• Liberia launches digital health insurance pilot for vulnerable groups

• MoU signed by LTA, NIR, and NICOL to oversee digital infrastructure

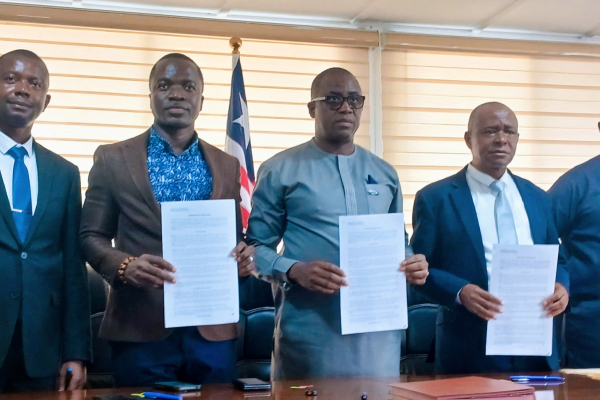

The Liberian government is embarking on a pilot program to expand health insurance access for its most vulnerable citizens by leveraging digital technologies. A memorandum of understanding to launch the initiative was signed on Tuesday, May 27, by the Liberia Telecommunications Authority (LTA), in partnership with the National Identification Registry (NIR) and the National Insurance Company of Liberia (NICOL).

The pilot project, set to begin enrollment on July 1, will initially target 5,000 individuals. "The MoU is a pilot project that will provide coverage for groups often underprivileged, including persons with disabilities, unemployed women and youth, pregnant women without support, and children engaged in street trading," the LTA stated in a Facebook post.

Under the agreement's terms, the collaboration will utilize digital identification systems provided by the NIR to ensure robust beneficiary verification and efficient data management. The LTA will oversee the technological infrastructure, guaranteeing secure communication and high-quality service delivery.

This initiative aligns with President Joseph Nyuma Boakai's pledge during his inaugural State of the Nation address to establish a national health insurance scheme, aiming to provide affordable healthcare to the country's most disadvantaged. Abdullah Kamara, acting chairman of the LTA, highlighted that studies in other nations demonstrate technology's potential as a catalyst in this domain. Liberia is also pursuing a broader digital transformation agenda.

Officials emphasize that this is currently a pilot program. A successful outcome will allow for comprehensive evaluation of enrollment procedures, service quality, and beneficiary feedback, with the goal of refining the system for a potential large-scale rollout.

However, limited digital penetration, particularly in Liberia's rural areas, could pose implementation challenges. Data from the International Telecommunication Union (ITU) indicates that internet penetration in Liberia stood at just 23.5% in 2023. The ITU also reported that 59% of Liberians owned a mobile phone, though it did not specify the number of smartphone users.

By Isaac K. Kassouwi,

Editing by Sèna D. B. de Sodji

-

Togo launches recruitment for "Digital 2025–2030" strategy consultant in bid to update its digital roadmap

-

New strategy targets digital inclusion, innovation, and economic growth

-

Focus areas include skills, cybersecurity, and tech startups

The Togolese government, through its Ministry of Digital Economy and Digital Transformation, has initiated a recruitment process to select a consultant to develop the nation's next digital strategy. Dubbed "Togo Digital 2025–2030," this new roadmap is designed to update the country's existing strategic framework from 2020, integrating the latest technological advancements and addressing emerging national priorities.

The forthcoming strategic document will outline a series of priority programs and projects aimed at strengthening the digitization of public services, boosting digital entrepreneurship, expanding access to digital services for marginalized populations, and fostering economic growth through innovation.

This initiative underscores Togo’s ambition to establish itself as a significant digital player in West Africa, capable of attracting investments in information and communication technologies. In 2022, the digital sector contributed approximately 4% to the national GDP, a growing figure, though still short of the long-term goal to reach 10% in the coming years.

Despite recent progress, significant challenges persist. In 2023, the Regulatory Authority for Electronic Communications and Posts (ARCEP) reported that internet penetration reached 84.72%, with over 7.8 million mobile subscribers in a population estimated at 8.9 million. However, the utilization of digital services remains uneven across different regions and social groups within the country.

