- WattWallet enables instant purchases of prepaid electricity tokens through a digital platform

- The startup reports more than 500,000 users across several African markets since its 2025 launch

- About 7 million South Africans rely on prepaid electricity, with limited access to regulated advance options

Prepaid electricity remains the dominant model for household energy access in several African countries. To meet this daily need, WattWallet positions itself as a digital platform dedicated to the instant purchase of electricity tokens.

WattWallet operates as a digital solution developed by a South African startup. The platform allows consumers to buy prepaid electricity tokens in a few clicks. Keagan and Zhaida Juries launched the service in 2025, and the startup has already reached more than 500,000 users across the West African sub-region, according to the company.

“Our mission is to ensure that households are never left without electricity because of the timing of their income and to reward responsible spending,” Keagan Juries said.

To access the service, users enter their meter number and the desired amount, after which the system instantly generates a valid token to recharge household meters. This process eliminates long queues and administrative hurdles commonly associated with traditional purchasing channels. The service operates 24 hours a day, seven days a week, works across all device types, and integrates automatic meter number validation alongside multiple payment options.

The startup also relies on a physical agent network of more than 10,000 operators, which allows users to convert cash into digital credit. The platform partners with major regional electricity utilities, including operators in Mali, Ivory Coast, Senegal, Ghana, Niger, and Benin, to ensure token reliability and validity.

Beyond instant purchases, WattWallet provides detailed transaction history tracking and a rewards program that encourages frequent users to optimize their spending. In addition to prepaid electricity credits, the startup also offers a “Buy Now, Pay Later” service.

Keagan Juries said “about 7 million South Africans depend on prepaid electricity and often run out before payday. There is currently no structured and regulated electricity advance solution on the market.” He added: “Existing alternatives remain informal, such as borrowing money, using high-interest cash advances, turning to loan sharks, or going without electricity. No financial services provider or utility currently offers large-scale, flat-rate electricity advances in compliance with regulations, which creates a clear gap.”

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum

- Essymart provides digital access to inputs, training, and markets for smallholder farmers

- The startup reached about 4,000 farmers in 2024, up roughly 20% year on year

- The platform operates via web, SMS, voice calls, and USSD to reach non-smartphone users

Essymart operates as an agritech solution developed by a Ugandan startup. The company aims to transform the livelihoods of smallholder farmers by providing digital solutions that improve yields, incomes, and access to markets.

The startup operates from Mayuge, about 120 kilometers from the capital Kampala. Elvis Kadhama, Viola Nakadama, and Stella Doreen Namulondo launched the company in 2022.

At the core of Essymart’s offering sits a digital platform accessible through a web application, SMS, voice calls, and USSD codes. The system allows farmers, including those without smartphones, to purchase agricultural inputs such as seeds, fertilizers, and pesticides. The platform also delivers personalized agronomic advice and provides access to training and market services.

The startup directly targets several constraints that limit agricultural productivity in Africa, including poor access to reliable inputs, low adoption of modern farming practices, and weak access to profitable markets. Through its integrated approach, Essymart helps farmers raise yields while reducing direct input costs.

“In 2024, we supported about 4,000 farmers, representing an increase of around 20% compared with the previous year, and we were close to our 2030 target of supporting 20,000 families,” Elvis Kadhama said. He added: “The user base combines direct customers receiving full services and farmers reached through partnerships with public and private actors, which reflects both demand for our integrated inputs, training, and market linkages, and the expansion of our distribution network.”

By relying on simple technologies such as USSD and SMS, the company ensures service access even in remote areas where internet connectivity remains limited. Essymart positions itself as both a digital marketplace for agricultural inputs and a service ecosystem that links farmers with certified suppliers, agronomic experts, and commercial outlets.

To date, the company has reached several thousand smallholder farmers in eastern Uganda and plans to expand into other African markets.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum

- FastClaim digitizes roadside assistance, claims tracking, and vehicle inspections through a mobile app.

- The startup launched operations in Zambia last week after expanding beyond Nigeria.

- The platform uses remote photo and video inspections to reduce processing times and fraud.

Okugo Uche Ayodele is a Nigerian entrepreneur and a seasoned insurance professional. He serves as founder and chief executive officer of FastClaim, a technology startup specializing in motor insurance management.

Founded in 2022, FastClaim operates as a mobile application that allows users to request roadside assistance, manage administrative documents, and track insurance claims directly from their phones. The application removes long waiting times and unnecessary travel. The solution serves both policyholders and insurance companies and aims to shorten processing timelines while limiting abusive claims.

FastClaim centralizes multiple automotive and insurance-related services within a single platform. In a few steps, users can request towing services from any location to receive rapid assistance during breakdowns. The application also simplifies vehicle ownership transfers by reducing paperwork and administrative bottlenecks.

The platform also enables users to renew driving licenses online without visiting physical offices. In addition, the system accelerates vehicle compliance by enabling rapid renewal of mandatory documents.

A core feature of FastClaim relies on remote vehicle inspection. Using a smartphone, users capture photos or videos that the application analyzes to identify damage. This process eliminates on-site inspection delays and accelerates the transition from claim submission to processing. The system also reduces exaggerated or fraudulent claims by verifying damage through visual evidence submitted via the application.

Last week, the startup announced the launch of its operations in Zambia. Industry bodies previously named the platform the most promising insurance application in 2023 and the best Nigerian insurance application in 2025.

Alongside his entrepreneurial activities, Okugo Uche Ayodele serves as a board member of Teens TV Africa in Nigeria. He holds a master’s degree in marketing obtained in 2003 from the University of Calabar. He began his professional career in 1998 at International Merchant Bank, where he worked as credit and marketing manager.

In 2000, he became marketing manager at Sovereign Trust Insurance. In 2004, he assumed the role of branch manager at Consolidated Hallmark Insurance in Port Harcourt before joining Cornerstone Insurance in 2005 as marketing manager. Between 2006 and 2020, he worked at International Energy Insurance, where he successively held regional director and managing director roles. Between 2023 and 2024, he also served as advisory director at JAVAT 365, a US-based content-sharing technology company.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

The EridanSeed SME Venture Scale 2026 program is open to high-growth Nigerian small and medium-sized businesses looking to scale. It offers $25,000 in funding, mentorship and networking, and aims to help founders build new sources of revenue. Open to all sectors, the program combines capital with operational support. Applications close on Jan. 31, 2026.

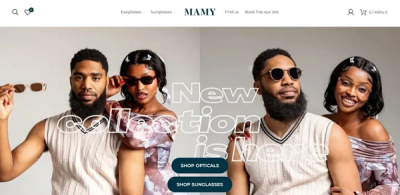

Mamy Eyewear, a Kenyan AI-driven vision testing startup, has received backing from Japan’s Ikemori Venture Support. The investment will help the company expand in East Africa and improve access to optical services.

NALA, a pan-African startup, has partnered with UK payment infrastructure provider Noah to launch a cross-border settlement network linking Africa and Asia. Through its Rafiki platform, NALA allows businesses to receive payments in stablecoins and convert them into local currency immediately, cutting fees and delays in emerging-market payments.

- Guinea quadrupled backbone capacity to 200 Gbps and deployed nearly 12,000 km of fiber

- Digital reforms generated more than $26.9 million in budget savings in public administration

- Telecoms now account for 4.4% of GDP and attracted about $220 million in investment

In 2025, Guinea intensified initiatives under its digital transformation strategy. Authorities accelerated infrastructure deployment, strengthened state digitalization, and modernized telecom sector governance. The Minister of Posts, Telecommunications and Digital Economy, Rose Pola Pricemou, presented these developments during a sector review.

On infrastructure, Guinea quadrupled national backbone capacity to 200 Gbps from 50 Gbps. Authorities deployed nearly 12,000 kilometers of fiber optic cable to connect all administrative regions. The country also commissioned its first Tier 3–certified national data center, operationalized an Internet Exchange Point, and secured sovereign management of the .gn country-code domain, which strengthened network security and resilience.

Public administration digitalization also gained momentum. In 2025, authorities deployed 39 public service applications and fully digitized several key procedures, including passport issuance, through a unified digital portal. The TELEMO platform fully digitized public procurement, improving transparency and traceability. At the same time, the FUGAS unified civil service registry streamlined workforce management and generated budget savings exceeding 233 billion Guinean francs, or about $26.9 million.

Education and digital inclusion programs expanded in parallel. Authorities trained more than 10,000 people in digital skills. The Univ Connect project interconnected several universities and reached more than 80,000 students, lecturers, and researchers. In primary education, the GIGA program connected 585 schools to the internet, with authorities targeting 2,200 schools by 2026, or nearly 900,000 beneficiaries. Authorities also expanded regional digital hubs, with 20 additional centers under construction. The government invested more than $4 million to support tech entrepreneurship and stimulate local innovation.

These reforms delivered economic and strategic returns. The telecommunications sector now accounts for 4.4% of Guinea’s gross domestic product and attracted about $220 million in investment. At the same time, mobile internet costs fell by about 25%.

In 2026, authorities will prioritize extending connectivity to underserved areas, with more than 600 identified white zones. The government will also expand digital use in education and public services and strengthen cybersecurity and local data hosting. However, challenges remain, including universal access, infrastructure maintenance, and continuous skills training to support sustainable nationwide adoption.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

The AgriTech4Tunisia Innovation Challenge 2026 is accepting submissions from startups, researchers and entrepreneurs seeking to address Tunisia’s agricultural challenges, including water scarcity and climate risks. Backed by the Accelerate for Impact platform, the program offers a bootcamp, technical support and access to investors. Applications are open until Feb. 12, 2026.

The Founders Smith Accelerator Program 2026 is accepting applications from African startups.

The program offers mentorship, strategic guidance and access to investors, aimed at strengthening business models and supporting growth. Open to startups across sectors, it helps founders prepare for regional and international markets. Applications close on Jan. 30, 2026.

Carbon AI will host the AI in Action conference in Lagos on Jan. 22, 2026, centering on the theme "Driving Productivity, Innovation, and Sustainability—Building the Future in AI Together."

The event will bring together founders, engineers, and experts to explore practical applications of artificial intelligence, including generative models. With a focus on real-world impact, the gathering aims to promote the ethical and collaborative adoption of AI across Africa.

More...

- Tether and the UN Office on Drugs and Crime launched a partnership to boost cybersecurity and public education on digital assets in Africa.

- The initiative includes youth cybersecurity training in Senegal and support for anti-trafficking organizations across several African countries.

- Interpol recently uncovered about $260 million in illicit crypto and fiat funds linked to financial crime in Africa.

Tether, a global cryptocurrency company, announced on Friday, January 9, 2026, a collaboration with the United Nations Office on Drugs and Crime to strengthen cybersecurity and public education around digital assets in Africa.

The initiative comes as cryptocurrency adoption accelerates across the continent, increasing user exposure to fraud and financial crime.

Tether and the United Nations Join Forces to Safeguard Africa’s Digital Economy

— Tether (@tether) January 9, 2026

Learn more: https://t.co/qKyZLH8j63

“Through this collaboration, we can advance digital inclusion, strengthen digital skills and youth employability, promote secure and transparent digital ecosystems, and harness innovation to prevent organized crime while fostering sustainable and inclusive economic growth,” said Sylvie Bertrand, UNODC Regional Representative for West and Central Africa.

The partnership includes several targeted projects.

In Senegal, the initiative focuses on youth cybersecurity education. The program provides multi-phase training that includes sessions conducted with the Plan B Foundation, which emerged from a collaboration between Tether and the city of Lugano. The initiative also offers coaching and mentoring to support the development of secure digital projects.

At the continental level, the program also supports civil society organizations that assist victims of human trafficking in countries including Nigeria, the Democratic Republic of Congo, Malawi, Ethiopia, and Uganda. At the same time, the initiative strengthens awareness of online financial risks.

The alliance takes shape amid rapid growth in digital asset use across Africa.

The continent now ranks as the world’s third-fastest-growing cryptocurrency market. However, this expansion also brings rising vulnerabilities.

A recent Interpol-coordinated operation uncovered nearly $260 million in cryptocurrencies and fiat currencies linked to illicit activities across multiple African countries.

Over the longer term, the partnership could strengthen trust in digital assets, support financial inclusion, and improve African states’ capacity to prevent financial crime.

The initiative also aims to support safer and more sustainable growth of Africa’s digital economy.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

- Pebla allows users to send and manage money without an internet connection, targeting regions with unstable networks.

- Ghanaian entrepreneur David Masoperh co-founded the app in Rwanda in 2020 with Jerry Auvagha.

- The platform consolidates multiple financial services into a single interface to simplify mobile payments.

David Masoperh is a Ghanaian computer scientist and entrepreneur based in Rwanda. He co-founded Pebla and serves as the company’s chief product officer.

Pebla operates as a financial services application that allows users to manage and send money, including without an internet connection. The platform brings multiple financial services together within a single application.

David Masoperh and Jerry Auvagha founded Pebla in 2020. The founders designed the application for emerging economies, with a primary focus on East Africa.

The platform centralizes services such as payments and transfers within one interface. This structure allows users to avoid juggling multiple applications and complex access codes.

Pebla enables offline payments and transactions through a simple menu accessible from a mobile phone. The application does not require a permanent internet connection.

Users can send and receive money, complete transactions, and track activity through a limited number of steps.

The application also supports expense sharing by allowing users to split a bill among several people. Each participant can pay their share directly from their phone.

Pebla further enables users to send and respond to payment requests quickly. This feature simplifies reimbursements among friends, colleagues, and family members.

Pebla targets individuals who seek a simple way to pay, split expenses, and send money without relying on network quality. The application also targets users who feel uncomfortable with complex digital tools.

The platform prioritizes a clear interface and streamlined user journeys to reduce friction.

David Masoperh graduated from African Leadership University in Rwanda with a bachelor’s degree in computer science. He also earned a master’s degree in information technology from Carnegie Mellon University in the United States.

He began his professional career in Ghana in 2017 with a project management internship at IT company theSOFTtribe.

Two years later, he completed an internship in risk management and compliance at financial group Absa Group.

In 2021, he joined KudiGo, a technology company specializing in retail management. He worked there for three months as a product management and sales intern.

In 2022, David Masoperh became a product manager at Upskiller, a UK-based human-centered edtech startup that relies on artificial intelligence. One year later, he held the same position at Ladder, a Ghanaian technology startup that offers an integrated personal finance management experience.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

- Lordrick Julius Meela founded Maestro Empire in 2018 to develop AI-driven education, media, and digital solutions.

- Maestro Empire launched EduTrack AI, an artificial-intelligence learning platform for schools, and Streets255, a digital media platform.

- The company aims to become a pan-African reference player in AI, educational technology, and digital innovation.

Lordrick Julius Meela is a Tanzanian entrepreneur. He founded and leads Maestro Empire, a startup that develops innovative solutions at the crossroads of education, artificial intelligence, media, and digital technologies.

Founded in 2018, Maestro Empire launched several projects that gained national and international recognition. The company aims to position itself as a leading pan-African player in artificial intelligence, educational technologies, media, and digital innovation.

The company bases its strategy on developing world-class solutions that transform learning processes, content production, and community development across the continent.

Maestro Empire counts EduTrack AI and Streets255 among its flagship projects.

EduTrack AI targets educational institutions and delivers AI-based learning support. The platform provides automated exam preparation, instant summary generation, problem-solving assistance tools, student performance analysis, and digital educational resources.

Streets255 operates as a media platform that focuses on cultural news, entertainment, and community events.

Beyond these core products, Maestro Empire developed additional initiatives. The company created the Safari Booking tourism application and the Dada Kazini donation platform. It also delivered websites and software solutions for clients across Tanzania.

Alongside his entrepreneurial activities, Lordrick Julius Meela studies computer engineering at Mbeya University of Science and Technology in Tanzania.

Between 2023 and 2025, he completed an internship at Braeburn International School in Arusha. During this period, he served as an information technology administrator.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

- Kenya’s School of Government is discussing a partnership with Huawei’s local unit to support public-sector digital transformation.

- The talks include a potential memorandum of understanding covering cloud, artificial intelligence, and cybersecurity skills.

- Kenya plans to digitize all public services and deploy 1,450 community digital centers under its 2022–2032 Digital Master Plan.

The Kenya School of Government (KSG), a public institution responsible for strengthening citizens’ skills, is exploring a partnership with the local subsidiary of Chinese technology company Huawei. The potential collaboration aims to support the country’s ongoing digital transformation.

KSG said the discussions focused on leveraging emerging digital technologies to strengthen leadership development, institutional efficiency, and innovation within the public administration. The talks also examined the development of a memorandum of understanding to anchor long-term cooperation on digital capacity building for senior officials, knowledge transfer, and national digital transformation priorities.

“Our objective is to build a public service that is not only digitally literate, but also capable of effectively applying cloud, artificial intelligence, and cybersecurity tools to improve service delivery, strengthen institutional performance, and protect citizens’ data,” said Nura Mohamed, Director General of KSG, as reported by TechTrend.

The initiative aligns with Kenya’s broader digital transformation agenda, which positions information and communication technologies as a pillar of socio-economic development.

Through its Digital Master Plan 2022–2032, Kenya aims to deploy 1,450 community digital centers and digitize all public services. In this context, the Organisation for Economic Co-operation and Development said investment in civil-service skills has become essential, as digital technologies can transform public administration by enabling more accessible and efficient services.

“Achieving digital government, where technology is applied to the design of processes, policies, and services that meet users’ needs, requires the adoption of new ways of working and new skills within public administrations,” the OECD said in its February 2024 report Developing skills for digital government: A review of good practices across OECD governments. “Governments must promote the skills, attitudes, and knowledge that allow civil servants to operate in a digital environment by integrating digital technologies to create public value.”

UNESCO said civil servants should not become technical experts. The organization said public officials should instead understand emerging technology trends and acquire a basic understanding of the societal implications of technology to lead digital transformation and governance initiatives.

UNESCO added that digital planning and design, data use and governance, and digital management and execution represent three essential skill areas that civil servants must master, depending on their country’s digital transformation needs.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange Jason Quenum