Moroccan Fintech Tresorerie.ma Offers a Robust Financial Management Platform for SMEs

With financial technology growing rapidly across Africa, more local companies have been developing several solutions to offer consumers interesting alternatives to traditional financial management software.

Tresorerie.ma is a digital platform developed by a Moroccan start-up. It allows SMEs and managers, to manage cash flow, centralize and pay supplier invoices, and follow up clients from a dashboard. Based in Tangier, the startup was founded in 2022 by Hicham Berrahou.

"Tresorerie.ma offers a service complementary to accounting: thanks to Tresorerie.ma, you can anticipate and follow the evolution of your cash flow in real time. This will not impact your accounting process. Your accountant can therefore continue to manage your accounts without any problem," the platform states.

To access the fintech's services, users need to visit the platform and create an account. It offers several pricing grids and a trial for a few days. Among other things, users will need to provide information such as their first and last name, email, company name, and their position within their company.

The platform offers distinct registration options, depending on the number of users. Annual packages cost 249, 490, and 890 dirhams (about $242) respectively for 1, 3, and 5 users. The 5-user package includes all features of the solution, unlike the other packages. These include the integration of various accounting software, a cash flow simulator, and cash flow forecasting. Moreover, bank transactions between Tresorerie.ma and users’ bank accounts are unlimited, whereas they are limited to 100 with the basic package.

Regardless of the package picked, users can, from the dashboard, synchronize and automatically categorize all of their company's banking operations, model and test different development scenarios, analyze various indicators to get an idea of the company's financial health, or even create personalized recovery plans.

The fintech also has a mobile application, but it is not available from the Play Store or Appstore. Tresorerie.ma claims to have over 325,000 active users and more than 94 tracking indicators available to its customers. It also offers personalized business support.

Adoni Conrad Quenum

Danielle Ekambi Soppo: This Cameroonian Entrepreneur Boosts Financial Inclusion in Her Country

Fintech is one of the sectors that has grown the most in Africa in recent years. And one of the entrepreneurs who contributed to this growth is Danielle Ekambi Soppo, who strives to advance financial inclusion.

Cameroonian entrepreneur and investor, Danielle Ekambi Soppo, co-founded and heads SuiTch. This is a startup that helps people who have low access to conventional banking solutions, by leveraging digital financial services.

Ekambi Soppo graduated from the Paris Dauphine-PSL University. Between 2007 and 2008, she completed her studies in economic studies and corporate strategies. And in 2011 and 2012, she studied financial engineering, corporate finance, private equity, treasury management, and mergers and acquisitions.

In 2010, she worked as a wealth management consultant at Elite Investment Group, in China. That same year, she went back to Cameroon and worked at the National Shippers' Council of Cameroon (CNCC), as a project financing analyst. She worked there for about a year.

Between 2012 and 2013, she worked at ESSCA Angers business school in banking and risk management. She has also worked as an investment analyst at several investment companies such as Argos Soditic and Platina Partners LLP.

Two years later, in 2015, Danielle Ekambi Soppo founded SuiTch. The startup’s mission is to give people the means to fully tap into the digital economy, enabling them to grow and grow their businesses. The businesswoman offers non-bancarized Cameroonians a mobile payment solution that allows for simple, fast, and secure financial transactions.

SuiTch’s partner companies can grant salary advances to their employees. The startup also gives microcredits, going up to 500,000 FCFA (about $840) to micro and small businesses that use the application.

Danielle Ekambi Soppo currently is the president of the circle of young leaders of Cameroon’s Inter-employer Group (GICAM), which represents the country’s private sector actors. She has also been, since 2014, the managing director of Malaïka Investment Partners, an investment club that supports micro-enterprises with equity and quasi-equity in Cameroon.

SuiTch is presently among Cameroon’s top 7 promising startups. It is also one of the 15 companies picked to join the 2023 cohort of Google for Startups Accelerator: Women Founders.

Melchior Koba

GoFree: A Nigerian Fintech Startup Merging Financial Services, E-commerce, and Instant Messaging

This tech entrepreneur already heads an edtech but still decided to venture into the fintech sector.

