his IT services startup, Jovan Group, he helps companies implement their digitalization projects.

Josué Vangu (photo) is a Congolese computer engineer who graduated from Unicaf University in 2022 with a master's degree in information systems management. He also holds a bachelor's degree in telecommunications and network administration from the Higher Institute of Computer Science, Programming, and Analysis (ISIPA). In 2018, he founded the IT service company Jovan Group, which he leads as a managing partner.

His service company specializes in the implementation of digital infrastructure and electronic security systems, but also provides training in information technology. It designs and develops electronic security offerings using integrated solutions that adapt to all architectures (from the simplest to the most secure) to address the specific security issues of each business sector.

"Our ambition and vision are to make life easier through technology! This means we focus on the digital transformation of businesses and upgrading the skills of students and IT professionals," said Josué in an interview with Techcabal in February 2023.

To achieve its ambitions, the company has three branches. The first is Jovan Group Academia, which offers practical training to students and a full range of information systems training to professionals, including those transitioning to new jobs, to help them improve their skills.

The second is Jovan Group Electronic Systems & Services, which is an installer and integrator of security systems. The last one is Jovan Group IT Services & Solutions, which provides network infrastructure optimization, and construction services as well as optimal hardware solutions.

In 2020, the company launched ENSOKO, a platform created, according to Josué Vangu, "to provide access to food for Congolese households in a context where Covid-19 was disrupting agricultural products' distribution/marketing chains."

Since 2014, the managing partner has been a freelance blogger. From 2013 to date, he is the IT manager of the youth organization Jeunesse Francophone Congolaise. He is also the coordinator of the Haut-Katanga branch of YPARD, an international organization of young professionals in the agricultural sector.

He started his professional career in May 2013 as a network and systems infrastructure trainer at Univers High Technology. From May to November 2013, he worked for the Canal+ Group in Congo as a part-time customer service technician (SAV). In January 2014, after leaving his job as a trainer, he was hired by StarTimes as an SAV technician. The following year, he joined RD Technologic Sarl as an IT support technician before being promoted to IT and projects manager in 2016. A year later, he was appointed delegate of the company's provincial management in Katanga, where he worked until 2021.

Melchior Koba

More...

Last November, Twitter launched a similar service, allowing its subscribers to authenticate their accounts by paying an eight-dollar monthly fee and receiving benefits such as "direct access to customer service."

This week, Facebook's parent company Meta will launch its paid verification system for Instagram and Facebook users, CEO Mark Zuckerberg announced last Sunday.

Meta Verified is "a subscription service that lets you verify your account with a government ID, get a blue badge, get extra impersonation protection against accounts claiming to be you, and get direct access to customer support," the CEO wrote, adding that the service will launch in New Zealand and Australia as early as this week and will cost $11.99/month on the web and $14.99/month on Apple's iOS. Other countries will get the service later.

This decision comes at a time when the social media giant is going through a difficult financial time. At the end of 2022, the company announced a major layoff plan involving 11,000 people worldwide, or 13% of its workforce. Recently, the Financial Times reported that the company is preparing a new restructuring plan that would start in March 2023.

The new feature aims to increase the authenticity and security of the group's services, according to Mark Zuckerberg. Thus, in addition to the blue tick as a guarantee of security, Meta Verified users will benefit from, among other things, increased visibility and reach on Instagram and Facebook, as well as exclusive stickers.

"As part of this vision, we are evolving the meaning of the verified badge so we can expand access to verification and more people can trust that the accounts they interact with are authentic," Meta explained in a blog post.

Samira Njoya

They are 18 in number. They were selected from hundreds of applicants who sent applications to the JFD Club, a women's network that promotes women's entrepreneurship, intrapreneurship, and innovation.

On Thursday, February 9, the Women's network JFD Club unveiled the 2023 finalists of the three categories of its "Les Magaret Awards", which rewards women entrepreneurs whose innovations are addressing key global issues. From the hundreds of applications received, eighteen women were selected, including nine Africans. They are notably Cameroonians (2), Gabonese (1), Kenyan (1), Senegalese (1), Beninese (1), Egyptian (1), Ghanaian (1), and Ivorian (1) in the three categories (Entrepreneur, Intrapreneur, and junior).

Entrepreneurs

- Nelly Chatué-Diop is a Cameroonian and the co-founder-CEO of Ejara, a digital platform that allows access to investments and savings products from as little as EUR1.5 for Africans.

- Kenyan-born Maryanne Gichanga is the co-founder and CEO of Agritech Analytics, an AI-powered crop and soil management tool that uses satellite data to help farmers improve yield.

- Gabonese Alvine Yeno made it to the list with Ntchina, a community platform that facilitates blood collection.

Intrapreneurs

- Rhoda Oduro is from Ghana. She is the Business Development & Operations Manager for Developers in Vogue, a program designed to address the underrepresentation of women in the technology industry.

- Senegalese-born Ndiate Séne is the regional director of software engineering at PAPS, a non-profit organization that advocates for a better representation of African women in tech.

- Beninese-born Livia Sossou is the Director of Certification & Financing for Kumulus Water, a water services start-up that aims to provide clean water in an economical and sustainable way.

Junior

- Hend Adel, a 17-year-old Egyptian national, is among the finalists thanks to his project to modify the structure of aluminum smokestacks to reduce CO2 emissions and metal residues in the air.

- Frederic Melissa Djouka Fongang, a 17-year-old Cameroonian, created a platform that allows both residents and the diaspora to securely acquire real estate properties in Cameroon.

- 18-year-old Laurianne Yao, from Côte d'Ivoire, is among the finalists thanks to her project E-COL'LECTE, a platform for collecting textbooks and school clothes to be donated to the poorest households.

According to Delphine Remy-Boutang, president of the jury of Les Margaret Awards, a greater number of applications were received for the 2023 edition. “We have seen massive participation of young girls with applications tripling in 2023 for the Junior category. This is an excellent trend which shows the growing desire of this new generation to influence, through digital technology, a future they hope will be better," she said.

The Margaret Awards was launched in 2013. It annually celebrates women entrepreneurs and intrapreneurs in Europe and Africa whose projects and innovations address major societal challenges. The award honors Margaret Hamilton, former director of the software engineering department at the MIT Instrumentation Laboratory who developed the embedded software for NASA's Apollo space program. This year, the award ceremony will take place in Paris next April 17.

Samira Njoya

Digital transformation is gaining momentum around the world since 2020. It is forcing telecom operators in various markets to rethink their business approaches to better meet new consumer needs.

Last Thursday, telecom group Orange unveiled its 2025 strategic plan. The plan, dubbed "Lead the future", focuses on four major points to achieve operational excellence for increased profitability.

Orange thus plans to improve its service quality by introducing more innovative offers that will enhance customer experience. It will also invest in more robust and innovative network infrastructures to provide access to quality telecom services to as many people as possible and strengthen its presence in the Enterprise segment (cybersecurity in particular). It will also take actions to keep growth momentum in the Middle East and Africa.

In Africa in particular, Orange plans to keep rolling out fixed and mobile networks (4G and 5G) to support socio-economic development, and at the same time maintain its strong results on the continent.

The group will accelerate the transformation of Orange Money to a digital platform model that will offer services beyond transfers and payments. The service will be offered to all consumers, whether Orange customers or not, in all countries where the group operates. By the end of 2022, the company reported strong growth in its subscriber base. With more than 29 million active users, it recorded more than EUR100 billion worth of transactions that year.

The telecom company will also continue to strengthen its local presence and its position as a multi-service operator through the deployment of its "Orange Digital Centers". The group will also invest in staff training to facilitate its employees' transition towards new professions in data, cloud, cybersecurity, or AI.

According to the plan, social and environmental responsibility is a priority for Orange in all of its markets. Through an ambitious program, the telecom group is committed to fighting global warming through its CO2 emissions reduction program. The aim of that program is to reduce the group's carbon emissions by more than 30% by 2025 and by 45% more by 2030.

Muriel Edjo

He is an engineer with over 13 years of experience in engineering, project management, business consulting, and entrepreneurship. He helps brands convert their visitors and occasional customers into loyal customers.

Ahmed Khairy (photo) is an Egyptian-born entrepreneur and the co-founder/CEO of Gameball, a marketing platform that enables businesses to grow and increase revenue through effective customer retention.

His startup, founded in 2019, is now the leading customer loyalty platform in the Middle East, serving more than 2,000 businesses and nearly 20 million consumers worldwide. Its Gameball solution is even available on international e-commerce platforms Shopify and WooCommerce's App Store.

On February 7, 2023, the startup announced it closed a US$3.5 million funding round to accelerate product commercialization, customer acquisition, and strategic recruitment. The round was led by 500 Global, P1 Ventures, and Launch Africa Ventures, and also included Seedra Ventures, Arzan Ventures, Propeller, and Core Vision alongside regional angel investors.

"This seed round brings on board renowned investors who will help fuel our growth, marking a critical milestone for us, as we evolve into a truly global platform," said Ahmed Khairy.

Prior to Gameball, in 2011, the entrepreneur co-founded Be Coaching, a life and business coaching and consulting company. Two years earlier he had co-founded the start-up Kite Automation to educate customers about automation technologies and how they simplify life and save energy and the environment. He was, successively, the company's technical manager and sales manager between 2009 and 2011.

In 2011, he joined Schneider Electric as a senior project engineer, where he worked until 2017. Between 2014 and 2017, he was a training partner at Jadarat International, a company specializing in training.

Melchior Koba