The "Togo Digital 2025–2030" strategy is expected to focus on several key areas, including improving network coverage, developing local digital skills, strengthening cybersecurity measures, and bolstering the tech startup ecosystem.

The new strategy will also build upon the achievements of its predecessor. Notable progress from the previous framework includes the launch of the e-Gouv government platform, the establishment of digital service centers, and the adoption of crucial legislative texts on cybersecurity and personal data protection.

Through this refreshed roadmap, Togolese authorities aim to stimulate innovation, enhance technological sovereignty, and accelerate the country’s socio-economic transformation.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

-

Algeria and Russia sign cybersecurity MoU to strengthen digital defenses

-

Agreement includes research, tailored solutions, and training

-

Deal builds on 2023 Algeria-Russia strategic pact amid rising cyber threats

Proxylan SPA, an Algerian state-owned economic enterprise and a subsidiary of the Centre for Scientific and Technical Information Research (CERIST), signed a memorandum of understanding on Sunday, May 25, with Russian cybersecurity firm Positive Technologies. The agreement aims to bolster Algeria's information system protection capabilities as the North African nation accelerates its digitalization efforts across both public and private sectors.

"This is an extremely positive step for the development of cybersecurity programs to benefit Algerian businesses and institutions across all digital sectors," said Idris Si-ahmed, CEO of Proxylan. "Such a partnership illustrates the strong ties between Algeria and Russia."

Specifically, the memorandum outlines joint projects focused on research, the design of cybersecurity solutions tailored to the Algerian context, and the deployment of training programs to strengthen local expertise. The cooperation could also expand into other technological domains, including smart cities, e-government systems, and critical digital services, particularly in the banking sector.

This partnership follows a strategic agreement signed in 2023 between Algerian President Abdelmadjid Tebboune and Russian President Vladimir Putin, which sought to deepen bilateral relations in forward-looking sectors.

Through this initiative, Algeria aims to establish a sovereign digital infrastructure capable of supporting its ongoing digital transformation. In this context, cybersecurity has become a strategic pillar, especially as cyberattacks targeting institutions and businesses are on the rise. Data from Kaspersky indicates that over 70 million cyberattacks have targeted Algeria, partly driven by the increase in remote work and widespread connectivity. This situation underscores the critical need for customized solutions and specialized skills to protect vital infrastructure.

On the Russian side, Positive Technologies, founded in 2002 and listed on the Moscow Stock Exchange, is considered a leader in the cybersecurity sector. The company already serves sensitive entities in North Africa and the Middle East. The partnership with Algeria could enable Positive Technologies to expand its footprint in North Africa while addressing the increasing demand for cybersecurity solutions adapted to specific national requirements.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

He embodies a committed vision of technology in the service of youth. At the helm of an incubator he founded, he harnesses innovation to train, support, and showcase the country’s digital talents.

Robin Businde, a computer scientist and entrepreneur, is the co-founder and Chief Executive Officer of Nguvu Tech, a technology incubator established in 2020 that supports young individuals in their digital and creative ventures.

Nguvu Tech positions itself as a catalyst for innovation, providing a collaborative workspace and think tank for young Congolese developers and creatives. The incubator offers training and coaching across diverse fields including technology, education, entrepreneurship, art, and culture. Its overarching objective is to foster the emergence of local and inclusive digital solutions.

Among its services, Nguvu Tech specializes in graphic design, website and application development, and IT systems development. The incubator has also launched Openclasslearn, an e-learning platform designed to enable young people to acquire skills and pursue independent training online. Through these initiatives, Nguvu Tech aims to blend technological innovation with social impact and cultural enrichment.

Businde, who earned a bachelor's degree in computer science from Kigali Independent University in Rwanda in 2024, previously worked as a web developer for the Nigerian digital company 3D Africa Youths Organization between 2022 and 2023.

In 2024, his dedication was recognized at the EclosionHack Hackathon, where Nguvu Tech secured second place with its YETU MUSEUM project. This digital platform, designed for the exhibition and sale of artworks, incorporates artificial intelligence for the authentication of artistic creations—a project that uniquely converges technology, culture, and entrepreneurship.

By Melchior Koba,

Editing by Sèna D. B. de Sodji

He relies on local innovation to develop sustainable solutions and train digital talents. Through his initiatives, he is building a technology ecosystem rooted in Kribi, yet oriented toward the whole of Africa.

Jacques Bonjawo (photo) is a Cameroonian scientist and tech entrepreneur, committed for several years to digital transformation on the African continent. He is the founder and president of Ocean Innovation Center (OIC), a technology and entrepreneurship hub established in 2017 in Kribi, southern Cameroon.

The OIC operates as both an incubator and accelerator for startups, with a core mission to train young people in digital professions, foster the creation of high-potential technology companies, and generate employment opportunities within the sector. Beyond enterprise development, the center actively supports the social inclusion of women through technological innovation and assists local businesses in their digital transformation journeys.

The OIC offers collaborative workspaces designed to facilitate interaction and project development among entrepreneurs and investors. It currently provides approximately 20 online courses led by over 50 experts, having already trained more than 1,000 students in information technology, communication, and digitalization. The center boasts over 100 classrooms, ready to accommodate new learners.

In addition to his work with the OIC, Jacques Bonjawo chairs the Africa AI Forum, a pan-African platform dedicated to artificial intelligence. This initiative promotes an ethical and responsible approach to AI development on the continent, encouraging collaboration between African experts and international partners.

Bonjawo's extensive career in technology and finance began after earning a Master's degree in Finance and Investments from George Washington University in the United States in 1995. He started at PricewaterhouseCoopers in 1997 as a senior associate. The following year, he joined Microsoft, serving as a systems engineer and project manager before becoming a program manager in 2000. From 2004 to 2005, he oversaw the Microsoft IT Academy program.

In 2005, Bonjawo moved to Aditi Technologies, a software development company, as a program manager. More recently, he served as the Information Systems Manager at General Dynamics Information Technology, an American tech company, between 2019 and 2020. From 2019 until February 2025, he also chaired the Industry Board of Alumni Affairs at George Washington University.

By Melchior Koba,

Editing by Sèna D. B. de Sodji

• Madagascar launches e-Ariary pilot to modernize payments

• Designed for mobile phones and offline use, the currency supports everyday transactions

• The trial involves banks, public services, vendors, and more.

Madagascar's central bank launched a 10-month pilot program for its digital currency, the e-Ariary, on Friday, May 23, aiming to modernize the financial system and boost inclusion across the island nation. The initiative seeks to reduce reliance on physical cash, lower transaction costs, improve financial traceability, and expand access to financial services, particularly in rural areas.

"We hope that, by the end of this process, the use of banknotes will decline, as managing them is very expensive for the Central Bank," said Aivo Andrianarivelo, Governor of the Central Bank of Madagascar. He noted that the 100 Ariary note, equivalent to about $0.022, does not even cover its printing cost and has a short lifespan of approximately six months, requiring frequent replacement that Madagascar cannot undertake domestically.

The e-Ariary is designed for broad accessibility, usable via smartphones, basic mobile phones, and offline methods such as QR codes, smart cards, and point-of-sale terminals. Its primary applications will include everyday transactions like merchant payments, transportation fares, salary disbursements, and social transfers, with an emphasis on affordability for all users.

The digital currency is intended to complement, rather than replace, existing financial tools, particularly mobile money platforms, which will continue operating in parallel. In 2023, Madagascar recorded over 10 million mobile money accounts, significantly outnumbering the 3 million traditional bank accounts. Mobile money platforms facilitated nearly 342 million transactions totaling 38,161 billion Ariary (approximately $8.5 billion USD), underscoring the increasing prominence of digital services in the country's financial landscape.

The pilot program will rigorously test the technical infrastructure, transaction security, and priority use cases of the e-Ariary. It will also assess the digital currency’s broader socio-economic impact. A diverse group of stakeholders is participating in the trial, including commercial banks, microfinance institutions, state-run entities such as the utility company Jirama, market vendors, the Treasury, and the tax administration.

Central to the rollout will be extensive user awareness campaigns, as public understanding and confidence are considered vital for the successful adoption of the e-Ariary. If successful, the project is expected to usher in a new era of digital payments in Madagascar, establishing a more inclusive, transparent, and interoperable financial ecosystem while supporting ongoing efforts to formalize the economy.

By Samira Njoya,

Editing by Sèna D. B. de Sodji

Reducing the cost of mobile data in Ghana is a significant step toward promoting digital inclusion, economic participation, and national development. For many Ghanaians, affordable internet access is not just a convenience but a necessity for education, e-commerce, financial services, and civic engagement.

Minister for Communications, Digital Technology and Innovation, Samuel Nartey George, has assured Ghanaians that the cost of mobile data will drop by the end of 2025. He said the Ministry is working closely with telecommunications stakeholders to make data more affordable.

Speaking during the 2025 World Telecommunication and Information Society Day on May 19, held under the theme "Gender Equality in Digital Transformation," the Minister reaffirmed his commitment to delivering on this promise.

“To the young people and all citizens of this country, I promised that by the end of this year, we’ll see data prices drop — and I remain committed to it. We will deliver, but trust the process,” he said.

His remarks follow recent public criticism on social media, where concerns were raised that a committee he established in February has not yet led to a reduction in data tariffs. The Minister clarified that the committee’s mandate was not to cut prices directly but to develop a strategic plan.

He urged the public to be patient, pointing to ongoing efforts to correct market imbalances caused by what he described as “eight years of policy distortions” under the previous administration.

The assurance comes at a time when high data costs continue to be a major concern for consumers and digital entrepreneurs alike. High data costs remain a major barrier to inclusive digital development, particularly in remote areas where infrastructure is weaker and incomes are lower.

According to recent market surveillance by the Billing Verification Unit of the National Communications Authority (NCA) published April 2024, the average cost of 1GB of data per month in Ghana is GH₵6.30 (approximately $0.61). The study further revealed that the cheapest 1GB package costs as little as GH₵1.08 ($0.10), while the most expensive reaches GH₵16.77 ($1.62). This wide disparity in pricing highlights the inconsistencies in data affordability across different service providers and regions, reinforcing the need for regulatory oversight and market reforms.

Hikmatu Bilali

In Côte d'Ivoire, a startup has developed a particularly useful healthtech solution designed to help families access healthcare services.

IvoireHealth, a digital health solution developed by the Ivorian startup Socapharm, is streamlining access to healthcare services for families by enabling users to obtain medicines and other pharmaceutical products from partner pharmacies without cash payments. Founded in 2016 by Raymond Bleu Lainé and based in Abidjan, Socapharm aims to simplify health expense management.

The solution features an Android mobile application where users can create an account and receive a virtual card, valid for 24 months. This card is activated via a confirmation code sent by email or SMS. IvoireHealth operates as a reloadable health savings card, allowing individuals to cover medical expenses for family members or manage their own monthly medication budget. Cardholders can add beneficiaries as needed.

This functionality extends its utility to users living abroad, who can easily help their relatives pay for medications in Côte d'Ivoire. The card can be recharged through bank card or mobile money transactions. It is exclusively accepted at partner pharmacies, where users simply present a valid identification and their virtual card number. The application also facilitates sending credit to other users.

IvoireHealth is currently active in nine cities, boasting a network of over 50 partner pharmacies and more than 700 registered subscribers. By simplifying access to medications and offering streamlined management of health expenses, the IvoireHealth card plays a role in enhancing healthcare delivery for the population.

Socapharm, the innovative startup behind IvoireHealth, has been selected as one of the 45 startups participating in the 2025 edition of the Vivatech technology fair in Paris, France.

By Adoni Conrad Quenum,

Editing by Feriol Bewa

Registration is now open for Kids Tech Fest 2025, an international summit designed to introduce children aged 6–16 to the world of Artificial Intelligence (AI) through fun, hands-on learning experiences. The event is scheduled for Saturday, June 14, 2025, at the Landmark Event Center in Victoria Island, Lagos, and kicks off at 9:00 AM.

The event will feature specially curated sessions for kids, parents, and tutors — creating a dynamic space for young minds to explore the power of technology alongside the adults shaping their learning environment.

With a focus on accessibility, innovation, and interactive education, Kids Tech Fest 2025 aims to inspire the next generation of tech leaders and digital thinkers making AI learning engaging, age-appropriate, and community-driven.

Despite his medical background, he is dedicated to fostering a connected Africa that actively participates in the global digital revolution. He has launched numerous initiatives to bridge the gap between African communities and innovations in blockchain and financial technologies.

Felix Macharia (photo) is a Kenyan serial entrepreneur specializing in technology and blockchain innovation. He is the co-founder and CEO of Kotani Pay, a startup launched in 2019 alongside Samuel Kariuki, Brian Kimotho, and Jonathan Morgan.

Kotani Pay aims to make Web3 services accessible to African users, including those without smartphones or internet access. The startup offers a wallet accessible via SMS, enabling users to receive and withdraw funds through their mobile money accounts.

The technology converts foreign currencies into stablecoins and then into local currency, and vice versa, providing a simple, fast, and secure way for businesses to transfer money to Africa. Kotani Pay’s mission is “to serve as a frictionless bridge between digital assets and fiat for new digital currency and blockchain adopters in Africa,” according to the company.

Macharia’s involvement in blockchain extends beyond Kotani Pay. He serves as Chief Operating Officer at EOS Nairobi, a community of blockchain enthusiasts who believe the technology will be central to the future. He is also a research affiliate at the Institute for Blockchain Studies, where he explores practical applications of blockchain technology across Africa.

In efforts to formalize the blockchain sector, Macharia co-founded the African Digital Asset Framework (ADAF) in 2019. ADAF is an open-source protocol designed to establish transnational standards for digital assets on the continent. Two years earlier, he launched First Nexus Company, which develops technology solutions inspired by the Fourth Industrial Revolution.

Macharia’s path to technology entrepreneurship is unconventional. He graduated from the University of Nairobi with a bachelor’s degree in medical physiology in 2016 and earned a second degree in medicine and surgery in 2020.

By Melchior Koba,

Editing by Sèna D. B. de Sodji

More...

A visionary rooted in the heart of Burundi, he builds bridges between African youth and the technologies of tomorrow. Driven by the ambition to make digital technology a catalyst for sustainable transformation.

Chris Clement Igiraneza (photo) is a Burundian entrepreneur and program manager known for his leadership in digital innovation and education. He is the founder and president of KIT Hub, a digital innovation center launched in 2019 that provides training and support to young people and women in Burundi, helping them bring innovative projects to fruition.

KIT Hub focuses on training, raising awareness, and supporting beneficiaries in key digital fields including web and mobile development, artificial intelligence, data science, and cybersecurity. The organization prioritizes enhancing employability and nurturing an entrepreneurial mindset, especially within the technology sector.

In addition to his work with KIT Hub, Igiraneza is an ambassador for the international Women in Tech movement and has initiated several other projects in Burundi. In 2020, he founded InnoTech Impact, a company dedicated to developing innovative digital solutions.

Continuing his commitment to education and technology, Igiraneza established the African Sustainable Education Academy (ASEA) in 2024. ASEA aims to transform education across Africa by promoting digital skills, encouraging the use of emerging technologies, and integrating sustainable principles to tackle the continent’s educational and social challenges. He also serves as an ambassador for the Polytechnic University of Gitega.

Igiraneza holds a bachelor’s degree in electrical and health engineering from the Royal Institute of Technology in Sweden, earned in 2011. He furthered his education with a master’s degree in energy systems from the University of Gävle, Sweden, completed in 2014.

His professional experience spans healthcare and technology sectors. From 2007 to 2011, he worked as a caregiver at Attendo, a Swedish healthcare service provider. In 2012, he became head of the commercial department and project manager at Bioenergy Burundi, a bioenergy company. In 2016, he joined Mycronic, a firm specializing in electronic manufacturing equipment, where he worked as a research and development engineer focusing on ejection systems.

Chris Clement Igiraneza’s multifaceted career and initiatives underscore his dedication to advancing digital innovation, education, and sustainable development in Burundi and across Africa.

By Melchior Koba,

Editing by Sèna D. B. de Sodji

Ghana will showcase its digital progress at the World Expo 2025 in Osaka, Japan, led by Minister for Communication, Digital Technology and Innovations, Hon. Samuel Nartey George (MP). The focus will be on Ghana’s achievements in Information and Communication Technology (ICT) and its vision to become a digital innovation hub in Africa.

A sub-committee has been formed to guide preparations, with sector agencies developing content aligned with the Sustainable Development Goals (SDGs).

The Expo offers Ghana a global platform to attract investment, build partnerships, and promote its digital economy. The event started from April 13 and will go on till October 13, 2025.

• Algeria will launch “Chabab Tech” program to train youth in cloud computing, AI, cybersecurity, and IoT

• Rollout will start via four existing “Skills Centers” but implementation timeline unclear

The Algerian government is set to launch "Chabab Tech," a new program aimed at equipping young people with essential digital skills in areas such as cloud computing, cybersecurity, artificial intelligence, and the Internet of Things. This initiative marks the latest government effort to bolster digital proficiency among the nation's youth.

A framework agreement for the program was formally signed on Saturday, May 24, by Sid Ali Zerrouki, Minister of Post and Telecommunications, and Mostapha Hidaoui, Minister of Youth and head of the Higher Council for Youth.

"Through this initiative, the ambition is to train a generation of 'ambassadors of digital transformation,' exemplary in innovation and responsibility, and capable of actively contributing to the promotion of digital culture and the building of a more competent Algerian society prepared for the challenges of tomorrow," the Ministry of Post and Telecommunications stated in a press release.

"Chabab Tech" builds on previous government efforts to enhance digital literacy. In February, Algeria began rolling out "Skills Centers" to provide free digital training to young individuals. These centers are currently operational in the wilayas of Annaba, Sétif, Oran, and Chlef. The "Chabab Tech" program will initially be implemented through these existing centers, with plans for expansion to other wilayas to ensure equitable national coverage.

These initiatives align with Algeria's "Digital Algeria 2030" strategy, which identifies skills development as a cornerstone among its five main pillars. The strategy underscores the government's commitment to advancing the information society by integrating information and communication technologies (ICTs) across all economic sectors. The executive aims to cultivate a new generation of talent capable of leading the country's digital transformation. While Algeria is not part of Sub-Saharan Africa, the World Bank's estimate that nearly 230 million jobs in that region will require digital skills by 2030 highlights the broader importance of digital training for African nations' development.

However, the government's efforts to enhance youth digital capacities are still in their nascent stages. For instance, the "Skills Centers" currently cover only four of the country's 58 wilayas. Furthermore, a precise timeline for the full implementation of the "Chabab Tech" program remains unspecified, with authorities indicating that details regarding registration and participation will be announced at a later date.

By Isaac K. Kassouwi,

Editing by Sèna D. B. de Sodji

Africa is steadily embracing digital transformation. While most countries on the continent face challenges in fostering an environment that supports globally competitive, cutting-edge technological innovation, a growing number are proving to be exceptions.

Thirteen African countries have secured spots in the global Top 100 for best startup ecosystems, a report published Wednesday by research firm StartupBlink revealed.

The "Global Startup Ecosystem Index 2025" leverages 33 indicators, categorized across "quantity," "quality," and "business environment," to assess global startup landscapes. These indicators include the number of startups, co-working spaces, and accelerators; total investment in startups, the presence of unicorns, and R&D centers established by major international tech companies; and internet connection speed, internet cost, and R&D expenditure.

South Africa (52nd globally) maintained its lead as the continent's top startup ecosystem. Kenya (58th globally) ascended five places from its 2024 ranking to claim the second spot in Africa.

The rest of the African Top 10 includes Egypt (65th globally), Nigeria (66th), Cape Verde (75th), Ghana (81st), Tunisia (82nd), Namibia (85th), and Morocco (88th). Senegal (92nd globally) rounded out the top ten, followed by Uganda (94th), Rwanda (96th), and Somalia (100th).

Overall, ten African countries improved their rankings from the previous edition, while two (Senegal and Nigeria) experienced a drop. South Africa was the sole country to retain its position. Tunisia saw the largest jump, climbing eight places, followed by Ghana (+7), Kenya (+5), and Morocco (+4).

In its city-level ranking of 1,000 startup ecosystems worldwide, StartupBlink highlighted only Lagos (76th globally) and Cairo (90th globally) within the Top 100. Both cities were recognized for their vibrant ecosystems, which boast multiple unicorns, a high concentration of successful startups, and prominent incubators and accelerators.

Walid Kéfi