Futa Streamlines Money Transfers in Cameroon

After the failure of their first startup, two tech entrepreneurs decided to embark on a new venture. They turned to financial technologies, a popular segment on the continent. Then Futa was born.

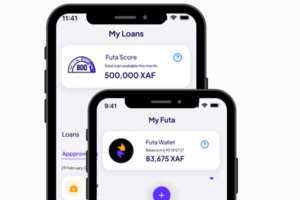

Futa, a fintech solution developed by a Cameroonian startup based in Douala, enables users to send and receive money via mobile money, as well as pay for airtime and subscribe to telecom bundles. Founded in 2022 by Grace Jerolgan and Daniel Dang, the startup sees itself as more than just a payment app.

“Our goal is to build a modern bank for the modern African, enabling even a farmer in the remotest village to securely send and receive money, access loans, and even investment opportunities, with or without internet access,” the startup explains.

Currently, the app is available exclusively on Android, boasting over 5,000 downloads. For iOS users, access is provided through the web version of Futa. Users simply need to click on the ‘Install’ pop-up and follow the steps. This process installs a shortcut to the web app on the home screen, allowing users to use Futa just like any other app.

Once users register and create an account with their name, city, and phone number, they gain access to various services, including sending and receiving funds and purchasing plans. Notably, Futa enables users to manage multiple mobile money accounts from their dashboard. The fintech charges a fee ranging from 0 to 1.5%, depending on the type of transaction.

Futa reports having over 4,000 users, with more than 24,300 transactions processed through the app to date.

Adoni Conrad Quenum

Moneco Enables Seamless Euro Banking & Money Transfers within the African Diaspora

The financial solution was set up by three African tech entrepreneurs to assist African migrants in their transition to life in France.

Moneco, a fintech solution founded by three African tech entrepreneurs Algerian Bilal Dahlab, Beninese Jimmy Kuassi Kumako, and Malagasy Shams Radjabaly was launched in 2022. The France-based startup, which raised approximately $1 million for technology development and growth, allows users to open a euro account, obtain an international VISA payment card, and make transfers throughout Europe or between Moneco users.

The Moneco mobile application, available on iOS and Android, requires users to create an account using a passport and a selfie. A physical address in France is necessary to complete the account creation process. Once the account is set up, users can order a Visa card for payments and other financial transactions. Moneco’s ultimate goal is to serve as a comprehensive financial resource.

The Moneco debit card is priced at €20, with a monthly fee of €1.5. Withdrawals outside France but within the Euro zone also incur a €1.5 fee. Transfers, account maintenance, direct debits, transfers to another Moneco user, card payments within the eurozone, and account opening are all free of charge.

Moneco took part in the Summer 2022 cohort of the Californian accelerator Y Combinator. Since its launch, the Android version of its mobile application has been downloaded over 5,000 times, according to the Play Store.

Adoni Conrad Quenum

In Cameroon, agritech solution Freshbag supplies cities with fresh food

The digital solution was set up to facilitate the supply of goods to retailers.

Freshbag, a Cameroonian startup, has developed an agritech solution that serves as a bridge between producers or agricultural cooperatives and small retailers. The startup, founded by Brice Ludovic Bindzi Mvogo, received an undisclosed amount of funding in 2020 from GreenTec Capital, an investment fund launched in Germany in 2015 by Cameroonian-born Frenchman Eric Yong to support startups and SMEs.

Bindzi Mvogo expressed his gratitude for GreenTec Capital’s support, stating, “Thanks to Greentec, we now have a real opportunity to move into growth mode, scale our operations, and ultimately create a greater impact for the millions of street vendors across Africa. A dream now closer to becoming a reality.”

The solution does not require a mobile application. Interested parties can directly register on the startup’s web platform as sellers to join Freshbag’s network of distributors, or as producers to supply fresh produce. Following registration, the startup conducts site visits for the usual checks and to sign a partnership agreement with the user.

In September 2020, Bindzi Mvogo acknowledged the daily challenges faced by the startup stating, “The main risks are linked to the people we serve. Informal street vendors - because they live in constant uncertainty - are often unreliable and reluctant to commit to formal contracts. Our loyalty and reward programs are gradually helping to solve this problem, but we still have a long way to go to change attitudes and behavior.”

Freshbag currently boasts around 1,600 producers and 700 sellers but it plans to expand beyond Cameroon to other countries in sub-Saharan Africa.

Adoni Conrad Quenum

Congo: MaxiCash Facilitates Payments and Money Transfers for the Diaspora

According to its co-founder, Ruddy Mukwamu, MaxiCash was inspired by the Apple ecosystem.

MaxiCash, a fintech solution developed by a Congolese startup, is enabling Africans in the diaspora to make payments, transfer money internationally, and pay for various goods and services. The startup, launched in 2016 by Ruddy Mukwamu, is based in Kinshasa, Democratic Republic of Congo, and Johannesburg, South Africa.

“We combined our experience in tech and digital to help communities use technology to foster financial inclusion,” Mukwamu said.

The MaxiCash mobile application, available on iOS and Android, allows users to create an account and access various fintech services. Users can send money internationally, make payments, and shop online in partnership with MaxiCash. The application includes a digital wallet, which can be topped up using various digital payment methods, including bank cards.

MaxiCash also offers Visa bank cards for online payments and receiving international payments. The start-up provides a payment gateway for businesses, enabling those involved in online commerce to integrate MaxiCash’s payment solution to facilitate their financial transactions. According to the Play Store, the application has been downloaded more than 10,000 times.

Adoni Conrad Quenum

Zambian economist Evelyn Chilomo Kaingu provides loans to Zambians

An economist turned entrepreneur, she develops digital finance products to meet the needs of individuals and businesses in Zambia.

Evelyn Chilomo Kaingu, a Zambian economist with a background in financial services and technology, is the co-founder and CEO of fintech startup Lupiya. Established in 2016 by Evelyn Chilomo Kaingu and Muchu Kaingu, Lupiya aims to make financial opportunities accessible to all Zambians by simplifying the borrowing process and conditions.

The company offers three loan programs: Personal Loans, Lupiya for Business, and Lupiya for Women. The Personal Loans program provides secured loans and loans backed by a memorandum of understanding, catering to civil servants via Zambia’s integrated payroll and settlement control system (PMEC). Lupiya for Business offers secured working capital loans to help entrepreneurs expand their businesses.

Lupiya for Women serves as a growth partner for women-led small businesses. Under this initiative, women receive management training and best practices for startups, along with financial support through flexible credit facilities. This program provides a financing opportunity for women who lack the financial resources to advance economically.

Kaingu, a 2010 Economics graduate from Cavendish University Zambia, has held various roles in her career. In 2012, she joined The SPAR Group, a South African retailer, as Finance and Administration Manager. She later worked as a data specialist at the World Bank Group in 2015 before dedicating herself full-time to her startup, Lupiya.

Melchior Koba

Ethiopia: eQub digitizes the tontine system through its mobile platform

eQub is an Amharic term for a rotating savings and credit association (ROSCA). Members of an eQub pool their savings, which are then distributed to each member in a predetermined sequence.

eQub, an Ethiopian fintech startup, has developed a solution that allows users to collectivize savings via its mobile application. The startup, headquartered in Addis Ababa, was established in 2020 by Alexander Hizikias. This week, eQub claimed victory at the Fintech Pitch-off competition at 4YFN 2024, held during the Mobile World Congress in Barcelona, Spain.

“Equb is an alternative means to achieve saving and improve access to credit by rotation of savings. Individuals agree to pool their savings for a defined period to jointly save by creating an eQub,” it explains.

Currently available only on Android (with an iOS version under development), it enables users to register by providing personal details, and verifying if they have a bank account and a mobile phone to access the platform. After that step, users then join an existing savings group or one established by the startup.

Users also have the option to create their group but this requires the provision of additional information such as address and biometric national card. The user can set the conditions for joining their group and launch the eQub at a suitable time. The number of rounds in the tontine is dependent on the number of participants.

eQub awards points to participants, which can be used to qualify for deferred payment services and other financial services it plans to introduce soon. According to Nahom Michael, eQub’s business development manager, the solution has attracted over 25,000 users and has formed over 200 savings groups since its inception. The fintech startup generates revenue when tontine winners withdraw funds from the platform.

Adoni Conrad Quenum

Benin: FeexPay streamlines online payment for businesses

Financial technology (fintech) startups are experiencing rapid growth across Africa, driving financial inclusion by offering individuals and businesses easier access to a wider range of financial services. These innovative companies leverage technology to provide services like mobile money transfers, digital payments, and online lending, often reaching segments of the population traditionally excluded from traditional financial institutions.

Benin-based fintech FeexPay, launched in May 2023, announced its expansion into Togo, Côte d'Ivoire, Burkina Faso, and Senegal on Tuesday. The platform, developed by JH Trading, aims to simplify financial transactions for businesses and merchants by enabling payments via mobile money and bank cards.

"We launched FeexPay to significantly contribute to financial inclusion in Africa," said founder Jean Hugues Houinsou in an interview with We Are Tech Africa. "This expansion into four new countries marks a significant step forward, but we remain committed to doing more for the benefit of the African population."

Unlike many fintech solutions, FeexPay operates solely through its website, avoiding the need for a mobile app. Users create accounts by providing personal details and company information, followed by document verification. Once validated, businesses can receive payments via various methods, including Visa, Mastercard, and mobile money.

The platform features functionalities such as FeexLink, which generates payment links to be shared with customers via various channels; FeexCorporate, which enables mass payments to be made to employees, customers, or suppliers; and FeexMarket, which provides access to a single payment link for all of a store's products.

Visa, Transak Partner to Enable Crypto Withdrawals in 30 African Countries

Cryptocurrency adoption is growing across Africa, driven by factors such as financial inclusion and diverse uses. However, regulatory ambiguities and security concerns cloud the optimism surrounding the technology.

U.S. financial technology company Visa announced a partnership with Web3 infrastructure provider Transak to offer cryptocurrency withdrawals in fiat currencies to Transak users in 30 African countries, according to a January 30th post on Transak's X account.

The service will utilize Visa Direct, a real-time money transfer solution, allowing users to convert over 40 cryptocurrencies into local fiat for spending at millions of Visa-accepting merchants.

"By enabling real-time card withdrawals through Visa Direct, Transak is delivering a faster, simpler, and more connected experience for its users — making it easier to convert crypto balances into fiat, which can be spent at the more than 130M merchant locations where Visa is accepted," said Yanilsa Gonzalez-Ore, head of Visa Direct and global ecosystem readiness for North America at Visa, in a statement.

Africa has emerged as a global leader in cryptocurrency adoption, with transactions in sub-Saharan Africa reaching $117.1 billion between July 2022 and June 2023, according to Chainalysis data. Nigeria leads the continent with $56.7 billion in transactions during the same period and ranks second globally in the Chainalysis Cryptocurrency Adoption Index.

"We believe this partnership is an inflection point for Web3 as a whole. Now, millions across the globe have a straightforward way to cash out their digital asset holdings to their local currency in real-time and intuitively," said Sami Start, co-founder of Transak.

Adoni Conrad Quenum

Côte d'Ivoire's Babimo Democratizes Contactless Payments Using QR Codes

In Africa, many startups are focused on improving financial inclusion. They have developed many fintech solutions, some more innovative than others.

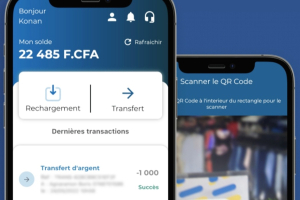

Babimo is a fintech solution developed by an Ivorian startup. It enables users to pay bills online using a contactless QR code. The Abidjan-based startup was founded in 2021 by El Mehdi Messek.

The solution features a mobile app accessible on iOS and Android. Through the app, a user can create an account, with a phone number and a PIN code, and access the various services. In addition to paying bills online using the QR code, users can transfer money to their contacts via the Moov Africa, MTN, or Orange mobile networks, or buy airtime.

Babimo's digital wallet can be topped up by mobile money for various commercial transactions. It is worth mentioning that the startup collects commissions on the various operations. For example, for a 25,000 CFA Franc (around $40) top-up with Babimo, an operator transfer fee of 625 CFA Franc and an account top-up fee of 125 CFA Franc will be deducted, crediting the account with 24,250 CFA Franc.

The startup, which passed through Orange Fab, has received several awards since its launch. In 2022, it came second and received a check for 5,000,000 CFA Franc at the Moov Start-Up Challenge. In early 2023, it won first prize, a check for 2 million CFA Franc, at the first IMP'HACK Hackathon organized by online betting platform 1xbet and Go Impact Côte d'Ivoire. In October 2023, it was also part of the Africa Startup Initiative Program at Startupbootcamp Afritech.

Adoni Conrad Quenum

Nigeria: PiggyVest digitalizes piggy saving

Africa has historically been the continent with one of the lowest banking penetration rates. Those rates have been growing over the past few years but, with the introduction of digital alternatives, the rise is poised to be faster.

PiggyVest is a fintech solution developed by a Lagos-based startup founded in 2016. It enables individuals and businesses to save towards goals like launching a business, buying a car, or furthering education. It was founded by five passionate entrepreneurs, who succeeded in raising around $1.2 million in funding to accelerate its growth.

"When we started, there were 22 banks in Nigeria. So there was quite a lot of option and yet, young people were storing their savings in wooden boxes under their beds. This showed us that people might have access to financial services but they weren’t developed to serve their needs," explained Odunayo Eweniyi, co-founder and chief operations officer of PiggyVest

To access the various services offered by the solution, users need to download its mobile app –Android or iOS version– and register for an account. Among other things, PiggyVest offers several ways to save, such as goal-oriented savings, savings in foreign currencies such as the dollar (flex dollar), or fixed savings, which involves blocking funds for a set period without having access to them until maturity. Its savings plans remunerate users with 5 to 15% interest.

"With PiggyVest, users can save as much as they want as frequently or infrequently as they want, be it every day, every week, or every month. [...] We offer quarterly free withdrawal days when users can take money out if they need to without any cost. Should a user want to withdraw their money early or outside of these days, they will be charged a fee to discourage them from doing so," indicated Odunayo Eweniyi. PiggyVest claims over 4 million users. In 2021, its users saved over $480 million.

Adoni Conrad Quenum