South African organization WomHub is accepting applications for the second edition of its Green Acceleration Programme, aimed at women entrepreneurs driving sustainable innovation. The programme supports projects in circular manufacturing, climate-friendly technologies and sustainability. Applications are open until February 18, 2026.

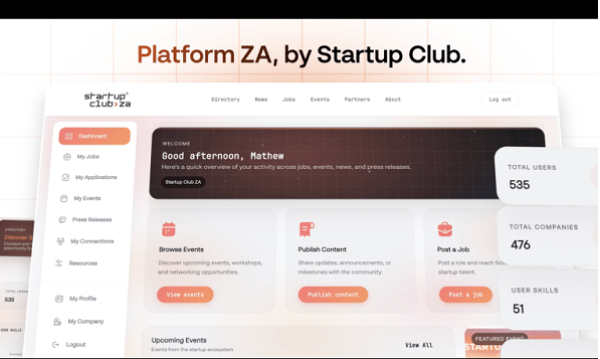

Startup Club ZA, a South African network of early-stage tech companies, is launching Platform ZA, a free nationwide platform designed to streamline access to jobs, resources and opportunities. The initiative aims to connect founders, investors and partners, making the tech ecosystem more inclusive and collaborative. Open to all, the platform will continue to evolve based on feedback from the local tech community.

- CNSS to launch pilot of electronic health claim form in Kenitra

- Nationwide rollout planned between April and June 2026

- Reform aims to cut delays, reduce costs, and secure data flows

Morocco will launch the pilot phase of its electronic health claim form (FSE) in Kenitra by the end of March 2026, according to the National Social Security Fund (CNSS). The initiative marks the first step toward fully digital processing of medical claims, with a gradual nationwide rollout planned between April and June, subject to technical and regulatory validation.

The electronic system allows doctors, pharmacists, and other health professionals to transmit consultation, examination, and prescription data directly to health insurance providers without using paper forms.

Under the new process, each prescriber issues prescriptions through dedicated software or the CNSS FSE portal. Patients receive a prescription with a QR code and a unique FSE number. When services are delivered, providers scan the QR code to access the file and record completed procedures, ensuring real-time and secure tracking.

The reform forms part of a broader effort to digitalize Morocco’s healthcare system. The objective is to improve care coordination, shorten reimbursement timelines, and enhance the reliability of administrative data.

It complements other initiatives, including the Shared Medical Record (DMP) and the planned digital health card, both designed to centralize health data, simplify access to care, and generate savings for insurance funds.

Beyond administrative simplification, the FSE carries strategic weight. Healthcare accounts for about 6% of Morocco’s GDP, compared with around 10% in developed economies. The sector faces high administrative costs and reimbursement delays that affect both insured patients and providers.

The electronic claim system is expected to improve data accuracy, reduce disputes linked to paper files, and lower management costs, currently estimated at several hundred million dirhams per year for health insurance funds. It also aims to modernize oversight and performance monitoring of the national health system.

Samira Njoya

- Egypt launches “Egypt Innovate” national digital platform

- Platform connects 780 entities and 81,000 users

- Aims to boost funding access, innovation ecosystem coordination

On Thursday, February 12, Egypt unveiled "Egypt Innovate" in Cairo, the country's first fully integrated national digital platform for innovation and entrepreneurship. The launch took place during the AI Everything Middle East & Africa exhibition at the Egypt International Exhibition Center, with delegations from over 30 countries in attendance.

Developed and operated by a consortium led by Entlaq, alongside partners Robusta and Kamelizer, the platform establishes a public-private alliance designed to unite startups, investors, universities, research centers, and public institutions within a single digital ecosystem.

Ahmed ElZaher, CEO of ITIDA, explained that the platform supports the national strategy to build a knowledge-based economy by using data and advanced technologies to drive sustainable growth. It aims to facilitate funding access through a dynamic database that showcases young companies' business models and value propositions, while elevating Egypt's entrepreneurial ecosystem on regional and international stages.

