He is a civil engineer and a young entrepreneur. To make real estate investment more accessible to Africans, he co-founded the fintech start-up Keble.

Emmanuel Oballa (photo) is the CEO and one of the co-founders of fintech startup Keble. The tech entrepreneur was born and raised in Nigeria, where he attended the University of Lagos, earning a bachelor's in civil and environmental engineering.

His startup Keble, founded in 2020, allows access to affordable real estate investment options to Nigerians wherever they are. Its goal is to let them profit from real estate investment opportunities by creating a safe and stable way for them to confidently grow their wealth.

Keble connects its users with the best real estate investment options available in the global market, enabling them to successfully save, invest and diversify their portfolios. It is one of the 12 startups selected for the inaugural class of the ARM Labs Lagos Techstars Accelerator, a Lagos-based program that focuses on building early-stage proptech and fintech startups across Africa.

“We are giving you dollar-based real estate assets that are fixed in price [...] and we are giving you trust,” Emmanuel Oballa said in March 2023. Thanks to Keble, users have every detail about the investments, their locations, and performance.

The startup explains that it has partnerships and administrators on different continents for the maintenance of its international assets.

“We have a good relationship with the body of developers in the UK, for example. So we have consistent communication. We get reports, documentation, updates, and first-hand information about the properties and new investment opportunities,” its CEO says.

The latter is, since 2018, the program director for the Connected Development (CODE) campus. His professional career began in 2013, as a quality assurance staff at House Of Chi (better known as Chivita), a manufacturing industry responsible for the production of juices, dairy and diet products, pharmaceuticals, etc.

From January to April 2018, he was the Director of Program Management at Enpact Initiative, a University of Lagos pioneering student community dedicated to entrepreneurship development and professional enrichment. From July 2018 to the inception of Keble, he was a real estate consultant with RealtyPro Investment Global Limited, a real estate company.

Melchior Koba

Kenya, which is at the forefront of Africa's young technology scene, is increasingly attracting international companies looking to tap into the potential of its burgeoning IT sector. In that context, authorities are developing resources to facilitate the liaison between the various parties.

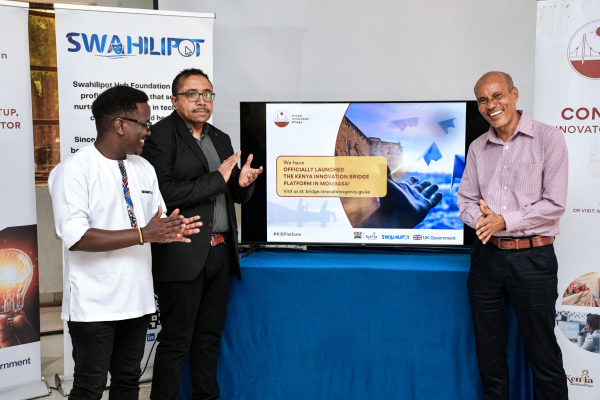

Last Friday, the Kenya National Innovation Agency (KeNIA) officially launched the Kenya Innovation Bridge, a digital marketplace to connect innovators, inventors, researchers, and start-ups with funders, customers, and users, in Mombasa.

This marketplace aims to enable as many innovations as possible to scale up by attracting appropriate funding and partnerships.

According to George Masila (photo, left), KeNIA's head of communications and partnerships, the marketplace was set up because there was a gap between innovators and people interested in their innovations.

“What we did is we developed a platform that would enable them to have that direct connection with those people who will be interested in whatever they are doing. [...] The innovation platform is just a simple interface that people of all levels of education can easily interact with. It’s almost like a LinkedIn or Facebook version,” he said.

Recently dubbed the "Silicon Savannah" because of its thriving technology ecosystem, Kenya is one of the fastest-growing economies in sub-Saharan Africa. According to the Swiss Business Hub Southern Africa, this technology ecosystem is estimated to be worth $1 billion and is an attractive environment for businesses, investors, and high-tech professionals. It is already host to subsidiaries of leading companies such as Facebook, Microsoft, IBM, and Intel.

With the launch of the Kenya Innovation Bridge, the Kenyan executive wants to further foster innovation in the country. The platform will link to investment/partnership and capacity-building opportunities that will turn innovations into commercially viable products and businesses, thereby contributing to job creation and overall economic growth in the country.

Samira Njoya

The rapidly changing world is powered by emerging technologies such as AI, 5G connectivity, and the cloud. It is, therefore, crucial to build public authorities' capacities in those technologies to enable them to participate in the ongoing digital transformation.

Last Friday, the Commonwealth Secretariat and U.S. tech company Intel launched a digital learning platform to enable public servants from the 56 Commonwealth member countries- including 21 African countries- to understand and harness emerging technologies like artificial intelligence.

The program, titled "Digital Readiness for Public Sector Leaders," aims to demystify AI for senior Commonwealth officials and raise awareness of its potential applications in various sectors, reports the release issued by the organization.

Unveiling the platform at the Commonwealth's headquarters in London, Commonwealth Secretary-General Rt. Hon. Patricia Scotland (photo) said, "this course is a new and important milestone achievement, which the Commonwealth has developed for our member countries in close collaboration with Intel. It provides a unique opportunity for public sector workers and leaders in member states to be trained in the fundamentals of Artificial Intelligence and Machine Learning."

Recent developments have forced governments to drive national digital transformation to improve services to citizens and maintain competitiveness by appropriately designing and using technology solutions. However, any digital transformation requires leadership training, and according to Gartner's "Transition to Digital Government in 2022," 80 percent of public sector leaders say they are lagging behind the private sector.

As such, the new program will enable governments to develop strategies, scalable solutions, and action plans for digital transformation in their communities. It covers topics such as digital governance, technology, infrastructure, and inclusion.

Samira Njoya

In Africa, only a few tech entrepreneurs embrace the legal sector. Yet, legaltech solutions will be very useful for the broader dissemination of all kinds of legal frameworks governing every type of person, protecting against abuses, and defending rights.

Legal Doctrine is a digital solution developed by an Algerian startup. It allows users to access legislation, regulations, and court decisions from several Francophone African countries. The legaltech startup behind the solution is based in Algiers. Founded in 2018 by Walid Ghanemi, it wants to ensure that every African business and institution has transparent access to the laws it is governed by.

“Legal Doctrine transforms a wide range of data into exploitable information that allows decision-makers and practitioners to monitor all legal news daily,” the platform indicates.

Through its Android or iOS apps, users can set up their Legal Doctrine accounts to test the platform with the free trial option or request subscription information.

The legaltech builds up its legal library with the jurisprudence of Algeria, Tunisia, Morocco, Senegal, Côte d’Ivoire, and Cameroon.

“Thanks to its powerful indexing and search by keywords features, Legal Doctrine’s Legal Search engine allows you to quickly identify the most relevant legal information on which you can elaborate your strategy,” the solution explains on its platform. Its platforms are localized in English, French, and Arabic. Currently, it claims some 4,000 subscribers, over one million searches in 2020, and 15 million in 2021. On Playsotre, its Android app has been downloaded more than 5,000 times. In 2018, Legal Doctrine won the “Best African Legaltech Startup” in Zurich. In 2019, it won a similar award in Tunis.

Adoni Conrad Quenum

With over 10 years of entrepreneurship experience, he specializes in financial technologies. He heads two start-ups that work towards financial inclusion in Africa.

Opio Obwangamoi David (photo) is a Ugandan-trained economist, entrepreneur, and co-founder/CEO of the fintech company gnuGrid CRB.

His fintech company, founded in 2019, facilitates financial inclusion by providing credit data on “last mile financial services consumers.” Since 2021, it is licensed by the Ugandan central bank as “the first-ever indigenous Credit Reference Bureau (CRB)” in the country. Indeed, the data it generates base reports and credit scores on individual borrowers, helping credit providers make more informed lending decisions. One of its core offerings is Solar Sentra, a paygo system combining software and hardware to allow solar energy companies to manage customers’ data, sales, delivery, installation, and after-sales services.

Before gnuGrid CRB, in 2012, David founded Ensibuuko, a software company that develops fintech solutions to let Savings and Credit Cooperative Societies, lending companies, savings groups, and investment clubs automate operations.

A Westerwelle Foundation Younger Founders Program Fellow and World Frontiers Young Convergence Pioneer, in 2021, Opio Obwangamoi David attended a masterclass at the America Express Leadership Academy, where he studied Ashoka System Change.

Between 2009 and 2010, the entrepreneur was a volunteer youth mentor at Educate! a nonprofit organization that prepares African youth with the skills needed to succeed in today's economy. In 2013, he won the ICT4agric competition through Ensibuuko.

