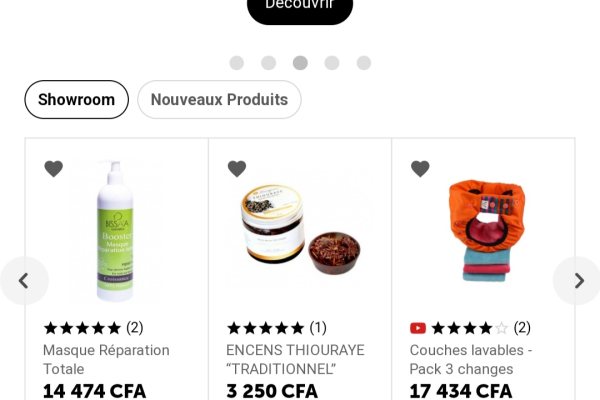

To help African entrepreneurs showcase their products across the continent and the world, a tech entrepreneur created a digital platform to facilitate commercial transactions within and beyond Africa.

Awalebiz is a digital marketplace developed by a Senegalese startup. It allows users, sellers, and buyers, to purchase and sell unique products online. The startup is based in Dakar. It was founded in 2014 by Nafy Diagne, to pool entrepreneurs from several African countries on a single platform where they could sell their products to people all around the world.

"In the spirit of the Awalé game, based on the idea of sowing seeds and reaping the fruit, our company focuses not only on online sales, our core business but also on promoting our artisans and African culture that we want to share with the world," the platform explains.

Available on iOS and Android, the platform is most accessed through its website. Users do not need to have an account, but when placing an order, the buyer must always provide their billing and delivery address.

"Sellers from all African countries are showcasing their products. The Cameroonian buyer gets delivered from Kenya, the South African buyer from Senegal, and the Australian buyer from Benin. We cast the net to connect the continent from all sides, and of course, to connect it to the rest of the world. The spirit is Pan-African. The ambition is global," the platform states.

Delivery times depend on the chosen delivery method, where the item will come from, and the buyer’s location. The platform provides a reasonable time range within which items are likely to be delivered.

In 2017, Awalebiz won the first prize in the third edition of the Linguère Digital Challenge. As a result, the startup received financial support, in the form of a check of CFA7.5 million (about $12,867), as well as technical support worth CFA2.5 million.

Adoni Conrad Quenum

5G will soon be deployed in Senegal. Sonatel recently won the bid to commercialize the technology in the country.

Senegal’s telecom regulator, the ARTP, has provisionally awarded the 5G license to the Sonatel group through its commercial brand Orange. Abdou Karim Sall, the director general of the watchdog, announced on July 17, 2023, during a press conference in Dakar.

L' artp a attribué la 5G à la Sonatel. L'opérateur historique a déboursé 34,5 milliards de CFA pour avoir la technologie de la cinquième génération(5G). L’Autorité de Régulation des Télécommunications et Postes (ARTP) avait lancé la procédure d’appel à candidature pour… pic.twitter.com/pZo1TlpdMf

— A.P.S - Sénégal (@APS_Senegal) July 17, 2023

According to the ARTP’s boss, Sonatel paid CFA34.5 billion (€52.7 million) for the technology. "The main goal is to allow all operators who wish to have a 5G license for the great benefit of users [...] We had set a reserve price of 19.5 billion FCFA. When we proceeded to the counting, we retained that of Sonatel since its offer was compliant," said Abdou Karim Sall.

The ARTP issued a call for bids on May 31 for operators interested in deploying the technology in Senegal. Three operators – Free, Sonatel, and Expresso – submitted bids.

Following the bidding, Free and Expresso were taken out because they did not respect the clause of the reserve price set at CFA19.5 billion, leaving Sonatel as the winner.

In the coming days, Sonatel will have to sign the concession agreement and specifications alongside the ministries in charge of Telecommunications and Finance. Afterwards, the President of Senegal will issue a decree and the ARTP will give its final approval for the official deployment of the 5G technology.

Deploying the technology in Senegal will enable Sonatel to meet the population’s growing demand for high-speed connectivity and new digital consumption modes, influenced notably by Covid-19.

Samira Njoya

With financial technology growing rapidly across Africa, more local companies have been developing several solutions to offer consumers interesting alternatives to traditional financial management software.