GoFree is a technological solution developed by a Nigerian startup. Available on iOS and Android, the mobile app gives access to financial services, e-commerce, and instant messaging. Based in Nigeria and the US, the startup was founded in 2022, by Lekan Adejumo.

Adejumo, according to a Medium post, claims that "if data can freely circulate between different mobile phone operators, money should be able to do the same.” The post further explains that the founder “wanted to create the equivalent of GSM for money, allowing seamless transactions between various financial services". Thinking of this interoperability was one of the reasons that pushed him to put together a team to solve the problem.

Users must first set up an account to use the app’s various services. Information needed includes a phone number, which will be linked to the user's banking services, virtual cards, payments, and social services on GoFree. A Naira wallet is automatically created upon setting up the account; this eases access to the fintech’s financial services, such as sending and receiving money, paying bills, or managing one's finances. The wallet can be topped up by various means such as bank wiring, Nigerian-issued bank cards, Flutterwave, Apple Pay, or Google Pay.

The messaging function, on the other hand, allows for exchanging instant messages with colleagues, friends, or family, sharing files and documents, and collaborating on projects. The application also integrates e-commerce services. Users can publish items on their GoFree profile and also sell them to other users. GoFree doesn’t charge fees for in-App transactions. According to Play Store statistics, the Android version of the app has been downloaded more than 500 times.

Adoni Conrad Quenum

Cynthia Wandia: A Renowned Kenyan Entrepreneur Providing Financial Cooperatives with Effective Technology

She is an internationally renowned entrepreneur and business leader. She co-founded and heads Kwara, a startup that helps financial cooperatives better manage their operations using technology.

Cynthia Wandia, a Kenyan electrical engineer and entrepreneur, founded the start-up Kwara with David Hwan in 2018. Kwara, which she steers as CEO, offers financial cooperatives and their members a secure, enjoyable, and affordable online and mobile banking experience.

Based in Kenya, Kwara's mission is to enable the 3 billion under-served people worldwide to become financially stable and balanced. To achieve this, the start-up is modernizing and equipping savings and credit cooperatives with a banking services platform that updates and improves their back-office operations.

In January 2023, the startup, which already serves over 100,000 members, raised $3 million in seed capital and signed an exclusive digital solutions distribution agreement with the Kenyan Union of Savings and Credit Cooperatives (Kuscco), representing over 4,000 savings and credit cooperatives (Saccos) in Kenya.

"We believe that we have barely scratched the surface of the Kenyan market. That's why we're going to invest in products and services that will allow us to deepen our relationships here," said Cynthia Wandia.

"The logic of the agreement is clear: it's an opportunity to generate leads and distribute our core product as quickly as possible, and to deepen our competitive edge," she added.

Cynthia Wandia holds a bachelor's degree in electrical engineering, obtained in 2009 from Yale University. In 2014, she co-founded ASTRA Innovations, an energy company where she served as CEO until 2017.

Before founding Kwara, she worked for several companies. In 2010, she served for six months as a business development consultant for the Mexican business accelerators network Aceleradora de Empresas ITESM. Between 2012 and 2014, she worked at E.ON Climate & Renewables, successively as a fleet performance analyst and director of special projects. In 2017, she joined Finparx, a business creation studio, as a project developer.

In 2018, the Kenyan newspaper Business Daily Africa named Wandia one of the country's 40 most influential women under 40.

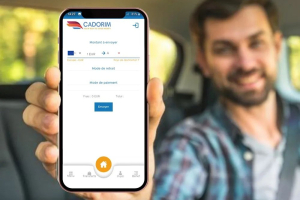

Cadorim specializes in money transfers from Europe to Mauritania

The solution was launched by a Mauritanian tech entrepreneur to address the challenges faced by his compatriots when sending remittances to their relatives.

Cadorim is a fintech solution developed by a Mauritanian start-up. It enables the Mauritanian diaspora in Europe to send remittance home.

The startup behind the app is based in Nouakchott and Brussels. It was founded, in 2018, by Mohamed Elmoctar Neine. Guests can browse the web platform to get a feel of its services without creating an account.