Melchior Koba

Gabon’s digital transformation strategy provides for the creation of several digital infrastructures to develop the ICT industry. Several players have recently sent proposals to help the government successfully implement that strategy.

The Gabonese Minister of Digital Economy, Jean Pierre Doukaga Kassa, received Thursday, an American delegation led by Dilawar Syed, Special Representative to the United States Office of Economic and Business Affairs.

On social media, the Ministry of Digital Economy said that the delegation came "to [express] U.S. [companies’] will to support Gabon in its major digital investment projects.”

The two parties reviewed the areas of cooperation between Gabon and the U.S., but also U.S. companies’ support in the development of the Gabonese digital ecosystem through the construction of infrastructure (backbone and data center), innovation (start-up and training), as well as the improvement of the legislative and regulatory framework specifically in the fight against cybercrime and cybersecurity.

The visit comes in a context where Gabon is working to further develop its digital sector so that it can make a greater contribution to the transformation of its economy. Since 2009, through the strategic plan Emerging Gabon 2025, the government is working to make Gabon a model in the African digital sector by 2025.

Over the past few months, the country is visited by foreign investors who are offering to support the country in achieving its goal. Earlier this month, the Minister of Digital Economy also received a delegation of Indian businessmen who offered their expertise for the construction of data centers in the country.

On Twitter, Dilawar Syed said that the visit of U.S. investors comes in the wake of the U.S.-Africa summit and responds to the willingness of U.S. President Joe Biden to assist African countries in their digital transformation.

Samira Njoya

Motorcycle taxis are one of the most widely used transport modes in Africa. But, the sector is sometimes disorganized and hailing bike drivers can be a hurdle. In Rwanda, a start-up wants to make bike hailing easier.

Yegomoto is an urban mobility solution developed by the Rwandan start-up Yego Innovision Ltd, a subsidiary of the Singaporean firm Kommlabs. It allows Kigalians to easily move around town on their preferred transport mode, motorcycle cabs.

Through its mobile apps -available for Android and iOS devices, users can request a bike ride or even hail car drivers. Its motorcycle taxi drivers are identifiable by their bright-red helmets. So, if a user doesn’t want to or is unable to book a ride through the mobile app, he/she can just hail the Yegomoto drivers on the roadside and easily get to their destination. In the two cases, once at the destination, the cost of the ride is displayed by meters, allowing the user to pay via mobile money, the Tap and Pay card, or Yegomoto’s Ride-tap-Pay card.

In addition to public transport, the start-up is active in last-mile delivery. Since its launch, the Android version of the application has been downloaded more than 10,000 times. Yegomoto claims more than 16,226,575 trips and more than 84,820,632 kilometers traveled. It plans to launch in Harare and Bulawayo, Zimbabwe before eying other African countries.

Adoni Conrad Quenum

Africa is attracting a rising volume of venture capital but, most of the funds go to startups in a handful of countries.

Factor[e] Ventures, a team of company builders that invests in early-stage startups in sub-Saharan Africa and Southeast Asia, has launched Delta40, a startup studio specifically focused on Africa.

Per its website, Delta40’s “mission is to increase incomes and tackle climate change in Africa by building high-impact, technology-enabled energy, agriculture, and mobility ventures led by diverse, experienced founders.”

“A decade of investing in energy, agriculture, mobility, and water innovations in emerging markets has affirmed that there is a great opportunity at the formation stage to support local and diverse founders as they connect their technologies and markets,” said Factor[e] Ventures co-founder, Morgan DeFoort.

The startup studio will invest between $100,000 and $600,000 to create and support African startups specializing in energy, agriculture, and mobility –the sectors that captured 8% of the overall VC funding attracted by Africa in 2022, according to Partech Africa.

With the launch of Delta40, Factor[e] Ventures aims to boost the volume of VC financing attracted by African startups and encourage investors to fund even more startups in the targeted sectors. In addition to providing capital, Delta40 will also act as a co-founder, offering product testing, technology brokering, early-stage commercialization, and accelerating company creation.

Delta40 has secured funding and support from several private and public institutions, including the Autodesk Foundation, the Global Energy Alliance for People and Planet, and the climate technology law firm Wilson Sonisi. The startup studio will be based in Kenya, with operations in Nigeria.

Samira Njoya

He is a lawyer specializing in information and communication technology law. To boost the livestock sector and facilitate livestock trade in South Africa, he founded SwiftVEE.