Tresorerie.ma is a digital platform developed by a Moroccan start-up. It allows SMEs and managers, to manage cash flow, centralize and pay supplier invoices, and follow up clients from a dashboard. Based in Tangier, the startup was founded in 2022 by Hicham Berrahou.

"Tresorerie.ma offers a service complementary to accounting: thanks to Tresorerie.ma, you can anticipate and follow the evolution of your cash flow in real time. This will not impact your accounting process. Your accountant can therefore continue to manage your accounts without any problem," the platform states.

To access the fintech's services, users need to visit the platform and create an account. It offers several pricing grids and a trial for a few days. Among other things, users will need to provide information such as their first and last name, email, company name, and their position within their company.

The platform offers distinct registration options, depending on the number of users. Annual packages cost 249, 490, and 890 dirhams (about $242) respectively for 1, 3, and 5 users. The 5-user package includes all features of the solution, unlike the other packages. These include the integration of various accounting software, a cash flow simulator, and cash flow forecasting. Moreover, bank transactions between Tresorerie.ma and users’ bank accounts are unlimited, whereas they are limited to 100 with the basic package.

Regardless of the package picked, users can, from the dashboard, synchronize and automatically categorize all of their company's banking operations, model and test different development scenarios, analyze various indicators to get an idea of the company's financial health, or even create personalized recovery plans.

The fintech also has a mobile application, but it is not available from the Play Store or Appstore. Tresorerie.ma claims to have over 325,000 active users and more than 94 tracking indicators available to its customers. It also offers personalized business support.

Adoni Conrad Quenum

Dakar’s Cheikh Anta Diop University (UCAD) switched to online learning in mid-June. To strengthen its offering, the university is signing partnerships and multiplying efforts to meet the needs of thousands of students.

Dakar’s Cheikh Anta Diop University (UCAD) and the National Telecommunications Company of Senegal (SONATEL) signed a partnership agreement last Friday, July 14. The move is to launch the "Pass UCAD" program, whose goal is to allow UCAD’s students and teachers to access the university’s dedicated online learning platform for free.

SONATEL’s Managing Director, Sékou Dramé (picture on the right), announced the establishment of a platform that allows students to continue classes online. "From next week, it will be implemented. This platform will allow students to identify themselves and access this specific 'Pass UCAD' issued for students, which will allow them to connect to the online teaching platform set up by the university for free until October 31," he said.

A month ago, the Senegalese government decided to adopt online education in the country's public universities amidst violent protests that broke out after opposition leader Ousmane Sonko was convicted. Many universities’ facilities were destroyed during the protests; these include six UCAD faculties.

The new partnership with SONATEL will support education and promote internet access for UCAD students. It will also allow students to benefit from educational resources and online research, as well as strengthen their digital skills, and prepare them for the digital future.

Samira Njoya

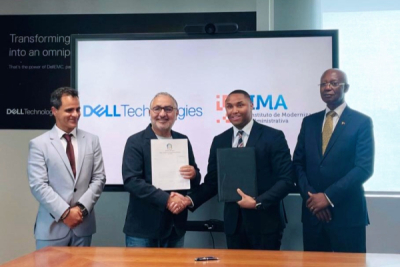

The Angolan government has been taking many steps to reform its administration through digitalization. To speed up this process, the country is now teaming up with major tech actors.

The Administrative Modernization Institute (IMA), an auxiliary body of the Angolan Republic's presidency responsible for public administration modernization, and Dell Technologies, an American company providing tech solutions, services, and support, signed a strategic cooperation agreement in Dubai on Friday, July 14. The partnership aims to promote digital governance in Angola.

"The memorandum of understanding between the IMA and Dell Technologies establishes comprehensive cooperation in the field of digital governance. It anticipates the exchange of experiences, knowledge, and best practices, with a focus on the quality of public services, digitization of the economy, improvement of the business environment, support for entrepreneurship, training, and creation of human capital skills," the IMA wrote in a statement.

Last May, IMA took part in the "Dell Technologies World" conference. Organized by Dell, the conference aimed to accelerate digital growth and technological development in the world. The new deal aligns with the Angolan government's ambition to speed up digital growth as well, locally, and with the Angolan people, with various online government services.

