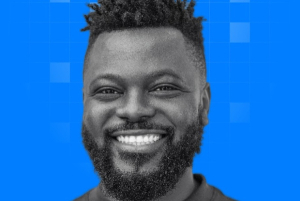

Chibuotu Amadi Targets Frictionless Crypto Transactions With Paycrest

-

Nigerian entrepreneur Chibuotu Amadi co-founded Paycrest to bridge cryptocurrencies and local fiat payments.

-

Paycrest enables instant crypto-to-fiat transactions using a liquidity provider network with reduced costs.

-

Amadi brings experience from Web3, fintech, and decentralized health platforms to the payment infrastructure.

Chibuotu Amadi is a Nigerian entrepreneur and software engineer. He co-founded and leads Paycrest as chief executive officer. Paycrest operates a payment infrastructure that seeks to make cryptocurrency transactions as simple and accessible as traditional payments for individuals and businesses worldwide.

Founded in 2024, Paycrest targets financial inclusion by enabling seamless payments between digital currencies and local fiat money. The company aims to lower transaction costs, simplify processes, and remove frictions linked to daily cryptocurrency use.

Paycrest offers open tools that allow users to send or receive payments in cryptocurrencies while settling or collecting local currency through standard bank accounts and wallets. Behind the platform, a network of liquidity providers converts value instantly between digital assets and traditional currencies at reduced cost. The tools target individuals, online merchants, enterprises, and decentralized finance projects.

Amadi has built multiple ventures over the past decade. In 2014, he founded SMSLeak, a Nigerian bulk SMS company that provides large-scale messaging solutions for advertising, sales promotions, product launches, and customer engagement.

In 2018, he co-founded Cura Network and served as chief technology officer until 2022. The company develops a decentralized global healthcare system that connects entities to collaborate and share data to promote, restore, and maintain health.

Amadi graduated from the University of Benin in Nigeria, where he earned a bachelor’s degree in computer engineering in 2016. He completed a software engineering internship at the Manipal Institute of Technology in India in 2015.

In 2019, Amadi joined Indian financial firm Inkredo as a full-stack developer. At the same time, he worked at Smarter.Codes, a software development company. In 2020, he joined U.S.-based ConsenSys, which provides tools for building Web3 solutions. From 2021 to 2023, he held a similar role at Gitcoin, a U.S. organization that funds community-driven projects.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de BERRY QUENUM

Nigerian Startup Timon Targets Borderless Payments for Global Travelers

- Nigerian startup Timon offers an all-in-one financial app for travelers, students, and remote workers living across borders.

- The platform provides multi-currency wallets, global payment cards, eSIM services, and money transfers in over 100 countries.

- The mobile app has surpassed 50,000 downloads on Android since its 2023 launch.

Timon operates as a digital solution developed by a Nigerian startup. The company designed the product for frequent travelers, international students, remote workers, and users who adopt a borderless lifestyle. Founders Oluwatomi Olarinde and Chizaram Ucheaga launched the startup in 2023.

At the core of Timon’s offering, a mobile application combines multiple financial services. The app allows users to create and manage multi-currency wallets, including naira and U.S. dollars. The platform also provides physical and virtual payment cards that users can access in more than 100 countries. In addition, the app integrates complementary services such as international eSIMs and money transfers. Timon offers the application on iOS and Android, where downloads have exceeded 50,000, according to Google Play Store data.

“We comply with local and international financial regulations, use advanced fraud prevention systems, and apply industry-standard encryption to protect your funds and personal information at all times,” the startup said.

Through the mobile platform, users can pay online or in stores, plan trips, activate cards instantly, and convert stablecoins into spendable currencies. Timon targets a seamless user experience through transparent fees, rapid service deployment, and an interface designed for globally mobile African users and diaspora communities.

