Mobile money integration specialist Tola Mobile is expanding its payment platform in Africa by adding card payment capabilities. Operating in 23 countries, Tola Mobile provides merchants with a single API that allows them to process deposits, withdrawals and real-time settlements through both mobile wallets and cards.

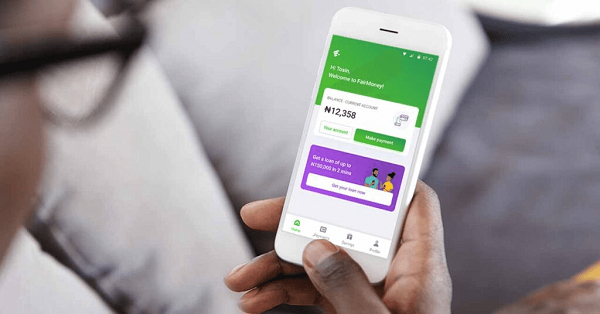

Nigerian fintech company FairMoney, through its subsidiary MyCredit Investments Limited, has had its long-term rating upgraded to BBB+ and its short-term rating to A2 by Global Credit Ratings. The upgrade reflects the strength of its business model, well-managed credit-risk growth and 2024 revenue of more than 112 billion naira, equivalent to over 77 million dollars.

- Stokvel Academy provides online courses and tools to help South Africans create and manage stokvels.

- The platform, launched in 2017 in Soweto by Busisiwe Skenjana, aims to expand financial education and reduce youth unemployment.

- The initiative seeks to modernize traditional collective-saving groups and strengthen financial inclusion in underserved communities.

Stokvel Academy, an e-learning platform developed by the Soweto-based start-up of the same name, offers online courses, educational resources and practical tools designed to help individuals and communities create or join stokvels, the traditional collective-saving groups widespread in South Africa. The platform positions itself as a response to limited access to formal credit and low levels of financial literacy.

Busisiwe Skenjana launched the start-up in 2017. She said, “By training young agents, we do not only tackle unemployment, but we also give stokvels the means to become stronger and more resilient.” Her approach combines skills development with community-driven financial empowerment.

The platform hosts a structured catalogue of modules covering basic saving principles, financial planning, cash-flow management, governance of savings groups, risk assessment and investment strategy. Users access these tools through a web browser and learn at their own pace. Stokvel Academy aims to make financial education inclusive by lowering barriers to understanding collective-saving mechanisms.

The platform blends tradition with technology to update a well-established social model. Existing stokvels can use the training to strengthen internal governance, prevent conflicts and improve long-term sustainability. New members can rely on the tools to adopt structured saving practices from the outset.

Limited access to banking services continues to affect a large share of South Africans. Stokvel Academy positions its services as an alternative that supports financial inclusion, capacity building and community empowerment. By training informed and responsible savers, the platform seeks to reinforce household resilience, stimulate local investment and promote forms of solidarity-based economic activity adapted to African realities.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange Jason Quenum

- Côte d’Ivoire launched Tradepost to digitalize postal logistics and ease cross-border trade in ECOWAS.

- Authorities expect the system to accelerate customs procedures, reduce logistics costs and provide full shipment traceability.

- The initiative targets improved access to African and international markets for Ivorian SMEs.

Côte d’Ivoire launched the Tradepost project on December 1 in Abidjan to modernize postal logistics and facilitate cross-border commerce within ECOWAS. The Universal Postal Union (UPU), La Poste de Côte d’Ivoire and the West African Postal Conference (CPEAO) jointly support the initiative. The project signals a new phase in regional economic integration and in the digitalization of postal services.

Assoua Raymond, chief of staff at the Ministry of Digital Transition and Digitalization, said Tradepost will “accelerate customs procedures through digitalization, reduce logistics costs and delivery times, while offering full shipment traceability.” He added that the platform represents “a strategic instrument to connect Ivorian SMEs to African and international markets.”

