With the acceleration of digital transformation across Africa, cybersecurity has become a major concern, with increasingly targeted attacks. The issue pushes governments to streamline their digital defense strategies.

Last December 14, the Chadian Ministry of Telecommunications and the National Agency for Computer Security and eCertification (ANSICE) launched a workshop for the development of a national cybersecurity strategy.

The cybersecurity strategy to be developed during the workshop -organized in partnership with the International Telecommunication Union (ITU)- aims to find ways to better fight cyber threats. "It is important to assess the cybersecurity challenges to define and prioritize the responses to implement in a strategy capable of enhancing the cybersecurity of every institution,” said Digital Minister Mahamat Allahou Taher.

In recent days, Chad has accelerated its efforts to strengthen its cybersecurity. On December 5, two bills were passed to strengthen the country's cybersecurity framework. The first bill ratifies Ordinance No. 007/PCMT/2022 of August 31, 2022, on cybercrime and cyber defense, while the second ratified Ordinance No. 008/PCMT/2022 of August 31, 2022, on cybersecurity.

To strengthen its legal framework, the government decided to quicken the elaboration of the cybersecurity strategy, which was not really advancing. In 2019, during a meeting with participants from 32 national and regional institutions, it was already decided that the elaboration of the national cybersecurity strategy would be accelerated. In February, the country also hosted cybersecurity experts from various countries and the sub-region to discuss issues related to assessment methodology, strategic cybersecurity policy, online commerce, banking, legal and regulatory framework, and technology standards.

Samira Njoya

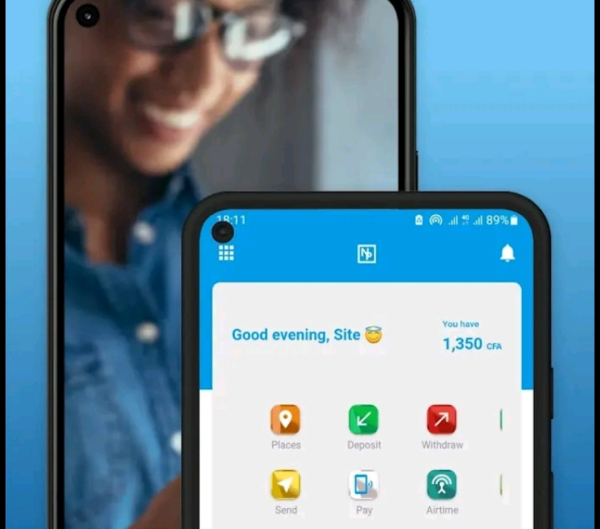

The solution facilitates virtual payments and various day-to-day transactions.

Noupia is a fintech solution developed by Cameroonian startup Noupia Limited. It allows users to make online purchases, pay bills online, get paid online, buy cryptocurrencies or make top-ups from telecom operators.

Through its mobile app -Android and iOS, users can sign up for its services. They can for instance instantly top-up their bank cards, pay Netflix subscriptions or for ads on various social networks. They can also connect the solution to their Paypal, Apple Pay or Google Play accounts.

Noupia also integrates a QR code that allows to make payments when they forget their IDs. It also has a feature (Noupia Tip) for users to send tips to content creators to let them “concentrate on the work they're passionate about, without depending solely on advertising revenues.”

The platform also allows users to pay bills at Eneo, Camwater or Canal Plus, to buy Orange, Camtel, Nexttel or MTN airtime. According to Play Store statistics, the Android version of the application has already been downloaded over 50,000 times. The fintech is expanding rapidly and hopes to sustain its growth in Cameroon and the sub-region in the coming months.

Adoni Conrad Quenum

The tech entrepreneur has experience in a wide range of sectors including finance and banking, education, and technology. With his edtech Zeraki, he develops tech solutions to improve the quality of education in Africa.

Isaac Nyangolo (photo) is a Kenyan entrepreneur and the co-founder/CEO of edtech firm Zeraki which offers innovative tools to make teaching and learning effective, engaging, and productive.

The flagship product of that edtech (founded in 2014) is Zeraki Analytics. It transforms the way educational data is collected, analyzed, and used. Another product, Zeraki Learning, provides a platform to learn from highly experienced teachers, get tested, and track performance. The third product, Zeraki Touch, is a foolproof biometric system that allows for efficient tracking of daily school operations.