Last February, Luanda announced an investment of $89 million to build its national cloud infrastructure by 2024. The digital infrastructure, built across the government’s centers, is expected to provide over 80 public services.

The partnership with Dell will support the ongoing digitization process of public administration in Angola. It should also allow the country to boost its e-government development score. On the UN’s 2022 e-Government Development Index, Angola ranked 157th out of 193 countries, placing it among countries with a medium level of electronic administration development.

South Africa is taking a significant step towards embracing the digital revolution, leveraging Huawei's expertise, and unlocking the potential of advanced technologies for economic development and societal progress

South African President Cyril Ramaphosa inaugurated, on July 13, the Huawei Innovation Centre in Woodmead, Johannesburg. The cutting-edge facility, established by Huawei South Africa, aims to foster joint innovation, collaborate with local partners and developers, and showcase advanced digital technologies.

President Ramaphosa praised the Innovation Centre, calling it an impressive hub for technological breakthroughs. He highlighted its crucial role in propelling South Africa and the wider African continent into the Fourth Industrial Revolution, with technologies like 5G, Cloud, and AI being showcased at the centre.

The President emphasized the government's commitment to digital transformation, expressing hope that the Innovation Centre would spur the launch of local ICT enterprises and create employment opportunities. He acknowledged the significance of digital technologies in achieving national development goals and commended Huawei's confidence in the South African economy.

President Ramaphosa also acknowledged the role of digital technologies in enhancing sectors such as mining and transportation. He referenced the successful launch of the first 5G coal mine in South Africa, facilitated by Huawei's partnership with industry stakeholders and telecom partners, as an example of the company's contribution to the country's economic potential. “The application of digital technologies to improve production processes spans a broad range of economic sectors from mining to ports to transportation and others,” he said.

Furthermore, he emphasized the importance of knowledge transfer, skills development, and the growth of small and medium-sized enterprises (SMEs), and applauded Huawei's efforts in cultivating local digital talent through initiatives like the LEAP digital talent program, ICT academies, and Tech4All-DigiSchool projects. These initiatives align with the government's vision of empowering the youth and enabling their participation in the digital economy.

The Chinese Ambassador to South Africa, HE Chen Xiaodong, highlighted the significance of the Huawei Innovation Centre as a symbol of South Africa-China cooperation. He emphasized China's commitment to supporting South Africa in accelerating 5G deployment and embracing the Fourth Industrial Revolution.

Leo Chen, President of Huawei Sub-Saharan Africa, commended South Africa's strong vision for its digital economy and its role as a continental and global role model for 5G deployment and industrial digital transformation. Chen reaffirmed Huawei's commitment to supporting South Africa's ICT infrastructure development and industry digitization through the introduction of the latest technologies. He also emphasized the company's dedication to training young South Africans, enabling their participation and benefit from the digital economy.

The inauguration ceremony was attended by various dignitaries, including Minister Stella Ndabeni Abrahams (Small Business Development) and Minister Sindisiwe Chikunga (Transport), along with representatives from government departments. Their presence underscored the government's endorsement and support for the Huawei Innovation Centre and its potential to drive the country's digital agenda.

With the inauguration of the Huawei Innovation Centre, South Africa takes a significant step towards embracing the digital revolution, leveraging Huawei's expertise, and unlocking the potential of advanced technologies for economic development and societal progress.

Hikmatu Bilali

Initially named Tayar, this startup was founded in 2018 by Hassan Kamel and Mohamed Gessraha. It was later rebranded and shifted its focus to AI-based solutions that support startups operating in the delivery sector. The Cairo-based startup provides a technological solution that assists companies operating in the e-commerce, retail, and delivery service sectors in better managing their last-mile delivery operations.

Since its inception, the startup has raised over $700,000 to develop its technology and accelerate its growth. Roboost's service includes order collection, route optimization, delivery agent management, and real-time monitoring of all delivery operations.

"Radical and transformational change in delivery operations has positioned us as the optimal solution for local and multinational brands that we are proud to serve with a 100% retention rate," explains Hassan Kamel. By integrating Roboost's programming interface, businesses can harness its AI capabilities to reach their full operational potential.