The platform places particular emphasis on Arabic-language content, which authorities view as essential for digital inclusion and local skills development. Officials believe that providing technical and entrepreneurial resources in founders' native language broadens access to opportunities and reinforces Egypt's standing as a regional innovation hub.

Following its pilot phase, Egypt Innovate now connects 780 entities, including startups, investors, incubators, and research centers, and hosts over 3,700 pieces of sector-specific content. The community comprises more than 81,000 registered users, supported by a network of expert advisors.

The platform's functionality centers on data-driven and AI-powered tools: a digital assistant, an interactive ecosystem map, an automated matching system linking startups with investors, and a learning center offering training, mentorship, and entrepreneurial simulations. A self-verification mechanism, where entities directly update their own information, helps ensure data reliability and accuracy.

Egypt Innovate joins multiple existing initiatives aimed at structuring and financing the country's entrepreneurial ecosystem, which ranks among the region's most dynamic. In 2025, Egyptian startups raised nearly $614 million in venture capital and debt financing, according to the Ministry of Planning, Economic Development and International Cooperation. This figure reflects growing investor confidence. Within this context, Egypt Innovate seeks to strengthen stakeholder coordination and streamline funding access in an increasingly mature market.

Samira Njoya

As companies face rising customer expectations and increasing pressure to deliver faster, more personalized support, Egyptian startup Tactful AI is positioning itself as a next-generation customer experience platform powered by artificial intelligence.

Tactful AI, a digital solution from an Egyptian startup, unifies customer interactions across voice calls, web messaging, social media, and live chat into a single interface. This gives agents a complete view of customer exchanges, streamlines response times, and reduces wait through automation that preserves the human touch.

Founded in 2016 by Mohamed El Masry (pictured), Mohammad Hassan, and Sherif Khairallah, the startup recently announced $1 million in funding to advance its technology and fuel expansion.

"Over the past year, we made a conscious decision to prioritise depth over speed, focusing on product–market fit and working closely with enterprise customers to solve real CX challenges," said El Masry.

At the platform's core is an intelligent routing engine that matches each inquiry to the right agent using customizable rules and behavior-based models. This optimizes customer satisfaction while boosting support team productivity by freeing agents for high-value interactions.

Tactful also deploys multilingual conversational agents that handle routine inquiries 24/7, escalating to human advisors when needed. Through a visual automation studio, businesses can configure complex workflows without technical expertise.

The solution integrates seamlessly with over 1,000 business applications, including CRM, ERP, and CMS platforms, embedding customer interactions into existing systems without data loss or disruption.

This positions Tactful as a next-generation alternative to legacy solutions: a smarter, more flexible, AI-powered platform that helps businesses of all sizes modernize their customer experience.

Adoni Conrad Quenum

Launched in 2024 by Nigerian startup New Generation Tech Ventures, 9jawap is positioning itself as a homegrown alternative to global social networks.

9jawap is a digital platform developed by Nigerian startup New Generation Tech Ventures to offer a locally-tailored alternative to mainstream social networks. Founded in 2024 by Ezekiel Adewunmi, the platform gives users a space to post content, engage with others, sell products, and monetize their presence, all from their mobile devices.

Available on iOS and Android, 9jawap takes a mobile-first approach with tools for creating diverse content types including posts, photos, videos, and blogs. Users can also create groups and events, while earning through tipping and subscription systems that let them monetize their publications directly.

The platform differentiates itself from global competitors by removing what it sees as opaque algorithms and monetization barriers that often restrict creators. It includes an integrated marketplace where users can sell goods or services directly to their community without leaving the platform.

"We identified a gap in locally relevant social platforms that reflect African user behaviour and incentives. Global social networks prioritise ads and subscriptions, while many African users value practical, immediate utility. Competitors include mainstream social platforms and local community apps, but most do not directly incentivise participation in a way that fits local realities," Ezekiel Adewunmi told Disrupt Africa.