By combining financial management, global connectivity, and universal payment cards, the Nigerian fintech positions itself as a digital financial passport for 21st-century travelers, digital nomads, and mobile professionals.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J.A de Berry Quenum

Sunday Paul Adah Scales Fintech Platform for Global Education Costs

- Nigerian entrepreneur Sunday Paul Adah co-founded and leads Radius, a cross-border payments platform for international students.

- Radius enables same-day payments for tuition, visas, exams, and housing while avoiding traditional international transfer constraints.

- The platform launched in 2022 and operates with real-time tracking and competitive exchange rates.

Sunday Paul Adah, a Nigerian entrepreneur based in Boise, United States, co-founded and leads Radius, formerly known as Pay4Me App, a payment platform designed to simplify financial procedures for international students who must pay fees to foreign schools, institutions, or organizations.

Founded in 2022, Radius enables users to pay tuition, visa fees, examination costs, and housing expenses while avoiding constraints linked to traditional international bank transfers. The mobile application allows users to execute same-day payments and monitor transactions in real time, which increases transparency and reduces uncertainty.

The platform integrates currency management tools that offer competitive exchange rates, which remain critical for cross-border payments. Radius also emphasizes a user-friendly interface and provides 24/7 customer support to assist students throughout every step of their education-related financial processes.

In parallel, Sunday Paul Adah founded Across The Horizon in 2015, a study-abroad consulting firm that supports African students and families in identifying affordable international education opportunities. He also founded Scholarships Africa in 2020, a platform dedicated to identifying and applying for international scholarship programs.

Sunday Paul Adah earned a bachelor’s degree in multidisciplinary studies from Boise State University in 2021. He also holds a master’s degree in public administration, government, and politics from Grand Canyon University, obtained in 2023, as well as a master’s degree in entrepreneurship from the David Eccles School of Business at the University of Utah, completed in 2025.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de BERRY QUENUM

Kenya’s Payd Targets Freelancers With Low-Cost Global Payments

-

Kenyan fintech Payd enables instant cross-border payments to more than 35 countries at fees up to 70% lower than traditional banks.

-

The Nairobi-based startup launched in 2023 to serve freelancers, creatives and small businesses operating globally.

-

Payd allows users to open virtual dollar and euro accounts and manage international payroll, invoicing and bulk payments.

Payd operates as a fintech solution developed by a Kenyan startup. The platform provides a suite of financial tools that allow users to receive, send and manage money internationally within seconds. The Nairobi-based startup launched in 2023 under the leadership of founders Benaiah Wepundi and Japheth Achimba.

“Our PayPal accounts were suspended due to address verification issues and irregular income,” Benaiah Wepundi told Disrupt Africa. “I was also running a distributed talent team across Kenya, Nigeria, Brazil and the Philippines for a U.S. company, and payroll was always delayed by a full day,” he said.

At the core of Payd’s offering, the platform delivers instant payments to more than 35 countries, with fees that can be up to 70% lower than those charged by traditional banks. Users can send funds through mobile money, bank transfers, cards or digital dollars, which removes the three- to five-day delays commonly associated with conventional banking services.

Payd also focuses on simplifying income generation for independent workers. Freelancers can create professional invoices within minutes, generate payment links and set up customized digital storefronts that allow clients to pay easily for services or products.

“Most users never directly interact with wallets, chains or tokens: they simply receive and use their money as they would with a bank account,” Wepundi said.

Another key feature allows users to open virtual U.S. dollar and euro accounts within minutes. This capability enables users to receive international payments without complex banking procedures and convert funds into local currencies at often more competitive exchange rates.

Payd also targets businesses through its Business offering. The platform provides advanced financial management tools, including international payroll management, automated invoicing, expense tracking and the ability to execute bulk payments to global partners and subcontractors.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J. A. de BERRY QUENUM

Mkuzo Kuwani Targets African Saving Groups With Structured Digital Finance

-

Zambian entrepreneur Mkuzo Kuwani founded ComGrow to digitalize African savings groups and village banking.