Russel Luck (photo) is a lawyer and the founder/CEO of SwiftVEE, an agritech startup.

Founded in 2017, SwiftVEE provides livestock advertising and insurance services online. Its platform helps address water scarcity, food insecurity, and market inefficiencies in the livestock sector. Currently, it claims over 100,000 livestock sold and more than 20,000 satisfied customers.

In January 2023, the startup launched a new app to help farmers buy the inputs they need at the best rates. The app, called PrysWys, allows farmers to list the inputs they need and receive the best quotes.

According to Russel Luck, PrysWys was launched to curb the rising costs of inputs. "[...] We have noticed that farmers pay high premiums for their inputs at brick-and-mortar retailers. We believe there is a lot of unnecessary bloat in the traditional supply of inputs…," he told Disrupt Africa.

To date, with over 1,000 active users, PrysWys has sold tens of thousands of dollars worth of input online.

Since 2014, its originator, Russell Luck, has been a non-executive consultant with SwiftTechLaw, a law firm specializing in the tech sector. He began his professional career in 2005 as a graduate intern at BNP Paribas Bank. In 2007, he became an attorney with the real estate law firm Smith Tabata Buchanan Boyes.

The lawyer has received several awards for his start-up, which is a Google Launchpad company and the winner of the 2018 MEST Africa Challenge South Africa.

Melchior Koba

Liberia's financial sector faces several challenges, including inadequate ICT infrastructure. The existing payment infrastructure deployed in 2016 has served the country well over the past six years but requires urgent upgrading.

The African Development Bank (AfDB) will finance the Liberia Payments Infrastructure and Systems Upgrade Project. For the said project, the Board of Directors of the African Development Fund, the AfDB's concessional lending window, approved a $3.9 million grant on Friday, March 17.

“The modernization of Liberia’s payments infrastructure and systems to improve payments efficiency will not only strengthen the formal financial sector but contribute to greater financial stability and improved private sector development,” explained Benedict Kanu, African Development Bank country manager for Liberia.

According to an AfDB release, the financing will target the automated check processing and automated clearing house systems, as well as the real-time gross settlement systems that form the backbone of payment processing in the country's financial sector.

It will also finance the upgrading of the Central Bank of Liberia's main data center and “impact the institution and government ministries involved in the payment.”

The main objective is to strengthen Liberia's payments ecosystem for increased efficiency and to foster growth and innovation, as well as financial inclusion, which currently stands at 44.2 percent according to the World Bank's Global Findex 2021 database.

Samira Njoya

More...

He is a serial entrepreneur with over five companies created in Morocco and Dubai. His companies include Ezzal, a startup that aims to facilitate the transport of goods across Africa and the Middle East.

Mohamed Badr (photo) is an Egyptian serial entrepreneur and one of the co-founders of Ezzal, a mobile platform that aims to facilitate the transport of goods.

Founded in 2020, Ezzal allows vehicle owners to offer services to anyone who needs to transport items -appliances, furniture, machinery, or materials. It helps businesses and individuals find the right and reliable carrier for their needs and avoid being surprised by high costs and poor service quality.

Mohamed Badr launched the app in Morocco instead of Egypt where he was born and raised "due to the economic conditions in Egypt, such as inflation and the low local currency, in addition to the authorities imposing a lot of additional fees and petty cash that did not exist in the past, such as security permits."

The app is now accessible in every city in Morocco and neighboring countries like Spain, Gibraltar, Portugal, Mauritania, and Senegal. The company also plans to expand to other countries in North Africa and the Middle East but has yet to make plans to expand to Egypt.

Before launching Ezzal, in 2017, Mohamed Badr co-founded LarusDubai, a Dubai-based startup that provides freight forwarding, customs clearance, transportation, and courier services. In 2021, he launched Megamaa, a rain management tech that created a natural material of the same name to solve flooding problems. In submerged cities, the material can be thrown around before rains. It then collects rainwater that can be used in drought-affected areas or to irrigate farms.

In 2022, the serial entrepreneur founded Murabetsport, a crowd and event management company. He also founded Nazyef, an electric car charger manufacturer, and Neque contumelia, an artificial intelligence technology that aims to reduce injuries in soccer.

His professional career began in 2014 at Engineers Club of Alexandria where he was the inventory control supervisor. In 2015, he was hired by IEREK (International Experts for Research Enrichment and Knowledge Exchange), an international institution dedicated to knowledge exchange and research improvement, as an event coordinator. He worked there until the launch of LarusDubai.

