-

Malawi seeks a bilateral agreement with Ghana to replicate its digital transformation model.

-

Ghana plans to lead a delegation of 15–20 tech firms to Malawi to deploy ID, fintech and e-government solutions.

-

Malawi ranks 163rd on the UN E-Government Development Index, while Ghana ranks 108th and leads Africa in cybersecurity tier classification.

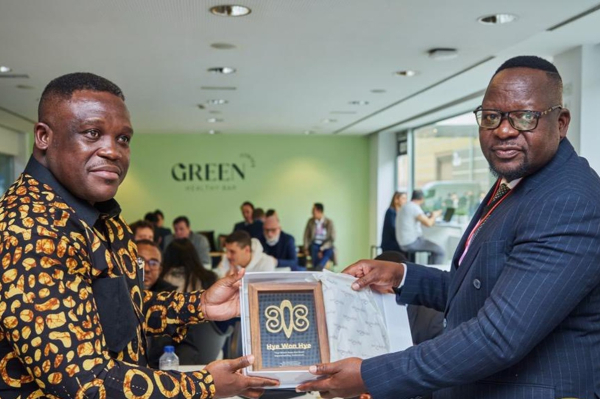

Malawi is seeking to leverage Ghana’s expertise to fast-track its digital transformation. Officials expressed this interest on the sidelines of the Mobile World Congress 2026, which took place in Barcelona from March 2 to March 5 and gathered government delegations and global digital industry players.

Malawi’s Minister of Information and Digitalisation, Shadric Namalomba, invited Ghana’s Minister for Communication, Digital Technology and Innovations, Samuel Nartey George, to conclude a bilateral agreement aimed at replicating Ghana’s digital innovation successes in Malawi.

In an exclusive interview with Techfocus24 following the meeting, which his ministry relayed, Sam George said Malawi had requested support across several areas. He said Malawi sought assistance in fintech, digital identification systems, last-mile connectivity, energy solutions for rural connectivity, e-government, smart workplaces, agritech, edutech, healthtech and artificial intelligence-integrated systems.

He added that he would soon lead a delegation of 15 to 20 Ghanaian technology companies to Malawi to help deploy national identification solutions, fintech services and e-government portals, among other systems. “To begin with, I will share a copy of our revised legislations with them so that they can draw inspiration from them and adapt them to their needs. I will also share our AI strategy with them so that they can build on it,” he said.

This rapprochement comes as Malawi aims, like many African countries, to position digital technology as a driver of inclusive socio-economic development. For example, the Digital Malawi project, which the World Bank supports, seeks to lay the foundations for a digitally enabled economy, society and public administration to expand access to services and improve citizens’ quality of life.

“Beyond investments in broadband infrastructure and other digital enablers, it is equally essential to invest in complementary non-digital factors such as digital leadership, an enabling regulatory framework, accountable institutions, as well as the development of appropriate digital skills,” the government website states.

However, Malawi continues to face structural gaps. The country ranks 163rd on the United Nations E-Government Development Index (EGDI) with a score of 0.3753 in 2024, below the averages for Southern Africa, Africa and the world. Malawi also scored 35 out of 100 on the 2025 ICT Development Index of the International Telecommunication Union, including an estimated internet penetration rate of 18%.

In cybersecurity, the ITU places Malawi in Tier 3 out of five on its 2024 Global Cybersecurity Index. The country performs relatively well in regulatory frameworks and organizational measures but needs to strengthen technical measures, capacity building and cooperation.

By contrast, Ghana ranks in Tier 1, which includes countries considered cybersecurity role models. On the EGDI, Ghana ranks 108th globally with a score of 0.6317 out of 1, above the averages for West Africa and the continent but slightly below the global average. Before Malawi, Zambia also expressed interest in Ghana’s digital transformation expertise.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange J.A de Berry Quenum

Payment provider Flocash is partnering with Quest Financial Services to launch a new prepaid Visa card in Zimbabwe.

The card can be reloaded at Quest branches and through digital wallets. It enables secure online and in-store payments locally and internationally. Users get high transaction limits, real-time tracking via a mobile app, and virtual cards for online purchases.

Fintech startups Noah and Nafolo are launching virtual bank accounts in euros and U.S. dollars backed by stablecoins for remote workers, students and families in sub-Saharan Africa.

Payments are processed within minutes rather than days, with fees significantly lower than the roughly 9% typically charged on remittances. The platforms also allow withdrawals via mobile money or virtual cards.

-

Fido Money provides instant, unsecured digital loans to individuals and SMEs via a mobile app.