The AI solution provides detailed reports on each operation and evaluates the performance of delivery agents. In the case of multi-branch startups, the system allows for performance comparison across various locations. Companies can monitor operations on the web platform or mobile application which is available on iOS and Android, with AI handling all processes autonomously.

"With data collected from more than 2,200 delivery agents who have traveled more than 9 million kilometers, we are always looking for new ways to improve our clients' delivery operations and add new features," says Hassan Kamel.

Adoni Conrad Quenum

Most African countries are dematerializing their administrative services to make their people's daily lives easier. Governments in these countries are now taking further steps to speed up this process.

The government of Senegal has just validated its 2023-2027 digitalization plan for the judiciary sector. The authorities did so during a workshop held on July 13.

The project should cost $13.7 million and result in the establishment of a digital public service of justice that will benefit all of the sector’s actors and users.

"The ownership and implementation of the digital plan for justice by all actors will bring about a revolution in the functioning of justice by allowing faster decisions, simplifying procedures and steps with a more transparent dimension of the procedures. In addition, it will enable users to reduce travel, and magistrates and ministry staff to improve daily work," said Ismaïla Madior Fall, Senegalese Minister of Justice.

In 2016, Senegal adopted its National Digital strategy which aims to digitize approximately 700 administrative procedures. Many investments have been made to ensure this digital transformation in various sectors of activity. Last June, Dakar released $49.8 million as part of the National Program for the Digitalization of the Health System.

For the second half of this year, Ismaïla Madior Fall explained that the project will focus among other things "on the digitization of the process for issuing legal documents and criminal records, the collection of fines, electronic archiving, naturalization, electronic mail management".

Furthermore, the project aims to adapt the texts to dematerialization, to make the working environment suitable; to give citizens remote access to judicial services by dematerializing all judicial procedures; to operationalize alternative justice; to protect children, or to have management tools for the judicial sector.

Adoni Conrad Quenum

Despite having made significant progress in various areas in the past years, Rwanda still faces several issues, such as youth unemployment. Kigali, however, is taking many steps to tackle this specific challenge and help the youth to actively, and productively, contribute to the economy, via the digital sector.

The Rwandan government recently teamed up with the International Labor Organization (ILO) to start a development cooperation project. In a statement dated July 12, 2023, the ILO announced the partnership.

According to the statement, the project will promote youth employment, through digital technologies.

📢Good news for young Rwandans.@ILOAfrica and #Rwanda have announced a new development cooperation project designed to promote #youthemployment in the #digitaleconomy.

— ILO Africa (@ILOAfrica) July 12, 2023

More infos 👇👇https://t.co/0LD9jsA70f via @ILO pic.twitter.com/a8eRuj8s1T

"This project is an exciting milestone in our ongoing efforts to increase investment in the digital economy and uplift Africa's young workforce. It will serve as a new model to generate practical and effective results that will inspire other countries. I am delighted with the potential of this project to serve as a global best practice," said Cynthia Samuel-Olonjuwon, ILO Assistant Director-General and Regional Director for Africa.

Precisely, the project targets young people aged between 16 and 30, in Kigali and secondary towns. It will support job creation and entrepreneurial ventures in the digital economy; help boost youth’s digital skills; and improve public and private employment services provided to the youth.

With a €4 million budget, the project aligns with the Rwanda 2050 Vision, the Rwandan Transformation Strategy 1, the National Skills Development and Employment Promotion Strategy (NSDEPS) 2019-2024, and the Decent Work Country Program for Rwanda.

Once launched, the project will introduce new digital labor market interventions to create new jobs, reinforce existing programs to promote digital skills and stimulate demand for digital services among micro, small, and medium-sized enterprises.

Samira Njoya

Tech is a pillar of Kenya's socio-economic development strategy. Eager to digitize all the country's key sectors, Nairobi is looking for international partners.

The Kenyan Minister of Information, Communications, and Digital Economy, Eliud Owalo (photo, right), recently showcased his country's telecommunications and digital assets in Geneva, Switzerland.

On July 11, speaking at the International Telecommunication Union (ITU) 2023 Council meeting, Owalo noted that Kenya's digital network is ahead of most African countries. He then invited global development partners and investors to support the country’s ongoing digitization program.

"Kenya is keen on partnerships that will equip our youth with digital skills for digital jobs and also develop our ICT infrastructure, using affordable digital devices and finding jobs for young Kenyans in cyberspace," the Kenyan ICT ministry said on Twitter.

1/2 The Cabinet Secretary for Information, Communications and the Digital Economy, Mr Eliud Owalo today was hosted by the Secretary-General of the International Telecommunications Union (ITU), Ms. Doreen Bogdan-Martin, at the ITU Headquarters in Geneva, Switzerland. pic.twitter.com/kVs1HFJhQg

— Ministry of Info, Comms & The Digital Economy KE (@MoICTKenya) July 12, 2023

Over 5,000 government services have been dematerialized since Kenya started its digitization a few years ago; fiber optics are being deployed throughout the country, and public Wi-Fi access points have already been installed in several localities.

While lauding the achievements, Eliud Owalo said there’s still a lot to do. Indeed, if 98% of the Kenyan population has access to mobile phones and broadband services, around 1.7 million people still don’t. Also, about 45% of the population still doesn’t have access to smart devices in the country.

To meet this challenge, the Kenyan government is counting on its various international partners, including the US, with whom the Kenyan delegation has begun talks in Geneva.

1/3 The Cabinet Secretary for Information, Communications and the Digital Economy, Mr Eliud Owalo today held consultations with the leader of the United States Delegation to the 2023 ITU Council Meeting in Geneva, Ambassador at Large, H. E. Nathaniel C Flick. pic.twitter.com/h5Mllmhbdr

— Ministry of Info, Comms & The Digital Economy KE (@MoICTKenya) July 12, 2023

Samira Njoya

More...

Ghana Tech Lab firmly believes in Africa's development through emerging technological innovations. Through its unique programs and courses, the Lab supports budding entrepreneurs, from the idea stage to the creation of a profitable business.

Ghana Tech Lab is a technology innovation center aiming to become a major platform for digital innovations in Africa and beyond. Established in 2018, it has set up an open collaboration space for digital skills training, initiating innovations, and growing startups.

The innovation center offers free digital skills training, startup incubation services, seed funding for innovative ideas, and startup growth. Its team of experts also create solutions to meet the needs of various industries.

Ghana Tech Lab provides entrepreneurs and innovators with technology innovation spaces such as the Makerspace, the creative space, the AI Lab, the Blockchain Lab, the Robotics Lab, the Cybersecurity Lab, the IoT Lab, and the VR/AR lab.

Ghana Tech Lab's core program, which is also its flagship, prepares individuals to think and create new digital solutions. It lasts three months and is divided into two sub-programs. The first is a one-month digital skills training, and the second is a two-month intensive incubation program intended for the top trainees spotted during the training.

The center offers grants to new companies created during and after their incubation. This is to help them turn their ideas into world-class startups. Through its partners, Ghana Tech Lab offers its trainees internship programs, to help them hone their newly-acquired skills.

Since launching, Ghana Tech Lab has trained 3,972 people, created 401 jobs, and incubated 31 startups. The center’s partners include the World Bank, Ghana's Ministry of Communications, the Mastercard Foundation, Kumasi Hive, Innohub, and the Accra Digital Centre.

Melchior Koba

From Banking to Digital Health: Joelle Itoua Owona's Journey in Fostering Global Medical Connections

A Cameroonian native, Joelle Itoua Owona worked in France and the US for many years. She, however, returned to Africa, to the Republic of Congo precisely where she founded an e-health startup.

Joelle Itoua Owona is a banker who moved into e-health. This Cameroonian native founded and is the CEO of AfriWell Health, a medical technology startup, active in the Republic of Congo.

Founded in 2022, the startup provides a digital platform that connects, rapidly and efficiently, patients in Congo with health professionals worldwide. In its first five years of activity, the company aims to create 500,000 patient-doctor connections.

AfriWell Health offers multiple diverse features. It provides services such as online appointment booking and video consultation. It also allows for doctor reviews and online access to medical history. All of these services are aimed at helping Congolese people better manage their health.

The startup is in partnership with several international hospitals, including Euracare in Ghana and Nigeria, the Zaghouan clinic in Tunisia, Memorial and Dent-Health in Turkey, and Narayana Health in India. It is one of the startups selected to take part in the 2023 cohort of the Google For Startups: Women Founders program.

Owona is a graduate of ESCP Business School and the MIT Sloan School of Management. In the former, she earned a master's degree in 2008, and in the latter, she obtained an MBA in Finance in 2016. Prior to venturing into the e-health sector, she worked for several financial institutions in Europe and the US.

In 2008, she worked for Crédit Agricole CIB in France as a junior analyst. In 2009, she joined the HSBC banking group as an international manager in New York, USA. She also worked for Bank of America Merril Lynch from 2016 to 2023 as an investment banker covering healthcare.

Melchior Koba

Fintech is one of the sectors that has grown the most in Africa in recent years. And one of the entrepreneurs who contributed to this growth is Danielle Ekambi Soppo, who strives to advance financial inclusion.

Cameroonian entrepreneur and investor, Danielle Ekambi Soppo, co-founded and heads SuiTch. This is a startup that helps people who have low access to conventional banking solutions, by leveraging digital financial services.

Ekambi Soppo graduated from the Paris Dauphine-PSL University. Between 2007 and 2008, she completed her studies in economic studies and corporate strategies. And in 2011 and 2012, she studied financial engineering, corporate finance, private equity, treasury management, and mergers and acquisitions.

In 2010, she worked as a wealth management consultant at Elite Investment Group, in China. That same year, she went back to Cameroon and worked at the National Shippers' Council of Cameroon (CNCC), as a project financing analyst. She worked there for about a year.

Between 2012 and 2013, she worked at ESSCA Angers business school in banking and risk management. She has also worked as an investment analyst at several investment companies such as Argos Soditic and Platina Partners LLP.

Two years later, in 2015, Danielle Ekambi Soppo founded SuiTch. The startup’s mission is to give people the means to fully tap into the digital economy, enabling them to grow and grow their businesses. The businesswoman offers non-bancarized Cameroonians a mobile payment solution that allows for simple, fast, and secure financial transactions.

SuiTch’s partner companies can grant salary advances to their employees. The startup also gives microcredits, going up to 500,000 FCFA (about $840) to micro and small businesses that use the application.

Danielle Ekambi Soppo currently is the president of the circle of young leaders of Cameroon’s Inter-employer Group (GICAM), which represents the country’s private sector actors. She has also been, since 2014, the managing director of Malaïka Investment Partners, an investment club that supports micro-enterprises with equity and quasi-equity in Cameroon.

SuiTch is presently among Cameroon’s top 7 promising startups. It is also one of the 15 companies picked to join the 2023 cohort of Google for Startups Accelerator: Women Founders.

Melchior Koba

Adopting digital tools continues to prove to be the way forward to development. The Ghana police service is utilizing technology to solve many social issues.

During a recent visit to police stations in Accra, led by IGP Dr. George Akuffo Dampare, the Ghana Police Service (GPS) announced the provision of 150 body cameras to enhance professionalism and strengthen investigative capabilities. The stations that were visited during the tour on July 12 included Tesano Divisional, Achimota District, and Mile '7' police stations.

The body cameras have been assigned to officers of the Visibility Unit in Accra, according to ACP Grace Ansah Akrofi, the Director of Police Public Affairs.

Body cameras are wearable devices used by law enforcement to record events involving officers. ACP Akrofi mentioned their successful use during recent by-elections in Assin North and Kumawu, aiding police operations.

IGP Dr. Dampare emphasized the need to protect the police service's image and support its transformation agenda. He commended officers for their dedication and assured them of continuous support, including logistics and welfare promotion.

The introduction of body cameras and specialized units demonstrates the GPS's commitment to professionalism and improved law enforcement. These technological advancements, coupled with ongoing support and welfare measures, will further strengthen the police service's ability to protect and serve Ghana's citizens.

In 2019, the Ghana Police Service took delivery of 250 body cameras. This was the first batch of 3,000 pieces expected to be delivered by the close of that year as part of efforts to enhance police transparency and accountability.

As part of a GH¢800 million retooling budget for the Ghana Police Service, President Nana Addo Dankwa Akufo-Addo announced the allocation of equipment and vehicles during his State of the Nation Address on February 8, 2018.

Hikmatu Bilali