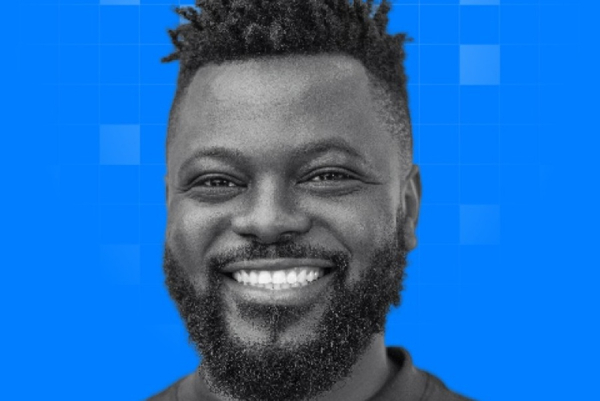

- Nigerian entrepreneur Sunday Paul Adah co-founded and leads Radius, a cross-border payments platform for international students.

- Radius enables same-day payments for tuition, visas, exams, and housing while avoiding traditional international transfer constraints.

- The platform launched in 2022 and operates with real-time tracking and competitive exchange rates.

Sunday Paul Adah, a Nigerian entrepreneur based in Boise, United States, co-founded and leads Radius, formerly known as Pay4Me App, a payment platform designed to simplify financial procedures for international students who must pay fees to foreign schools, institutions, or organizations.

Founded in 2022, Radius enables users to pay tuition, visa fees, examination costs, and housing expenses while avoiding constraints linked to traditional international bank transfers. The mobile application allows users to execute same-day payments and monitor transactions in real time, which increases transparency and reduces uncertainty.

The platform integrates currency management tools that offer competitive exchange rates, which remain critical for cross-border payments. Radius also emphasizes a user-friendly interface and provides 24/7 customer support to assist students throughout every step of their education-related financial processes.

In parallel, Sunday Paul Adah founded Across The Horizon in 2015, a study-abroad consulting firm that supports African students and families in identifying affordable international education opportunities. He also founded Scholarships Africa in 2020, a platform dedicated to identifying and applying for international scholarship programs.

Sunday Paul Adah earned a bachelor’s degree in multidisciplinary studies from Boise State University in 2021. He also holds a master’s degree in public administration, government, and politics from Grand Canyon University, obtained in 2023, as well as a master’s degree in entrepreneurship from the David Eccles School of Business at the University of Utah, completed in 2025.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de BERRY QUENUM

- Steve Nganga founded and leads Balozy, a Kenyan service-booking mobile app launched in 2022.

- The platform connects users to verified local providers (“Balozypros”) across household, personal, and business services.

- The application operates free of charge on Android and iOS in Kenya.

Steve Nganga, a Kenyan administrator and serial entrepreneur, founded and leads Balozy, a mobile application dedicated to searching for and booking local service providers.

Balozy launched in 2022 and offers free access to Kenyan users on Android and iOS. The application positions itself as a simple and practical tool that allows users to quickly find qualified professionals when needs arise. The platform connects users with verified service providers, called “Balozypros,” who operate across a wide range of fields, including home maintenance, personal assistance, and specialized services for businesses or specific projects.

Balozy bases its value proposition on immediate access to reliable solutions for both daily needs and one-off situations. Users browse multiple service categories, including cleaning, appliance repair, home maintenance, childcare, mobility assistance, and event services. Users also review provider profiles, compare multiple professionals, and select the option that best fits their needs. The application allows downloads and usage without fees or paid registration.

Before launching Balozy, Steve Nganga co-founded EventPremier in 2016, a digital startup focused on event services, and he served as chief executive officer until 2019. He earned a bachelor’s degree in accounting and management information systems from the University of Maine in 2004, followed by a master’s degree in public administration in 2007.

Steve Nganga began his professional career in the United States in 2008 as a financial analyst at Muckleshoot Indian Casino. He later joined Columbia Threadneedle Investments, where he worked from 2014 to 2019 as a business intelligence architect and then as BI manager. In 2019, he became a BI analyst at Nuance Communications, a U.S. technology company, before joining Microsoft, where he held a BI analyst role from 2022 to 2025.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de BERRY QUENUM

CivicHive has launched its 2026 Civic Tech Fellowship, a 20-week program designed to support 15 West African innovators building tech-driven solutions for civic engagement. Projects focused on responsible AI, climate action, healthcare, or advocacy will receive expert mentorship, monthly stipends, and access to a powerful regional network. Applications are open until February 11 for those looking to turn bold ideas into lasting social impact.

The 2026 UN Global Pulse Accelerator is now supporting teams with proven, implementation-ready innovative solutions. Three selected projects will each receive $60,000 in funding, alongside technical support and mentorship to scale and measure their impact. The program is seeking initiatives that leverage data or AI to advance sustainable development, humanitarian action, and social inclusion. Applications are open through February 11, 2026.

Heifer International has launched the 2026 AYuTe Nigeria challenge, a competition awarding $40,000 in grants to climate-smart agritech solutions. The grand prize winner will receive $20,000, with second and third place taking home $12,000 and $8,000, respectively. Beyond the funding, these young innovators transforming Nigerian agriculture will receive professional mentorship. The grand finale is set for May 2026 in Abuja.

- Algeria adopted a new presidential decree to reinforce cybersecurity governance across public institutions.

- The framework mandates dedicated cybersecurity units reporting directly to institutional heads.

- Algeria faced more than 70 million cyberattacks in 2024, according to Kaspersky data.

Algeria has adopted a strengthened institutional framework to protect its information systems against rising cyber threats. Presidential Decree No. 26-07 of January 7, 2026, published on January 21 in the Official Gazette, defines the organisation and operation of cybersecurity structures within public institutions, administrations and agencies to improve the anticipation and management of cyberattack risks.

Under the decree, each public entity will establish a dedicated cybersecurity unit that remains separate from the technical information systems management function. The unit will report directly to the head of the institution and will coordinate all actions related to data protection and system security, including for supervised agencies.

The cybersecurity units will design and oversee the implementation of cybersecurity policies, identify risks through dedicated mapping, and deploy appropriate remediation plans. The framework also requires continuous monitoring, regular audits, and the immediate reporting of any incident to the competent authorities.

The decree further mandates compliance with personal data protection legislation in coordination with the national supervisory authority. In addition, it promotes coordination with public procurement and internal security bodies to integrate cybersecurity clauses into outsourcing contracts and strengthen the protection of personnel and equipment.

This initiative comes amid a sharp rise in cyberattacks in Algeria. In 2024, the country recorded more than 70 million cyberattacks, according to Kaspersky, which ranked Algeria 17th globally among the most targeted countries. Security solutions blocked over 13 million phishing attempts and neutralised nearly 750,000 malicious attachments, highlighting the scale of the risks facing users and organisations.

Authorities expect the new framework to deliver a lasting strengthening of cybersecurity governance across the public sector and to support Algeria’s digital transition through tighter institutional oversight. In a country where digital systems continue to expand rapidly, the operational cybersecurity framework aims to protect public services, critical infrastructure and sensitive data, while reinforcing confidence among citizens and economic actors in the digital ecosystem.

This article was initially published in French by Samira Njoya

Adapted in English by Ange J.A. de BERRY QUENUM

- Ayooka launched a national digital blood transfusion management platform in Guinea in 2022.

- The system uses artificial intelligence to manage blood stocks, reduce waste and anticipate shortages.

- The platform operates with support from the National Blood Transfusion Centre (CNTS) and health professionals.

Ayooka operates as an integrated digital solution dedicated to the management and optimisation of blood transfusion services in Guinea. The platform functions as a digital information and management system designed to improve the efficiency and security of processes related to blood collection, processing, distribution and traceability. The platform launched operations in 2022.

“Ayooka is the digital information and management system for Guinea’s blood transfusion services,” the platform said. “This integrated technological platform enables efficient and secure management of all processes related to the collection, processing, distribution and traceability of blood and its components.” The platform added: “Our objective is to optimise blood product stock management, guarantee the quality and safety of transfusions, and facilitate communication between all stakeholders in the transfusion sector, including donors, healthcare facilities and laboratories.”

The solution relies on several functional modules to address sector-specific challenges. Ayooka deploys artificial intelligence-assisted stock management to anticipate shortages, reduce waste and plan blood collection operations. The platform also integrates a hemovigilance module to monitor, assess and prevent incidents linked to blood products. In addition, the system allows physicians to track requests and prescriptions for labile blood products, while ensuring full documentation of administration to patients.

The platform also integrates public awareness features through digital and multimedia campaigns designed to encourage blood donations, including among non-schooled populations. A quality assurance component covers the entire transfusion chain, from donation to clinical administration.

With support from the National Blood Transfusion Centre (CNTS) and healthcare professionals, Ayooka aims to increase donation frequency and contribute to saving lives by improving the availability and safety of blood products.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J.A. de BERRY QUENUM

Cape Town will host the Africa Green Economy Summit 2026 from February 24-27. Centered on the theme "From Ambition to Action," the summit connects decision-makers with investors to accelerate green and blue projects. With a focus on closing the climate funding gap, the event will feature 50 bankable projects in sectors like renewables, sustainable farming, and electric mobility.

Nigerian stablecoin-focused fintech OneDosh has raised $3 million in pre-seed funding to build out its cross-border payment infrastructure. Operating in both the U.S. and Nigeria, the platform enables rapid transfers, stablecoin storage, and payments via Apple Pay and Google Pay-compatible cards. The capital will fuel expansion into new payment corridors and the growth of its engineering teams.

Last week, Central Bank of Congo (BCC) Governor André Wameso met with GSMA representatives to discuss potential partnerships to expand connectivity nationwide. Talks focused on digitalisation, financial inclusion and infrastructure, key priorities in the BCC’s drive to modernise the financial sector.

More...

-

Côte d’Ivoire appointed Djibril Ouattara as Minister of Digital Transition and Technological Innovation on Jan. 23, 2026.

-

Ouattara brings more than 20 years of telecom and ICT experience, including leadership roles at MTN and Canal+.

-

The government expects faster progress on digital administration, broadband rollout, cybersecurity, and 5G preparation.

Djibril Ouattara is now Côte d’Ivoire’s Minister of Digital Transition and Technological Innovation. The government appointed him on Friday, Jan. 23, as part of the Beugré Mambé II cabinet reshuffle. He succeeds Ibrahim Kalil Konaté, who had held the portfolio since October 2023.

A recognized figure in the telecom ecosystem, Ouattara brings more than two decades of experience in information and communication technologies. He previously led MTN Congo and later MTN Côte d’Ivoire, where he oversaw network modernization programs, digital infrastructure expansion, and service quality improvements in a highly competitive market.

His professional career also includes senior management roles at Canal+ Côte d’Ivoire and Etisalat Atlantique Togo, a West African telecommunications operator active in mobile, internet, and data services.

Trained at the Félix Houphouët-Boigny National Polytechnic Institute and holding an MBA from the MIT Sloan School of Management in the United States, Ouattara combines technical expertise, strategic management skills, and international exposure. This profile is expected to influence the execution of the state’s flagship digital projects.

As head of the Ministry of Digital Transition and Technological Innovation, Ouattara takes charge of several structural initiatives. Government priorities include accelerating the digitalization of public administration, improving the quality of digital public services, strengthening cybersecurity, and enhancing the protection of personal data.

The government also expects faster deployment of high-speed broadband infrastructure, preparation for the introduction of 5G, and expanded coverage in rural areas that remain poorly connected. Côte d’Ivoire already counts more than 58 million active mobile lines and reports an internet penetration rate exceeding 185%, according to official data.

The new minister will also need to structure an environment that supports local innovation. Authorities expect stronger support for startups, easier access to private investment, and expanded digital skills development for young people, as demand for technology talent continues to rise.

Djibril Ouattara’s appointment marks a new phase in Côte d’Ivoire’s digital governance. After a period focused on institutional structuring under his predecessor, the executive now seeks faster operational execution to convert digital ambitions into concrete, measurable, and sustainable results.

This article was initially published in French by Samira Njoya

Adapted in English by Ange J.A. de BERRY QUENUM

-

Paul-Hermann Alao founded Charts, a SaaS company that helps SMEs convert raw data into decision-ready insights.

-

Charts offers ready-to-use and customized BI reporting tools across core business functions.

-

Alao built his expertise through roles at NSIA Technologies, ASCENS Services, and Orange.

Paul-Hermann Alao is an Ivorian data consultant and business intelligence specialist. He founded and leads Charts, a company that focuses on data analysis and value creation to help organizations improve strategic decision-making.

Founded in 2022, Charts aims to support small and medium-sized enterprises in structuring and scaling their operations through improved data usage. The company designs and deploys tools based on data analytics and business intelligence, a set of methods that convert raw data into actionable insights for decision-makers.

Charts operates under a software-as-a-service model. The company delivers its tools and reports through an online platform. Clients select a reporting package from a predefined catalog. The platform then analyzes company-specific data and adapts the reports accordingly. At the end of the process, clients receive fully customized dashboards and reports.

Charts structures its offering around several ready-to-use reporting packages that cover key business functions. These packages include sales, finance, human resources, marketing and customer relationship management, project management, and IT service management. Each package allows companies to visualize performance clearly and track key performance indicators.

Beyond standardized products, the startup also provides tailored services. Charts designs and implements custom decision-support systems based on each organization’s specific needs. The company also delivers data integration and visualization services and provides training in Microsoft Power BI, a widely used tool for creating interactive reports, charts, and dashboards.

Paul-Hermann Alao graduated from Félix Houphouët-Boigny University in 2020 with a master’s degree in applied computer methods for business management (MIAGE). He began his professional career in 2017 as a software developer. He worked for technology company LIFILED and for Ivorian mobile banking firm S-Cash.

In 2020, Alao joined NSIA Technologies as a business intelligence engineer. In 2021, ASCENS Services appointed him head of BI support. Orange Côte d’Ivoire recruited him in 2022 as a Power BI consultant and promoted him in 2023 to technical lead for Power BI. From 2024 to 2025, he worked as a Power BI consultant at Orange Burkina Faso.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J. A. de BERRY QUENUM

-

Abderahmane Boucetta founded DataInsta, a Tokyo-based platform that links companies with vetted AI and data experts.

-

The platform allows firms to hire individual specialists or build full AI teams for complex projects.

-

Boucetta combines a deep scientific background with experience at firms including Amazon and PINKO.

Abderahmane Boucetta is an Algerian entrepreneur based in Tokyo, Japan. He founded and leads DataInsta, an online platform dedicated to connecting companies with specialists in artificial intelligence and data science.

Founded in Tokyo in 2024, DataInsta allows organizations to rapidly access qualified professionals to execute projects related to AI, data analytics, and adjacent technologies. Companies can recruit a single expert or assemble a complete project team depending on operational needs. The platform rigorously vets listed specialists to ensure a high level of technical competence and professional experience.

Beyond matchmaking, DataInsta offers a suite of tools and services branded InstaAgents. This offering allows clients to move beyond talent sourcing and deploy AI-based solutions more rapidly and in a structured manner.

The platform also provides a dedicated space for freelancers. Independent experts can create profiles, showcase skills, and connect directly with companies seeking targeted expertise. DataInsta aims to simplify access to AI and data expertise for businesses across sectors and company sizes.

Alongside DataInsta, Boucetta founded Boutique Boost, a digital marketing agency specializing in fashion brands, which he launched in 2019. His first entrepreneurial venture dates back to 2015 with Kaayn, a classified advertising platform that offered promotional and sales services to businesses and individuals.

Boucetta holds a degree in nuclear engineering obtained in 2011 from Ferhat Abbas University in Sétif, Algeria. He earned a master’s degree in materials science in 2013 from the University of Science and Technology of Oran Mohamed Boudiaf. He also completed a PhD in science and engineering in 2016 at Hirosaki University in Japan.

In the same year, Boucetta became head of research and development at SEAVAC, an international surface treatment services company. In 2020, he joined Italian fashion brand PINKO as a media buyer before moving to Amazon in 2021 as a marketing and advertising specialist. He later joined PlusOne, a mixed reality and artificial intelligence firm, as head of B2C growth marketing. From 2022 to 2023, he served as marketing lead at CoA Nexus, a technology company specializing in the recruitment of scientific researchers.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J. A. de BERRY QUENUM

- Egyptian startup Knot develops an AI-based online ticketing platform.

- The solution targets fraud, resale losses, and weak demand visibility.

- The platform has been tested with over 50 professional clients across three regions.

Knot is an online ticketing solution developed by Egyptian startup Knot Technologie. Based in the United Kingdom and Egypt, the company offers a platform designed to modernize traditional ticketing systems, which are often seen as inefficient, vulnerable to fraud, and opaque for event organizers. The startup was founded in 2025 by Ahmed Abdalla and Hussein ElBendak.

The current ticketing model for concerts, festivals, sports events, and other large gatherings has become a major source of economic leakage. Organizers struggle to assess real demand, a significant share of revenue is lost to unregulated secondary resale markets, and fans are frequently exposed to fraud or inflated prices.

Knot’s platform integrates artificial intelligence at several levels to address these structural challenges. It authenticates buyer identities, manages ticket distribution, and monitors demand in real time. These functions allow organizers to limit unauthorized transfers, recover revenue lost to secondary markets, and access detailed data on how events are marketed and consumed.

Following successful pilot programs with more than 50 professional clients in Europe, the Middle East, and North Africa, the company is positioning itself as a core infrastructure player for the next generation of digital events. The platform aims to deliver more secure, seamless, and data-driven experiences for organizers, venues, and audiences.

Adoni Conrad Quenum