Tradepost aims to digitalize and harmonize procedures linked to trade flows, including parcel declaration, processing, tracking and customs formalities. It also seeks to connect users to regional and global e-commerce platforms. Authorities designed the system to remove long-standing barriers to cross-border trade in West Africa, such as fragmented regulations, high logistics costs, slow procedures and weak integration of digital ecosystems.

The launch aligns with the rapid rise of digital trade in West Africa. Improved connectivity, broader digital public services and the growth of online-commerce platforms drive this momentum. Côte d’Ivoire stands out in this trend. The country’s e-commerce market reached more than CFA280 billion ($495.5 million) in 2023 and is expected to grow at a compound annual rate of 11.3% through 2027, according to Ivorian e-commerce industry stakeholders.

Authorities expect Tradepost to strengthen parcel traceability and harmonize procedures across borders. They said the system should reduce obstacles to regional commerce, improve market access for artisans, farmers and young entrepreneurs, and support a more transparent and efficient e-commerce ecosystem in ECOWAS. The data-driven approach will allow policymakers to identify bottlenecks, guide investment and sustain long-term digital and economic integration.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

Zazu, a digital banking platform designed for entrepreneurs and small businesses, recently raised $1 million in a pre-seed funding round from African and European investors.

The startup is currently active in South Africa and Morocco, where it integrates with key payment providers such as Paystack and Ozow. Zazu plans to accelerate its rollout now, ahead of a major pan-African expansion scheduled for 2026.

British fintech company Wise has received conditional approval from the South African Reserve Bank to operate as an authorized foreign-exchange intermediary, allowing it to offer international transfers to consumers.

The approval will enable South Africans to send money abroad at the mid-market exchange rate, with all fees disclosed upfront. The move comes amid rising demand for faster and cheaper cross-border payments in the region.

The D-Prize global competition is accepting applications from African and international entrepreneurs developing solutions to reduce extreme poverty.

Selected startups working in sectors such as health, water, agriculture, energy and education can receive up to $20,000 in seed funding to launch a pilot.

The application deadline is Jan. 4, 2026.

-

Togo integrates three new procedures online: renunciation of nationality, reinstatement of nationality, and modification of patronym or matronym.

-

The national portal now centralises 101 digital public services, including passports, residency cards and nationality certificates.

-

The UN’s 2024 EGDI report ranked Togo 161st out of 193, highlighting a major digitalisation gap the government actively seeks to close.

Togo aims to digitise all public services in the coming years to simplify administrative processes and improve access for all citizens. The addition of new online procedures confirms the progress of this nationwide transformation.

Togo continues to modernise its administration by adding three new services to the national portal service-public.gouv.tg. Citizens can now complete online the renunciation or reinstatement of Togolese nationality and the modification of their patronym or matronym.

The Ministry of Justice and Human Rights leads these digital procedures as part of a methodical modernisation effort. The platform now enables users to complete entire processes remotely: application submission, real-time tracking and receipt of decisions. Officials strengthened the national digital one-stop shop to centralise administrative services and improve accessibility.

This deployment comes as Togo accelerates the digitalisation of administrative services. In recent months, the national portal added major services, including applications for nationality certificates, passport renewals, residence permits, criminal records, construction permits and other formalities. With these additions, the platform now offers 101 online services.

The integration of the three new procedures addresses key priorities: reducing citizens’ travel, increasing procedural transparency, shortening processing times and improving administrative efficiency. The expansion also strengthens administrative inclusion by enabling citizens—especially those far from urban centres—to access essential services without geographic constraints.

This acceleration of digital transformation occurs as Togo works to close a significant gap in public-service digitalisation. The 2024 UN E-Government Development Index (EGDI) assigned Togo a score of 0.3920, ranking the country 161st out of 193, a result that underscores the scale of the challenges ahead. The progress achieved in recent months demonstrates the government’s determination to modernise public administration, improve accessibility and integrate Togo’s public sector into the digital era.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

Enovation Factory and UNDP Cameroon launched Scale 32, a 14-month national programme to support 32 tech startups.