In early December, Isaac Nyangolo raised US$1.8 million in seed funding in a round led by Acumen Fund to expand the startup's product catalog and continue its regional expansion. "We plan on building more administrative tools for schools, and payment products on the parents’ side. We have also brought back focus on [the once dormant] digital learning platform, and tested a number of products like timetabling.[...]We’re expanding first into the regions that we understand and have similar business environments with. We plan on first moving into the entire East Africa community and then exploring the Anglophone region," Isaac said.

Currently, he is the chairperson of the Harvard Club of Kenya and a member of the board of the data analytics firm Superfluid Labs. He is also a member of the advisory board of the Kenyan chapter of non-profit organization Education For All Children. He entered the professional world in 2007, as a planning and design engineer for home entertainment operator Wananchi Online.

In 2009, he joined Citibank N.A. as a clearing assistant before landing at Equity Bank Ltd as a marketing analyst. He was later appointed program manager for the Nairobi-based Equity Group Foundation.

Melchior Koba

The serial entrepreneur streamlines data management to improve businesses’ decision-making. His data automation solution has attracted huge funding.

Martin Naude (photo) is a South African computer scientist and the founder/CEO of Synatic, a modern data automation platform developed for businesses.

The platform, founded in 2019, combines an on-demand integration platform (iPaaS), Enterprise Service Bus (ESB) software, Extraction, Transformation, and Loading (ETL) process, and API management into a simple, yet powerful tool. It makes it easy to solve complex data problems quickly.

After a seed funding round in early 2021, it raised an additional US$2.5 million in an extension round in December 2022. Thanks to the funds raised, it plans to “expand its market reach in the United States in preparation for Series A funding in 2023.”

“Synatic’s integration and automation platform is already gaining ground in multiple international markets. With this additional seed money, we can bring a new focus to the U.S. market, expanding our sales and marketing program and recruiting new reseller and developer partners,” said Martin Naude.

In 2017, the latter founded FilePounder, a modern integration platform and ETL tool that makes integration, processing, and data manipulation easy. Between 2015 and 2016, he was the CEO of Encentivize, an employee reward, recognition, and engagement platform that provides companies with the tools to create high-performing organizations.

His professional career began in 2001 when he joined the tech company Simplexity as the director of development.

In 2004, he worked for the software development company Sage as Development Manager (VIP Corporate). In 2005, he became the managing director of the IT services and consulting company Entelect. Some six years later, he was director of new technologies in the same company.

Melchior Koba

The booming tech and digital sectors play an increasingly important role in East African economies. To support the countries in their projects and foster digital integration, partner institutions are committing significant funds.

The World Bank recently granted US$15 million to strengthen and accelerate regional digital integration efforts in the East African Community (EAC).

According to a statement issued by the EAC on Saturday, December 17, with that funding, the World Bank -through its Single Digital Market (SDM) initiative- wants to help the region become a deeply integrated and dynamic hub for digital investment, innovation, and growth.

For EAC secretary general Peter Mathuki, the funds will be used to create, among other things, regional digital innovation centers in all partner states to address digital challenges. "This support will further enhance the region's competitiveness and skills development that are central to successful digital transformation," he said.

Developing digital infrastructure and the economy is one of the development priorities of EAC member countries (Burundi, Democratic Republic of Congo, Kenya, Rwanda, South Sudan, Tanzania, and Uganda). Two years ago,

decided to align their tax regulations concerning the digital economy. The alignment aims to increase member countries’ revenues from the ICT sector and establish a legal framework that can help countries regulate large digital firms in the years to come.

According to a study conducted by the International Finance Corporation (IFC) in 2020, by 2025, the digital economy’s contribution to GDP would reach 9.24% in Kenya, 5.96% in Rwanda, 4.57% in Tanzania, and 4.18% in Uganda.

To achieve this, the community can rely on the World Bank and its single digital market initiative. According to the EAC release, the project will focus on the development and integration of the connectivity market, which will involve the creation of a legal, regulatory and institutional environment conducive to information technology and communication to strengthen digitization in the region.

Samira Njoya

In recent years, a number of fintech solutions have entered the African market. Their aim is to be alternatives for largely under-banked populations.

Cassbana is a fintech solution developed by an Egyptian start-up. It allows small merchants to buy goods from partners and pay in small installments.

"Cassbana is a technology solution that builds financial identities for the underserved communities in Egypt through managing their business needs and building a behavior-based scoring system, making us the future data-based financial advisory collective," the explains on its website.

The solution has an Android app that allows users to create their accounts and access Cassbana’s services. Based on the usage data collected, the startup uses AI and machine learning to customize and improve the services offered to each merchant.

On Playstore, the Android app has been downloaded more than 50,000 times. With the solution attracting a growing number of users, Cassbana founder Haitham Nassar wants to roll out new services to better serve users. In 2021, the startup had already raised US$1 million to support its growth.

Adoni Conrad Quenum

The tech entrepreneur is specialized in the e-commerce segment. The platform he developed connects small merchants to e-commerce services in the Middle East and North Africa region.

Waleed Rashed (photo) is an Egyptian entrepreneur and the Founder/CEO of SIDEUP, a platform offering smart solutions to MSMEs specialized in the e-commerce sector.

SIDEUP was founded in 2008. Formerly known as VOO, it was launched to meet all the needs of e-commerce entrepreneurs, from local and international logistics support to warehousing services and a comprehensive real-time dashboard for performance analysis. It integrates a partner account manager and the best tech tools like Zammit, Wuilt, Paymob Aramex, and DHL used in the MENA region.

In early December 2022, the startup, which already serves 2,000 e-commerce businesses, raised US$1.2 million for its expansion. It also entered Saudi Arabia where it is now headquartered.

"SideUp is for the merchants in the village, or those selling products over Instagram, Facebook, or WhatsApp. They get accessibility to all the services starting from the courier company, warehousing, and fulfillment, to marketing services," Waleed Rashed said after the fundraising round.

Apart from SideUp, Waleed Rashed has founded Ingez, a company assisting users in their various errands, from grocery shopping to clothing drop-off. From 2013 to 2016, he led the errand-running firm as the CEO.

His professional career started in 2007 at the First Abu Dhabi Bank where he was a sales representative. In 2008, he joined the Al Khalij Commercial Bank as a sales team leader.

Melchior Koba

The Malagasy government is determined to achieve its digital transformation ambitions and deploy e-governance nationwide. It also wants to give digital training to its citizens.

Last Tuesday, the IFC and the Malagasy Digital Ministry announced a partnership aimed at improving access to advanced and specialized computer training courses in the country.

The program aims to train, within two years, 6,000 people, including public and private sector employees and youth, in IT occupations such as software development, cloud architecture, data engineering, and cybersecurity.

“The project aligns with the government's commitment to better prepare for the digital economy by developing the needed digital skills and modernizing its administration to improve service delivery, boost economic growth and create much needed jobs,” said Digital Minister Tahina Razafindramalo (photo, right).

Indeed, for several years now, digital transformation has been the core of the Malagasy government’s actions. The country defined four main axes for its development programs. They are notably the digitization of public education, health and land services, the use of new technologies in agriculture, the development of technical infrastructures, and financial inclusion.

To achieve these four objectives within a short period, the government secured support from the World Bank, which pledged more than US$140 million for the various projects. According to the international financial institution, an acceleration of the digital transformation could allow the Malagasy government to create “about 140,000 new jobs linked to digital skills across nine sectors by 2027, including apparel, agri-processing, and tourism.”

Samira Njoya

Digital health systems are expanding rapidly in Sub-Sahran Africa, democratizing access to healthcare for millions of people. However, as it is not sufficiently financed, the sector is still growing to its full potential.

The Global Fund to Fight AIDS, Tuberculosis and Malaria and its private sector partners recently set up a US$50 million catalytic fund to support the digital health sector in Sub-Saharn Africa.

The fund, called Digital Health Impact Accelerator (DHIA), was announced during the Africa HealthTech Summit held in Kigali, Rwanda, on the sidelines of the Second International Conference on Public Health in Africa (December 13-15, 2022).

The fund “will help further strengthen regional and global data systems and surveillance capacity for data-driven decision-making, enable better patient care, and transform millions of lives,” said Country Technology Services Manager at the Global Fund and Lead for the DHIA.

“The Global Fund has played a key role in strengthening digital health systems and health data in low- and middle-income countries since its inception. These tools are critical to defeat infectious diseases and prevent future health threats,” he added.

Indeed, digital health is not yet fully developed and exploited in Sub-Saharan Africa. The coronavirus pandemic helped stimulate the segment and, since then, innovative e-health initiatives have multiplied. Same for the number of cell phone users. The GSM Association estimates that by 2025, there will be at least 634 million mobile users in Sub-Saharan Africa. The figures prove that digital technologies have already taken an important place in residents’ lives. Those technologies will also change habits in how they access healthcare in the near future.

Through the DHIA Catalytic Fund, the Global Fund and its private partners aim to “support countries to accelerate and scale up digital health solutions through more widespread internet access, strengthened information systems for data sharing, extensive use of mobile technologies, patient-centric digital tools, and unique patient IDs, among others.”

Samira Njoya

By paying €15 daily, cab drivers can become owners within 48 to 60 months.

Cmontaxi is a digital solution developed by a Senegalese eponymous startup, founded in 2015. It allows cab drivers to become car owners within a given time frame.

"With an average monthly salary of €600, cab drivers] don’t earn enough to be able to access traditional bank loans or the car manufacturers’ leasing packages,” says Aziz Senni, founder and CEO of Cmontaxi.

The package set up by Cmontaxi includes lease-purchase, maintenance, and insurance agreements. Drivers have to pay €15 daily and become owners within 48 and 60 months. The amount is about 10% lower than the price drivers have to pay for other lease-purchase agreements. This is probably why the startup also uses the cabs as advertising media.

Its stated goal is to improve its drivers’ living standards by making transforming them into entrepreneurs, not just cab drivers. "I decided to allow these drivers to become cab owners without upfront payment, give them micro-business management training and help them reduce their insurance and maintenance costs,” Aziz Senni explains.

With its booking platform, the startup allows its drivers to boost their revenues. Cmontaxi also set up "Taxishop", a concept that allows drivers to increase their revenues by offering additional products and services on board their taxis.

Adoni Conrad Quenum

More...

She is one of the leading women in the African cybersecurity industry. Through CyberSafe Foundation, she raises awareness on how to stay cyber-safe. For her impact on the continent, she has already received several awards and recognitions.

Confidence Staveley (photo) is a Nigerian cybersecurity expert. She graduated from Middlesex University, in 2011, with a BSc in information technology and Business information systems. In 2013, she got a Master’s in IT management from the University of Bradford.

In 2019, she founded Cybersafe Foundation, an NGO that raises promotes changes (through awareness campaigns and training) for a safer internet for African users.

Recently, through the #NoGoFallMaga initiative, the organization launched cybersecurity awareness campaigns that reached over 20 million people. It also organized cybersecurity training reaching more than 4,000 small and medium-sized businesses and over 9,000 employees. The NGO also launched the first cybersecurity awareness handbook in Africa.

“We were looking at really innovative ways to drive awareness about cybersecurity and making people see the importance in the first place and how it applies to them as individuals. And helping them take actionable steps to become safer online, but we’re doing it in a way that’s not overwhelming,” Confidence Staveley said in June 2022, explaining the reasons behind the campaign.

Since August 2022, the cybersecurity expert, who calls herself a “cyber evangelist”, is a member of the Forbes Technology Council. She entered the professional world, in 2009, as a computer instructor at Eastern Data Services Ltd. In 2011, she was hired as an IT Assistant by the Cross River State Government.

She later joined Lloyds Banking Group as a customer service advisor and telephone banking consultant. In 2013, she joined the Calabar International Convention Centre as an IT specialist and, two years later, she landed at InfoGraphics Nigeria, where she was appointed technical marketing and interactive media manager.

Between 2016 and 2018, she was a cybersecurity analyst for UIC Innovations Africa. A year later, she became the country manager of the computer security firm DIGISS. Concurrently, from 2017 to 2022, she worked as a part-time managing partner of the marketing firm Gidinerd.

Ms. Staveley is a multiple award winner. She has been cited on CIO Magazine’s 2021-2022 list of Africa’s 45 most influential women in Digital Transformation. the Cyber Security Expert Association of Nigeria (CSEAN) also named her the 2022 Cyber Security Woman of the Year and she received the Meridian Global Leadership Award at the Global Leadership Summit for her positive impacts. This year, she also made it to the list of the top 100 Most Inspiring Women in Nigeria and received the Obama Leader's Personal Commitment Award.

Melchior Koba

Congo plans to considerably advance its digital projects in 2023. For that purpose, it is multiplying partnerships and agreements with specialized companies.

Last Tuesday, Congolese Digital Minister Leon Juste Ibombo (photo, left), signed a memorandum of understanding with Sivakumaran Kathiresan (photo, right), the vice president of ATDXT, an Indian company specializing in digital transformation.

The memorandum between Congo and the Dubai-based company aims to support the country in the implementation of several projects, including the most important which is the digitization of the Post and Savings Company of Congo (Sopéco).

According to Sivakumaran Kathiresan, the memorandum aims to enable the construction of digital infrastructure and contribute to the digitalization of the Congolese economy.

“We will build data centers, finance the digitization of the Sopéco, promote the revival of its activities and proceed to the design of single windows in Congo,” he said.

The memorandum adds to the other agreements and partnerships already signed by Congo for its digital transformation this year. The country has teamed up with several partners to build choice digital infrastructure and build resilience. In November, the Digital Minister signed an agreement with Canadian company Casimir Network to train local talents in innovative technologies and build and operate a datacenter that will host the servers of the country's blockchain services.

With ATDXT, which is also established in Great Britain, the United States of America, India, and the Democratic Republic of Congo, Congo aims to take advantage of Indian expertise to implement its digital development policy and achieve the objectives of the digital strategy "Digital Congo 2025".

Samira Njoya

In Africa, the ecommerce industry is booming. According to the IFC, the number of online shoppers on the continent has risen by 18 percent since 2014. This growth, fueled notably by the coronavirus pandemic, could continue over the next decade.

Last Wednesday, Gabonese ecommerce platform Olatono Market, announced it raised €45,000 to accelerate its expansion in Central Africa, strengthen partnerships and create a platform that revolutionizes ecommerce in Gabon.

"Our innovative platform differs from the existing offers. It is launched to meet the expectations of customers who are increasingly searching for solutions that give them command over their choices, enable them to compare prices and access products wherever they are in Gabon,” said Thierry Dzime, founder of Olatano Market.

The platform created in March 2021 wants to transform the ecommerce industry in Central Africa. It developed a service called Achat Flex, allowing individuals to purchase products online and pay on delivery, by installments, by mobile money, or by bank cards. It was a first in Gabon where ecommerce was gradually gaining ground.

Thanks to the funds secured, Olatano Market's managers want to develop even more services, accelerate the start-up's growth, strengthen its workforce and sign new agreements. "We are delighted to support the expansion of the company and the launch of the new product Achat Flex. The ambition is to help the future champions of Gabon’s economy emerge. We are pleased to have made these investments in a start-up with great potential. We will support its progress," said Fabrice Nze-Bekale, President of Gabon Angel Investor Network (GAIN).

According to a report by the GSMA and the Economic Commission for Africa (ECA), Gabon became the e-commerce leader in the ECCAS (Economic Community of Central African States) zone in 2021, overtaking Cameroon.

Samira Njoya

In the growing music streaming market, giants like Apple Music, Spotify, and Deezer have captured the bulk of the demand. Nevertheless, African platforms are gradually poking the market by focusing on local content.

Mdundo is a digital platform developed by a Kenyan eponymous startup. It allows users to legally download and stream African songs.

According to its co-founder and CEO Martin Nielsen, the platform currently has some five million monthly users but, its potential is 30-fold higher. “With a steep growth curve and a very scalable solution, we plan to invest further in user growth to increase our market coverage in sub-Saharan Africa and within approximately three years establish Mdundo as the leading Pan-African music service for consumers and musicians. We want to achieve in Africa what Spotify has achieved in the West and what Tencent has achieved in Asia.,” he explains.

To achieve its growth targets, the startup, which claims to be the leader in the pan-African music market, has already raised more than US$6.4 million.

Apart from a web platform, its solution has an Android app, through which users can sign up for streaming services. Currently, the services are available in more than 15 countries in Sub-Saharan Africa. Its Android app has been downloaded more than a million times while the startup claims over 20 million monthly music downloads and streaming through its web and mobile apps.