Melchior Koba

Africans are increasingly turning to e-learning. Since the Covid-19 pandemic, interest in this sector has increased and local tech entrepreneurs are offering tailor-made solutions, adapted to the needs of the population.

Teesas is an edtech solution developed by a Nigerian start-up. It helps users -children notably- improve their understanding of various topics and subjects and learn indigenous languages. The start-up, based in Ikeja, was founded in 2020 by Osayi Izedonmwen. It raised, less than two months after its launch, $1.6 million to develop its technology and better position itself in the Nigerian market.

“Teesas provides a platform where educators and learners engage seamlessly and efficiently, to facilitate a fun and effective learning experience via the deployment of technology and the adoption of local culture and dialects,” the startup indicates on its web platform.

Users can access its content through its mobile applications developed for iOS and Android devices -the Android version has been downloaded more than 100,000 times from Playstore. To allow their children to access the contents, parents can register accounts and select the subjects their children are struggling with or local language courses. The content is inspired by the Nigerian national curriculum, which makes it easier for learners.

Osayi Izedonmwen explains that "live classes deal with concepts where learners have challenges. The learners sit with teachers in small remote classes of 10 or 15 for a personalized engagement, and to get more rigor into the teaching process.” Access to the content requires a subscription (starting from $6 monthly).

The solution also has dedicated Android and iOS apps for parents to track children’s progress in the selected subjects and languages. It provides access to information about opportunities for improvement and personalized learning data. "We foresee a future where kids don’t have to attend in-person classes because they can cover entire curriculums on an app, and be ready enough for their secondary school entrance exams," Osayi Izedonmwen indicates.

Adoni Conrad Quenum

With the improvement in internet access, the rise in smartphone adoption, the drop in the costs of sensors, the development of the cloud, etc… Africa has the opportunity to become a real player in the development of the internet of things. In that context, Nigeria is upping its investments in the sector.

E-Space, a global satellite communications company, announced, Monday, it has secured landing rights in Nigeria for its upcoming constellation of low-orbit satellites.

The approval issued by the Nigerian Communications Commission gives E-Space the right to deploy its satellite system, which will "provide communications services and connect Internet of Things (IoT) devices throughout Nigeria in many of the hardest-to-reach parts of the country, particularly those areas currently unserved by terrestrial providers."

Nigeria is among the many nations that are leveraging the Internet of Things to address a wide variety of national challenges while implementing solutions to grow their economy. In 2018, U.S. giant IBM and agritech company Hello Tractor, which has a presence in Nigeria and Kenya, partnered to develop an AI and blockchain platform for African farmers. The partnership has enabled the installation of connected objects equipped with sensors in farms to collect and transmit data on rainfall, plant predators, input use, etc.

The landing right opens a new era in the field and paves the way for future collaboration between E-Space and the country's government, businesses, and communities. The collaboration can lead to the development of the ecosystem and applications needed to develop the local economy and create new jobs in a range of fields, including engineering, and data analysis.

After its launch in 2017, the insuretech company struggled to gain ground in the South African market until 2021 when it suddenly grew by 200% in the first semester.

Pineapple is an insurtech solution developed by a South African eponymous startup. It allows users to purchase insurance policies online

On its web and mobile (Android and iOS apps) platforms, the solution offers a multitude of insurance policies users can buy after they set up their Pineapple accounts. Among others, Pineapple offers insurance for cars, bikes, smartphones, fire, theft, leaks and floods, power surge, or accidental damage.

Before subscribing, users can request and receive record time quotes and policy details, and benefits.

In some cases, the insuretech offers discounts on some policies. For instance, if a car insurance subscriber travels less than 300 kilometers per month, he/she will get a discount that can go up to 30%.

According to PlayStore data, the Android version of its mobile app has been downloaded more than 100,000 times. In 2019, the South African insuretech won the top prize in the annual VentureClash competition in the US. It was awarded $1.5 million, an amount that the executives invested in the development of the startup. Also, since its launch, it has raised some $9.1 million to support its growth. In July 2021, when it secured ZAR80 million in Series A round, it announced that in the first six months of the year, it grew by an unexpected 200%.

Adoni Conrad Quenum

![Factor[e] Ventures launches an Africa-focused startup studio](/media/k2/items/cache/cbbcf4fa489d61b42aa4a35932850e0b_S.jpg)