Bamboo Enters Remittance Market with 'Coins' App for Diaspora Transfers to Africa

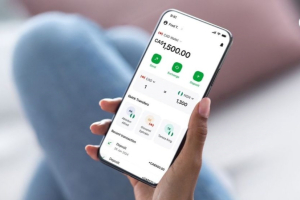

Bamboo, a platform dedicated to empowering Africans to invest in global markets, has launched its new remittance app, Coins by Bamboo.

This app, announced on October 31, facilitates money transfers from the diaspora to Africa with low fees and favorable exchange rates, positioning Bamboo as a contender in the burgeoning remittance sector.

Available on both iOS and Android, the app currently supports transfers from Canada to Nigeria, with plans to expand to more regions soon.

Nigeria's Moniepoint Secures $110M to Expand Fintech Services Across Africa

Nigeria-based fintech Moniepoint has raised $110 million in funding from investors, including Google, to expand digital payments and banking solutions across Africa. The investment, announced Tuesday, October 29, supports Moniepoint's goal to become a key player in Africa's financial ecosystem.

Existing investors Development Partners International and Lightrock led the round, with Google’s Africa Investment Fund and Verod Capital joining as new backers.

Moniepoint will use the capital to grow its business across Africa and build a unified platform for digital payments, banking, FX, credit, and business tools.

Littlefish, Visa to Equip African MSMEs with Digital Payment Solutions

SMEs employ the majority of people on the continent. However, they face numerous challenges, including limited access to capital, markets, and digital resources, which hampers their growth and ability to scale. Addressing these challenges is essential for achieving sustainable socioeconomic development in Africa.

On October 16, Littlefish announced a partnership with Visa to enhance digital experiences for businesses, providing advanced solutions for both in-store and online transactions. The omnichannel platform offering business solutions to financial institutions aims to empower micro, small, and medium-sized enterprises (MSMEs) across Africa.

Co-founder and CEO of Little Fish Brandon Roberts noted the importance of delivering “a seamless, cost-effective digital platform that empowers financial institutions to support sustainable growth in the MSME sector.”

The partnership also integrates Visa's CyberSource system, enhancing secure payment processing and opening the door for future products like remittance flows, lending, and loyalty programs. This collaboration marks a crucial step towards digital transformation for MSMEs in Africa, making commerce more efficient and accessible across the continent.

According to Forbes Africa, citing the World Economic Forum, MSMEs account for around 80% of businesses and more than 50% of the GDP in Africa. This underscores their importance to economic stability and job creation. However, these businesses often struggle with limited access to digital payment solutions and financial tools, which can hinder their growth potential.

As cash transactions continue to dominate daily business in Africa despite global digital payment trends, this collaboration addresses a significant gap. Visa and Littlefish will offer innovative payment solutions through traditional POS systems, mobile POS, Tap2Phone, and e-commerce channels, coupled with value-added services designed to streamline MSME operations and support growth.

Hikmatu Bilali

Nigeria’s SEC to Reinforce Fintech Regulations to Protect Investors

With more consumers and businesses relying on fintech, the potential for unauthorized or mismanaged investments rises. This underscores the need for robust regulatory frameworks to protect users and enhance market stability.

The Securities and Exchange Commission (SEC) of Nigeria has announced its plans to crack down on fraudulent activities within the country’s rapidly growing fintech sector to protect investors and maintain market integrity. Speaking at the Nigeria Fintech Week, held from October 8-10, SEC’s Director-General Emomotimi Agama emphasized the importance of safeguarding the public interest while fostering innovation within the sector.

He highlighted the potential risks that unregulated fintech operations pose, such as unauthorized data use and unverified fundraising efforts.“We cannot afford to leave this growing sector unchecked. Large amounts of investment data could be misused without consent, and companies are increasingly raising public funds without adequate regulatory control,” Agama said.

The regulatory body aims to enforce “smart regulations” tailored to the fintech landscape, aimed at curbing fund mismanagement and ensuring legal compliance across the industry. Both public and private fintech companies engaging in fundraising activities would need to comply with the SEC’s standards.

This move by Nigeria’s SEC reflects a broader trend towards increased scrutiny within the fintech sector, as regulators worldwide seek to balance technological advancement with investor protections and consumer rights. To ensure a balanced approach, the SEC plans to introduce a three-pronged strategy focused on regulatory compliance, bolstering stakeholder confidence, and validating investor protections.

Fintech fraud is a significant concern in Nigeria, underscoring the importance of the SEC’s recent regulatory measures. Wema Bank’s suspension of several fintech partners highlights Nigeria's ongoing challenges in tackling fraud within its financial system. In a similar move, Fidelity Bank imposed restrictions on fund transfers to neobanks like Kuda Bank, OPay, Moniepoint, and PalmPay in 2023, aiming to curb financial misconduct and protect customer funds. These actions underscore the financial sector's proactive efforts to tighten security and reduce the risk of illicit activities in the growing digital payments landscape.

According to the Financial Institutions Training Centre’s (FITC) Q2 2024 Fraud and Forgeries report, in Q2 2024, Nigerian banks reported losses of ₦42.6 billion (over $55 million) due to various types of fraud—a sharp increase of 637% compared to the previous year. Most of this was attributed to miscellaneous fraud types, along with withdrawals and computer/web fraud related to fintechs. To this end, banks including Wema Bank and Fidelity Bank suspended several fintech partners. This rise in fraud highlights the urgency for stricter regulations to mitigate risks associated with fintech operations and protect investors.

According to Fintech Global, Nigeria’s fintech market accounted for 42% of the total investment made in African fintech in Q3 2023, and it continues to attract significant global interest. However, with such rapid growth comes the risk of financial mismanagement and investor fraud. The SEC’s focus on "smart regulation" aims to address these issues by implementing tailored regulations that promote innovation while ensuring compliance and investor protection.

Hikmatu Bilali

Nigeria, Mastercard Bring Digital Financial Tools to 1M African Farmers

Smallholder farmers, who dominate Africa’s agricultural landscape, often lack access to formal credit, limiting their ability to invest in modern tools, equipment, seeds, and fertilizers. Financial inclusion enables farmers to secure loans, helping them adopt improved farming practices and increase yields.

Nigeria and Mastercard have partnered to support one million farmers in Nigeria, Kenya, and Tanzania, aiming to boost agricultural productivity and financial inclusion, the Ministry of Information and National Orientation announced on September 27. The initiative, backed by the African Development Bank (AfDB), will provide farmers with digital access to financial services.

The agreement was sealed during a meeting between Nigerian Vice President Kashim Shettima and Mastercard executives at the 79th United Nations General Assembly in New York. “This partnership is a major milestone in advancing financial inclusion and agricultural development across the continent,” Shettima said.

Mastercard’s Country Manager for West Africa, Dr. Folasade Femi-Lawal, added that the initiative includes 160 seminars on contactless payment systems, scheduled to begin in February 2025, to prepare the market for the adoption of new technology.

The World Bank’s Global Findex Database 2021 reveals that over half of the world’s unbanked adults reside in just seven economies, which collectively account for 54% of the unbanked population, with Nigeria alone representing 5%. The report also highlights that digitizing common payments—such as government subsidies, wages from private employers, and payments from agricultural buyers—could enhance financial inclusion for unbanked and underbanked adults. Providing digital financial tools can empower farmers to increase productivity and income.

Hikmatu Bilali

Flutterwave Expands Services Across 49 US States with MainStreet Bank

Payment technology company Flutterwave announced, on September 24, the expansion of its money transfer service, Send App, to 49 states across the United States.

Implemented through a strategic collaboration with American MainStreet Bank, the expansion aims to provide Africans in the Diaspora with a seamless way to send money back home.

The move highlights Flutterwave's commitment to offering secure and efficient banking solutions, compliant with regulatory standards.

Uganda’s Agent Banking Company Secures Funding from Goodwell Investments

Uganda's Agent Banking Company (ABC) has received an undisclosed investment from Goodwell Investments, marking the Dutch firm's entry into Uganda’s financial inclusion sector, Goodwell announced September 19.

Through Goodwell’s €150 million uMunthu II Fund, the funding will help ABC expand its client base, increase agent coverage, and introduce new services.

Goodwell’s uMunthu II Fund focuses on early-stage growth companies in financial services, food, agriculture, mobility, and logistics across Africa.

Fintech Nala Obtains License to Operate in Uganda

The Bank of Uganda has granted Tanzanian fintech NALA an International Money Transfer Operator (IMTO) license, the fintech announced on August 29. This allows NALA to expand its operations in Uganda by integrating directly with mobile money services, offering users a seamless way to transfer funds into local mobile wallets and enhancing the efficiency and security of cross-border payments.

NALA facilitates money transfers from the UK, US, and EU to several African countries, including Uganda. It has collaborated closely with the Bank of Uganda to meet regulatory requirements, contributing to an increase in foreign exchange supply, which is vital for economic growth.

Flutterwave Secures License in Uganda, Expands Digital Payment Solutions

Flutterwave has secured a Payment Systems Operator (PSO) license from the Bank of Uganda, enabling it to offer its payment solutions to businesses in the east-african country. The company announced this new move on August 28.

Ki kati Uganda, we have brought the wave to you! 🇺🇬🦋

— Flutterwave (@theflutterwave) August 28, 2024

We have secured a Payment Systems Operator license from the Bank of Uganda!

Expanding into Uganda aligns with our vision of a financially connected Africa where enterprises can operate seamlessly on the continent and expand… pic.twitter.com/4WKblu1GkA

This milestone allows Ugandan businesses to accept various payment methods, including mobile money, bank transfers and cards, while also facilitating easy remittances from the diaspora.

The expansion allows businesses to boost growth and efficiency by capitalizing on Flutterwave’s solutions, including payment collection, seamless payouts and invoicing.

Proparco Grants €400,000 Loan to Rubyx for Expansion of Services

Proparco has provided a €400,000 loan to Rubyx, an African start-up, through the Bridge by Digital Africa facility. This funding will help Rubyx rapidly expand its algorithmic loan offering for start-ups and microfinance institutions across Africa.

The Bridge by Digital Africa facility, backed by Digital Africa and managed by Proparco, offers bridging finance to young African companies to support their growth between funding rounds.

This investment aims to boost access to loan products for African Very Small Enterprises (VSEs) and Small and Medium-sized Enterprises (SMEs), supporting financial inclusion efforts on the continent.