In case they need to make a transfer, users can register for an account or just log back in and provide the required information to complete the transaction. Among other things, the user will be asked to enter the amount in euros or pounds sterling, the recipient's first and last name, telephone number, the receiving city, and whether the person will receive the money in cash at one of the fintech's branches or in their MauriPay e-wallet.

Once the transaction is validated, the next step is to upload a valid identity document issued by a European country to finalize the procedure.

“The technology used by Cadorim is based on the blockchain which guarantees maximum security. It protects your money both when sending and withdrawing,” the platform assures.

Cadorim also allows users to send money to Senegal and Cameroon. These transactions are carried out through its partner MauriPay. Recipients receive the funds directly into their e-wallets. Unlike Cadorim, MauriPay has a mobile application. In 2019, the start-up won the first edition of the Fintech Challenge organized by the Central Bank of Mauritania

Adoni Conrad Quenum

Nigeria: HalalVest simplifies access to interest-free financial products and services

Unlike most of the fintech solutions sprouting across Africa, the solution chose to add Sharia-compliant products and services.

HalalVest is a fintech solution developed by a Nigerian start-up. It facilitates access to financial services such as savings, loans, investments, insurance, pensions, and payments.

As a Halal-friendly solution, the fintech works with financial institutions to help them list their Sharia-compliant products. It facilitates electronic payments and the collection of Islamic alms like zakat, sadaqah, and waqf. It aims to democratize access to interest-free financial products and services.

“We are focused on building and sustaining long-term access to ethical financial products and services. [We aim] to be a leading Non-Interest Fintech Bank in Africa and Middle East region,” the solution indicates on its web platform.

Users can sign up for HalalVest's services through their Android app by completing a specialized form. After verification, they gain access to a variety of ethical savings and investment plans from multiple providers. HalalVest serves as a convenient platform for accessing traditional financial services and more. Through their web platform and mobile app, users can conveniently transfer funds to any bank globally.

The fintech claims a thousand members and serves around 5 countries in Africa and the Middle East. According to Play Store, its mobile application has already been downloaded over 100 times.

Adoni Conrad Quenum

Mélanie Keïta finances African SMEs’ green transition

She leverages her expertise and experience in finance to contribute to economic and sustainable development initiatives on the African continent. Through Melanin Kapital, she provides financial support for Africa's green revolution.

Mélanie Keïta (photo) is a Franco-Congolese finance and investment expert. In 2020, she co-founded Melanin Kapital, a carbon financing platform that aims to become the leading fintech platform financing green transition in Africa.

Her Kenya-based financing platform funds the acquisition of clean energy equipment that SMEs need to grow and simultaneously reduce their carbon footprint. The equipment includes electric vehicles, renewable energy equipment, waste management facilities, and green kitchen equipment.

The platform empowers entrepreneurs by helping them access the capital they need to turn their idea into a business. It also trains and coaches them, focusing particularly on women and local entrepreneurs and promotes the use of digital tools.

Mélanie Keïta, who heads that platform as its CEO, is also the Head of Operations at Tuungane Foundation, the non-profit arm of Melanin Kapital that prepares SMEs to access credit and funding from its parent company and other lending partners. She is also a guest lecturer at ESCP Business School, where she graduated with a master's degree in development economics and international development in 2018.

The entrepreneur also holds a master's degree in finance and financial management services, from the ESSCA business school (2016) and an International Certificate in Corporate Finance from HEC Paris (2016).

Her professional career began, in 2015, as an intern in the SME finance department of France's Générale Electrique et Mesures Optiques (GEMO). Since then, she has worked for several finance and investment institutions such as Investisseurs et Partenaires (I & P), 2° Investing Initiative, and Finance in Motion.

A member of the NextGen committee of the 100 Women in Finance network of finance professionals, Mélanie Keïta was listed in Forbes magazine's 2021 Top 30 under 30. In 2022, she received the Top Africa award issued by GITEX, among others.

Melchior Koba

Benin: MyFeda Allows Accountless International Transfers

Before launching MyFeda, the Beninese startup behind the solution had developed a popular payment aggregator. This new technology aims to facilitate online transactions.