-

The platform replaces cash, notebooks, and spreadsheets with traceable, automated records.

-

ComGrow enables community lending with transparent rules and shared interest income.

Mkuzo Kuwani founded ComGrow, a fintech that digitalizes rotating savings groups, village banking, and community-based savings and credit groups across Africa.

Founded in 2019, ComGrow allows groups of people who already know each other—friends, colleagues, or neighbors—to pool money, grant loans to members, and track transactions securely and transparently through a mobile application.

The platform replaces notebooks, cash boxes, and Excel files with a single tool that centralizes savings, loans, repayments, and profit sharing. The system automatically records every transaction, reduces human error, and eliminates recurring disputes over paid or outstanding amounts. Members no longer search through WhatsApp messages to find information or payment proof.

The application prioritizes simplicity. Each member selects a payment method and pays monthly contributions in a few clicks. The group monitors savings levels, outstanding loans, completed repayments, and distributable amounts in real time at the end of each cycle. A member can request a loan from the collective pool and repay it with a low interest rate under group-defined rules. The group redistributes interest income to members and increases collective savings.

Alongside his entrepreneurial activity, Kuwani works as an investment banking services analyst at MELCOFIN & Co., a firm specializing in mergers and acquisitions advisory and corporate finance.

Kuwani graduated from Durham University in England with a bachelor’s degree in economics in 2021. He also served as a sales development representative at UK-based workforce management platform Playroll from 2023 to 2024.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

With Rank, Femi Iromini Streamlines Savings and Payments Across Africa

- Rank targets individuals and small businesses seeking structured, long-term financial discipline through technology.

- The fintech offers multiple savings products alongside instant payments and bill management.

- Founder Femi Iromini previously worked with the World Bank and led an education-to-employment startup.

Femi Iromini is a Nigerian entrepreneur and the co-founder and chief executive officer of Rank, formerly known as Moni. Rank operates as a community-based fintech that develops financial products for African small businesses and individuals seeking to build wealth.

Founded in 2020, Rank positions itself as a financial application for ambitious users who want to save more effectively, manage spending efficiently, and grow within a goal-oriented community. The company aims to make prosperity more accessible by creating links between users who aspire to advance financially and those who already master savings discipline.

Rank offers several savings mechanisms. The first product, called “Reserve,” allows users to set aside funds securely for a fixed period while earning regular returns. The second product, “Flex,” provides greater liquidity by allowing users to withdraw funds at any time without forfeiting interest.

The platform also offers “Goals,” a savings product designed to finance clearly defined projects through targeted contributions. In addition, Rank provides a “Premium” offering for users managing larger balances or building long-term wealth, with higher interest rates and priority support.

Beyond savings, Rank integrates payment and expense management features. Users can send and receive money instantly at any time and pay multiple bills, including electricity, cable television, internet, and other services, through a single interface.

Before launching Rank, Femi Iromini founded Lead360HQ in 2017. The organization partnered with African universities to help students convert academic training and personal ambition into concrete career opportunities. He served as chief executive officer of Lead360HQ until 2019.

Femi Iromini graduated from Obafemi Awolowo University in Nigeria, where he earned a bachelor’s degree in geophysics in 2012. He later worked as a consultant for the World Bank from 2019 to 2021.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

With Pebla, David Masoperh Brings Offline Mobile Payments to East Africa

- Pebla allows users to send and manage money without an internet connection, targeting regions with unstable networks.

- Ghanaian entrepreneur David Masoperh co-founded the app in Rwanda in 2020 with Jerry Auvagha.

- The platform consolidates multiple financial services into a single interface to simplify mobile payments.

David Masoperh is a Ghanaian computer scientist and entrepreneur based in Rwanda. He co-founded Pebla and serves as the company’s chief product officer.

Pebla operates as a financial services application that allows users to manage and send money, including without an internet connection. The platform brings multiple financial services together within a single application.