-

The company raised $5.5 million in debt financing to scale technology and growth.

-

Its proprietary “Fido Score” algorithm assesses creditworthiness using alternative data.

Fido Money operates as a fintech solution developed by a Ghanaian company. The platform enables individuals and small enterprises to obtain instant digital loans without collateral or traditional banking procedures.

Founders Nadav Topolski, Tomer Edry and Nir Zepkowit launched the start-up in 2014. Earlier this week, the company announced that it had secured $5.5 million in debt financing to expand its technology and support growth.

The solution operates through a mobile application that allows users to verify their identity, receive a credit assessment and obtain funds directly in their mobile money wallets within minutes.

At the core of the model, Fido deploys a proprietary data analytics system called “Fido Score.” The algorithm evaluates borrower creditworthiness using alternative data such as phone usage, transactional behavior and digital history. The system enables the company to finance customers who often remain excluded from the traditional banking system.

The approach addresses a structural gap in West Africa, where micro-entrepreneurs and informal workers rarely hold formal financial histories. Beyond individual lending, Fido has developed solutions for SMEs, including progressive loans that allow merchants to increase borrowing capacity after successful repayments.

Through its fully digital model, Fido reflects a broader trend in African fintech. Platforms increasingly transform the smartphone into a primary gateway to credit, savings and, over time, a broader range of digital financial services.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J.A de Berry Quenum

-

Laskenta Technologie Limited launched in 2024 in Port Harcourt to deliver AI-based software solutions to businesses.

-

Founder Nnaemeka Ugwumba positioned the company as an integrated, “all-in-one” digital solutions provider.

-

The firm targets SMEs that face high digitalization costs and limited in-house technical expertise.

Laskenta Technologie Limited operates as a Nigerian start-up specializing in software development and artificial intelligence-based solutions. Founder Nnaemeka Ugwumba established the company in 2024 in Port Harcourt.

The company presents itself as a provider of integrated digital solutions for businesses that seek to modernize their operations. Laskenta covers mobile and web application development, enterprise system design, data analytics and the creation of AI-driven automation tools.

Laskenta structures its model around an “all-in-one” approach. The company supports organizations from the design phase through deployment and maintenance of digital solutions. It develops business intelligence dashboards, e-commerce platforms, predictive analytics systems and intelligent chatbots that automate certain customer interactions.

The company has delivered several applications that use artificial intelligence. These applications include an automated resume analyzer, a legal document summarization tool and a digital assistant dedicated to mental well-being. These projects reflect the start-up’s focus on practical AI use cases that address professional and individual needs.

Beyond technology, the company targets an economic gap. In many African countries, SMEs face high digitalization costs and lack internal technical expertise. By offering tailored solutions adapted to local realities, companies such as Laskenta seek to bridge the digital infrastructure deficit and facilitate broader enterprise modernization.

This article was initially published in French by Adoni Conrad Quenum

Adapted in English by Ange J.A de Berry Quenum

-

Pape Wade co-founded Montreal-based Airudi in 2019 to integrate AI into human resources management.

-

Airudi develops ready-to-deploy AI solutions, including workplace health and safety tools with real-time risk prevention.

-

Wade holds board and advisory roles at Mila, IVADO and the Chamber of Commerce of Metropolitan Montreal.

Pape Wade, a Senegalese entrepreneur based in Montreal, develops artificial intelligence solutions that support decision-makers while placing human value at the center of corporate strategy.

Wade co-founded and leads Airudi, a company that specializes in integrating artificial intelligence into human resources management. He established the company in Montreal in 2019 with the objective of repositioning people at the core of organizations through data and AI-driven tools.

Airudi designs solutions that align with business needs while prioritizing employees. The company supports organizations in planning their AI strategies by helping executives identify priorities and define roadmaps that match corporate objectives. It develops and deploys ready-to-use solutions, including data preparation and seamless integration into existing systems.

The start-up also offers a workplace health and safety solution that enables companies to prevent on-site risks and implement real-time corrective actions. The platform delivers instant recommendations and personalized prevention plans, and it promotes proactive management that significantly improves employee safety.

In parallel, Wade serves on the technology transfer committee of IVADO, an organization that promotes the responsible development of AI solutions. He also sits on the board of Mila, a Quebec-based artificial intelligence research institute, and on the board of the Chambre de commerce du Montréal métropolitain. In addition, he serves on the advisory committee of Québec Tech, which supports high-potential technology start-ups.

Wade holds a master’s degree in management and prevention of major industrial and technological risks from Institut national polytechnique de Toulouse. Between 2009 and 2018, he worked at Drakkar & Associés, a Canadian firm that supports the aerospace, ground transportation, defense and consumer goods sectors. He successively served as senior advisor in health, safety and wellness, director of health, safety and wellness, and director of people and culture.

Melchior Koba

- Eric Bemba founded Wiikko, a Kinshasa-based shopping and delivery platform launched in 2019.

- The platform connects local merchants and restaurants with digitally connected consumers.

- Bemba also serves as Yango’s Country Manager in DR Congo and co-founded fintech startup Splitti.

Eric Bemba is a Congolese entrepreneur active in technology and mobility. He founded Wiikko, a shopping and delivery platform that allows users to order products from restaurants and stores and receive them at an address of their choice in Kinshasa.

The company launched Wiikko in 2019 as a mobile application available on major online app stores. The platform targets a broad audience familiar with social media and evolving digital consumption trends. Users select their items, and the Wiikko team manages the process from preparation to delivery.

By simplifying ordering, tracking and delivery, Wiikko acts as an intermediary between merchants, restaurateurs and customers. The platform also enables consumers to discover new stores, products and promotional offers. For businesses, the platform provides additional visibility, order management tools and a logistics service that extends operations to customers’ homes.

Alongside this venture, Eric Bemba serves as Country Manager of Yango in the Democratic Republic of Congo and as operations director for Francophone Africa. He also co-founded Splitti in 2020, a fintech company that enables users to create groups and collect funds to finance events.

Bemba graduated from the University of Alabama in 2009 with a bachelor’s degree in commerce and business administration. He began his career in 2010 at ConseilRH, a French recruitment consulting firm, where he served as international payroll manager.

He joined EY Paris in 2013 as a consultant in audit, advisory, tax and legal services. He returned to Kinshasa in 2016 and joined Compagnie Financière du Congo as a consultant. He then became head of development at SESOMO Services, a human resources services provider, in 2017.

This article was initially published in French by Melchior Koba

Adapted in English by Ange J.A de Berry Quenum

The UNICEF Venture Fund is inviting early-stage startups from UNICEF programme countries to propose blockchain-based solutions that improve transparency, financial efficiency, and digital public goods. Selected projects will receive up to $100,000 in equity-free funding, technical mentorship, and 12 to 18 months of support. Applications are open until Tuesday, March 10, 2026.

-

Generative AI enables the creation of synthetic sexual abuse images and deepfakes targeting minors.

-

Around 40% of Africans aged 15–24 currently have internet access, increasing both opportunity and exposure to risk.

-

African regulatory frameworks remain fragmented and largely unprepared to address AI-generated harms.

As submarine cables multiply and 4G and 5G networks expand across the continent, an entire generation integrates into the digital world. Governments and businesses leverage this connectivity to drive economic, educational and social development. However, millions of minors face new, more sophisticated and harder-to-detect threats.

According to joint estimates from the International Telecommunication Union and the African Union, about 40% of Africans aged 15 to 24 currently access the internet. This steadily rising figure creates a dual imperative: authorities must accelerate digital inclusion while strengthening child protection mechanisms.

Generative AI, a New Frontier for Online Abuse

Generative AI is transforming the nature of online harm targeting children. Cyberbullying no longer relies solely on insults or the circulation of authentic images. Individuals now use widely accessible applications to fabricate intimate images, clone voices or manipulate videos from a single photograph.

In 2023, the Internet Watch Foundation reported for the first time the circulation of entirely AI-generated child sexual abuse images online. The organization warned that these technologies significantly lower technical barriers and complicate perpetrator identification. INTERPOL also acknowledged that increasingly sophisticated deepfakes hinder investigations and make it harder to distinguish authentic material from manipulated images. Criminals also use these tools to conduct “sextortion,” in which individuals blackmail teenagers and their families using fabricated content.

Child rights organizations report that predators also use AI to analyze online behavior, emotional states and personal interests in order to refine manipulation strategies.

Legal Frameworks Remain Inadequate

Regulatory responses remain uneven across the continent. The Malabo Convention, adopted by the African Union, establishes a foundation for cybersecurity and personal data protection. However, policymakers drafted the convention before the emergence of generative AI, and the text does not explicitly address synthetic content targeting minors.

Several African countries have enacted data protection laws that regulate the collection and processing of personal information. However, most frameworks do not include specific provisions regarding platform liability in cases involving deepfakes of children.

In South Africa, the Protection of Personal Information Act imposes strict obligations regarding data processing, including data relating to minors. Nevertheless, lawmakers designed the framework primarily to protect privacy rather than to proactively prevent AI-generated harmful content.

In Cameroon, authorities adopted a charter on online child protection in 2023 that establishes shared responsibility among telecom operators, regulators and families. However, the law protects only children under 18, while the legal age of majority in Cameroon stands at 21, which leaves a segment of minors without full legal coverage.

Toward More Structured AI Governance

Policymakers are advancing discussions at both continental and global levels. The African Union is developing a strategy to regulate AI development and use, with a focus on ethics, data governance and digital sovereignty. Policymakers are increasingly recognizing child protection as a cross-cutting issue, particularly in a continent with the world’s youngest population.

At the global level, UNICEF advocates a “Safety by Design” approach that integrates child protection into the design phase of digital products. The organization argues that stakeholders must anticipate risks rather than intervene only after harmful content spreads. UNICEF also warns that children face heightened exposure to online threats in environments where regulation, local-language moderation and reporting mechanisms remain underdeveloped.

Samira Njoya

Applications are now open for the Africa’s Business Heroes 2026 competition, which targets African entrepreneurs leading impact-driven businesses that have been registered on the continent for at least three years. Ten finalists will share $1.5 million in grant funding and receive support including increased visibility, mentorship and networking opportunities. Applications can be submitted by April 28, 2026.

More...

Google.org has opened applications for the "Impact Challenge: AI for Government Innovation," aimed at organizations developing artificial intelligence solutions with public partners to improve essential services. Selected projects may receive grants ranging from $1 million to $3 million and access specialized technical support to scale their impact. Applications are open until Friday, April 3, 2026.

-

South Africa and the Netherlands signed a memorandum of understanding on March 3 to deepen digital cooperation.

-

South Africa ranked 40th globally and 1st in Africa in the 2024 UN E-Government Development Index with a score of 0.8616.

-

The Netherlands ranked 10th globally in the same index with a score of 0.9538 and achieved top-tier status in cybersecurity under the International Telecommunication Union index.

South Africa is exploring cooperation with the Netherlands across several digital fields to stimulate innovation and strengthen the protection of online spaces. Both parties signed a memorandum of understanding on March 3.

Officials formalized the initiative during a bilateral meeting between Mondli Gungubele, South Africa’s Deputy Minister of Communications and Digital Technologies, and a delegation from the Embassy of the Netherlands in South Africa. Participants discussed digital skills development, emerging technologies, artificial intelligence, cybersecurity, and online child protection.

This rapprochement forms part of broader efforts by African countries to accelerate digital transformation. Governments are integrating digital technologies across all sectors of the economy to support socio-economic development.

South Africa remains one of Africa’s leaders in digital transformation, particularly in public administration. The country scored 0.8616 out of 1 in the 2024 E-Government Development Index published by the United Nations. The ranking placed South Africa first among 54 African countries and 40th out of 193 countries worldwide, above the global average of 0.6382.

In cybersecurity, the International Telecommunication Union placed South Africa in the second performance tier out of five. The country achieved the maximum score of 20 in two pillars covering technical, legal, and cooperation measures. However, the organization highlighted the need to strengthen capacity-building and organizational measures.

The Netherlands ranked 10th globally in the 2024 E-Government Development Index with a score of 0.9538 out of 1. In cybersecurity, the International Telecommunication Union classified the country in the top performance tier, which represents a model to follow. The Netherlands achieved the maximum score in four of the five ITU pillars—legal, technical, organizational, and cooperation—and scored 19.22 out of 20 in capacity development.

These indicators illustrate the Netherlands’ potential expertise in supporting South Africa’s digital ambitions. However, both parties have so far signed only a memorandum of understanding. The agreement formalizes their intent to cooperate but does not yet guarantee the implementation of funded projects with a defined timeline. Observers will need to monitor the next steps to assess the partnership’s concrete impact.

Isaac K. Kassouwi

-

Morocco’s CNDP and Portugal’s CNPD signed a memorandum of understanding in Lisbon on Feb. 25 to formalize institutional cooperation.

-

The agreement prioritizes artificial intelligence, deepfakes and digital violence amid rising cross-border data risks.

-

Morocco’s internet penetration exceeded 92% at end-2025, while Portugal reported high generative AI adoption and advanced GDPR enforcement.

Morocco and Portugal have stepped up coordination to tackle emerging digital challenges. The national authorities responsible for personal data protection in both countries signed a memorandum of understanding in Lisbon on Wednesday, Feb. 25, to structure their institutional cooperation.

Paula Meira Lourenço, president of the Comissão Nacional de Proteção de Dados (CNPD), and Omar Seghrouchni, president of Morocco’s Commission nationale de contrôle de la protection des données à caractère personnel (CNDP), signed the agreement at the CNPD headquarters. The text established an operational framework to intensify technical expertise exchanges and information sharing.

AI and Digital Violence at the Core of Priorities

The cooperation will primarily target issues related to artificial intelligence, image manipulation technologies such as deepfakes and digital violence. These phenomena have raised growing concerns regarding privacy protection, legal certainty and regulation of digital practices. The memorandum also provides for training programs, educational projects and the exchange of best practices in oversight and enforcement of regulatory frameworks, as technology continues to evolve rapidly.

This initiative comes as both countries experience strong digital momentum. In Morocco, internet penetration exceeded 92% at the end of 2025, according to DataReportal, placing the country among the most connected markets in Africa. Meanwhile, Portugal has recorded high adoption rates of generative artificial intelligence, according to a recent study by Bain & Company. Portugal has also built advanced experience in enforcing the European Union’s General Data Protection Regulation (GDPR).

Anchoring Cooperation in Regional Networks

The agreement provides for annual bilateral meetings to ensure structured follow-up. Each institution will also leverage its international networks. The CNPD will rely on the Ibero-American Data Protection Network (RIPD) and the Lusophone Data Protection Network (RLPD). Meanwhile, Morocco’s CNDP will activate the Network of African Data Protection Authorities (NADPA-RAPDP) and the Francophone Association of Data Protection Authorities (AFAPDP).

Samira Njoya

-

President Félix Tshisekedi instructed the government to strengthen regulation of social media platforms during a Feb. 27 cabinet meeting in Kinshasa.

-

Internet users in the Democratic Republic of Congo rose 64.1% to 34.7 million between 2021 and early 2026, while social media users climbed to 10.4 million, according to DataReportal.

-

The government will promote enforcement of the country’s Digital Code and require biweekly progress reports from relevant ministers.

President Félix Tshisekedi has instructed the government of the Democratic Republic of Congo (DRC) to tighten oversight of social media platforms in order to curb abuses. He issued the directive during the 80th ordinary meeting of the Council of Ministers held on Friday, Feb. 27, in Kinshasa.

The president tasked the Minister of State for Justice and Keeper of the Seals, along with the Minister of the Digital Economy, with proposing and implementing measures in coordination with relevant services to promote responsible, ethical and rational use of social media. The measures could include, where appropriate,“proportionate and lawful restrictive measures, while respecting fundamental freedoms,” according to the statement read by Augustin Kibassa Maliba, Minister of the Digital Economy.

The directive comes amid rapid growth in social media adoption alongside expanding telecommunications services, particularly internet access. DataReportal data show that the number of internet users increased from 21.14 million in 2021 to 34.7 million in early 2026, representing a 64.1% rise and an estimated penetration rate of 30.5%. Over the same period, the number of social media users rose from 4 million to 10.4 million.

Congolese authorities argue that “Far from serving exclusively positive purposes, social media increasingly constitute vectors of misinformation, public disorder, hate speech, manipulation of opinion, and incitement to division among Congolese people, thereby undermining national cohesion, public order, and social stability.”

The decision also follows persistent security challenges in several provinces. Social media platforms have become key arenas for debate on security issues.

Promoting and Enforcing the Digital Code

The presidential communication emphasized the need to promote and enforce the Digital Code, which lawmakers adopted to regulate digital platform use in the DRC. The president stated that the legal instrument already provides mechanisms to prevent, regulate and punish online abuses. However, he said authorities and the public have not sufficiently understood or applied the provisions.

The government will not limit awareness efforts to citizens. The Minister of Communication and Media will work with public and private operators to conduct ongoing public awareness campaigns. Authorities will also target magistrates under the coordination of the High Council of the Judiciary to ensure coherent and deterrent application of the law.

Beyond regulatory measures, the executive branch will invest in education. The Ministries of National Education and Higher Education will gradually integrate training modules and awareness programs on responsible digital use into school curricula. Authorities will incorporate issues related to social media and artificial intelligence into youth education.

The president has required relevant ministers to submit a detailed report every two weeks outlining actions taken, results achieved and any difficulties encountered to ensure monitoring and evaluation. However, authorities have not yet disclosed the precise implementation measures.

This article was initially published in French by Isaac K. Kassouwi

Adapted in English by Ange J.A de Berry Quenum