To support creators, 9jawap offers "Leader" membership plans with progressive benefits, from increased visibility to expanded sales and branding tools. These features help users build a professional presence while remaining optimized for low-data networks, addressing a critical need in African markets where connectivity can be limited.

Adoni Conrad Quenum

-

Mali now allows citizens to request criminal records and nationality certificates online.

-

The government launched two dedicated portals developed by AGETIC and the Ministry of Justice.

-

Mali ranks 173rd out of 193 countries in the UN’s 2024 e-Government Development Index.

Alhamdou Ag Ilyène, Minister of Communication, Digital Economy and Administrative Modernization, and Mamoudou Kassogué, Minister of Justice and Human Rights, officially launched the online issuance system on February 10. The reform allows citizens to submit applications and receive both documents through digital platforms without physical travel.

Authorities made the services available via two separate government portals: casiercasier.gouv.ml for criminal records and nationalitenationalite.gouv.ml for nationality certificates. Users can file requests and track application progress online.

The government developed the platform through collaboration between the Ministry in charge of Digital Affairs and Agence des technologies de l’information et de la communication (AGETIC), in partnership with the Ministry of Justice.

The initiative forms part of a broader digital rollout across government services. Authorities recently introduced additional digital solutions at the Prime Minister’s Office in the transport, health and territorial administration sectors. These measures complement existing systems, including online services for Malians in the diaspora seeking administrative documents, computerized judicial case management tools and ongoing consular service digitization projects.

However, Mali continues to face structural challenges in digital governance. According to the United Nations 2024 e-Government Development Index, the country scored 0.3005 out of 1, ranking 173rd among 193 states. The score remains below the African average of 0.4247, reflecting progress in online service delivery but persistent gaps in infrastructure and digital skills.

The dematerialization of criminal record and nationality certificate services expands Mali’s online public service portfolio. Yet authorities must address cybersecurity risks, personal data protection concerns and limited digital adoption, particularly in rural areas where connectivity and access remain uneven.

This article was initially published in French by Samira Njoya

Adapted in English by Ange J.A de Berry Quenum

-

Senegal’s National Police launched an online cybercrime reporting platform on February 12.

-

The platform enables secure pre-reporting of a wide range of digital offenses, with a focus on child protection.

-

Interpol estimates cybercrime losses in Africa exceeded $3 billion between 2019 and 2025.

Senegal’s General Directorate of the National Police (DGPN) officially launched a cybercrime reporting platform on Thursday, February 12, as authorities seek to respond to rising digital offenses.

Authorities made the platform accessible via signalementcyber.dgpn.sn. The initiative aims to facilitate the reporting and monitoring of cybercrime cases, which continue to increase alongside the rapid adoption of mobile telephony, internet services and mobile money across Africa. Authorities placed particular emphasis on protecting children online.

The platform allows users to securely and confidentially report a broad range of digital offenses. Users can report fraud, unauthorized content distribution, dissemination of obscene material, online harassment, defamation, digital extortion, child sexual abuse material, hate content, unlawful system intrusion, account hacking, identity theft, SIM swap fraud, romance scams, fake investment schemes, mobile money scams, fraudulent access to mobile money accounts, fake online recruitment, fraudulent payments and fake online sales.

“The system offers victims the possibility of making an online pre-report before formally filing a complaint with the competent services, thereby facilitating access to justice and the rapid handling of cases. Developed internally by engineers of the national police, the online cybercrime reporting platform constitutes a major lever for public sector reform and the strengthening of community policing,” Deputy Director of the Judicial Police Moustapha Diouf said, as quoted by local media outlet SocialNetLink.

Authorities launched the platform amid accelerated digital transformation across Africa, where telecom, internet and social media adoption continue to expand. However, this expansion has coincided with a rise in online offenses, particularly financial scams and personal data breaches. Interpol estimated that cybersecurity incidents across the continent caused financial losses exceeding $3 billion between 2019 and 2025.

In Senegal, authorities framed the initiative as part of a broader cybersecurity strengthening strategy, which policymakers consider essential to fully leverage digital transformation, according to the International Telecommunication Union (ITU). In its 2024 Global Cybersecurity Index, the ITU ranked Senegal in Tier 3 and assessed its regulatory framework, technical measures and cooperation mechanisms as satisfactory. However, the organization identified remaining gaps in capacity development and organizational measures.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange J.A de Berry Quenum

-

Mehdi L. Sariak founded Docteur 360 in 2022 to streamline access to medical appointments in Algeria.

-

The platform connects patients with doctors nationwide and automates appointment management.

-

Sariak previously held senior roles at Société Générale Algérie before launching his healthtech venture.

Algerian entrepreneur Mehdi L. Sariak is leveraging technology to improve access to healthcare in Algeria by simplifying how patients book medical appointments.

Mehdi L. Sariak founded Docteur 360 in 2022 as an online platform that allows patients to quickly find a doctor and book appointments directly. He positioned the platform as a health service with a strong human dimension that combines medical culture with personalized support. The company aims to modernize the patient journey and make access to care more fluid, faster and more equitable by removing common booking obstacles.

The platform allows each patient to search for a doctor, compare available profiles and select the specialist who best fits their needs. Direct access to practitioners’ profiles strengthens transparency and builds trust at the time of booking. Docteur 360 focuses on simplifying the patient pathway and reducing waiting times for appointments.

The company offers a broad range of services designed for both patients and healthcare professionals. The platform provides a nationwide directory of practitioners across Algeria, automates recurring tasks such as appointment management, reminders and notifications, and simplifies follow-up from booking to consultation. These features reduce delays and limit missed appointments.

Sariak holds a bachelor’s degree in business administration and management obtained in 2006 from Collège de Sherbrooke. He also earned a master’s degree in banking, financial, corporate and securities law in 2009 from IAE Paris.

He began his professional career in 2006 at Société Générale Algérie, where he successively served as credit analyst, senior banker, branch manager in Algiers and deputy director in charge of large corporates. Between 2016 and 2020, he chaired Oxonto, a French company, now closed, that specialized in wholesale trade of computers, IT equipment and software.

Sariak is positioning Docteur 360 as part of Algeria’s broader digital transformation in healthcare, where entrepreneurs are using technology to address structural inefficiencies in patient access and care coordination.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de Berry Quenum

- Ahmed Hormal founded Keema in 2020 to deliver custom AI applications and cloud infrastructure to organizations.

- Keema renewed its Qualiopi certification in 2025, underscoring the quality of its AI-focused training programs.

- Hormal concurrently serves as Head of Engineering at Yakeey while building a career across Capgemini, ING Direct France, Yomoni, SNCF Connect & Tech, Sonepar and BforBank.

Moroccan entrepreneur and computer scientist Ahmed Hormal is positioning his company Keema as a provider of practical and accessible artificial intelligence solutions for organizations seeking to accelerate their digital transformation.

Hormal founded Keema in 2020 to support organizations that want to fully leverage digital technologies and artificial intelligence. The company designs tailor-made applications and deploys stable cloud-based technical environments.

Keema builds infrastructure that supports business growth and ensures uninterrupted operations. The company provides performance-oriented tools that allow teams to rely on resilient systems in their day-to-day activities. Hormal’s strategy centers on creating solid digital foundations before layering advanced AI capabilities.

Keema integrates artificial intelligence directly into clients’ digital products and operational tools. The company also advises organizations that seek to understand how AI can transform their business models and internal processes.

Its training programs present a structured view of AI opportunities while highlighting the technology’s limitations and operational challenges in corporate environments. Keema provides specific training on intelligent assistants built on so-called “generative” AI systems.

The training targets software engineers, technical managers and professionals interested in emerging AI approaches. The programs teach participants how to design intelligent assistants that integrate into existing systems. Keema also offers a dedicated track focused on application quality.

In 2025, Keema renewed its Qualiopi certification for training activities, reinforcing the rigor and credibility of its educational processes.

Alongside his work at Keema, Hormal serves as Head of Engineering at Yakeey, a Moroccan digital real estate company. Previously, he co-founded Biilz in 2022, a digital receipt aggregation platform, and served as Chief Technology Officer until 2024.

Hormal holds a bachelor’s degree in mathematics and computer science from Hassan II University Mohammedia, obtained in 2011. He earned a master’s degree in computer engineering in 2013 from Blaise Pascal University (Clermont-II).

He began his professional career in France in 2013 as a software developer. He worked at Capgemini, at financial firms ING Direct France and Yomoni, and at technology company SNCF Connect & Tech. In 2019, he became Technical Manager at Muvraline. He then assumed a similar role in 2020 at Sonepar, a distributor of electrical equipment and solutions. Between 2023 and 2025, he served as Technical Manager at BforBank, a French online bank.

Melchior Koba

More...

Interswitch has launched Season 8 of InterswitchSPAK, a national STEM competition in Nigeria. The scholarship prize pool exceeds 40 million Naira (approximately $30,000) and includes five-year academic grants, laptops for the nine finalists, and cash prizes for their teachers. Parents and guardians can register students by May 24, 2026.

KPMG has opened applications for the 2026 'Female Founders in Africa' competition, targeting women entrepreneurs leading high-potential startups across the continent. The program spans various sectors, including tech, healthcare, and agriculture. Participants can benefit from mentorship, increased visibility, and networking opportunities with investors. Applications are open through Saturday, February 28.

WhatsApp is rolling out voice and video calls directly to its web browser, eliminating the need for a desktop app. The feature launches with one-on-one calls, while group calls, call links, and scheduled calls are set to arrive soon. All conversations remain protected by end-to-end encryption, and screen sharing is also available, which will be particularly useful for Linux users.

- Zimbabwe, UNESCO discuss AI and digital governance cooperation

- Talks align with Smart Zimbabwe 2030 digital plan

- Zimbabwe ranks 149th in 2024 UN e-government index

Zimbabwe is exploring new areas of cooperation with UNESCO in artificial intelligence, digital transformation and digital governance following a meeting on Tuesday, Feb. 10, between ICT Minister Tatenda Mavetera (pictured, center) and Tawfik Jelassi, UNESCO's assistant director-general for communication and information.

"Our discussions covered artificial intelligence and national policy frameworks, digital transformation in the public sector, the regulation and governance of digital platforms, and the development of digital skills for both youth and adults," Jelassi said.

Mavetera highlighted the transformative role of AI and emerging technologies in government operations and national development, stressing the importance of research, innovation and collaboration with academic and technical institutions to foster sustainable technological solutions.

The engagement aligns with Zimbabwe's digital transformation ambitions. Through the "Smart Zimbabwe 2030 Master Plan," the government aims to fully integrate ICTs across society and all economic sectors to drive rapid and sustainable socio-economic development. The plan references an International Telecommunication Union study showing that a 10% increase in a country's digitalization score leads to a 0.75% rise in GDP per capita.

Artificial intelligence is positioned as a key catalyst in this strategy, with potential to boost efficiency, drive innovation and improve services across sectors from agriculture and health to education and public administration. The recent UNESCO collaboration has focused on AI, with the organization helping to develop Zimbabwe's national strategy and assess the country's readiness.

However, an assessment report published in July 2025 notes that to fully harness AI's potential, Zimbabwe must establish a comprehensive national strategy with a plan to address key challenges including foreign dominance and cultural imposition, loss of human autonomy, financing constraints, technical infrastructure limitations, and research capacity gaps exacerbated by brain drain.

Zimbabwe currently ranks 149th out of 193 countries in the United Nations' 2024 E-Government Development Index, with a score of 0.4481 out of 1, below the global average of 0.6382.

Isaac K. Kassouwi