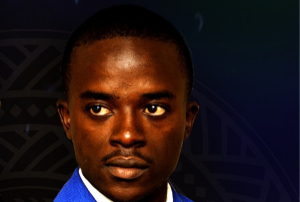

Black Swan’s Derick Kazimoto Pushes Data-Driven Credit Models in Africa

-

Black Swan builds alternative AI-based credit-scoring tools for Africa’s informal economy.

-

The fintech won the 2025 MEST Africa Challenge and secured a $50,000 investment.

-

The company uses non-traditional data such as mobile-money flows and merchant-terminal activity to estimate borrower capacity.

Derick Kazimoto develops a new method to interpret economic traces and reshapes how lenders analyze credit risk. He opens access to previously untapped information that financial institutions use to refine their lending decisions.

Kazimoto, an entrepreneur and consultant based in Dar es Salaam, co-founded and currently leads Black Swan. The fintech, registered in Mauritius, builds alternative data-analytics tools that enable lenders to assess solvency with higher precision and broader flexibility.

Black Swan, founded in 2022, focuses its operations on the informal economy in sub-Saharan Africa. The company designs AI-based evaluation models that rely on non-traditional data to expand financing access for SMEs, micro-entrepreneurs, traders and individuals with limited banking history.

The company’s core product is an alternative credit-scoring engine. The system estimates the borrowing and repayment capacity of individuals or small businesses without depending on conventional bank-history checks. The models integrate mobile-money transactions, merchant-terminal receipts, recurring bill payments and a broad range of digital footprints. Lenders can combine these scores with their internal systems to refine risk models.

Black Swan won the seventh edition of the MEST Africa Challenge in November 2025. The award granted the company a USD 50,000 investment and entry into the MEST portfolio.

“Our mission is to make Africa bankable. We believe the continent is shifting from informal, collateral-heavy lending to data-driven credit. This transformation changes how banks and fintechs trust, lend and grow,” said Black Swan CEO Derick Kazimoto after the announcement.

Alongside his role at Black Swan, Kazimoto works as a fintech consultant for AfroPavo Analytics, a Tanzanian company that builds digital solutions using data analysis. He also co-founded Tausi Africa, an AfroPavo subsidiary that develops financial tools.

Kazimoto earned a bachelor’s degree in civil engineering from the University of Cape Town in 2019, followed by a master’s degree in financial technology in 2021. He began his career the same year as a data scientist at Spoon Money, a South African fintech. He later joined Akeo Tanzania, the development hub of the Akeo Group, where he served as country director from 2021 to 2022.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Norbert Haguma Deploys Asset-Financing Solution for Rwandan Drivers

- Norbert Haguma founded Swapinga in February 2025 to provide vehicle financing for micro-entrepreneurs.

- The platform requires a 20% down payment and approves applications within seven days without demanding real estate collateral.

- Haguma brings experience from previous roles at Smart Africa, SPENN Technology, and NALA.

Entrepreneur Norbert Haguma is reshaping economic inclusion in a sector where financing remains a major hurdle. He utilizes technology to transform how drivers access their work tools.

Norbert Haguma specializes in fintech, mobility, and Africa-China relations. He serves as the founder and CEO of Swapinga. The company focuses on financial technologies and mobility solutions. Haguma established the firm in February 2025. Swapinga targets drivers and micro-entrepreneurs who seek vehicle ownership. The platform offers a simplified financing solution to boost their revenues. The company aims to remove the primary barriers regarding access to automotive credit.

The system relies on a four-step process. The candidate submits a request via an online form. The team reviews the file and provides an answer within seven days. Successful applicants must open a bank account. They subsequently pay a 20% down payment on the purchase amount. The driver then takes possession of the vehicle to launch or expand their business.

Swapinga promotes a model that requires neither land nor housing as collateral. This feature is decisive for drivers who traditional banks often exclude. The enterprise specifically targets actors in the taxi ecosystem and mobility platforms such as YEGO.

Haguma holds a seat on the board of the Pan-African Council. This organization commits to the unification of Africa and its diaspora. He also acts as a Senior Associate at Africa Equity Group. This firm provides operational consulting, market analysis, and financial support.

