BusyMed Brings Affordable Medicines to South Africans via Mobile App

BusyMed, a South African healthtech startup, is transforming how patients access medicines through its mobile app. Founded in 2018 by Mphati Jezile in Port Elizabeth, BusyMed allows users to order pharmaceutical products directly from their homes.

“BusyMed seeks to solve a challenge that many South Africans face – not having access to affordable and convenient primary healthcare services. COVID-19 has made us all realise the strain our healthcare system is under, which means more services like BusyMed are essential in supporting the struggling healthcare system,” Jezile said in July 2022 to Disrupt Africa.

BusyMed integrates local pharmacies on its platform so patients can check real-time stock, place orders, and receive medicines within hours. The app also lets users submit prescriptions, consult healthcare professionals, and make secure payments.

The platform especially serves people in rural and remote areas, where medicine shortages and long waits at pharmacies are common. BusyMed’s model digitizes the entire pharmaceutical supply chain, building an integrated system around community-based healthcare.

Beyond delivering medicine, BusyMed plans to expand its app with teleconsultation and treatment management features. “Our goal is to offer primary healthcare businesses in the public and private sector the technology and resources they would need to serve the communities they are based in, and beyond, from the comfort of the patient’s home, at an affordable price,” Jezile emphasized.

This article was initially published in French by Adoni Conrad Quenum

Edited in English by Ange Jason Quenum

Richard Nischk Revolutionizes Customer Service with AI Automation

Richard Nischk has built his career around new technologies and their impact on business-to-customer communication. Today, he leads the charge in transforming how companies engage with customers on social media.

Nischk, a South African entrepreneur, co-founded and now serves as CEO of Cue, a startup specializing in AI-powered customer service solutions.

Founded in 2015, Cue developed a platform that lets companies manage and automate customer interactions across WhatsApp, Facebook Messenger, web chat, and Instagram—all from one unified interface. The platform aims to deliver fast, personalized, and efficient service while cutting response times and operational costs.

Cue’s technology integrates advanced chatbots and AI conversational agents. These tools handle routine requests, tailor responses, and adapt to each customer by analyzing conversations. The platform also provides detailed analytics to monitor every interaction, measure customer satisfaction, and boost support performance.

In 2024, Cue launched its AI Agents service—virtual assistants that understand natural language and learn from companies’ internal documents to offer more precise and autonomous support. Cue now serves hundreds of clients across South Africa and Europe. Its team of over 40 employees operates in 10 cities across 5 countries.

Before Cue, Nischk founded Forecast Raincoats in 2013 and co-managed it until 2023. The company produces and sells its own raincoat brand in South Africa.

Nischk earned a bachelor’s degree in social dynamics from Stellenbosch University in 2010. He also holds a postgraduate degree in business management from the University of Cape Town, obtained in 2013.

He started his career at Panacea Mobile, a communications tech company, managing accounts. In 2015, he joined Continuon, a smart marketing solutions firm, where he served as a non-executive director until 2021.

This article was initially published in French by Melchior Koba

Edited in English by Ange Jason Quenum

Talenteo Streamlines HR and Payroll for Algeria’s SMEs

Two Algerian tech entrepreneurs built a solution to help small and medium-sized businesses manage their human resources more easily and locally.

Talenteo, a SaaS platform developed by a young Algiers-based startup, gives SMEs tools to handle their entire HR cycle — from payroll to onboarding, plus leave, absences, and regulatory compliance. Tarik Metnani and Louai Djaffer launched the startup in 2022.

In June, the company raised an undisclosed six-figure investment from Tunisia-based 216 Capital. This funding will speed up Talenteo’s growth in Algeria and prepare it for regional expansion. The founders plan to move into Tunisia first, then other North African markets.

“We believe that a company’s success relies on investing in human resources. Talenteo was created to help African companies digitize their HR processes to support their growth and impact,” said co-founder Louai Djaffer.

Talenteo positions itself as a local alternative to foreign solutions, which often fail to match African regulatory and linguistic needs. The platform mainly targets businesses with fewer than 250 employees — the core of Algeria’s and Francophone Africa’s economy.

The company says its solution offers an integrated approach that fits local administrative requirements, such as payslip compliance under Algerian law and customized dashboards. Talenteo aims to cut paperwork for SMEs, boost transparency, and professionalize talent management.

Adoni Conrad Quenum

Amr Gamal Digitizes Fleet Finance Management in Egypt

Amr Gamal started his career in telecommunications, then expanded into industry and finance. He later focused on creating digital tools that meet companies’ operational needs.

Gamal, an Egyptian tech entrepreneur, co-founded and leads Octane, a start-up specializing in digital management of payments and expenses for vehicle fleets.

Octane, founded in 2022, developed a digital platform to manage fleet costs such as fuel, maintenance, spare parts, petty cash, and tolls. The platform uses a closed digital wallet that centralizes all mobility payments in a secure, traceable system.

The platform includes advanced technologies like NFC smart cards, which ensure payments happen only at service stations, reducing fraud risk. The system requires a pump photo for every transaction, sends instant alerts if payments don’t match actual consumption, and collects mileage data manually for accurate tracking.

Octane connects clients to more than 2,400 service stations. It also provides real-time analytics, automated controls, and detailed reports to optimize costs, prevent fraud, and improve fleet efficiency. Recently, Octane raised $5.2 million to expand in the Middle East and North Africa, upgrade its AI tools, and add features like support for electric vehicles.

Before founding Octane, Gamal co-founded TEDxCairo in 2010 to bring together changemakers and spark local and international innovation.

Gamal graduated from Ain Shams University in 2010 with a bachelor’s degree in electronics and communications. That same year, he began his career at Orange Egypt, where he worked as transmission quality engineer, radio quality and benchmarking engineer, radio frequency optimization team leader, and geomarketing team leader.

In 2015, he joined Procter & Gamble as operations and initiative availability manager for the Near East. In 2018, he became a marketing team leader at Vodafone. In 2022, he served as operations director at FlapKap, a financial company in Abu Dhabi.

This article was initially published in French by Melchior Koba

Edited in English by Ange Jason Quenum

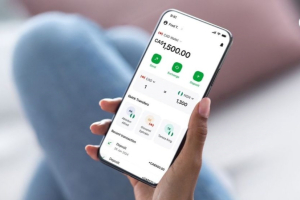

Bamboo Enters Remittance Market with 'Coins' App for Diaspora Transfers to Africa

Bamboo, a platform dedicated to empowering Africans to invest in global markets, has launched its new remittance app, Coins by Bamboo.

This app, announced on October 31, facilitates money transfers from the diaspora to Africa with low fees and favorable exchange rates, positioning Bamboo as a contender in the burgeoning remittance sector.

Available on both iOS and Android, the app currently supports transfers from Canada to Nigeria, with plans to expand to more regions soon.

Nigeria's Moniepoint Secures $110M to Expand Fintech Services Across Africa

Nigeria-based fintech Moniepoint has raised $110 million in funding from investors, including Google, to expand digital payments and banking solutions across Africa. The investment, announced Tuesday, October 29, supports Moniepoint's goal to become a key player in Africa's financial ecosystem.

Existing investors Development Partners International and Lightrock led the round, with Google’s Africa Investment Fund and Verod Capital joining as new backers.

Moniepoint will use the capital to grow its business across Africa and build a unified platform for digital payments, banking, FX, credit, and business tools.

Littlefish, Visa to Equip African MSMEs with Digital Payment Solutions

SMEs employ the majority of people on the continent. However, they face numerous challenges, including limited access to capital, markets, and digital resources, which hampers their growth and ability to scale. Addressing these challenges is essential for achieving sustainable socioeconomic development in Africa.

On October 16, Littlefish announced a partnership with Visa to enhance digital experiences for businesses, providing advanced solutions for both in-store and online transactions. The omnichannel platform offering business solutions to financial institutions aims to empower micro, small, and medium-sized enterprises (MSMEs) across Africa.

Co-founder and CEO of Little Fish Brandon Roberts noted the importance of delivering “a seamless, cost-effective digital platform that empowers financial institutions to support sustainable growth in the MSME sector.”

The partnership also integrates Visa's CyberSource system, enhancing secure payment processing and opening the door for future products like remittance flows, lending, and loyalty programs. This collaboration marks a crucial step towards digital transformation for MSMEs in Africa, making commerce more efficient and accessible across the continent.

According to Forbes Africa, citing the World Economic Forum, MSMEs account for around 80% of businesses and more than 50% of the GDP in Africa. This underscores their importance to economic stability and job creation. However, these businesses often struggle with limited access to digital payment solutions and financial tools, which can hinder their growth potential.

As cash transactions continue to dominate daily business in Africa despite global digital payment trends, this collaboration addresses a significant gap. Visa and Littlefish will offer innovative payment solutions through traditional POS systems, mobile POS, Tap2Phone, and e-commerce channels, coupled with value-added services designed to streamline MSME operations and support growth.

Hikmatu Bilali

Nigeria’s SEC to Reinforce Fintech Regulations to Protect Investors

With more consumers and businesses relying on fintech, the potential for unauthorized or mismanaged investments rises. This underscores the need for robust regulatory frameworks to protect users and enhance market stability.

The Securities and Exchange Commission (SEC) of Nigeria has announced its plans to crack down on fraudulent activities within the country’s rapidly growing fintech sector to protect investors and maintain market integrity. Speaking at the Nigeria Fintech Week, held from October 8-10, SEC’s Director-General Emomotimi Agama emphasized the importance of safeguarding the public interest while fostering innovation within the sector.

He highlighted the potential risks that unregulated fintech operations pose, such as unauthorized data use and unverified fundraising efforts.“We cannot afford to leave this growing sector unchecked. Large amounts of investment data could be misused without consent, and companies are increasingly raising public funds without adequate regulatory control,” Agama said.

The regulatory body aims to enforce “smart regulations” tailored to the fintech landscape, aimed at curbing fund mismanagement and ensuring legal compliance across the industry. Both public and private fintech companies engaging in fundraising activities would need to comply with the SEC’s standards.

This move by Nigeria’s SEC reflects a broader trend towards increased scrutiny within the fintech sector, as regulators worldwide seek to balance technological advancement with investor protections and consumer rights. To ensure a balanced approach, the SEC plans to introduce a three-pronged strategy focused on regulatory compliance, bolstering stakeholder confidence, and validating investor protections.

Fintech fraud is a significant concern in Nigeria, underscoring the importance of the SEC’s recent regulatory measures. Wema Bank’s suspension of several fintech partners highlights Nigeria's ongoing challenges in tackling fraud within its financial system. In a similar move, Fidelity Bank imposed restrictions on fund transfers to neobanks like Kuda Bank, OPay, Moniepoint, and PalmPay in 2023, aiming to curb financial misconduct and protect customer funds. These actions underscore the financial sector's proactive efforts to tighten security and reduce the risk of illicit activities in the growing digital payments landscape.

According to the Financial Institutions Training Centre’s (FITC) Q2 2024 Fraud and Forgeries report, in Q2 2024, Nigerian banks reported losses of ₦42.6 billion (over $55 million) due to various types of fraud—a sharp increase of 637% compared to the previous year. Most of this was attributed to miscellaneous fraud types, along with withdrawals and computer/web fraud related to fintechs. To this end, banks including Wema Bank and Fidelity Bank suspended several fintech partners. This rise in fraud highlights the urgency for stricter regulations to mitigate risks associated with fintech operations and protect investors.

According to Fintech Global, Nigeria’s fintech market accounted for 42% of the total investment made in African fintech in Q3 2023, and it continues to attract significant global interest. However, with such rapid growth comes the risk of financial mismanagement and investor fraud. The SEC’s focus on "smart regulation" aims to address these issues by implementing tailored regulations that promote innovation while ensuring compliance and investor protection.

Hikmatu Bilali

Nigeria, Mastercard Bring Digital Financial Tools to 1M African Farmers

Smallholder farmers, who dominate Africa’s agricultural landscape, often lack access to formal credit, limiting their ability to invest in modern tools, equipment, seeds, and fertilizers. Financial inclusion enables farmers to secure loans, helping them adopt improved farming practices and increase yields.

Nigeria and Mastercard have partnered to support one million farmers in Nigeria, Kenya, and Tanzania, aiming to boost agricultural productivity and financial inclusion, the Ministry of Information and National Orientation announced on September 27. The initiative, backed by the African Development Bank (AfDB), will provide farmers with digital access to financial services.

The agreement was sealed during a meeting between Nigerian Vice President Kashim Shettima and Mastercard executives at the 79th United Nations General Assembly in New York. “This partnership is a major milestone in advancing financial inclusion and agricultural development across the continent,” Shettima said.

Mastercard’s Country Manager for West Africa, Dr. Folasade Femi-Lawal, added that the initiative includes 160 seminars on contactless payment systems, scheduled to begin in February 2025, to prepare the market for the adoption of new technology.

The World Bank’s Global Findex Database 2021 reveals that over half of the world’s unbanked adults reside in just seven economies, which collectively account for 54% of the unbanked population, with Nigeria alone representing 5%. The report also highlights that digitizing common payments—such as government subsidies, wages from private employers, and payments from agricultural buyers—could enhance financial inclusion for unbanked and underbanked adults. Providing digital financial tools can empower farmers to increase productivity and income.

Hikmatu Bilali

Flutterwave Expands Services Across 49 US States with MainStreet Bank

Payment technology company Flutterwave announced, on September 24, the expansion of its money transfer service, Send App, to 49 states across the United States.

Implemented through a strategic collaboration with American MainStreet Bank, the expansion aims to provide Africans in the Diaspora with a seamless way to send money back home.

The move highlights Flutterwave's commitment to offering secure and efficient banking solutions, compliant with regulatory standards.