MyFeda is a fintech solution developed by Beninese startup FedaPay SAS. It allows users to send and receive funds and make online payments anywhere in the world without a bank account.

"MyFeda is a mobile solution that allows you to manage your money daily. Whether your money is on your mobile money account or a card, MyFeda allows you to control all your expenses whatever their nature (online, or in a brick-and-mortar store),” the solution indicates on its web platform.

To access its services, users need to first download its mobile app (Android or iOS version) and create their MyFeda accounts. The process can be completed in just a few minutes.

With MyFeda, users can send and receive funds via mobile money in Benin, Togo, Côte d'Ivoire, Mali, Niger, Senegal, and Guinea. They can also send funds via Western Union and MoneyGram or make bank transfers using MasterCard and Visa cards. The solution also provides access to a virtual Visa card.

Each MyFeda account is managed by the Lagos-based pan-African bank, United Bank of Africa (UBA), and linked to a card from the same bank.

A monthly subscription fee is required to use the services offered by MyFeda. Since its launch, the Android version of the app has been downloaded more than 5,000 times, according to PlayStore data.

Adoni Conrad Quenum

Grey provides banking services to African digital nomads

The fintech company, originally known as Aboki, has evolved into a full-fledged neobank that provides banking services to unbanked individuals.

Grey is a fintech solution developed by an eponymous Nigerian start-up. It provides digital banking services such as current account opening, debit card issuance, and loans. It also offers free virtual international bank accounts to let African teleworkers get paid easily.

Its main objective is to provide adequate financial services to everyone. For that purpose, it developed a mobile app that is available on Playstore and AppStore. Through the app, users can sign up for a Grey account and access the various services.

In 2022, the fintech startup behind the solution was claiming 100,000 users and a 200% growth in the volume of transactions processed. Currently, the Android version of its app has been downloaded over 100,000 times from PlayStore, demonstrating a certain popularity. It is growing rapidly and has won several awards. In 2022, it was selected to join the Winter cohort of California-based accelerator Y Combinator. In addition to Nigeria, it is present in Kenya and Tanzania and hopes to continue its expansion into other African markets.

Since its launch in 2020, it has raised about $2.5 million to support its growth, among other things. “We like to say that we’re on a mission to make international payments as easy as sending an email. We want to do impactful work to improve how Africa as a continent interacts with money across its borders,” said its CEO Idorenyin Obong when Grey raised $2 million in 2022.

Adoni Conrad Quenum

Kenya: CBK launches QR code standard to promote digital payments

The QR code technology was democratized in the 2000s but, it recently gained popularity in the Covid-19 period that facilitated the boom of the contactless economy. By adopting the technology, Kenya joins the few African markets that have standardized QR code usage to facilitate payments.

Last Wednesday, the Central Bank of Kenya (CBK) launched the "Kenya Quick Response (KE-QR) Code Standard 2023" aimed at improving digital payment services.

According to CBK governor, Dr. Patrick Njoroge, “the payment system will provide Kenyans with additional secure payment solution methods, increasing usability and consumer adoption of digital payment channels.”

The launch of the KE-QR Code Standard 2023 is one of the several initiatives taken by the CBK under its 2022-2025 National Payment Strategy to support the adoption of key standards and align Kenya's national payment system with global standards.

The effective implementation of the standard and the use of standardized QR Code payments will enable customers to make digital payments in a simple, fast, convenient, and secure manner using the QR code as opposed to the manual system used in the past. It will also promote financial inclusion by allowing institutions of different sizes and customer focus to

By effectively implementing the standard and utilizing standardized QR Code payments, customers can conveniently, quickly, securely, and easily make digital payments using the QR code instead of the manual payment system used in the past. Additionally, it will enhance financial inclusion by enabling institutions of various sizes and customer focus to expand the adoption of digital payments.

QR Code is a universal technology that can be scanned by specialized equipment and apps like the MPESA mobile app and banking apps similar to the ones offered by Equity Bank and the CBK. Thanks to the new standard, merchants can now have QR codes that contain their details as well as the unique identifiers of payment service providers. This technology also provides information about the transaction that has taken place.

Samira Njoya