Haguma created his first enterprise, AfrOrient Group, in China in 2009. The company operates in trade and investment. He subsequently co-founded the edtech startup Kiziga in China in 2012. This startup develops a platform that allows Africans to apply, pay, and obtain documents for studies in China. He participated in the creation of AfricaGen in Kigali in 2018. This organization dedicates itself to mobilizing Africans through technology.

Norbert Haguma holds a degree from Beijing Jiaotong University. He obtained a bachelor's in computer science and technology and a master's in business administration there. He joined the Embassy of the Republic of Rwanda in China as an IT engineer in 2009.

Haguma became the head of the Blockchain Hub and the African hub for digital transformation at Smart Africa in 2018. He worked at SPENN Technology from 2020 to 2024. He successively occupied the positions of Country Director for Rwanda, Head of Africa Partnerships, and Non-Executive Director. He served as Country Director for the fintech NALA in Rwanda between September 2024 and February 2025.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Joel Mirimo Introduces an All-in-One Payment Solution for the DRC

- MbiyoPay integrates mobile money, bank cards, crypto and digital tools into a single payment platform.

- The app is already operational in the DRC, Cameroon and Côte d’Ivoire after a 2023 launch.

- Founder Joel Mirimo previously created Maxuschain, a crypto-trading platform supporting 30+ cryptocurrencies.

In the Democratic Republic of Congo, entrepreneur Joel Mirimo has launched MbiyoPay, an application that consolidates digital payments by integrating mobile money, bank cards, cryptocurrencies and other digital solutions. The company aims to simplify and secure financial transactions for users across multiple African markets.

Mirimo, the founder and CEO of MbiyoPay, developed the platform to help consumers manage payments from a single smartphone. The app reflects his broader goal to streamline day-to-day transactions and expand access to digital financial tools.

MbiyoPay, founded in 2023, enables users to create virtual cards, receive money, pay bills and buy mobile credit without switching between multiple services. The platform centralizes transactions and reduces fragmentation by allowing users to collect payments from clients or receive transfers from individuals in one digital environment.

The app accepts several payment methods, including mobile money, bank cards, cryptocurrencies, QR codes, payment links and its own dedicated virtual card. MbiyoPay allows users to recharge the virtual card and make secure online payments on international platforms.

MbiyoPay has already rolled out services in several African countries, including the Democratic Republic of Congo, Cameroon and Côte d’Ivoire. Users can verify availability in each market directly through the app. The platform also lets users transfer funds to mobile money accounts, bank accounts or crypto wallets depending on their preferred channel.

Before launching MbiyoPay, Mirimo founded Maxuschain in 2022, a platform offering instant cryptocurrency trading via mobile money. Maxuschain supported more than 30 cryptocurrencies and integrated four blockchains.

Mirimo holds a bachelor’s degree in marketing and commercial and financial sciences obtained in August 2025. He worked as a payment agent and broker at Deriv, an international financial company, from 2021 to September 2025. He also served as business development director at Afgig, a 100% African marketplace connecting continental talent to global markets, from 2021 to 2024.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Beth Wambui Mwangi Drives Digital Credit Innovation Through Mywagepay

-

Mywagepay, founded in 2021, enables employees to access earned wages instantly through a digital platform.

-

The fintech integrates customizable credit products directly into SMEs’ services, helping firms boost revenues and customer acquisition.

-

CEO Beth Wambui Mwangi positions the platform as both a financial-wellbeing tool for employees and a growth accelerator for businesses.

Kenyan entrepreneur Beth Wambui Mwangi, founder and chief executive of Mywagepay, is reshaping how companies and employees access financial services. She is positioning her fintech as a tool that converts everyday financial challenges into opportunities for growth and inclusion.

Mwangi founded Mywagepay in 2021. The company develops a digital platform that creates or integrates credit products into business services. The system helps companies attract customers, increase revenues and accelerate growth.

The platform also gives workers quick access to wages already earned, allowing them to manage cash-flow needs without waiting for payday.

Mywagepay allows employees to receive a portion of their salary before the official payday through a secure mobile application. Users complete the process entirely online through a few simple steps, which ensures a smooth and fast experience.

Beyond wage advances, the company offers financial-wellbeing tools that help workers improve money management. These services include budgeting features, savings options and investment guidance. Mywagepay aims to encourage healthier and more sustainable financial habits across the workforce.

The fintech provides small and medium-sized enterprises with embedded credit solutions that integrate directly into their products or operations. Mywagepay designs these tools to help businesses offer financing to customers or employees without building their own financial infrastructure.

The company emphasizes personalized support to adapt each credit solution to the specific needs of individual SMEs.

Mwangi received a bachelor’s degree in education from Mount Kenya University in 2015. She also earned a master’s degree in business administration and management from the United States International University-Africa in 2022.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Mwambutsa Edgar Proposes Blockchain Gateway for Money Transfers in Africa

-

PeerPesa, founded in 2020, uses Celo blockchain and stablecoins (cUSD, CELO) to enable cross-border money transfers across Africa.

-

The platform relies on a peer-to-peer liquidity model with local traders to convert stablecoins into national currencies.

-

PeerPesa targets faster, cheaper, mobile-based transfers to improve financial inclusion for unbanked populations.

Mwambutsa Edgar, a Kampala-based technology entrepreneur and co-founder of PeerPesa, serves as the company’s chief executive. PeerPesa operates as a cross-border payment and money transfer platform that enables users to send funds to mobile wallets and bank accounts by relying on blockchain infrastructure.

PeerPesa, founded in 2020, positions itself as a P2P remittance and payment service dedicated to African markets. The company aims to connect Africa to international corridors by offering faster and low-cost transfers. It promotes financial inclusion by giving remote users access to DeFi-based tools outside traditional banking networks.

The platform seeks to remove common barriers in international transfers, such as high fees, long delays and complex banking routes. It uses stablecoins backed by strong currencies to provide predictable and lower-cost transfers completed via mobile phones.

PeerPesa uses the Celo blockchain and stablecoins like cUSD, along with the CELO token, to facilitate fund transfers to several African countries. The company executes transactions through a peer-to-peer model built on local traders who guarantee liquidity between crypto assets and national currencies.

Recipients can obtain funds directly in a bank account or mobile-money service, aligning with entrenched African practices such as M-Pesa. The use of blockchain ensures transaction traceability, while smart contracts reduce reliance on financial intermediaries.

Before PeerPesa, Mwambutsa co-founded Coinpesa in 2016, a digital-assets platform focused on expanding cryptocurrency access. The company states that it wants to broaden the use of these financial tools to support global financial inclusion.

Mwambutsa graduated from Makerere University in 2006 with a bachelor’s degree in quantitative economics. He later obtained an MBA in 2019 from the Edinburgh Business School at Heriot-Watt University in Scotland. He began his professional career in 2006 at Uganda’s National Social Security Fund, where he served as a relationship officer.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Tunde Ogundipe Builds Banking-Data Infrastructure for Financial Institutions

-

E-Doc Online, founded in 2021, provides an open-banking data gateway that connects— with user consent— to bank accounts and transaction histories in real time.

-

The company’s API automates identity verification, credit decisions and compliance, using AI and large language models to classify unstructured banking data.

-

The system aims to strengthen risk scoring, reduce document fraud and accelerate onboarding and lending for B2B financial institutions.

Tunde Ogundipe links banking data to risk evaluation and reshapes how financial actors operate. He redefines the use of information in credit decisions and the monitoring of financial services.

Tunde Ogundipe is a Nigerian financier and entrepreneur. He co-founded E-Doc Online and serves as its CEO. The UK-based company specializes in accessing and structuring financial data. It operates in Nigeria and provides a banking-data gateway for B2B institutions.

E-Doc Online, founded in 2021, develops data infrastructure based on open-banking principles. The technology connects— with user consent— to customers’ bank accounts and transaction histories. The platform then structures the data and delivers it to financial institutions and enterprises that need stronger customer insights and real-time risk evaluation.

The platform relies on an application programming interface (API) that automates identity verification and credit decisions. The API collects user consent, pulls real-time banking data and transmits it in a usable format to partner systems.

The system integrates artificial-intelligence models, including large language models that analyze transaction descriptions. These models interpret and classify unstructured data. The method strengthens risk-score accuracy, reduces attempts at document falsification and accelerates onboarding, loan approvals and compliance checks.

Before founding E-Doc Online, Ogundipe launched Kolobox in 2018. The application enables users to invest savings through a digital wallet funded automatically from a debit card at a defined frequency to help them meet financial goals.

Ogundipe holds a bachelor’s degree in accounting from Kennesaw State University in the United States and a management diploma obtained in 2006 from the Georgia Institute of Technology. He started his career in 2001 at Cingular as a senior IT accountant.

He joined Verizon in 2003 as a financial analyst. He later worked as a business analyst at Metro Bank in London from 2016 to 2019, and as an analyst at Bank of America Merrill Lynch in Ireland between 2020 and 2024.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Koshiek Karan Builds Tools to Democratize Investment and Financial Education

- BankerX uses AI-driven tools and media to expand financial inclusion across emerging markets.

- The company’s podcasts rank highly on Apple Podcasts and Spotify among young professionals.

- BankerX GPT supports financial decision-making with a focus on emerging-market users.

Koshiek Karan develops digital tools to reshape how people learn, use, and move money. He aims to open new paths for understanding, investing, and acting within the modern economy.

Karan, a former South African investment banker, now works as a financial content creator and serial entrepreneur. He founded several companies at the intersection of fintech, media, and wellness. He currently leads BankerX, a media and technology business.

BankerX, founded in 2020, positions itself as a hybrid platform combining financial media and technology. The company seeks to expand access to investing, saving, and money management. It relies on artificial intelligence, digital tools, and cross-border communities to support this goal. BankerX builds its offering around financial education, digital content, investor networks, and learning hubs.

The company defines financial inclusion and long-term wealth creation as its core mission, particularly for global audiences in Africa and other emerging markets. It blends AI, digital media, fintech tools, and human networks to help users understand money, invest, and build wealth over time.

BankerX produces content covering personal finance, markets, business, and macro-economy topics. Its podcasts rank high on Apple Podcasts and Spotify, with a strong following among young professionals and entrepreneurs.

BankerX also maintains an active presence on social media and its website. It publishes market news, analysis, and open educational resources on investing. The company designs its content to encourage immediate practical application.

The firm develops several technology projects, including BankerX GPT. The tool guides financial decision-making and supports operational tasks in finance, with a particular focus on emerging markets. It helps users analyse financial products, test scenarios, and clarify choices.

Alongside BankerX, Karan co-founded multiple companies. In 2021, he launched AltVest Capital, where he served as executive chairman until 2023. That same year, he created WealthX, an educational platform; RAX Wealth, a wealth-management technology firm; and Flex Fitness, an international wellness community.

Karan holds a finance degree from the University of Cape Town, awarded in 2012. He began his career in 2013 as an investment banking analyst at Barclays Investment Bank. In 2020, he joined Barloworld as a transaction adviser.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Temitope Omotolani Launches Platform for Saving, Investing and Managing Payments

-

Crowdyvest, created in 2019, combines saving, investing and payment management in a single digital platform.

-

The platform automates deposits, offers curated investment opportunities and provides a digital wallet for bill settlement and transactions.

-

CEO Temitope Omotolani previously helped launch Farmcrowdy and brings a strong background in economics and agribusiness.

Temitope Omotolani, a Nigerian entrepreneur and trained economist, develops a user-centred financial model that creates a new framework for organising personal capital. Her project introduces a notable shift in everyday money management.

Omotolani serves as cofounder and chief executive officer of Crowdyvest, an online platform that provides savings and investment tools to the general public.

Crowdyvest, created in 2019, brings savings, investment and payment management together in one ecosystem. The platform offers interactive products and a catalogue of curated investment opportunities. Users define their financial goals, set their contribution rhythm and manage their budgets through a personal dashboard. The system aims to help individuals progressively strengthen their financial stability and anticipate future uncertainties.

Savings form the core of the platform. Crowdyvest integrates automation and digital tracking to encourage consistent deposits and simplify their management. The company presents its savings products with annual interest rates advertised as attractive. Alongside these options, the Crowdyvest Yield section gives users access to impact-oriented investments across several sectors, with short- or long-term horizons depending on the saver’s profile and objectives.

The platform also includes a bill-payment and transaction service supported by a digital wallet. It enables members to track expenses, meet payment deadlines and conduct routine transactions. Crowdyvest expands this ecosystem through negotiated partner offers that provide discounts and preferential conditions on selected financial products, thereby supporting users beyond simple capital allocation.

