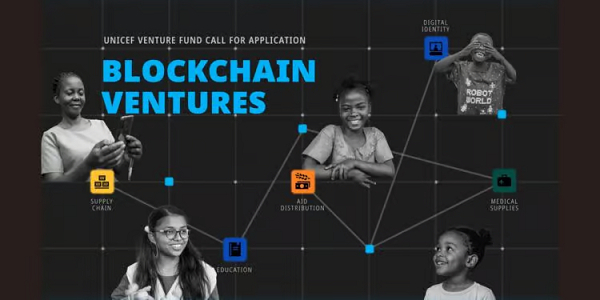

The UNICEF Venture Fund is inviting early-stage startups from UNICEF programme countries to propose blockchain-based solutions that improve transparency, financial efficiency, and digital public goods. Selected projects will receive up to $100,000 in equity-free funding, technical mentorship, and 12 to 18 months of support. Applications are open until Tuesday, March 10, 2026.

-

Generative AI enables the creation of synthetic sexual abuse images and deepfakes targeting minors.

-

Around 40% of Africans aged 15–24 currently have internet access, increasing both opportunity and exposure to risk.

-

African regulatory frameworks remain fragmented and largely unprepared to address AI-generated harms.

As submarine cables multiply and 4G and 5G networks expand across the continent, an entire generation integrates into the digital world. Governments and businesses leverage this connectivity to drive economic, educational and social development. However, millions of minors face new, more sophisticated and harder-to-detect threats.

According to joint estimates from the International Telecommunication Union and the African Union, about 40% of Africans aged 15 to 24 currently access the internet. This steadily rising figure creates a dual imperative: authorities must accelerate digital inclusion while strengthening child protection mechanisms.

Generative AI, a New Frontier for Online Abuse

Generative AI is transforming the nature of online harm targeting children. Cyberbullying no longer relies solely on insults or the circulation of authentic images. Individuals now use widely accessible applications to fabricate intimate images, clone voices or manipulate videos from a single photograph.

In 2023, the Internet Watch Foundation reported for the first time the circulation of entirely AI-generated child sexual abuse images online. The organization warned that these technologies significantly lower technical barriers and complicate perpetrator identification. INTERPOL also acknowledged that increasingly sophisticated deepfakes hinder investigations and make it harder to distinguish authentic material from manipulated images. Criminals also use these tools to conduct “sextortion,” in which individuals blackmail teenagers and their families using fabricated content.

Child rights organizations report that predators also use AI to analyze online behavior, emotional states and personal interests in order to refine manipulation strategies.

Legal Frameworks Remain Inadequate

Regulatory responses remain uneven across the continent. The Malabo Convention, adopted by the African Union, establishes a foundation for cybersecurity and personal data protection. However, policymakers drafted the convention before the emergence of generative AI, and the text does not explicitly address synthetic content targeting minors.

Several African countries have enacted data protection laws that regulate the collection and processing of personal information. However, most frameworks do not include specific provisions regarding platform liability in cases involving deepfakes of children.

In South Africa, the Protection of Personal Information Act imposes strict obligations regarding data processing, including data relating to minors. Nevertheless, lawmakers designed the framework primarily to protect privacy rather than to proactively prevent AI-generated harmful content.

In Cameroon, authorities adopted a charter on online child protection in 2023 that establishes shared responsibility among telecom operators, regulators and families. However, the law protects only children under 18, while the legal age of majority in Cameroon stands at 21, which leaves a segment of minors without full legal coverage.

Toward More Structured AI Governance

Policymakers are advancing discussions at both continental and global levels. The African Union is developing a strategy to regulate AI development and use, with a focus on ethics, data governance and digital sovereignty. Policymakers are increasingly recognizing child protection as a cross-cutting issue, particularly in a continent with the world’s youngest population.

At the global level, UNICEF advocates a “Safety by Design” approach that integrates child protection into the design phase of digital products. The organization argues that stakeholders must anticipate risks rather than intervene only after harmful content spreads. UNICEF also warns that children face heightened exposure to online threats in environments where regulation, local-language moderation and reporting mechanisms remain underdeveloped.

Samira Njoya

Applications are now open for the Africa’s Business Heroes 2026 competition, which targets African entrepreneurs leading impact-driven businesses that have been registered on the continent for at least three years. Ten finalists will share $1.5 million in grant funding and receive support including increased visibility, mentorship and networking opportunities. Applications can be submitted by April 28, 2026.

Google.org has opened applications for the "Impact Challenge: AI for Government Innovation," aimed at organizations developing artificial intelligence solutions with public partners to improve essential services. Selected projects may receive grants ranging from $1 million to $3 million and access specialized technical support to scale their impact. Applications are open until Friday, April 3, 2026.

-

South Africa and the Netherlands signed a memorandum of understanding on March 3 to deepen digital cooperation.

-

South Africa ranked 40th globally and 1st in Africa in the 2024 UN E-Government Development Index with a score of 0.8616.

-

The Netherlands ranked 10th globally in the same index with a score of 0.9538 and achieved top-tier status in cybersecurity under the International Telecommunication Union index.

South Africa is exploring cooperation with the Netherlands across several digital fields to stimulate innovation and strengthen the protection of online spaces. Both parties signed a memorandum of understanding on March 3.

Officials formalized the initiative during a bilateral meeting between Mondli Gungubele, South Africa’s Deputy Minister of Communications and Digital Technologies, and a delegation from the Embassy of the Netherlands in South Africa. Participants discussed digital skills development, emerging technologies, artificial intelligence, cybersecurity, and online child protection.

This rapprochement forms part of broader efforts by African countries to accelerate digital transformation. Governments are integrating digital technologies across all sectors of the economy to support socio-economic development.

South Africa remains one of Africa’s leaders in digital transformation, particularly in public administration. The country scored 0.8616 out of 1 in the 2024 E-Government Development Index published by the United Nations. The ranking placed South Africa first among 54 African countries and 40th out of 193 countries worldwide, above the global average of 0.6382.

In cybersecurity, the International Telecommunication Union placed South Africa in the second performance tier out of five. The country achieved the maximum score of 20 in two pillars covering technical, legal, and cooperation measures. However, the organization highlighted the need to strengthen capacity-building and organizational measures.

The Netherlands ranked 10th globally in the 2024 E-Government Development Index with a score of 0.9538 out of 1. In cybersecurity, the International Telecommunication Union classified the country in the top performance tier, which represents a model to follow. The Netherlands achieved the maximum score in four of the five ITU pillars—legal, technical, organizational, and cooperation—and scored 19.22 out of 20 in capacity development.

These indicators illustrate the Netherlands’ potential expertise in supporting South Africa’s digital ambitions. However, both parties have so far signed only a memorandum of understanding. The agreement formalizes their intent to cooperate but does not yet guarantee the implementation of funded projects with a defined timeline. Observers will need to monitor the next steps to assess the partnership’s concrete impact.

Isaac K. Kassouwi

-

Morocco’s CNDP and Portugal’s CNPD signed a memorandum of understanding in Lisbon on Feb. 25 to formalize institutional cooperation.

-

The agreement prioritizes artificial intelligence, deepfakes and digital violence amid rising cross-border data risks.

-

Morocco’s internet penetration exceeded 92% at end-2025, while Portugal reported high generative AI adoption and advanced GDPR enforcement.

Morocco and Portugal have stepped up coordination to tackle emerging digital challenges. The national authorities responsible for personal data protection in both countries signed a memorandum of understanding in Lisbon on Wednesday, Feb. 25, to structure their institutional cooperation.

Paula Meira Lourenço, president of the Comissão Nacional de Proteção de Dados (CNPD), and Omar Seghrouchni, president of Morocco’s Commission nationale de contrôle de la protection des données à caractère personnel (CNDP), signed the agreement at the CNPD headquarters. The text established an operational framework to intensify technical expertise exchanges and information sharing.

AI and Digital Violence at the Core of Priorities

The cooperation will primarily target issues related to artificial intelligence, image manipulation technologies such as deepfakes and digital violence. These phenomena have raised growing concerns regarding privacy protection, legal certainty and regulation of digital practices. The memorandum also provides for training programs, educational projects and the exchange of best practices in oversight and enforcement of regulatory frameworks, as technology continues to evolve rapidly.

This initiative comes as both countries experience strong digital momentum. In Morocco, internet penetration exceeded 92% at the end of 2025, according to DataReportal, placing the country among the most connected markets in Africa. Meanwhile, Portugal has recorded high adoption rates of generative artificial intelligence, according to a recent study by Bain & Company. Portugal has also built advanced experience in enforcing the European Union’s General Data Protection Regulation (GDPR).

Anchoring Cooperation in Regional Networks

The agreement provides for annual bilateral meetings to ensure structured follow-up. Each institution will also leverage its international networks. The CNPD will rely on the Ibero-American Data Protection Network (RIPD) and the Lusophone Data Protection Network (RLPD). Meanwhile, Morocco’s CNDP will activate the Network of African Data Protection Authorities (NADPA-RAPDP) and the Francophone Association of Data Protection Authorities (AFAPDP).

Samira Njoya

-

President Félix Tshisekedi instructed the government to strengthen regulation of social media platforms during a Feb. 27 cabinet meeting in Kinshasa.

-

Internet users in the Democratic Republic of Congo rose 64.1% to 34.7 million between 2021 and early 2026, while social media users climbed to 10.4 million, according to DataReportal.

-

The government will promote enforcement of the country’s Digital Code and require biweekly progress reports from relevant ministers.

President Félix Tshisekedi has instructed the government of the Democratic Republic of Congo (DRC) to tighten oversight of social media platforms in order to curb abuses. He issued the directive during the 80th ordinary meeting of the Council of Ministers held on Friday, Feb. 27, in Kinshasa.

The president tasked the Minister of State for Justice and Keeper of the Seals, along with the Minister of the Digital Economy, with proposing and implementing measures in coordination with relevant services to promote responsible, ethical and rational use of social media. The measures could include, where appropriate,“proportionate and lawful restrictive measures, while respecting fundamental freedoms,” according to the statement read by Augustin Kibassa Maliba, Minister of the Digital Economy.

The directive comes amid rapid growth in social media adoption alongside expanding telecommunications services, particularly internet access. DataReportal data show that the number of internet users increased from 21.14 million in 2021 to 34.7 million in early 2026, representing a 64.1% rise and an estimated penetration rate of 30.5%. Over the same period, the number of social media users rose from 4 million to 10.4 million.

Congolese authorities argue that “Far from serving exclusively positive purposes, social media increasingly constitute vectors of misinformation, public disorder, hate speech, manipulation of opinion, and incitement to division among Congolese people, thereby undermining national cohesion, public order, and social stability.”

The decision also follows persistent security challenges in several provinces. Social media platforms have become key arenas for debate on security issues.

Promoting and Enforcing the Digital Code

The presidential communication emphasized the need to promote and enforce the Digital Code, which lawmakers adopted to regulate digital platform use in the DRC. The president stated that the legal instrument already provides mechanisms to prevent, regulate and punish online abuses. However, he said authorities and the public have not sufficiently understood or applied the provisions.

The government will not limit awareness efforts to citizens. The Minister of Communication and Media will work with public and private operators to conduct ongoing public awareness campaigns. Authorities will also target magistrates under the coordination of the High Council of the Judiciary to ensure coherent and deterrent application of the law.

Beyond regulatory measures, the executive branch will invest in education. The Ministries of National Education and Higher Education will gradually integrate training modules and awareness programs on responsible digital use into school curricula. Authorities will incorporate issues related to social media and artificial intelligence into youth education.

The president has required relevant ministers to submit a detailed report every two weeks outlining actions taken, results achieved and any difficulties encountered to ensure monitoring and evaluation. However, authorities have not yet disclosed the precise implementation measures.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange J.A de Berry Quenum

-

Senegal’s National Police held talks with Meta Platforms to strengthen operational cooperation on online security.

-

Authorities plan technical training for specialized cybercrime units, including the division dedicated to cybercrime.

-

The International Telecommunication Union ranked Senegal Tier 3 in its Global Cybersecurity Index 2024 with a score of 67.17/100.

Abdoul Wahabou Sall, deputy director general of Senegal’s National Police, met last week with a delegation from Meta Platforms, the parent company of Facebook, WhatsApp and Instagram. The meeting aimed to explore new avenues of cooperation on online security.

Discussions focused on protecting young people and minors on social media platforms and strengthening operational collaboration mechanisms between law enforcement and the U.S. company. “In this regard, Meta representatives reaffirmed their willingness to support the National Police through capacity-building initiatives,” the Senegalese Police said.

Authorities expect the partnership to translate into capacity-building initiatives for specialized units, particularly the cybercrime division. Meta will organize technical training sessions on its tools and dedicated law enforcement portal to improve the handling of judicial requests and the processing of flagged content.

This initiative forms part of a broader trend across Africa, where governments have expanded partnerships with digital players to address the rapid growth of online activity. Senegalese authorities have sought to adapt investigative methods to a digital environment that now lies at the core of criminal activity, as cyber fraud, online harassment and illicit content dissemination increase.

Public institutions have also faced attacks in recent months. Hackers breached the national tax platform in October. A cyberattack then targeted the Department of File Automation (DAF) in early February. The agency manages the issuance of national identity cards, passports and biometric data. The attack forced authorities to temporarily suspend the production of national identity cards.

Cooperation with digital platforms provides a critical lever to identify perpetrators and accelerate the processing of reports. This cooperation reflects a broader shift in the role of security forces, which must now operate in cyberspace as actively as they operate on the ground.

Does Senegal Have the Means to Respond?

In its “Global Cybersecurity Index 2024” report, the International Telecommunication Union assigned Senegal a score of 67.17 out of 100. The score placed the country in Tier 3, which groups countries “having scored at least 55/100 and demonstrating an initial commitment to cybersecurity. This category corresponds to countries that have taken action—assessment, adoption, or implementation of recognized measures—in a moderate number of areas or indicators.”

Since that assessment, Senegalese authorities have announced the New Deal Technologique, a $1.7 billion program designed to turn the country into a technology hub by 2034. During the program’s launch in February 2025, President Bassirou Diomaye Faye said: "We are committed to building a sovereign digital space by strengthening our cyber resilience, securing infrastructure, protecting our critical data, and gradually reducing our dependence on foreign solutions."

Adoni Conrad Quenum

-

Clive Nabale founded Zoyk Pay Group in 2021 to unify online and on-the-ground business payments across Africa.

-

The platform enables companies to accept in-store, web and agent-based payments while consolidating financial flows into a single interface.

-

Nabale also leads Bettergames Limited Zambia and co-founded cross-border payments firm Payabrod.

Clive Nabale, a Zambian fintech entrepreneur, founded and leads Zoyk Pay Group, a technology company that aims to simplify everyday transactions for businesses across the continent, whether online or in physical environments.

Founded in 2021, Zoyk Pay Group offers an integrated platform that allows organizations to accept, manage and scale digital payments across multiple channels, including brick-and-mortar stores, agent networks and fully online services.

Zoyk Pay acts as a single entry point for diverse payment scenarios. The solution enables companies to collect payments in-store, on their websites or through proximity agents while maintaining a consolidated overview of their financial flows. The platform also facilitates the management of digital wallets for customers or partners, including top-ups, recurring payments and refunds.

Companies can leverage Zoyk Pay’s agent network to reach underserved areas where traditional banks maintain limited presence, without deploying their own infrastructure. The platform also integrates additional financial services such as fund distribution, bill payments and other routine transactions.

Alongside this venture, Nabale serves as chief executive officer of Bettergames Limited Zambia, an online lottery services company that he co-founded in 2017. He also acts as managing partner at Morgace Venture Fund and co-founded Payabrod in 2020 to focus on cross-border payment solutions.

Earlier in his career, Nabale founded Jobtoria in 2008, an online platform dedicated to career opportunities in East Africa. He then launched Quick Charge Media in Nairobi in 2012.

Nabale earned a degree in marketing and international business from Edith Cowan University in 2007. He also obtained a degree in business and economics the same year from York University in Canada.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de BERRY QUENUM

-

Catherine Njeri co-founded Acre Insights in 2023 to measure and verify agricultural and forest land across Africa.

-

The company uses drones, satellites and data analytics to estimate biomass and carbon stocks for reforestation and regenerative agriculture projects.

-

Acre Insights delivers interactive maps and detailed reports to support faster and more informed land-use decisions.

Catherine Njeri, a Kenyan entrepreneur specializing in data and digital products applied to agriculture and climate, co-founded and leads Acre Insights. The company supports agricultural and forestry actors across Africa by helping them better measure, monitor and valorize their land.

Founded in 2023, Acre Insights aims to contribute to an Africa where every hectare, whether farmland or forest, can be reliably measured, verified and valued. The company provides a clear and verifiable data foundation for reforestation, regenerative agriculture and carbon offset projects.

The firm relies on two main categories of tools: aerial and spatial observation, and advanced data analytics. It deploys drones and satellites to capture detailed imagery of agricultural and forest areas. It then applies proprietary algorithms to identify vegetation cover, measure tree height and extract other key indicators required to estimate biomass and on-site carbon stocks.

Acre Insights delivers results through interactive maps and detailed analytical reports. The company simplifies the complexity of natural systems to enable faster, better-informed and more sustainable decisions.

Njeri earned a bachelor’s degree in international business administration in 2015 from African Leadership University. She also obtained a diploma in business information technology the same year from Strathmore University.

She completed internships in marketing and business development at Cellulant and later worked in project management and data analysis at ALX. She joined African Leadership University in 2019 as a data analyst. She then returned to Cellulant in the same year, where she successively held roles as operational process coordinator, global commercial operations manager and key account manager.

In 2022, she became head of commercial operations, data and reporting at Ramani, a company specializing in the digitization of Africa’s supply chain. From 2024 to 2025, she served as head of research at Kenya Flying Labs, a center dedicated to robotics and technological innovation.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de Berry Quenum

More...

-

Guinean start-up Fifoow launched its mobile marketplace in February 2026 under founder Oumar Sadjo Barry.

-

The platform connects buyers, sellers and recruiters through a centralized mobile application available on iOS and Android.

-

The initiative aims to formalize largely informal, social media-driven commercial exchanges in Guinea.

Fifoow operates as an e-commerce solution developed by a young Guinean start-up. The company positions the platform as a mobile marketplace dedicated to classified ads and local opportunities. Founder Oumar Sadjo Barry launched the start-up in February 2026.

The solution offers a mobile application available on iOS and Android. The application allows users to buy, sell or search for various goods and services through a single interface. The platform connects sellers, buyers and recruiters directly within a digital space tailored to the Guinean market.

The platform covers multiple categories of use. Users can post real estate listings, offer vehicles, search for jobs, sell electronic products or promote professional services. Each listing includes photos, a detailed description, the seller’s location and direct contact via phone or messaging, which reduces intermediaries in transactions.

Fifoow follows a mobile-first approach and integrates a search engine with filters that sort offers by price, category, product condition or geographic area. The application also provides store profiles for merchants, real-time notifications and verification mechanisms designed to strengthen trust among users.

Beyond a traditional classified ads site, the platform aims to digitize everyday exchanges in a market where online commerce remains nascent, particularly in Guinea. By consolidating job offers, products, services and economic opportunities within a single platform, Fifoow seeks to create a unified digital entry point for local transactions.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J.A de Berry Quenum

-

Ghana has finalized and government-approved its National Artificial Intelligence (AI) Strategy, with an official launch expected in the coming weeks by President John Dramani Mahama.

-

The strategy rests on four pillars, including data protection and exploitation, digital infrastructure development, skills training through the “One Million Coders” program, and ethical governance.

-

The United Nations warns that AI deployment carries risks, including data bias, ethical concerns and digital divides, particularly in lower-income countries.

Ghanaian authorities have finalized the National Artificial Intelligence Strategy, which the government recently approved. Authorities expect President John Dramani Mahama to officially launch the roadmap in the coming weeks.

Samuel Nartey George, Minister of Communication, Digital Technology and Innovation, disclosed the information during his address at the National Data Protection Conference 2026 held on Thursday, February 26.

Ghana’s National AI Strategy rests on four key priorities. Authorities aim to harness and protect national data, including African genomic data, as a strategic asset. Authorities also plan to develop robust digital infrastructure and adequate computing power to support innovation and large-scale data processing. In addition, authorities intend to strengthen skills development through initiatives such as the “One Million Coders” program to build a qualified workforce in AI and cybersecurity. Finally, the strategy commits to transparent and ethical governance, supported by concrete use cases that aim to generate tangible value for all citizens.

The roadmap reflects the government’s ambition to position digital technologies as a central driver of national development. Authorities emphasize AI’s transformative potential across multiple sectors. During the launch of the Stakeholder Consultation Forum on the National AI Strategy in May 2025, Samuel Nartey George cited specific applications, including crop health forecasting in agriculture, faster diagnostics in healthcare, personalized learning in education, enhanced transport safety and strengthened surveillance for defense and border security.

The United Nations has endorsed this strategic direction. In its “E-Government Survey 2024,” the United Nations Department of Economic and Social Affairs states that artificial intelligence can optimize public sector operations. The report explains that automation of administrative tasks can increase efficiency and eliminate delays and redundancies. The report also states that AI can detect anomalies, classify data and generate precise recommendations.

However, the United Nations Department of Economic and Social Affairs highlights several potential risks. The report identifies data bias as a concern because bias can misrepresent certain groups. The report also underscores ethical, security and social concerns. In addition, the report identifies the digital divide as a major challenge for AI implementation in the public sector, particularly in middle-income, low-income and least developed countries.

Isaac K. Kassouwi

-

The Gabonese government approved a draft ordinance amending the Criminal Procedure Code to regulate the admissibility of digital evidence.

-

Authorities now require digital evidence to prove reliability, authenticity and traceability through verification by authorized public entities.

-

An international Cellebrite study shows that 60% of investigators consider digital evidence more decisive than DNA in some cases, while 74% say it improves case resolution rates.

The Gabonese government approved a draft ordinance on February 26, during a cabinet meeting. Justice Minister Augustin Emane presented the text, which amends the Criminal Procedure Code to regulate the admissibility of digital evidence before courts. The reform introduces formal requirements that aim to adapt the judicial system to the rise in digital-related offenses.

The reform establishes a technical framework for the use of electronic data in criminal proceedings. Authorities will admit digital evidence only if it demonstrates reliability, authenticity and traceability. Authorized public entities, including cybersecurity services and competent state bodies, will verify the data before courts accept it. Authorities aim to secure the judicial use of digital data and to limit manipulation and falsification risks.

Through this amendment, authorities seek to strengthen the reliability of investigations and to enhance the protection of litigants. The formal recognition of technical validation standards also aims to regulate prosecutions related to digital offenses, which have increased alongside the rapid expansion of digital usage in the country. Internet penetration now covers more than half of Gabon’s population, which increases the volume of digital interactions that may generate disputes.

The ordinance forms part of a broader regional movement to modernize African legal frameworks in response to digital transformation. Governments across the continent face a growing number of disputes related to electronic content, online transactions and information systems. At the international level, digital evidence continues to gain importance in criminal investigations. A study conducted by Israeli digital forensics specialist Cellebrite among more than 2,000 investigators, prosecutors and experts shows that 60% of respondents consider digital evidence more decisive than DNA in certain cases, while 74% state that its use improves investigation resolution rates.

According to Gabonese authorities, the ordinance will enter into force after publication in the Official Gazette, in line with legislative promulgation procedures. Authorities consider the reform a first step toward modernizing the judicial handling of digital offenses and strengthening legal certainty in criminal matters in line with the country’s technological evolution.

Samira Njoya

-

President Évariste Ndayishimiye met Lyca Mobile’s founder Subaskaran Allirajah to lay the groundwork for a strategic digital partnership.

-

Internet penetration in Burundi reached 11.1% at end-2025, or about 1.6 million users, according to DataReportal.

-

Lyca Mobile secured a telecommunications license in October 2025 and has moved discussions into a technical deployment phase.

President Évariste Ndayishimiye received a delegation from British group Lyca Mobile on Friday, February 27. Subaskaran Allirajah, the group’s founder and chairman, led the delegation. The presidency said the meeting laid the foundations for a strategic partnership that aims to accelerate the country’s digital transformation and strengthen healthcare coverage.

SE @GeneralNeva, le Chef de l’Etat #Burundi-ais et Président en exercice de l’ @_AfricanUnion a reçu en audience Mr Subaskaran Allirajah,Président-Fondateur du Groupe Lyca Mobile et sa délégation. Les échanges ont porté sur la coopération entre l’opérateur LYCA et le Gouvernement pic.twitter.com/3ijRKDQ6oO

— Ntare Rushatsi House (@NtareHouse) February 27, 2026

In telecommunications, the envisaged cooperation seeks to expand universal access to internet and communication services across the country. Internet penetration in Burundi remains low despite recent growth. DataReportal data show that penetration reached about 11.1% at end-2025, which corresponds to nearly 1.6 million users.

Lyca Mobile also plans to support the digital integration of public administrations and services. The group aims to improve administrative efficiency and enhance the delivery of essential services. Authorities consider digital transformation a key growth driver in this context.

Beyond telecoms, the group plans to operate in the health sector through its Lyca Health division. The initiative aims to strengthen universal health coverage, introduce solutions such as telemedicine and support the modernization of selected medical infrastructure. Authorities have aligned this approach with Burundi’s National Vision 2040-2060, which identifies information and communication technologies as structural levers of economic and social transformation.

This initiative extends previous exchanges between Burundian authorities and the group. Lyca Mobile, which already operates in Uganda and Tunisia, obtained a license in October 2025 by presidential decree to establish and operate a telecommunications network in Burundi. Discussions have now entered a technical phase focused on deployment preparations. Authorities and the group aim to expand access to reliable connectivity, improve service quality and foster more affordable communication offers for the population.

Samira Njoya