-

The programme provides intensive training, mentorship, workspace access and investor matchmaking, followed by 12 months of alumni support.

-

Cameroon seeks to strengthen its technology ecosystem amid low startup survival rates, weak governance and limited access to capital.

Cameroonian startups continue to struggle to attract investment as limited managerial expertise and weak ecosystem structuring hinder their growth. Observers argue that targeted support remains essential to improve competitiveness and unlock financing opportunities.

Enovation Factory, a Cameroon-based incubator and accelerator, launched in partnership with UNDP Cameroon a national 14-month initiative named Scale 32. The programme aims to support 32 technology startups by addressing their main barriers to growth, including access to capital, management skills and investor networks.

The programme unfolds in two phases. The first cohort will receive six months of intensive support from January to June 2026. The second cohort will benefit from a similar cycle from June to December 2026.

Enovation Factory will integrate selected startups into one of its two streams: Newbie, which targets early-stage or ideation-level projects, and Cracker, which targets operational startups seeking accelerated growth. The support package includes specialised training, mentorship, workspace access and connections with institutional partners and investors.

Enovation Factory will transition each startup into its Alumni programme after the six-month support phase. The incubator will provide an additional 12 months of follow-up, which includes access to its network, financing opportunities and major ecosystem events. The structure aims to ensure that each company consolidates the skills and gains achieved during the programme.

The initiative comes as Cameroon seeks to fortify its technology ecosystem and stimulate job creation. Policymakers attempt to complement existing sector-building efforts by addressing low startup survival rates and the weak governance that affects many early-stage companies.

However, challenges persist. The small volume of capital raised by local startups, the limited number of firms able to attract investors and the region’s low share of venture-capital flows underscore the need for deeper structural reforms. Analysts stress the need to strengthen corporate governance, improve investor appeal, reinforce institutional support and enhance the visibility of Cameroonian startups on the global stage.

Startups operating in technology, agritech, healthtech, fintech, edtech, green economy and other innovative sectors may apply before 18 December via the link provided by Enovation Factory: https://www.enovation-factory.com/postuler.

This article was initially published in French by Samira Njoya

Adapted in English by Ange Jason Quenum

-

PeerPesa, founded in 2020, uses Celo blockchain and stablecoins (cUSD, CELO) to enable cross-border money transfers across Africa.

-

The platform relies on a peer-to-peer liquidity model with local traders to convert stablecoins into national currencies.

-

PeerPesa targets faster, cheaper, mobile-based transfers to improve financial inclusion for unbanked populations.

Mwambutsa Edgar, a Kampala-based technology entrepreneur and co-founder of PeerPesa, serves as the company’s chief executive. PeerPesa operates as a cross-border payment and money transfer platform that enables users to send funds to mobile wallets and bank accounts by relying on blockchain infrastructure.

PeerPesa, founded in 2020, positions itself as a P2P remittance and payment service dedicated to African markets. The company aims to connect Africa to international corridors by offering faster and low-cost transfers. It promotes financial inclusion by giving remote users access to DeFi-based tools outside traditional banking networks.

The platform seeks to remove common barriers in international transfers, such as high fees, long delays and complex banking routes. It uses stablecoins backed by strong currencies to provide predictable and lower-cost transfers completed via mobile phones.

PeerPesa uses the Celo blockchain and stablecoins like cUSD, along with the CELO token, to facilitate fund transfers to several African countries. The company executes transactions through a peer-to-peer model built on local traders who guarantee liquidity between crypto assets and national currencies.

Recipients can obtain funds directly in a bank account or mobile-money service, aligning with entrenched African practices such as M-Pesa. The use of blockchain ensures transaction traceability, while smart contracts reduce reliance on financial intermediaries.

Before PeerPesa, Mwambutsa co-founded Coinpesa in 2016, a digital-assets platform focused on expanding cryptocurrency access. The company states that it wants to broaden the use of these financial tools to support global financial inclusion.

Mwambutsa graduated from Makerere University in 2006 with a bachelor’s degree in quantitative economics. He later obtained an MBA in 2019 from the Edinburgh Business School at Heriot-Watt University in Scotland. He began his professional career in 2006 at Uganda’s National Social Security Fund, where he served as a relationship officer.

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

More...

-

Awahnji Jean Awah pursues a Master’s in Data Science and AI while completing extensive multi-vendor certifications across IBM, Meta, Google, AWS, Azure, Red Hat and others.

-

Orange Digital Center (ODC) trains him through its partnership with Coursera, signed in April 2024, offering hands-on programmes and continuous mentorship.

-

He applies his skills in freelance development and AI practice, gaining better-paid missions, higher responsibilities and increased client trust.

Cameroonian developer Awahnji Jean Awah builds digital solutions and moves toward cloud technologies and artificial intelligence. He pursues a Master’s degree in Data Science and Artificial Intelligence at the Institut universitaire de la Côte, where he acquires scientific and practical foundations in these fields.

Alongside his academic programme, he trains himself through web development, data-analysis projects and website creation for clients. This autonomous work allows him to test his skills against concrete business needs.

With the goal of becoming “an end-to-end AI engineer capable of designing high-impact digital solutions,” Awahnji joins the Orange Digital Center (ODC), Orange’s technology-training hub. He follows several programmes created through an April 2024 partnership between ODC and Coursera, which he discovered on social media.

He completes certifications from IBM (DevOps, Software Engineering, Machine Learning, AI Developer), Meta (Back-End and Front-End Developer), Google (UX, Data Analytics, Project Management), AWS (Cloud Architect), Microsoft Azure (Developer), Red Hat (Kubernetes/OpenShift), Microsoft (Project Management, Cloud Support), Scrum Master, and additional technical modules.

This training path, which began in July 2024 and continues throughout 2025, relies on an intensive schedule that combines practical workshops, ODC staff mentoring and professional simulations. In an interview with We Are Tech Africa, he describes the experience as “rich, practical, intuitive, well supervised by the ODC staff.”

In parallel, he works as a freelance developer and AI practitioner, a framework that allows him to apply his newly acquired skills. He says that the certifications have “strengthened my portfolio, improved my technical autonomy, increased my opportunities for freelance missions and enhanced my professional credibility.”

He states that they have transformed his “skills, strengthened my confidence and given me the tools needed to turn my ideas into real and impactful solutions.” He adds that this evolution results in “better-paid missions, more responsibilities and greater client trust.”

Looking ahead, Awahnji plans to “become a certified AI and cloud engineer, design impactful AI tools, develop scalable cloud solutions and, ultimately, create or join a technology start-up.”

This article was initially published in French by Melchior Koba

Adapted in English by Ange Jason Quenum

- Orange Sierra Leone inaugurated a €23 million ($26.7 million) backup datacenter in Bo.

- The company invested $50 million to modernise its network, now fully 4G- and 5G-compatible.

- Orange Sierra Leone controls 51% of the mobile market with 3.04 million subscribers.

Orange Sierra Leone continues to scale its network infrastructure as the market leader. The company recently announced that it invested $50 million to modernise its nationwide telecom network.

Orange Sierra Leone inaugurated a new datacenter on 29 November in the southern city of Bo. The company built the facility for €23 million ($26.7 million) as an identical replica of its main datacenter in Freetown. The operator says the new site will function as a disaster-recovery hub to prevent emergencies, outages or natural disasters from disrupting digital services across the country.

The company highlighted the strategic location of the site. “Strategically located in the south of the country, the new centre contributes to extending digital infrastructure to rural and regional communities, particularly in the southern and eastern corridors toward Makeni, Kono and Kenema. It will enable better distribution of network traffic and improve connectivity in underserved areas,” Orange said in a statement posted on Facebook on 30 November.

The operator built the datacenter as Freetown remains exposed to landslides such as the 2017 event and as the country continues to face recurrent flooding. The backup site aims to ensure service continuity if such disasters threaten the capital.

The inauguration aligns with Sierra Leone’s broader digital-transformation agenda. Telecom services now support daily activities for businesses, households and public administration. Communications Minister Salima Bah stressed the importance of uninterrupted service after a brief outage in August 2024. “The Internet has become an indispensable tool in our daily lives. If the connection were interrupted, everyone would realise how much we depend on it,” she said. She added that the government and telecom operators have made significant investments to prevent future disruptions.

Beyond the new datacenter, Orange Sierra Leone operates 616 telecom sites nationwide, including 40 recently deployed sites. The company powers 70% of those sites with green-energy sources. Orange also invested $50 million to modernise its entire network, which now supports full 4G and 5G capability.

The GSMA argues that these upgrades should strengthen Orange Sierra Leone’s competitive position. The organisation notes that “good quality of service can improve the digital experience and create new opportunities for individuals and the broader community.” By December 2024, Orange Sierra Leone reported 3.04 million mobile subscribers and a 51% market share in competition with Africell and QCell.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange Jason Quenum

-

Youth unemployment in Lesotho reaches nearly 50% among 15–35-year-olds.

-

The government launched the YOMA digital platform with UNICEF to improve employability and access to skills.

-

Only 48% of the population uses the Internet, which threatens the programme’s adoption.

Lesotho faces one of the highest youth unemployment rates in Southern Africa, with nearly half of young people unable to find work. The government uses digital solutions to expand access to skills, boost employability and create new economic opportunities.

The Ministry of Gender, Youth and Social Development launched the Youth Agency Marketplace (YOMA) on 26 November in Maseru in partnership with UNICEF. The ministry says the platform aims to remove barriers that limit youth integration, including restricted access to training, digital skills and market opportunities.

YOMA operates as a pan-African digital platform that allows young people to acquire skills, receive mentorship and access economic opportunities. It offers pathways ranging from basic training to matchmaking with companies, NGOs and institutions. Users complete social or environmental “impact missions,” which reward them with digital tokens they can exchange for goods or services such as mobile credit or additional training.

The platform records all user activities in a verifiable digital CV, which increases the visibility and credibility of young jobseekers. YOMA aligns with international skills-development standards and uses a personalised approach. It adapts opportunities to each user’s profile, goals and potential while staying linked to labour-market demand.

Authorities say YOMA supports the government’s strategy to empower young people through accessible digital solutions. The stakes are high in a country where youth represent a large share of the unemployed. Official data estimate unemployment among 15–35-year-olds at nearly 50%, one of the highest ratios in the region.

Officials expect YOMA to improve employability, stimulate self-employment, facilitate access to certified training and generate income through paid missions. The platform also seeks to expand digital literacy in a country where young people still lack the tools to participate in a rapidly digitalising economy.

However, weak connectivity threatens uptake. DataReportal estimates that only 48% of Lesotho’s population used the Internet at the start of 2025, while mobile data costs remain high relative to average income. Rural areas face unstable mobile coverage, which limits access to a fully digital platform. YOMA’s success depends on stronger connectivity, lower access costs and broader awareness campaigns.

By launching in Lesotho, YOMA adds to deployments already underway since 2020 in Benin, Burundi, Côte d’Ivoire, Kenya, Nigeria and South Africa. The partnership with UNICEF allows Lesotho to rely on a tested model to broaden access to training, economic opportunities and entrepreneurship.

Samira Njoya

NBA Africa has selected ten startups from five countries for the second edition of its Triple-Double program, which supports young technology ventures in sports and the creative industries. The selected companies include Athlon Technology and Fitclan (Egypt), Novate and Reborn (Morocco), ProPath Sports and Safia Health (Kenya), and Contestify, Atsur and SongDis (Nigeria). They are scheduled to pitch their projects in Kigali on Friday, December 5.