Before launching Crowdyvest, Omotolani helped create Farmcrowdy in 2016, a company specialising in technologies applied to agricultural production. She served as vice president of operations and later as chief operating officer until 2019.

Omotolani holds a bachelor’s degree in economics earned in 2017 from the University of Lagos. She also completed training in agricultural business and management at the Lagos Business School of the Pan-Atlantic University.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Cameroonian Tech Entrepreneur Jalil Ketou Uses Skynesys to Streamline Corporate Banking Operations

- Skynesys, founded in 2023, centralises and automates the management of corporate bank accounts in a single AI-supported interface.

- The platform consolidates balances, transactions and operations from multiple banks to improve treasury visibility and reduce manual workloads.

- Co-founder Jalil Ketou also works as a support engineer at ALFYNS Group and holds a software engineering degree from the National Advanced School of Engineering of Douala.

Jalil Ketou introduces a new way of managing corporate banking operations through his digital solution, which improves access to financial information and the way firms use it daily.

Ketou, a Cameroonian tech entrepreneur and software engineer, is the co-founder of Skynesys, a digital-banking platform that applies artificial intelligence to corporate financial management by centralising and automating the oversight of bank accounts.

Skynesys, founded in 2023, presents itself as a platform for financial directors and executives who want to consolidate all their bank accounts in a single interface. The solution organises and analyses banking flows to simplify daily treasury monitoring and strengthen the quality of decisions linked to financial operations.

The platform aggregates balances, movements and operations from various banks into a unified dashboard. It integrates automation functions for control and analysis, which reduces manual tasks and limits risks associated with dispersed data processing.

For companies, Skynesys provides continuous visibility on cash positions, which helps them anticipate financing or investment needs more easily. The use of AI accelerates the identification of trends, irregularities and sensitive signals within the flows and supports banking and financial-risk management.

Alongside his entrepreneurial work, Ketou holds a support-engineer position at ALFYNS Group, a company active in IT training, digital financial services and IT services. He graduated from the National Advanced School of Engineering of Douala with a bachelor’s degree in software engineering.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

Nigeria’s Karsa Offers Virtual U.S. Bank Accounts for Dollar Transfers

- Karsa enables Nigerians to open fully digital USD accounts with virtual Visa cards.

- The fintech offers 4–5% dollar yields tied to U.S. Treasury instruments.

- The platform targets freelancers and remote workers who struggle to access simple cross-border payment tools.

In Nigeria, fintech firm Karsa positions itself as a gateway to the U.S. banking system. The company offers a simple, secure and cost-efficient way to receive, save and spend dollars while leveraging the potential of stablecoins.

Karsa is a solution developed by the Nigerian fintech of the same name. The company provides Nigerians with a virtual U.S. dollar banking service, which includes a fully digital USD account and a virtual Visa card. Founders Shahryar Hasnani and Dale Wilson launched the start-up in 2024.

Hasnani told Disrupt Africa that Nigerians still face fragmented tools for cross-border payments. “In Nigeria, transferring money internationally still means using a dozen different tools. You get paid through one app, you convert your money through another, you store your savings in a third, and you still cannot easily spend those dollars,” he said. He added: “There is no simple and reliable solution for managing money internationally, especially for remote workers, freelancers and anyone who wants to hold U.S. dollars.”

Karsa operates through a mobile app available on iOS and Android. Play Store data shows more than one thousand downloads. The platform lets users receive dollar payments, including from marketplaces such as Upwork or Fiverr, and send funds to any bank account worldwide with reduced fees. The service aims to ease financial mobility for international workers, freelancers and individuals with foreign-currency income or obligations.

The fintech also allows users to save in dollars while earning returns. The company’s website reports a 4–5% interest rate tied to yields from “US Treasury yield” instruments. This feature helps users protect their savings from naira volatility while earning a competitive dollar return.

On the spending side, Karsa says users can pay internationally through a virtual Visa card, which offers some of the most competitive fees on the market. The company’s roadmap also includes a physical card launch.

Nigeria already shows strong adoption of stablecoins. In this context, Karsa’s offer could attract users looking for a secure and liquid refuge in a strong currency.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum