Founded in 2022, the solution provides tailored loans to help businesses grow and thrive.

Egyptian fintech solution Qardy offers loans to micro, small, and medium-sized enterprises (MSMEs) and startups. Founded in 2022 by Abdel Aziz Abdel Nabi and based in Giza, it provides loans through a web platform, offering various options including traditional loans and supply chain financing to manage working capital. Loan amounts range from 1,000 to 242,000 Egyptian pounds (about $20 to $4,800).

Currently, Qardy has no mobile app. Users access services directly through the web platform. It assesses MSMEs based on annual revenue, creditworthiness, and stability. Loan approval can take up to 18 days, depending on application complexity. Qardy can provide multiple loan types to a single business, tailoring offerings based on individual needs.

In August 2024, it raised an undisclosed amount of funding to fuel growth.

“The support and trust of our investors have been instrumental in driving our growth and enabling us to expand our reach and impact in the market. This investment will allow us to further enhance our services, as well as accelerate our plans for expansion in Saudi Arabia and the region,” said Tamer El-Manasterly, Qardy’s chief operating officer.

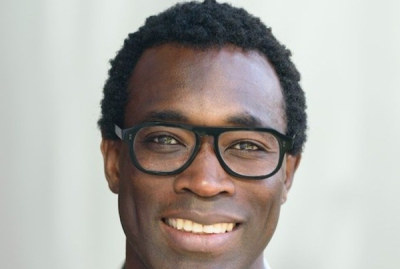

Adoni Conrad Quenum