David Masoperh and Jerry Auvagha founded Pebla in 2020. The founders designed the application for emerging economies, with a primary focus on East Africa.

The platform centralizes services such as payments and transfers within one interface. This structure allows users to avoid juggling multiple applications and complex access codes.

Pebla enables offline payments and transactions through a simple menu accessible from a mobile phone. The application does not require a permanent internet connection.

Users can send and receive money, complete transactions, and track activity through a limited number of steps.

The application also supports expense sharing by allowing users to split a bill among several people. Each participant can pay their share directly from their phone.

Pebla further enables users to send and respond to payment requests quickly. This feature simplifies reimbursements among friends, colleagues, and family members.

Pebla targets individuals who seek a simple way to pay, split expenses, and send money without relying on network quality. The application also targets users who feel uncomfortable with complex digital tools.

The platform prioritizes a clear interface and streamlined user journeys to reduce friction.

David Masoperh graduated from African Leadership University in Rwanda with a bachelor’s degree in computer science. He also earned a master’s degree in information technology from Carnegie Mellon University in the United States.

He began his professional career in Ghana in 2017 with a project management internship at IT company theSOFTtribe.

Two years later, he completed an internship in risk management and compliance at financial group Absa Group.

In 2021, he joined KudiGo, a technology company specializing in retail management. He worked there for three months as a product management and sales intern.

In 2022, David Masoperh became a product manager at Upskiller, a UK-based human-centered edtech startup that relies on artificial intelligence. One year later, he held the same position at Ladder, a Ghanaian technology startup that offers an integrated personal finance management experience.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Roqqu Founder Eseoghene Onomor Bets on All-in-One Fintech Platform

-

Nigerian entrepreneur Eseoghene Benjamin Onomor co-founded and leads fintech platform Roqqu.

-

Roqqu centralizes payments, savings, transfers, and digital currencies in one application.

-

The platform targets individuals and businesses seeking simple domestic and international money management.

Eseoghene Benjamin Onomor is a Nigerian entrepreneur based in Lagos. He co-founded and leads Roqqu as chief executive officer. Roqqu operates as an online platform designed to help individuals and businesses manage money more efficiently.

Roqqu launched in 2022 with the objective of expanding access to financial freedom. The platform simplifies everyday financial operations. Roqqu enables fast transactions through mobile phones and computers. The platform integrates digital currencies as tools for daily payments and savings. Roqqu combines fund management, money transfers, and digital currency purchases within one system.

Roqqu primarily operates through a mobile application available on major app stores. The application centralizes users’ money and digital assets in a single interface. The design targets non-specialist users through a clear and intuitive layout. Users buy or sell digital currencies by entering an amount and a local currency. The platform removes the need for advanced knowledge of market mechanisms.

The platform also allows users to send and receive money, including across borders. This functionality supports family remittances and payments to partners located in other countries.

Alongside Roqqu, Eseoghene Benjamin Onomor serves as chief executive officer of EN1 Technologies. The company operates in Africa’s automotive technology sector. He graduated from the University of Port Harcourt in 2015 with a bachelor’s degree in electrical and electronic engineering. He earned a finance diploma from London Business School in 2024.

Before focusing fully on entrepreneurship, he worked at Nigerian technology company IONS TECH from 2014 to 2022. He held roles as chief operating officer and lead user-interface developer.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Daniel Katz Builds Platform to Stabilize Crypto Transactions for Merchants

- Ezeebit converts customer crypto payments into local currency settlements for merchants with no exposure to volatility.

- The platform processes payments by converting crypto to USDT instantly, then to South African rand (ZAR) for merchants.

- Ezeebit enables in-store and online crypto payments through POS systems, QR codes, and an API for e-commerce.

Daniel Katz’s initiative addresses a major barrier that still limits the adoption of digital payments in Africa. It enables merchants to access a new category of transactions while maintaining the stability of their operations.

Daniel Katz, a South African entrepreneur and co-founder and chief executive of Ezeebit, leads a start-up that allows African merchants to accept cryptocurrency payments while receiving settlements in local currency without any exposure to price swings in digital assets.

Ezeebit, founded in 2022, aims to make cryptocurrency payments as simple and secure as traditional transactions. The company seeks to create new growth channels for merchants by giving them access to customers who prefer to pay with digital assets, while ensuring that settlements remain stable in local currency.

The solution enables customers to pay with a wide range of cryptocurrencies, while merchants receive their settlement in South African rand (ZAR). Ezeebit eliminates the risk of market volatility by automatically converting the cryptocurrency paid into the stablecoin USDT at the moment of the transaction. The company then converts and transfers the equivalent amount in local currency to the merchant’s bank account.

In physical stores, the payment process works through an electronic point-of-sale terminal. Staff enter the amount in ZAR, select the blockchain network and the cryptocurrency, generate a QR code, scan it, and print the receipt. Merchants may also display a static QR code in the shop for customers to scan before selecting the amount, the cryptocurrency, and their wallet.

For online shops, Ezeebit offers a crypto payment gateway that lets merchants add digital asset settlement options to their e-commerce platforms. Ezeebit ensures next-day settlement in fiat currency through an API integration.

Before Ezeebit, Daniel Katz co-founded Delve Systems in 2019, where he served as chief technology officer until 2023. That start-up helps retailers and brands make data-driven decisions using real-time insights, forecasts, and predictive analytics.

Katz graduated from the University of the Witwatersrand, where he earned a bachelor’s degree in electrical engineering in 2019 before pursuing a master’s degree in the same field.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Black Swan’s Derick Kazimoto Pushes Data-Driven Credit Models in Africa

-

Black Swan builds alternative AI-based credit-scoring tools for Africa’s informal economy.

-

The fintech won the 2025 MEST Africa Challenge and secured a $50,000 investment.

-

The company uses non-traditional data such as mobile-money flows and merchant-terminal activity to estimate borrower capacity.

Derick Kazimoto develops a new method to interpret economic traces and reshapes how lenders analyze credit risk. He opens access to previously untapped information that financial institutions use to refine their lending decisions.

Kazimoto, an entrepreneur and consultant based in Dar es Salaam, co-founded and currently leads Black Swan. The fintech, registered in Mauritius, builds alternative data-analytics tools that enable lenders to assess solvency with higher precision and broader flexibility.

Black Swan, founded in 2022, focuses its operations on the informal economy in sub-Saharan Africa. The company designs AI-based evaluation models that rely on non-traditional data to expand financing access for SMEs, micro-entrepreneurs, traders and individuals with limited banking history.

The company’s core product is an alternative credit-scoring engine. The system estimates the borrowing and repayment capacity of individuals or small businesses without depending on conventional bank-history checks. The models integrate mobile-money transactions, merchant-terminal receipts, recurring bill payments and a broad range of digital footprints. Lenders can combine these scores with their internal systems to refine risk models.

Black Swan won the seventh edition of the MEST Africa Challenge in November 2025. The award granted the company a USD 50,000 investment and entry into the MEST portfolio.

“Our mission is to make Africa bankable. We believe the continent is shifting from informal, collateral-heavy lending to data-driven credit. This transformation changes how banks and fintechs trust, lend and grow,” said Black Swan CEO Derick Kazimoto after the announcement.

Alongside his role at Black Swan, Kazimoto works as a fintech consultant for AfroPavo Analytics, a Tanzanian company that builds digital solutions using data analysis. He also co-founded Tausi Africa, an AfroPavo subsidiary that develops financial tools.

Kazimoto earned a bachelor’s degree in civil engineering from the University of Cape Town in 2019, followed by a master’s degree in financial technology in 2021. He began his career the same year as a data scientist at Spoon Money, a South African fintech. He later joined Akeo Tanzania, the development hub of the Akeo Group, where he served as country director from 2021 to 2022.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum