-

Mywagepay, founded in 2021, enables employees to access earned wages instantly through a digital platform.

-

The fintech integrates customizable credit products directly into SMEs’ services, helping firms boost revenues and customer acquisition.

-

CEO Beth Wambui Mwangi positions the platform as both a financial-wellbeing tool for employees and a growth accelerator for businesses.

Kenyan entrepreneur Beth Wambui Mwangi, founder and chief executive of Mywagepay, is reshaping how companies and employees access financial services. She is positioning her fintech as a tool that converts everyday financial challenges into opportunities for growth and inclusion.

Mwangi founded Mywagepay in 2021. The company develops a digital platform that creates or integrates credit products into business services. The system helps companies attract customers, increase revenues and accelerate growth.

The platform also gives workers quick access to wages already earned, allowing them to manage cash-flow needs without waiting for payday.

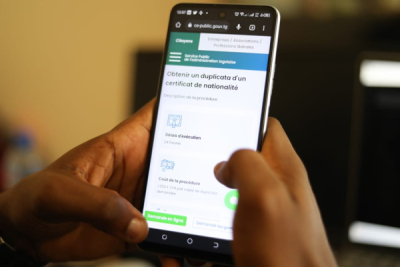

Mywagepay allows employees to receive a portion of their salary before the official payday through a secure mobile application. Users complete the process entirely online through a few simple steps, which ensures a smooth and fast experience.

Beyond wage advances, the company offers financial-wellbeing tools that help workers improve money management. These services include budgeting features, savings options and investment guidance. Mywagepay aims to encourage healthier and more sustainable financial habits across the workforce.

The fintech provides small and medium-sized enterprises with embedded credit solutions that integrate directly into their products or operations. Mywagepay designs these tools to help businesses offer financing to customers or employees without building their own financial infrastructure.

The company emphasizes personalized support to adapt each credit solution to the specific needs of individual SMEs.

Mwangi received a bachelor’s degree in education from Mount Kenya University in 2015. She also earned a master’s degree in business administration and management from the United States International University-Africa in 2022.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum